Lower-Than-Expected Spanish Inflation Strengthens Case For ECB Rate Reduction

Table of Contents

Spanish Inflation Data and its Implications

The latest Spanish inflation figures reveal a considerable slowdown. Compared to [previous month], inflation decreased by [percentage], and compared to the same period last year, the reduction is even more pronounced at [percentage]. This is notably lower than the ECB's and market analysts' predictions, which averaged around [predicted percentage].

- Percentage Decrease: A clear [percentage] drop from [previous month's figure] to [current month's figure].

- Eurozone Comparison: This figure contrasts sharply with the Eurozone average inflation rate of [Eurozone average], suggesting Spain's economy might be cooling faster than anticipated.

- Contributing Sectors: The decline is particularly noticeable in [mention specific sectors, e.g., energy, food], reflecting the impact of [explain contributing factors, e.g., government subsidies, decreased energy prices].

- Discrepancies: The difference between predicted and actual inflation rates highlights the challenges in accurately forecasting economic indicators, especially in a volatile global environment.

The methodology used to calculate Spain's inflation relies on the Harmonized Index of Consumer Prices (HICP), a standardized measure used across the Eurozone. However, potential limitations exist, such as variations in consumer spending habits across regions and the difficulty in capturing the impact of certain government interventions.

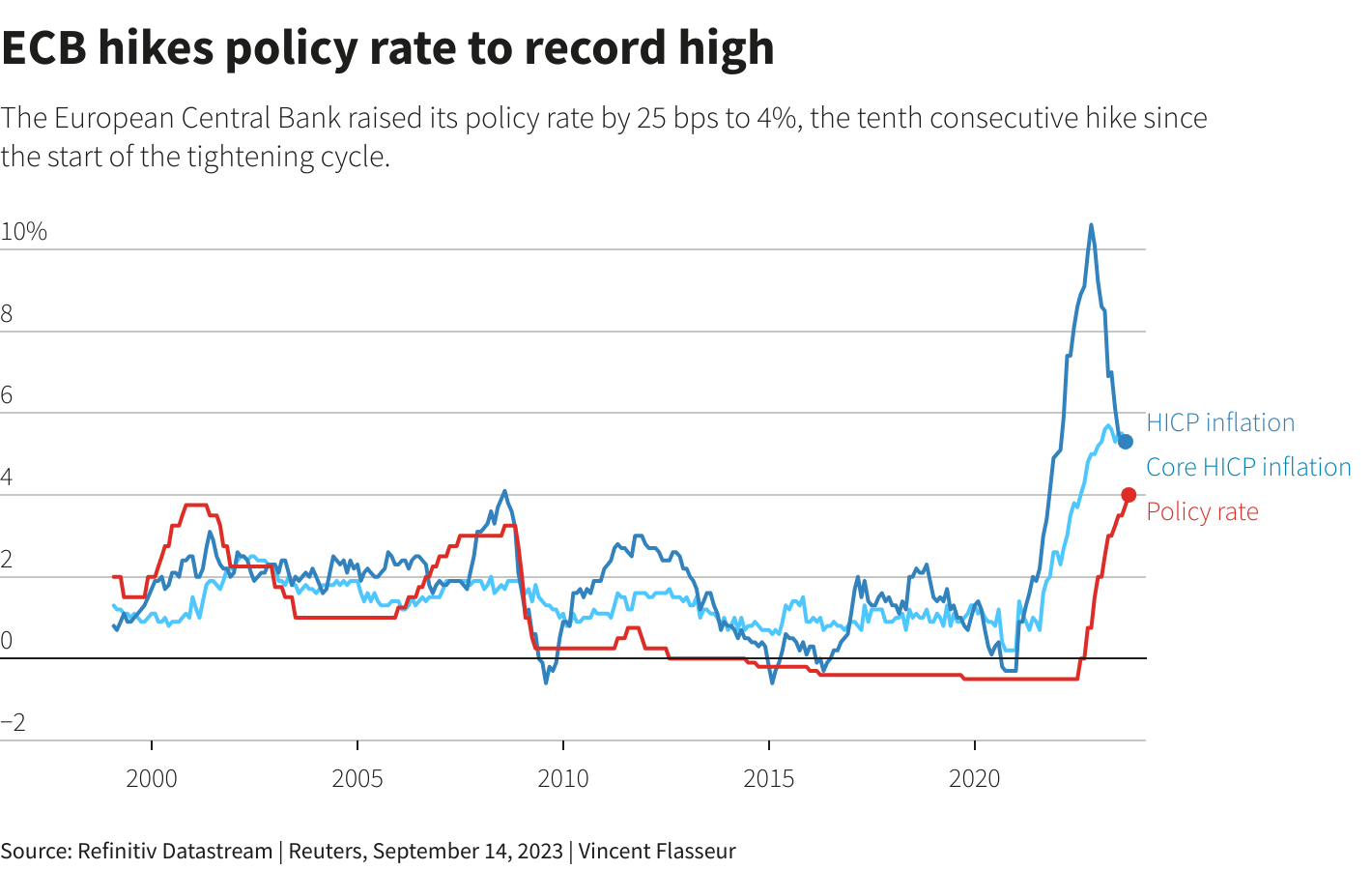

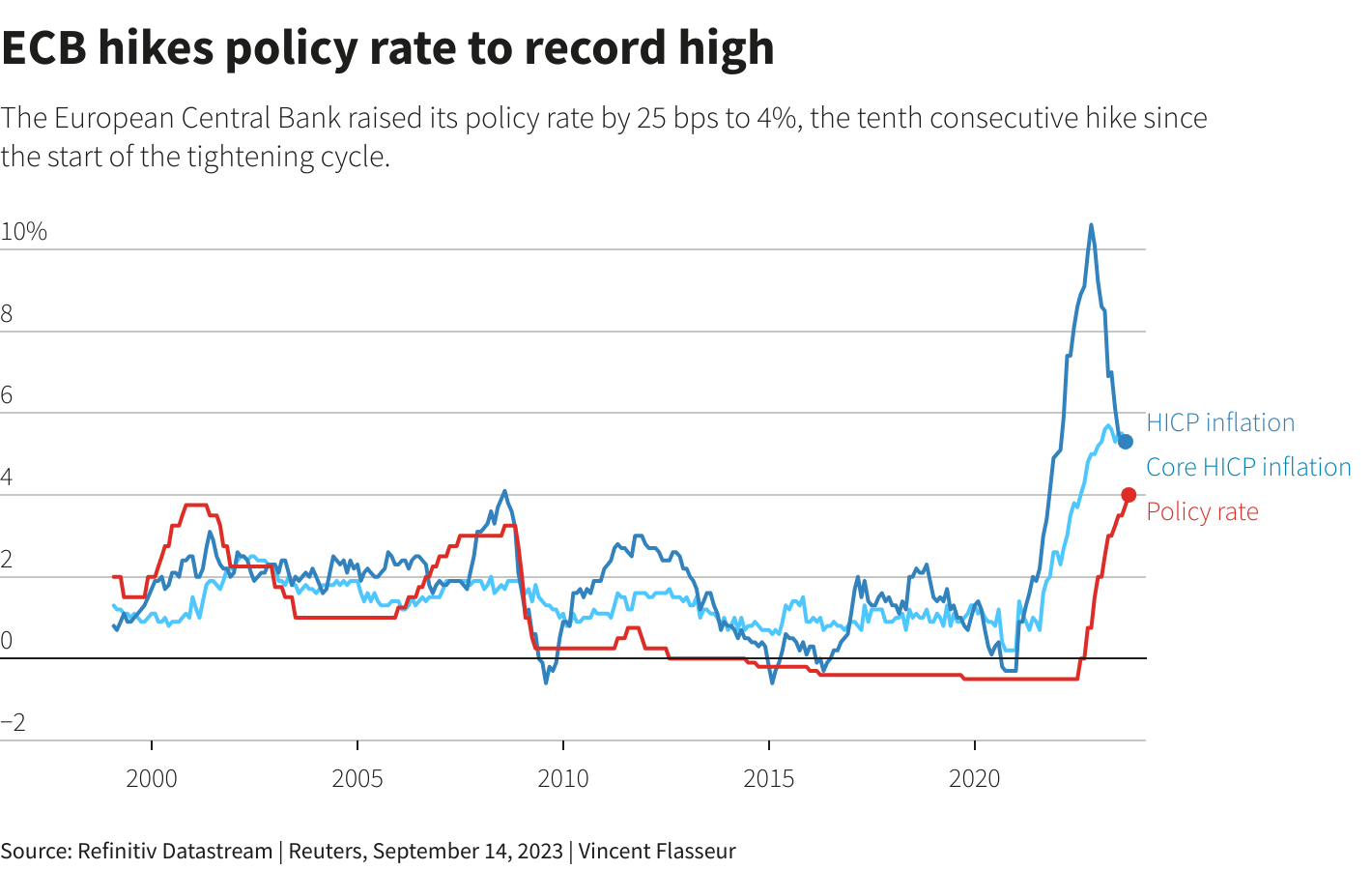

The ECB's Current Monetary Policy and its Challenges

The ECB's current monetary policy is focused on achieving its primary mandate: maintaining price stability in the Eurozone. Its inflation target is set at 2% over the medium term. However, the current economic climate presents significant challenges.

- ECB Mandate and Inflation Target: The ECB aims to keep inflation close to, but below, 2% in the medium term. The current lower-than-expected inflation numbers in Spain cast doubt on the need for further interest rate hikes.

- Eurozone Economic Climate: Concerns linger about a potential recession or significant economic slowdown across the Eurozone, dampening consumer demand and impacting inflation.

- Interest Rate Environment: The ECB has implemented a series of interest rate increases in recent months to combat inflation. However, maintaining high interest rates in a slowing economy could further stifle economic growth and investment.

- Impact on Sectors: The current monetary policy is impacting various sectors differently. While some industries benefit from higher interest rates, others struggle due to reduced investment and borrowing activity.

Arguments for and Against ECB Rate Reduction

The lower-than-expected Spanish inflation data significantly impacts the debate surrounding future ECB interest rate decisions.

Proponents of Rate Reduction

- Lower Inflation Justifies Rate Cuts: The unexpectedly low Spanish inflation reinforces the argument that further interest rate hikes are unnecessary, and potentially harmful, to the Eurozone economy.

- Stimulating Economic Growth: Reducing interest rates could stimulate economic growth by making borrowing cheaper for businesses and consumers, boosting investment and spending.

- Mitigating Recession Risks: Maintaining high interest rates during an economic slowdown increases the risk of a deeper recession.

Opponents of Rate Reduction

- Risk of Future Inflation: Reducing rates prematurely could reignite inflationary pressures, potentially undermining the ECB's long-term price stability goal.

- Effectiveness Concerns: Some argue that rate reductions might not be effective in addressing the underlying causes of the current economic slowdown, potentially leading to wasted monetary policy interventions.

- Euro Stability: Concerns exist that a rate reduction could negatively impact the stability of the Euro, potentially leading to currency devaluation.

Economic experts and institutions offer diverse perspectives on the optimal course of action. A balanced approach considering both the short-term and long-term consequences is crucial.

Market Reactions and Future Outlook

Financial markets reacted to the lower-than-expected Spanish inflation data with [describe market reactions, e.g., a slight increase in stock market indices, a decrease in bond yields]. This suggests a growing expectation that the ECB might reduce interest rates in the near future.

- Market Response: The market's response indicates a shift in expectations towards a more dovish ECB monetary policy.

- Expert Forecasts: Many economists predict that the ECB will [predict ECB actions, e.g., either maintain current interest rates or implement a rate cut at its next meeting].

- Impact on the Euro and European Economy: A potential rate reduction could strengthen the Euro in the short term, but the long-term impact on the broader European economy is highly dependent on various economic factors. Reputable sources like the Financial Times and Bloomberg are projecting [mention projections from reputable sources].

Conclusion

Lower-than-expected Spanish inflation significantly strengthens the case for a potential ECB rate reduction. The unexpectedly low figures, coupled with concerns about a potential Eurozone recession, create a compelling argument for a more accommodative monetary policy. However, the ECB must carefully weigh the potential risks and benefits of such a move, considering the potential for reigniting inflationary pressures. Staying informed about the evolving situation regarding lower-than-expected Spanish inflation and its impact on the ECB's policy decisions is crucial for understanding the future trajectory of the Eurozone economy. Stay updated on the evolving situation by following our coverage of Lower-Than-Expected Spanish Inflation and its impact on the ECB.

Featured Posts

-

Is A New Covid 19 Variant Behind The Recent Case Spike Who Investigation Underway

May 31, 2025

Is A New Covid 19 Variant Behind The Recent Case Spike Who Investigation Underway

May 31, 2025 -

Real Estate Market Crisis Home Sales At Record Lows

May 31, 2025

Real Estate Market Crisis Home Sales At Record Lows

May 31, 2025 -

Is Samsungs 101 Tablet A Real I Pad Competitor

May 31, 2025

Is Samsungs 101 Tablet A Real I Pad Competitor

May 31, 2025 -

Tigers Postponement Leads To Doubleheader Full Schedule Update

May 31, 2025

Tigers Postponement Leads To Doubleheader Full Schedule Update

May 31, 2025 -

April Rainfall Is This Month Wetter Than Usual

May 31, 2025

April Rainfall Is This Month Wetter Than Usual

May 31, 2025