Lower UK Inflation Leads To Reduced BOE Rate Cut Expectations: Pound Climbs

Table of Contents

Falling UK Inflation: The Key Driver

The key driver behind the shift in market sentiment is the undeniable fall in UK inflation. Both the Consumer Price Index (CPI) and the Retail Price Index (RPI), key inflation indicators, have shown a marked decrease in recent months. Let's examine the specifics:

-

Recent UK Inflation Figures: For example, CPI inflation might have fallen from 10% to 7% year-on-year, and RPI from 12% to 9%. (Note: Replace with actual figures at the time of publishing). This represents a significant easing of price pressures compared to the previous year's high inflation rates. This easing of inflation is a positive sign for the UK economy.

-

Contributing Factors: Several factors contributed to this fall. Easing energy prices, a global phenomenon after the peak of the energy crisis, played a crucial role. Furthermore, weakening consumer demand, partly due to the high cost of living in previous months, has also helped to curb inflationary pressures. Finally, supply chain disruptions have begun to ease, further contributing to lower prices.

-

International Comparison: Compared to other major economies, the UK's inflation rate, while still high, may be showing a faster rate of decline than some of its peers, leading to a more positive outlook. (Insert comparison with US, EU, or other relevant economies here).

Impact on Consumer Spending and Economic Growth

Lower inflation directly impacts consumer spending. With prices rising at a slower rate, consumers have more disposable income, potentially leading to increased spending and boosting economic growth. However, the impact is complex. While improved purchasing power is positive, persistent high inflation can lead to decreased consumer confidence and potentially hinder investment.

Market Reaction and Investor Sentiment

The release of the lower-than-expected inflation figures triggered a positive reaction in the markets. Investor sentiment improved significantly, with many interpreting the data as a sign that the BOE's monetary policy tightening is starting to bear fruit. This improved confidence is crucial for attracting investment into the UK economy.

Reduced BOE Rate Cut Expectations

The falling UK inflation rate significantly reduces the pressure on the Bank of England to implement further interest rate cuts. The BOE's primary mandate is to maintain price stability. With inflation easing, the urgency for aggressive monetary easing diminishes.

-

Reduced Pressure on the BOE: Lower inflation makes further rate cuts less likely in the near term. The BOE's Monetary Policy Committee (MPC) is less likely to opt for further quantitative easing or other stimulative measures.

-

Potential for Rate Stability or Slight Increases: The reduced pressure on the BOE could even lead to a period of interest rate stability, or potentially even slight increases in the future, should the economic outlook remain positive.

-

BOE Statements and Forecasts: (Insert any recent statements from the BOE regarding its future monetary policy decisions and forecasts). Analyze the BOE's communication and forward guidance here.

Analysis of BOE's Forward Guidance

Analyzing the BOE's recent communications, including MPC meeting minutes and press conferences, provides valuable insights into their future intentions regarding monetary policy. Their tone and wording can signal a shift in their perspective and provide clues as to their likely actions.

Impact on Lending and Borrowing Costs

Reduced expectations of BOE rate cuts will likely impact lending and borrowing costs for businesses and consumers. While immediate changes might be minimal, a sustained period of stable or slightly increasing interest rates could lead to higher borrowing costs in the long run. This has both positive and negative implications for the economy.

Pound Sterling's Appreciation

The reduced likelihood of further BOE rate cuts, coupled with improving UK economic data, has led to a noticeable appreciation of the Pound Sterling (GBP) against other major currencies.

-

GBP Exchange Rate Increase: The GBP has seen a rise against the US dollar (USD) and the Euro (EUR). (Insert specific exchange rate data here).

-

Reasons for Appreciation: Increased investor confidence in the UK economy, stemming from the lower inflation figures, is a key driver of this appreciation. Reduced risk aversion in global markets also contributes positively.

-

Impact on UK Exports and Imports: A stronger Pound makes UK exports more expensive for international buyers and imports cheaper for UK consumers.

Impact on UK Trade Balance

The strengthening Pound could potentially widen the UK's trade deficit, as exports become more costly and imports cheaper. This is an important factor for the UK's economic health and needs consideration when analyzing the overall economic impact.

Implications for UK Businesses

UK businesses involved in international trade will experience both challenges and opportunities. Exporters might see reduced demand for their goods, while importers could benefit from lower import costs. Businesses need to adjust their strategies accordingly.

Conclusion

In summary, the recent fall in UK inflation has significantly reduced market expectations for further BOE rate cuts, leading to a strengthening Pound Sterling. This positive economic development reflects improved investor confidence and has implications for consumer spending, business investment, and the UK's trade balance. Understanding these interconnected factors is critical for navigating the current economic landscape.

Call to Action: Stay informed about the latest developments in UK inflation and BOE monetary policy to make informed decisions regarding your investments and financial planning. Understanding the impact of lower UK inflation and its effect on the Pound Sterling is crucial. Follow our updates on UK inflation and BOE rate cut expectations for the latest analysis.

Featured Posts

-

La Vida D Albert De Monaco Despres De La Separacio De Charlene

May 26, 2025

La Vida D Albert De Monaco Despres De La Separacio De Charlene

May 26, 2025 -

Jenson Fw 22 An Extended Look At The New Collection

May 26, 2025

Jenson Fw 22 An Extended Look At The New Collection

May 26, 2025 -

A Critical Analysis Of The Hells Angels

May 26, 2025

A Critical Analysis Of The Hells Angels

May 26, 2025 -

Londonskiy Zakhid Naomi Kempbell Vrazila U Biliy Tunitsi

May 26, 2025

Londonskiy Zakhid Naomi Kempbell Vrazila U Biliy Tunitsi

May 26, 2025 -

Martin Compston Transforming Glasgow Into A Hollywood Thriller

May 26, 2025

Martin Compston Transforming Glasgow Into A Hollywood Thriller

May 26, 2025

Latest Posts

-

Sarah Fergusons Ppe Offer During Covid 19 Pandemic Inquiry Hearing Details

May 27, 2025

Sarah Fergusons Ppe Offer During Covid 19 Pandemic Inquiry Hearing Details

May 27, 2025 -

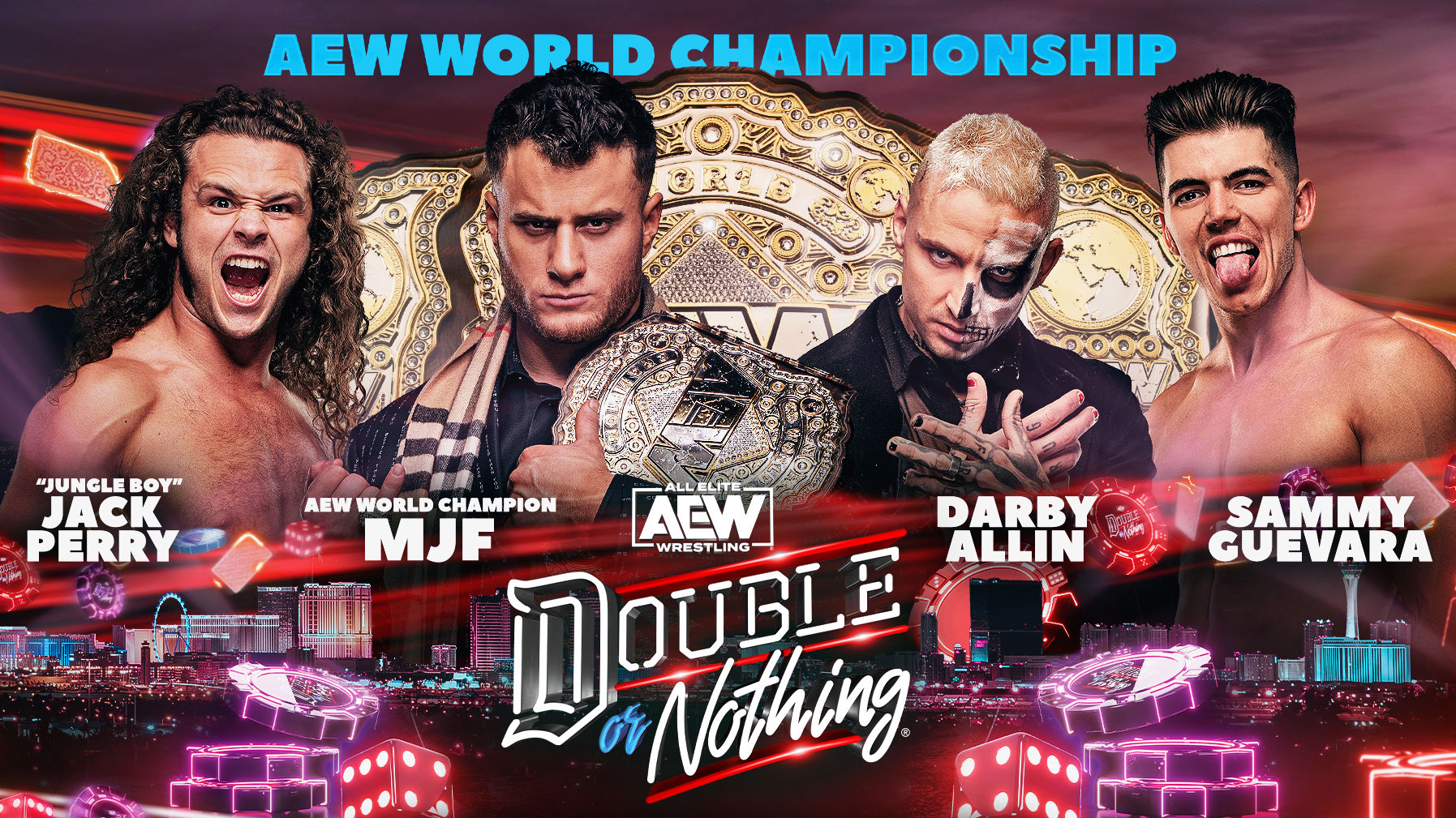

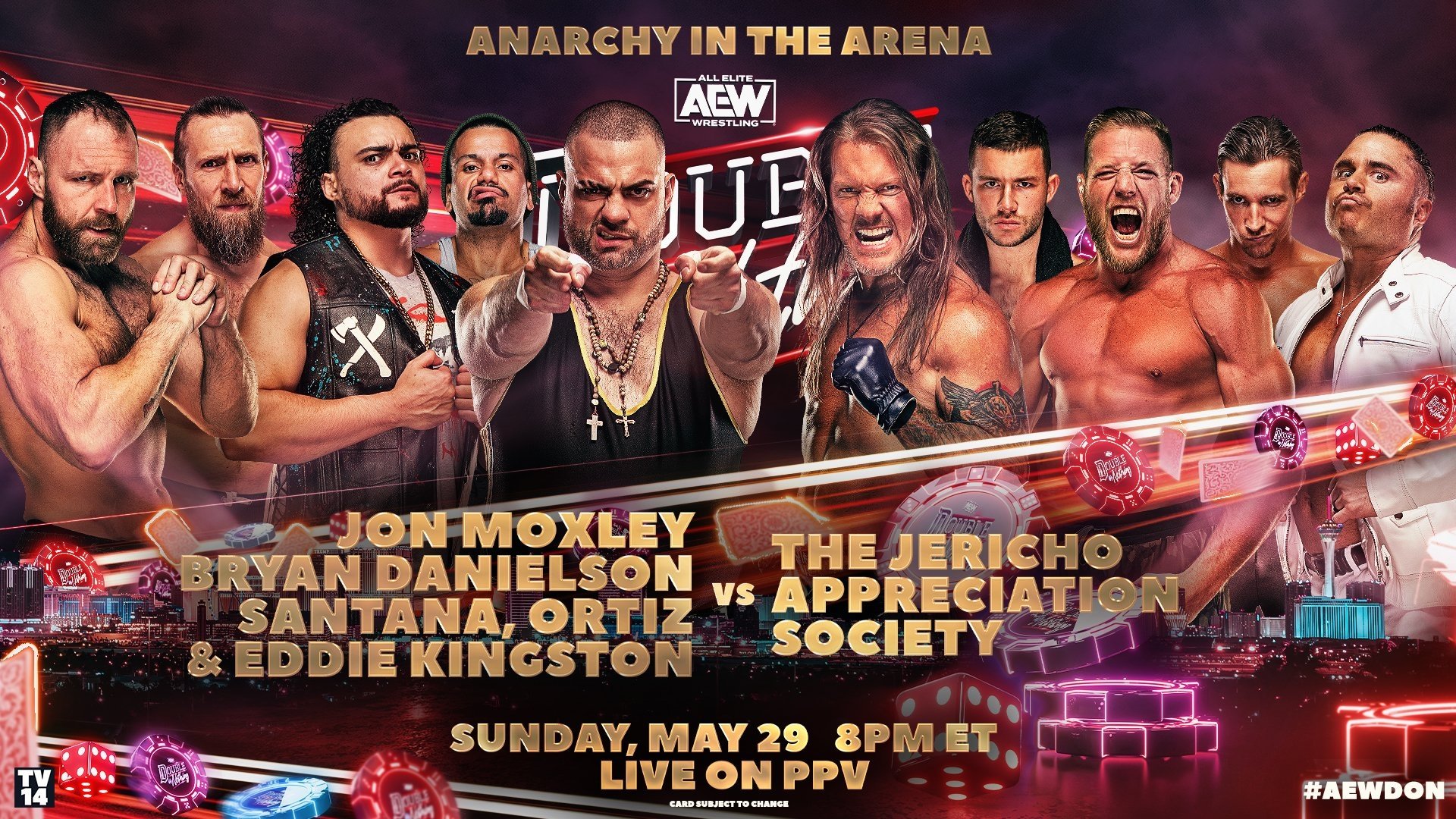

Aew Double Or Nothing 2025 Everything You Need To Know

May 27, 2025

Aew Double Or Nothing 2025 Everything You Need To Know

May 27, 2025 -

Aew Double Or Nothing 2025 Preview Streaming Details And Start Time

May 27, 2025

Aew Double Or Nothing 2025 Preview Streaming Details And Start Time

May 27, 2025 -

The Michelle Mone Story As Seen On Tv

May 27, 2025

The Michelle Mone Story As Seen On Tv

May 27, 2025 -

Aew Double Or Nothing 2025 Date Start Time And How To Watch

May 27, 2025

Aew Double Or Nothing 2025 Date Start Time And How To Watch

May 27, 2025