Market Analysis: D-Wave Quantum (QBTS) Stock Decline On Monday

Table of Contents

Analyzing the Monday Stock Dip

D-Wave Quantum (QBTS) experienced a [Insert Percentage]% drop on Monday, closing at [Insert Closing Price]. This decline was notable, especially considering the [Insert trading volume] trading volume, which was [higher/lower] than the average daily volume over the preceding [Number] days. This increased/decreased trading activity suggests [Increased investor interest/ selling pressure].

Potential Factors Contributing to the Decline

Several factors could have contributed to this significant D-Wave Quantum (QBTS) stock decline:

-

Absence of Positive News: A lack of recent positive news or announcements, such as new contracts, strategic partnerships, or groundbreaking technological advancements, could have dampened investor enthusiasm. The absence of substantial progress updates can lead to uncertainty and selling pressure.

-

Broader Market Trends: The overall technology sector, often reflected in indices like the NASDAQ, experienced [Describe the market trend - e.g., a general downturn, increased volatility]. This broader market sentiment can negatively impact even strong performers like D-Wave.

-

Profit-Taking: After a period of [Describe prior stock performance - e.g., growth or stability], some investors might have engaged in profit-taking, selling their shares to secure gains. This is a common occurrence in volatile markets.

-

Intense Competition: The quantum computing industry is fiercely competitive, with key players like IBM, Google, and IonQ vying for market share. Negative news or advancements from competitors could indirectly affect D-Wave's stock price.

-

Regulatory or Financial Filings: Any recent SEC filings or press releases concerning D-Wave Quantum, even if seemingly unrelated to technological breakthroughs, might have influenced investor sentiment and contributed to the decline. A closer look at these documents can provide further context.

Technical Analysis of QBTS Stock Chart

A review of the QBTS stock chart reveals [Describe chart patterns, e.g., a break below a key support level at X dollars, or the failure to break through a resistance level]. This technical analysis, combined with indicators like the RSI [Relative Strength Index] or MACD [Moving Average Convergence Divergence] – [brief description of indicator values and implications] – further supports the observed price drop. However, it’s crucial to remember that technical analysis is not a foolproof predictor of future price movements.

The Bigger Picture: Quantum Computing Market Outlook

The quantum computing market is currently experiencing a period of [Growth/Consolidation/Uncertainty]. While the long-term potential remains immense, the industry is still in its nascent stages. D-Wave's position in this landscape is characterized by [Strengths: e.g., its established annealing technology and customer base] and [Weaknesses: e.g., competition from gate-based approaches].

Long-Term Prospects for D-Wave Quantum

Despite the recent setback, D-Wave Quantum retains significant long-term potential.

-

Technological Advancements: D-Wave's ongoing research and development in annealing technology could lead to future breakthroughs, improving performance and expanding applications. Future announcements on these advancements could positively impact the stock price.

-

Strategic Plans: D-Wave's strategic focus on [Mention their strategic initiatives, e.g., specific industry applications or partnerships] could drive future growth.

-

Potential Catalysts: The launch of new products, significant partnerships, or successful pilot programs could act as catalysts, leading to future stock price increases.

Investor Sentiment and Advice

Current investor sentiment towards D-Wave Quantum appears to be [Cautious/Negative/Mixed]. The Monday decline has undoubtedly raised concerns, but a long-term perspective is essential.

Recommendations for Investors

-

Hold: Investors with a long-term outlook and confidence in D-Wave's technological roadmap and future prospects might consider holding their positions.

-

Buy: The dip presents a potential buying opportunity for investors with a high-risk tolerance and belief in the long-term growth of the quantum computing market. However, this should be done with caution and careful consideration of personal risk tolerance.

-

Sell: Investors seeking to minimize risk or those concerned about short-term volatility might consider selling their shares. However, this decision should weigh potential future gains against the immediate losses.

Diversifying investment portfolios is crucial to mitigate risks associated with individual stocks, particularly in volatile sectors like quantum computing.

Conclusion:

The Monday decline in D-Wave Quantum (QBTS) stock is a complex event with multiple contributing factors. While the short-term outlook may be uncertain, a thorough analysis of the broader market, D-Wave's position, and the long-term potential of quantum computing is crucial for informed investment decisions. Closely monitoring news, technological advancements, and market sentiment is essential for navigating the volatility surrounding D-Wave Quantum (QBTS) stock. To make well-informed decisions regarding your investments related to the D-Wave Quantum (QBTS) stock decline, continue to monitor reputable financial news and consult with a qualified financial advisor.

Featured Posts

-

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 20, 2025

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 20, 2025 -

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025 -

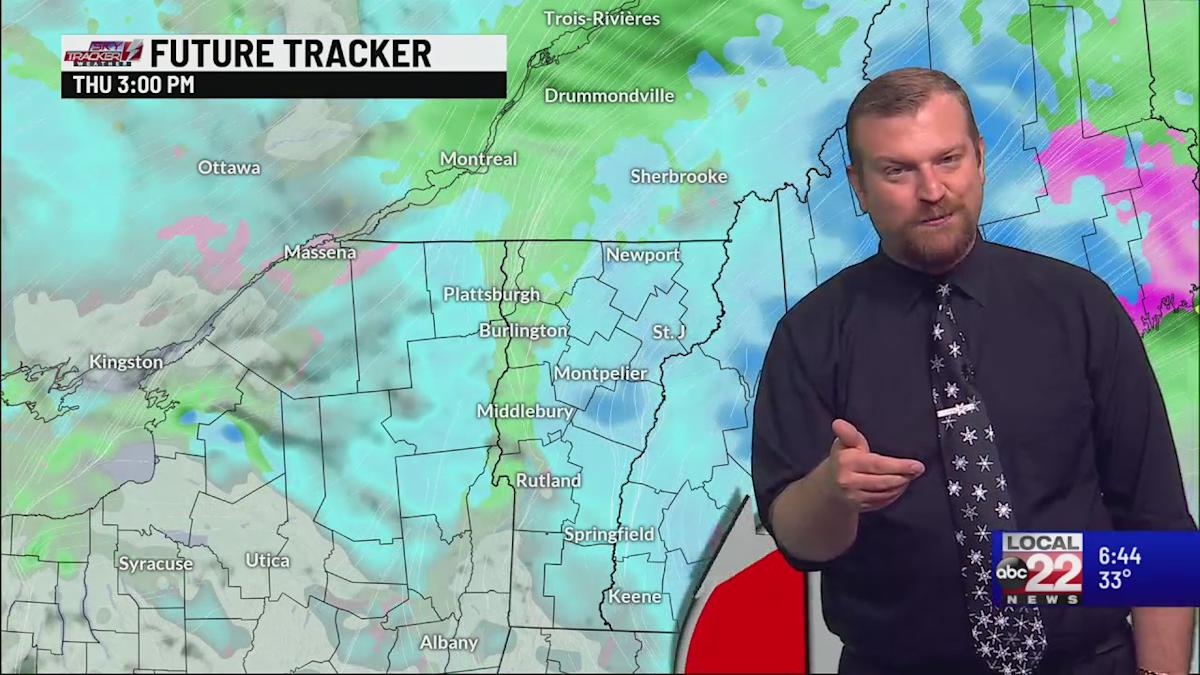

Is Drier Weather Really In Sight A Look At The Forecast

May 20, 2025

Is Drier Weather Really In Sight A Look At The Forecast

May 20, 2025 -

Solo Travel Safety Budget And Itinerary Planning

May 20, 2025

Solo Travel Safety Budget And Itinerary Planning

May 20, 2025 -

Understanding The Developing Wintry Mix Of Rain And Snow

May 20, 2025

Understanding The Developing Wintry Mix Of Rain And Snow

May 20, 2025

Latest Posts

-

Kriti Esperida Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025

Kriti Esperida Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025 -

Dimosia Synantisi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025

Dimosia Synantisi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025 -

Esperida Stin Patriarxiki Akadimia Kritis T Hemata Megalis Tessarakostis

May 20, 2025

Esperida Stin Patriarxiki Akadimia Kritis T Hemata Megalis Tessarakostis

May 20, 2025 -

Adas

May 20, 2025

Adas

May 20, 2025 -

Programma Esperidas Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025

Programma Esperidas Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025