Market Reaction: Berkshire Hathaway's Investment In Japanese Trading Firms

Table of Contents

The Investment's Significance

Berkshire Hathaway's investment in the five Japanese trading companies – Itochu, Mitsubishi, Mitsui, Sumitomo, and Marubeni – represents a monumental shift in the company's investment approach. The sheer scale of the investment is unprecedented for Berkshire, signaling a significant commitment to the Japanese market. This Berkshire Hathaway investment strategy represents a departure from its historically concentrated holdings in US-based companies, signifying a bold move towards global diversification.

- Specific percentage stakes acquired: While the exact percentages vary slightly, Berkshire Hathaway acquired approximately 5% stakes in each of the five companies.

- Total investment amount: The total investment amounts to billions of US dollars, underscoring the magnitude of Berkshire's commitment.

- Comparison to Berkshire's typical investment strategies: Traditionally, Berkshire Hathaway has focused on acquiring significant stakes in established, well-understood companies. This investment in Japanese trading houses, while still representing significant stakes, suggests a willingness to explore new investment avenues and global markets. This Warren Buffett investment reflects a strategic shift toward a more diversified portfolio.

Immediate Market Reactions

The announcement of Berkshire Hathaway's Japanese stock market investment triggered immediate and substantial reactions. The stock prices of both Berkshire Hathaway and the five Japanese trading companies experienced notable fluctuations.

- Percentage change in Berkshire Hathaway's stock price: While the initial market reaction was generally positive, Berkshire Hathaway's stock price experienced only a modest increase, indicating that the market largely anticipated the move or considered it a relatively low-risk diversification strategy.

- Percentage change in the stock prices of the Japanese trading companies: The five Japanese trading companies saw their stock prices surge significantly following the announcement, reflecting investor confidence and excitement about the investment from such a renowned investor.

- Quotes from financial analysts: Many analysts viewed the investment as a vote of confidence in the Japanese economy and the long-term stability of these trading houses. Some even suggested that this Berkshire Hathaway stock price increase, however modest, could be a precursor to further investments in Japan.

Long-Term Implications and Potential Outcomes

The long-term implications of this Berkshire Hathaway Japan investment are multifaceted and far-reaching. For Berkshire Hathaway, the potential benefits include significant diversification, increased exposure to the robust Japanese market, and access to new business opportunities.

- Potential for increased trade between the US and Japan: Berkshire Hathaway's investment could facilitate increased trade and economic collaboration between the US and Japan, strengthening existing ties.

- Impact on the global commodity markets: Given the involvement of major trading companies, this investment could influence global commodity markets, impacting prices and supply chains.

- Potential for follow-up investments by Berkshire Hathaway: The investment could serve as a stepping stone for further investments by Berkshire Hathaway in the Japanese market, signifying a broader strategic shift towards Asian markets. This speaks to a long-term investment strategy focused on global expansion.

Analyzing Buffett's Rationale

Understanding Warren Buffett's strategy behind this investment requires considering several factors. His decision likely reflects a belief in the long-term growth potential of the Japanese economy and the stability of these trading houses.

- Buffett's public statements: While official public statements haven't explicitly detailed his reasoning, his known preference for stable, undervalued companies with strong management aligns with the characteristics of these Japanese firms.

- Analysis of the financial stability and growth prospects: These Japanese trading houses have a history of consistent performance and strong financial positions, making them attractive long-term investments.

- Comparison to other successful long-term investments: This investment mirrors Berkshire Hathaway's successful track record of long-term value investing, focusing on companies with strong fundamentals and promising growth potential. This exemplifies his prudent risk management approach.

Conclusion

Berkshire Hathaway's substantial investment in Japanese trading firms represents a significant development in the global investment landscape. The market's initial reaction was mixed, reflecting both excitement about the diversification and uncertainty about the long-term implications. While the full impact remains to be seen, the investment showcases Berkshire Hathaway's confidence in the future of the Japanese economy and the potential for substantial long-term returns. This Berkshire Hathaway investment is a landmark event in the financial world, signaling a significant shift in investment strategies.

Call to Action: Stay informed on the ongoing developments surrounding this groundbreaking Berkshire Hathaway Japan investment. Continue to follow our analysis for further insights into the evolving market reaction and its broader implications. We will continue to provide updates as this story unfolds.

Featured Posts

-

4 Mlzman Grftar Mraksh Myn Ansany Asmglng Awr Kshty Hadthe Ky Thqyqat

May 08, 2025

4 Mlzman Grftar Mraksh Myn Ansany Asmglng Awr Kshty Hadthe Ky Thqyqat

May 08, 2025 -

The Dark Side Of Grief Corruption And The Treatment Of Fallen Soldiers In Ukraine

May 08, 2025

The Dark Side Of Grief Corruption And The Treatment Of Fallen Soldiers In Ukraine

May 08, 2025 -

Stocks Can T Wish Away Liberation Day Tariffs Economic Impact And Market Response

May 08, 2025

Stocks Can T Wish Away Liberation Day Tariffs Economic Impact And Market Response

May 08, 2025 -

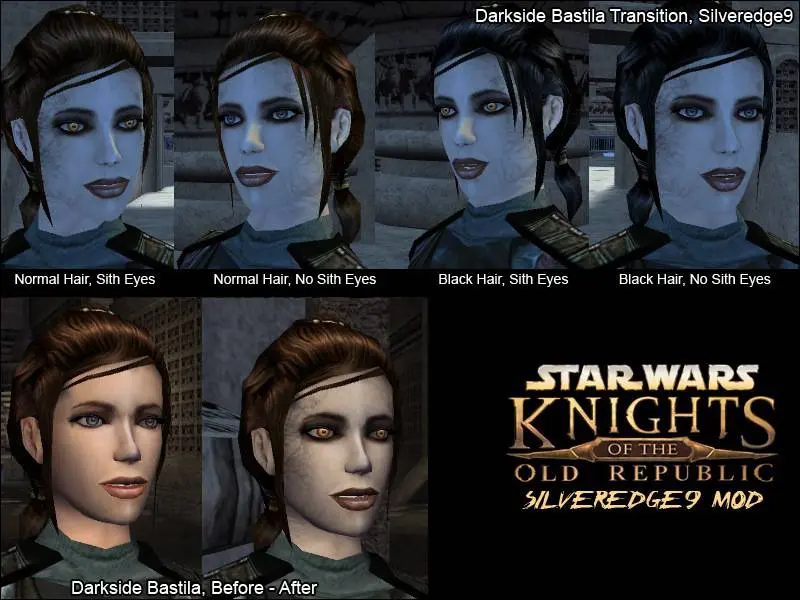

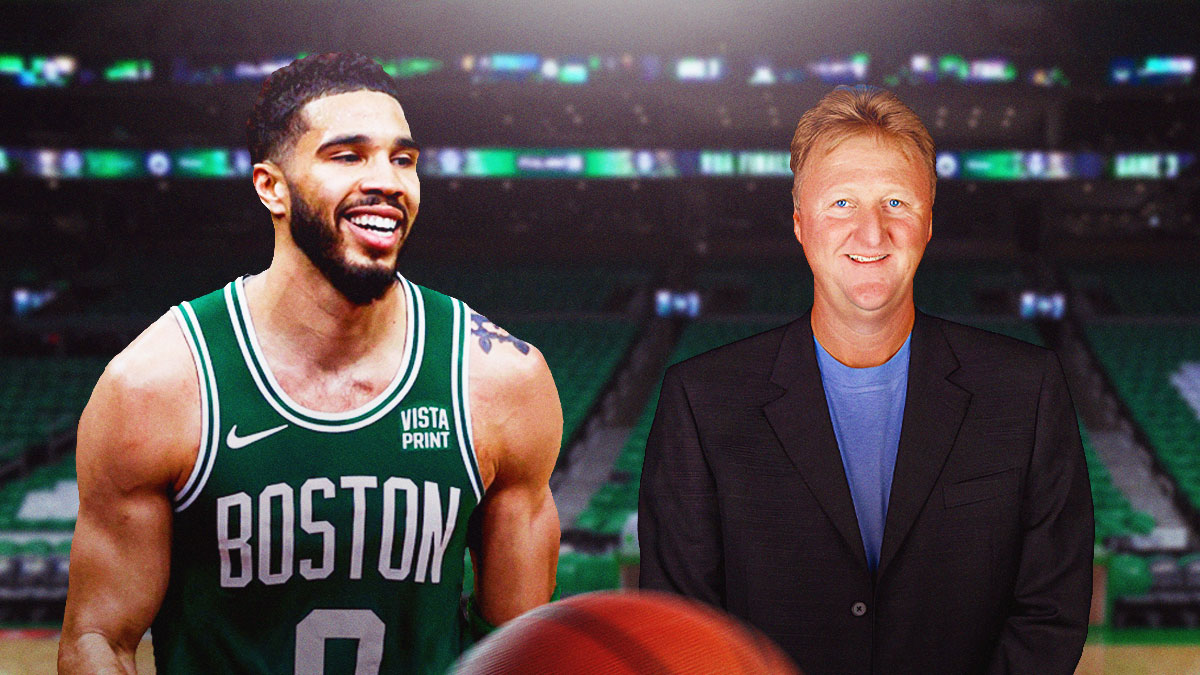

Tatums Candid Remarks On Larry Birds Impact On The Boston Celtics

May 08, 2025

Tatums Candid Remarks On Larry Birds Impact On The Boston Celtics

May 08, 2025 -

Liga Chempioniv 2024 2025 Peredmatcheviy Analiz Arsenal Ps Zh Barselona Inter

May 08, 2025

Liga Chempioniv 2024 2025 Peredmatcheviy Analiz Arsenal Ps Zh Barselona Inter

May 08, 2025