Market Update: Sensex And Nifty Record Significant Gains

Table of Contents

Key Drivers Behind Sensex and Nifty's Rise

Several factors have contributed to the recent positive performance of the Sensex and Nifty, reflecting a robust overall market sentiment. Let's break down the key drivers:

Positive Global Cues

Global market trends have played a significant role. Easing geopolitical uncertainties and positive economic data from major economies like the US and Europe have boosted investor confidence. Foreign Institutional Investors (FIIs) have shown increased interest in the Indian stock market, injecting significant capital. For example, the recent positive employment data from the US and signs of easing inflation in Europe have created a more optimistic global outlook, directly impacting the Indian stock market indices. These international markets are increasingly viewing India as a stable and growing economy.

- Stronger-than-expected GDP growth in several developed nations.

- Easing of inflation concerns in key global markets.

- Increased FII inflows into the Indian stock market.

Strong Domestic Economic Indicators

Positive domestic economic indicators are another key driver. Robust GDP growth, coupled with rising industrial production and improving consumer confidence, paint a picture of a healthy Indian economy. Lower-than-expected inflation rates have also contributed to investor optimism. The recent government initiatives to boost infrastructure and improve ease of doing business have also played a significant role.

- Higher-than-projected GDP growth for the current fiscal year.

- Increased industrial output and manufacturing activity.

- Stable inflation rates, easing concerns about monetary policy tightening.

Sector-Specific Performances

The impressive gains in Sensex and Nifty are not uniform across all sectors. Certain sectors have significantly outperformed others, contributing disproportionately to the overall market surge.

- IT Sector: Strong demand for IT services globally, particularly in cloud computing and digital transformation, led to impressive gains in IT stocks.

- Banking Sector: Improved asset quality and rising interest rates boosted the performance of banking stocks.

- Pharmaceutical Sector: The pharmaceutical sector benefited from increased demand and new product launches.

Analysis of Winning Stocks and Sectors

Identifying the top-performing stocks and sectors provides a clearer picture of the market dynamics.

Top Gainers in Sensex and Nifty

Several stocks have led the charge in the recent market upswing. Analyzing these top gainers can offer insights into emerging investment opportunities. (Note: Specific stock names and percentage increases would be included here in a real-time update. This section requires dynamic data.)

- (Stock Name 1) - Percentage Increase

- (Stock Name 2) - Percentage Increase

- (Stock Name 3) - Percentage Increase

- (Stock Name 4) - Percentage Increase

- (Stock Name 5) - Percentage Increase

Sectoral Outperformance

The IT, banking, and pharmaceutical sectors have notably outperformed others. This is largely due to factors specific to each sector, as discussed previously. (A chart or graph visually representing the sectoral performance would be beneficial here.)

Future Outlook and Investment Strategies

Predicting the future trajectory of the Sensex and Nifty requires careful consideration of various factors.

Short-Term Predictions

While the current market sentiment is positive, short-term market movements are inherently volatile. Factors like global economic uncertainties, inflation levels, and geopolitical events could impact the market in the short term. Investors should exercise caution and maintain a diversified portfolio.

Long-Term Investment Strategies

Despite short-term uncertainties, the long-term outlook for the Indian stock market remains positive. A well-diversified portfolio, incorporating a mix of stocks across sectors, is crucial for long-term growth. Regular portfolio rebalancing and risk management strategies are essential to mitigate potential downsides.

Sensex and Nifty's Growth – What's Next?

The recent surge in the Sensex and Nifty is primarily driven by positive global cues, strong domestic economic indicators, and sector-specific performance. Understanding these market dynamics is crucial for making informed investment decisions. While short-term predictions are inherently uncertain, the long-term outlook remains promising. Stay informed on future Sensex and Nifty movements by subscribing to our newsletter! Learn more about effective investment strategies by visiting our resource page dedicated to navigating the Indian stock market.

Featured Posts

-

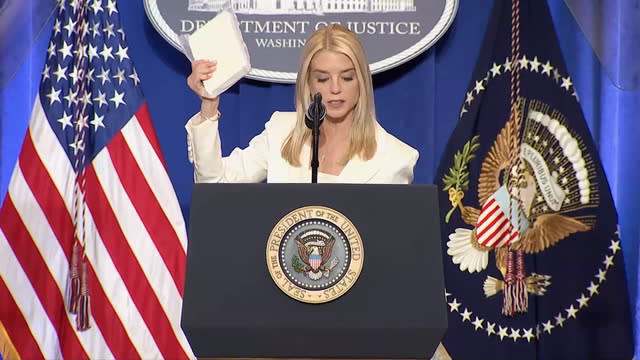

Press Conference Controversy Attorney General And The Fentanyl Block

May 10, 2025

Press Conference Controversy Attorney General And The Fentanyl Block

May 10, 2025 -

Sensex Today Live Stock Market Updates Nifty Above 17 950

May 10, 2025

Sensex Today Live Stock Market Updates Nifty Above 17 950

May 10, 2025 -

Ocasio Cortezs Sharp Rebuke Of Trump And Fox News

May 10, 2025

Ocasio Cortezs Sharp Rebuke Of Trump And Fox News

May 10, 2025 -

Njwm Krt Alqdm Aldhyn Kanwa Ydkhnwn Qsshm Wtathyrha

May 10, 2025

Njwm Krt Alqdm Aldhyn Kanwa Ydkhnwn Qsshm Wtathyrha

May 10, 2025 -

Manchester Castle Music Festival Olly Murs Confirmed

May 10, 2025

Manchester Castle Music Festival Olly Murs Confirmed

May 10, 2025