Market Volatility Today: Dow, Bonds, And Bitcoin Price Movements Explained

Table of Contents

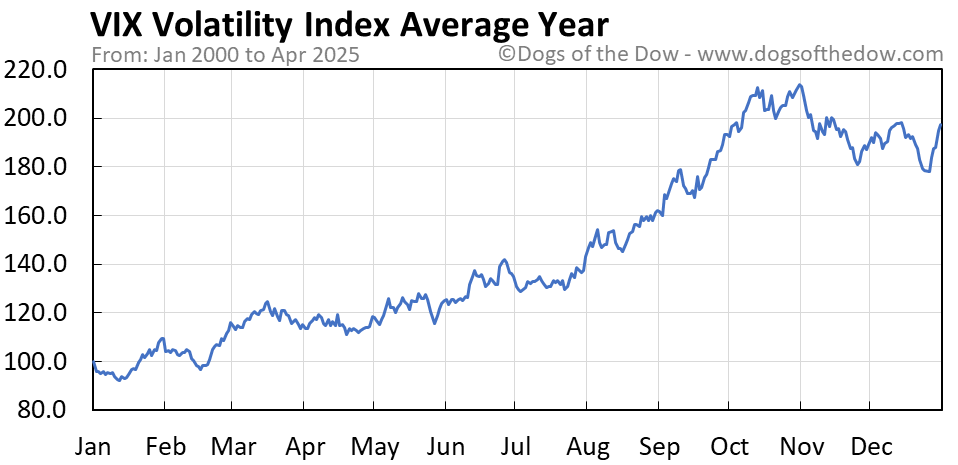

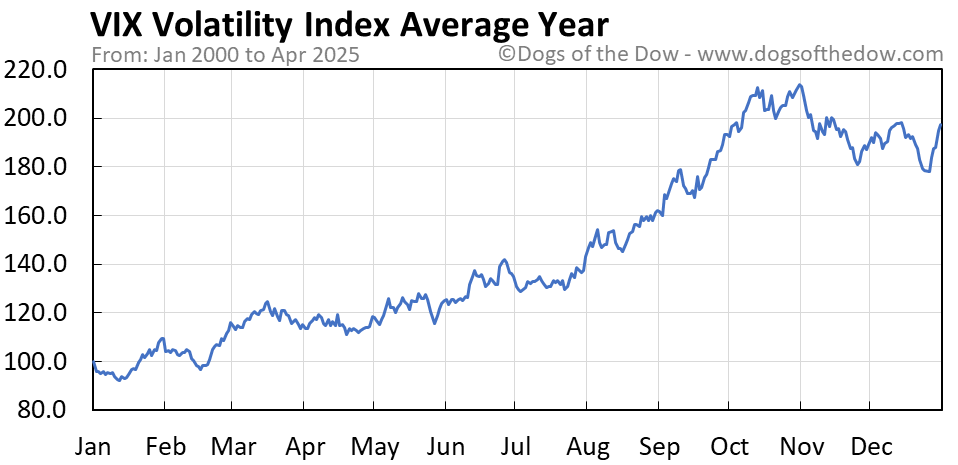

Understanding Current Market Volatility

Market volatility refers to the rate and extent of changes in market prices. High market volatility signifies rapid and substantial price swings, creating both opportunities and risks for investors. Understanding its causes is key to effective investment strategies. Several macroeconomic factors significantly influence market volatility:

-

Inflation: High inflation erodes purchasing power and forces central banks to raise interest rates, impacting bond yields and stock prices. Rising inflation often leads to increased market uncertainty and higher volatility.

-

Interest Rate Hikes: The Federal Reserve's (or other central banks') decisions on interest rate hikes directly influence borrowing costs, impacting business investment and consumer spending. Aggressive rate hikes generally increase market volatility.

-

Geopolitical Events: Global conflicts, political instability, and unexpected international events can trigger significant market swings. Uncertainty surrounding geopolitical factors often translates into higher market volatility.

-

Risk Assessment and Diversification: In volatile markets, a thorough risk assessment is paramount. Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) helps mitigate the impact of market fluctuations and reduce overall portfolio volatility.

Dow Jones Industrial Average: Analyzing Recent Price Swings

The Dow Jones Industrial Average (DJIA) has experienced considerable volatility recently, reflecting the overall state of the US economy and global markets. Several factors contribute to these price swings:

-

Earnings Reports: Strong earnings reports from major companies tend to boost the Dow, while disappointing results can trigger sell-offs and increase volatility. Analyzing individual company performance is crucial to understanding Dow movements.

-

Sector Performance: The performance of specific sectors (e.g., technology, energy, healthcare) significantly impacts the Dow. Strong performance in one sector can offset weakness in another, but broad-based weakness usually leads to increased volatility.

-

Investor Sentiment: Market sentiment, driven by news, economic data, and overall investor confidence, plays a vital role in shaping the Dow's trajectory. Negative sentiment often fuels sell-offs and increases volatility.

-

Short-Term and Long-Term Outlook: Predicting the Dow's future performance requires careful consideration of macroeconomic factors and current trends. While short-term predictions are inherently uncertain, analyzing long-term economic growth prospects helps investors make informed decisions. (Insert relevant chart or graph here illustrating recent Dow performance)

Bond Market Behavior Amidst Volatility

Bonds generally exhibit an inverse relationship with interest rates. When interest rates rise, bond prices typically fall, and vice-versa. Market volatility significantly impacts bond performance:

-

Rising Interest Rates and Bond Yields: Rising interest rates increase bond yields, making newly issued bonds more attractive. This often leads to a decline in the prices of existing bonds, increasing volatility in the bond market.

-

Safe Haven Status: During times of market uncertainty, bonds are often considered a safe haven asset, as their fixed income stream provides a degree of stability. This can lead to increased demand for bonds and potentially higher prices.

-

Diversification Strategies: Incorporating bonds into a diversified portfolio can help mitigate the risk associated with market volatility. The stability of bonds can offset potential losses in other, more volatile asset classes.

-

Current Bond Yields and Implications: Analyzing current bond yields across different maturities (short-term, long-term) provides valuable insights into investor expectations and potential future interest rate movements. Higher yields generally indicate higher risk but also higher potential returns.

Bitcoin's Price Fluctuations and Correlation (or Lack Thereof) with Traditional Markets

Bitcoin's price is notorious for its volatility. While some correlation exists between Bitcoin and traditional markets, it's often weak and inconsistent:

-

Bitcoin's Correlation with Traditional Assets: Studies show varying degrees of correlation between Bitcoin and traditional markets, often influenced by specific events and market conditions. The correlation isn't consistently strong, implying Bitcoin can act as a distinct asset class.

-

Regulatory News and Government Policies: Government regulations and policies regarding cryptocurrencies significantly impact Bitcoin's price. Positive regulatory developments tend to boost Bitcoin's value, while negative news can lead to price drops.

-

Cryptocurrency Adoption and Market Sentiment: Increased adoption of Bitcoin and positive market sentiment fuel price increases. Conversely, negative sentiment or reduced adoption can trigger sharp price declines.

-

Technical Analysis and Predictions: Technical analysis of Bitcoin's price charts can provide insights into potential future price movements, though predictions remain inherently uncertain due to the high volatility. (Insert relevant chart or graph here illustrating Bitcoin price performance)

Conclusion

This article explored the current market volatility, analyzing the price movements of the Dow, bonds, and Bitcoin. We examined the key factors contributing to these fluctuations, including macroeconomic conditions, investor sentiment, and specific asset-related news. Understanding these influences is essential for navigating the complexities of today's investment landscape.

Call to Action: Stay informed about market volatility by regularly reviewing financial news and conducting thorough research. Understanding the factors driving market volatility allows for more informed decision-making. Continue to monitor the Dow, bonds, and Bitcoin prices, and adapt your investment strategy accordingly to mitigate risks and maximize potential returns in this dynamic market. Learn more about managing your investments during periods of high market volatility and develop a robust investment plan to navigate this ever-changing environment.

Featured Posts

-

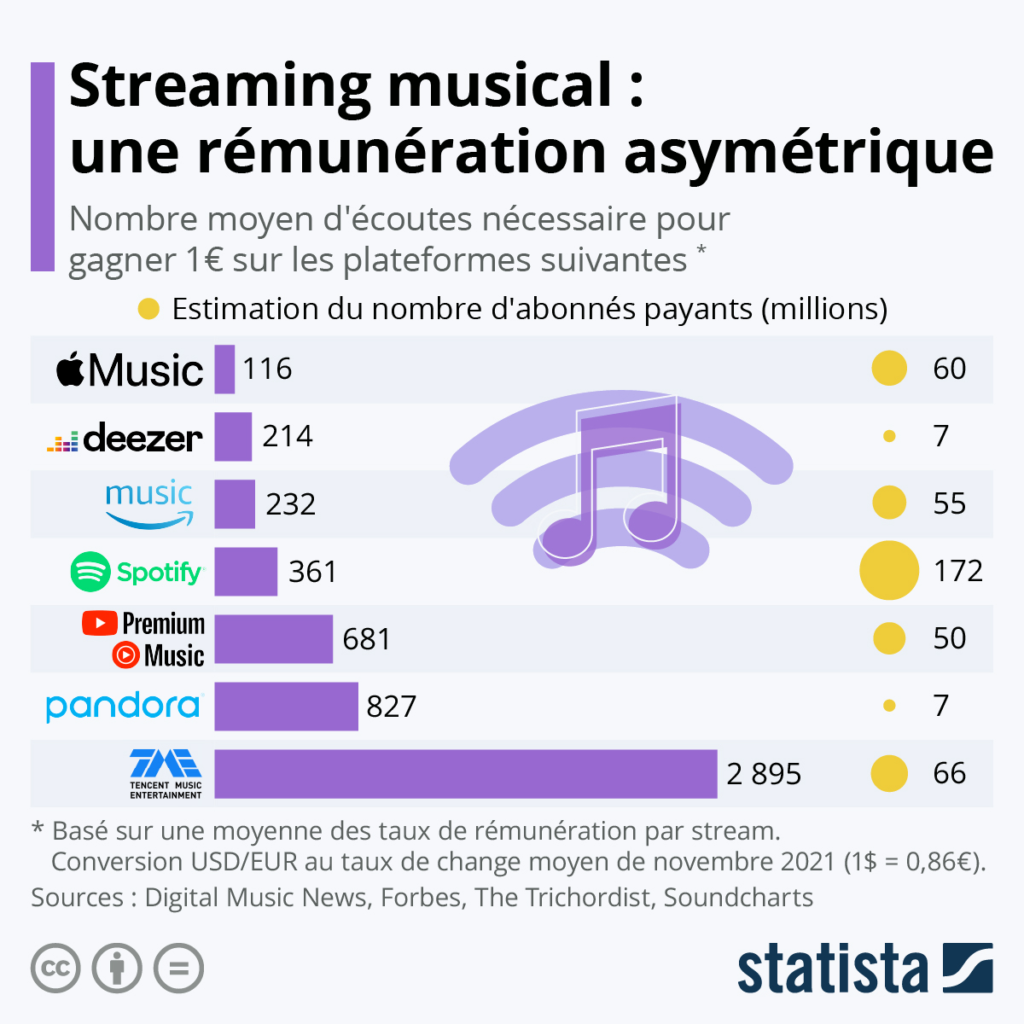

Quotas De Contenu Francais Sur Les Plateformes De Streaming Au Quebec

May 23, 2025

Quotas De Contenu Francais Sur Les Plateformes De Streaming Au Quebec

May 23, 2025 -

G 7 To Debate Lowering De Minimis Tariffs On Chinese Imports

May 23, 2025

G 7 To Debate Lowering De Minimis Tariffs On Chinese Imports

May 23, 2025 -

This Morning Cat Deeleys Wardrobe Glitch

May 23, 2025

This Morning Cat Deeleys Wardrobe Glitch

May 23, 2025 -

Are Airplane Crashes Common A Data Visualization Of Safety Statistics

May 23, 2025

Are Airplane Crashes Common A Data Visualization Of Safety Statistics

May 23, 2025 -

Urgent Evacuation In Swiss Mountain Area Due To Imminent Landslide

May 23, 2025

Urgent Evacuation In Swiss Mountain Area Due To Imminent Landslide

May 23, 2025

Latest Posts

-

Record Low Memorial Day Gas Prices Anticipated

May 23, 2025

Record Low Memorial Day Gas Prices Anticipated

May 23, 2025 -

Cheaper Gas Expected For Memorial Day Weekend Travel

May 23, 2025

Cheaper Gas Expected For Memorial Day Weekend Travel

May 23, 2025 -

Memorial Day Gas Prices A Decade Low Predicted

May 23, 2025

Memorial Day Gas Prices A Decade Low Predicted

May 23, 2025 -

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Beach And Sandy Point State Park

May 23, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Beach And Sandy Point State Park

May 23, 2025 -

Ocean City Rehoboth And Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 23, 2025

Ocean City Rehoboth And Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 23, 2025