Meta's Monopoly Trial: FTC Shifts Strategy To Defense

Table of Contents

The FTC's Initial Accusations and Their Weaknesses

The FTC's initial antitrust lawsuit against Meta, filed in 2020, alleged anti-competitive practices aimed at maintaining Meta's market dominance in social networking. The core accusations revolved around:

- Acquisition of Instagram and WhatsApp: The FTC argued that Meta's acquisitions of these platforms stifled competition by eliminating potential rivals.

- Leveraging market power: The commission claimed Meta used its dominance in social networking to leverage its position in adjacent markets, hindering competition.

- Anti-competitive practices: The FTC alleged various anti-competitive actions by Meta to maintain its market share, harming consumers.

However, the FTC's initial case has faced significant challenges. Weaknesses have emerged, including:

- Lack of strong evidence: The FTC has struggled to present compelling evidence directly linking Meta's actions to substantial harm to consumers.

- Difficulty proving causation: Establishing a clear causal link between Meta's acquisitions and reduced competition has proven difficult.

- Witness testimonies: Some key witness testimonies have reportedly weakened the FTC's narrative, raising doubts about the strength of their case.

The FTC's reliance on broad claims of market dominance, without concrete evidence of specific anti-competitive conduct, has become a point of vulnerability in the antitrust lawsuit. The legal definition of "monopoly power" and the application of antitrust laws in the dynamic digital marketplace are central to the ongoing debate.

Meta's Counterarguments and Defensive Tactics

Meta's defense strategy has centered on refuting the FTC's accusations and highlighting the benefits of its acquisitions and business practices. Key elements of their defense include:

- Emphasis on innovation and consumer choice: Meta argues its acquisitions spurred innovation and offered consumers more choice and better products.

- Competitive landscape: They highlight the vibrant and competitive nature of the social media market, asserting that numerous alternative platforms exist.

- Consumer benefits: Meta argues its platforms provide significant benefits to consumers globally, emphasizing factors like communication, connection, and information sharing.

Meta's legal team has employed various strategic maneuvers, including challenging the FTC's evidence and emphasizing the pro-competitive aspects of their acquisitions. Expert testimony supporting Meta's arguments regarding innovation and consumer benefit plays a significant role in their defense. The company's focus on the competitive landscape emphasizes the presence of competitors like TikTok, Twitter (now X), and Snapchat, weakening the FTC’s argument of a near-monopoly. This defense strategy cleverly shifts the narrative from accusations of stifling competition to a story of innovation and consumer benefit.

The Shifting Legal Landscape and Potential Outcomes

The FTC's shift to a more defensive posture significantly alters the potential outcomes of the Meta monopoly trial. This change suggests the commission may be facing challenges in proving their initial claims beyond a reasonable doubt. The implications are substantial:

- Weakened antitrust enforcement: A loss for the FTC could weaken future antitrust enforcement against large tech companies.

- Legal precedent: The case's outcome will set a crucial legal precedent regarding acquisitions in the tech sector.

- Potential penalties: While fines remain a possibility, the likelihood and severity may be reduced due to the altered legal landscape.

- Impact on tech regulation: The trial's outcome will have significant ramifications for future tech regulation globally.

Impact on Investors and Stock Market

The ongoing Meta monopoly trial has undoubtedly impacted Meta's stock price and investor sentiment. Fluctuations in the stock market reflect the uncertainty surrounding the trial's outcome. A positive outcome for Meta could boost investor confidence, leading to increased stock prices. Conversely, an unfavorable judgment could negatively impact investor confidence and trigger market volatility. Analyzing stock market trends alongside the legal proceedings provides valuable insights into investor perceptions of the trial's implications for Meta's future performance.

Conclusion: Meta's Monopoly Trial: A Turning Point in Antitrust Enforcement?

The FTC's strategic shift in Meta's monopoly trial marks a significant turning point in the ongoing debate over antitrust enforcement and tech regulation. The initial accusations of anti-competitive practices, while serious, have faced challenges in proving direct harm to consumers. Meta's robust defense, emphasizing innovation and consumer benefits, has complicated the FTC's case. The trial's outcome will not only impact Meta but will also shape the future of antitrust law and how regulators approach large tech companies. The shifting legal landscape suggests a need for a more nuanced approach to antitrust enforcement in the rapidly evolving digital world. Stay tuned for further updates on this landmark case, as Meta's monopoly trial continues to shape the future of big tech regulation.

Featured Posts

-

D Waves Quantum Leap Accelerating Drug Discovery With Ai And Qbts

May 20, 2025

D Waves Quantum Leap Accelerating Drug Discovery With Ai And Qbts

May 20, 2025 -

Jennifer Lawrence Ponovno Majka Docekala Drugo Dijete

May 20, 2025

Jennifer Lawrence Ponovno Majka Docekala Drugo Dijete

May 20, 2025 -

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025 -

Hl Ysttye Aldhkae Alastnaey Ktabt Rwayat Jdydt Baslwb Aghatha Krysty

May 20, 2025

Hl Ysttye Aldhkae Alastnaey Ktabt Rwayat Jdydt Baslwb Aghatha Krysty

May 20, 2025 -

Talisca Ve Fenerbahce Saha Tartismasi Ve Tadic Transferi

May 20, 2025

Talisca Ve Fenerbahce Saha Tartismasi Ve Tadic Transferi

May 20, 2025

Latest Posts

-

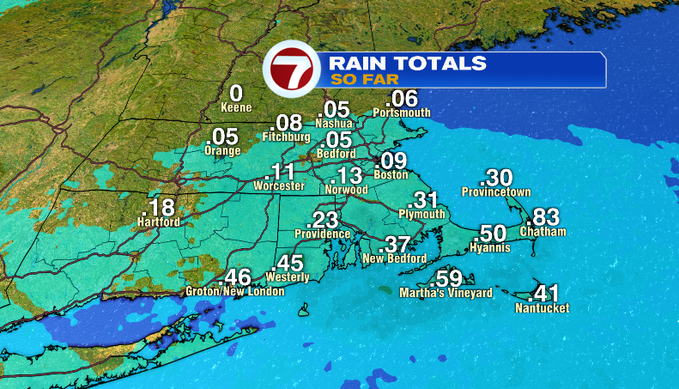

Mild Temperatures Little Rain Chance Your Weekend Forecast

May 20, 2025

Mild Temperatures Little Rain Chance Your Weekend Forecast

May 20, 2025 -

Severe Weather Outlook Storm Chance Overnight High Risk Monday

May 20, 2025

Severe Weather Outlook Storm Chance Overnight High Risk Monday

May 20, 2025 -

Understanding Breezy And Mild Conditions A Comprehensive Guide

May 20, 2025

Understanding Breezy And Mild Conditions A Comprehensive Guide

May 20, 2025 -

Finding The Perfect Breezy And Mild Climate For Your Next Vacation

May 20, 2025

Finding The Perfect Breezy And Mild Climate For Your Next Vacation

May 20, 2025 -

Breezy And Mild Weather Your Guide To Comfortable Temperatures

May 20, 2025

Breezy And Mild Weather Your Guide To Comfortable Temperatures

May 20, 2025