MicroStrategy Vs Bitcoin In 2025: Which Is The Better Investment?

Table of Contents

MicroStrategy's Bitcoin Strategy in 2025

Analyzing MicroStrategy's Current Holdings and Future Plans

MicroStrategy, under the leadership of Michael Saylor, has made a bold bet on Bitcoin. As of [insert current date], they hold approximately [insert current number] Bitcoin, representing a substantial portion of their assets. Their purchase strategy has involved accumulating Bitcoin over several years, often at varying price points. While they haven't explicitly laid out concrete plans for future acquisitions beyond opportunistic purchases, their continued vocal support for Bitcoin suggests a long-term commitment to this asset.

- Total BTC Holdings: [insert current number] BTC (as of [date])

- Average Purchase Price: [Insert approximate average purchase price]

- Debt Incurred: [Insert information on debt taken on to purchase Bitcoin]

- Impact of Bitcoin Price Fluctuations: Significant. A sharp drop in Bitcoin's price would negatively impact MicroStrategy's balance sheet and stock price. Conversely, a surge in Bitcoin's value would greatly benefit the company.

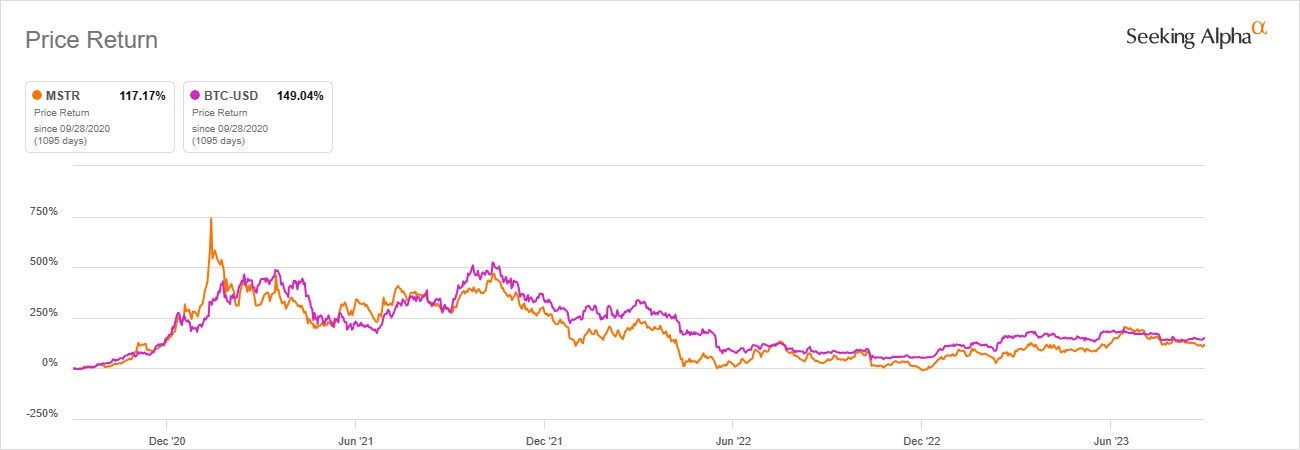

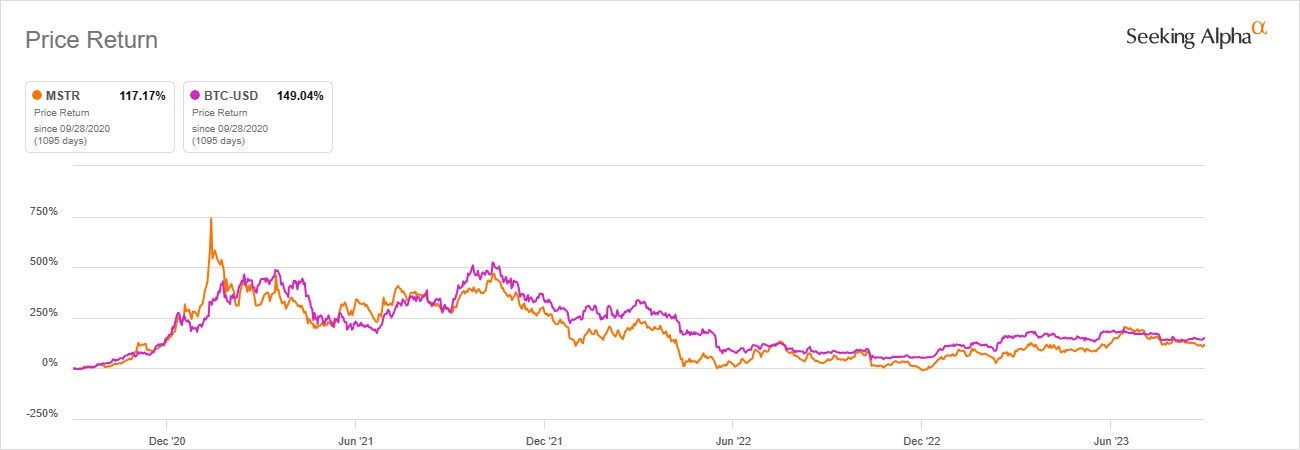

MicroStrategy Stock Performance and Correlation to Bitcoin

MicroStrategy's stock price (MSTR) has historically shown a strong correlation with Bitcoin's price. When Bitcoin rises, MSTR tends to rise, and vice versa. However, other factors such as the company's overall financial performance and general market sentiment also play a role. Whether this correlation will persist in 2025 remains uncertain. Several factors could influence this relationship:

- Increased Institutional Adoption of Bitcoin: If institutional adoption increases, the correlation between MSTR and Bitcoin could strengthen.

- MicroStrategy's Diversification Efforts: If MicroStrategy diversifies beyond Bitcoin, the correlation might weaken.

- MicroStrategy's Revenue and Earnings Growth: Stronger financial performance independent of Bitcoin could lessen the stock's dependence on Bitcoin's price.

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock presents a unique risk-reward profile:

Risks:

- Bitcoin Price Volatility: The primary risk is the volatility of Bitcoin. A significant drop in Bitcoin's price could severely impact MSTR's stock value.

- Regulatory Uncertainty: Changes in cryptocurrency regulations could negatively affect MicroStrategy's Bitcoin holdings and its overall business.

- Market Sentiment: Negative market sentiment towards either Bitcoin or the technology sector could depress MSTR's stock price.

Rewards:

- Bitcoin Price Appreciation: A substantial rise in Bitcoin's price would translate to significant gains for MSTR shareholders.

- Potential for Innovation: MicroStrategy's focus on Bitcoin could position it for future growth in the cryptocurrency sector.

Bitcoin's Potential in 2025

Bitcoin Price Prediction and Market Adoption

Predicting Bitcoin's price in 2025 is inherently speculative. Various analysts offer widely differing predictions, ranging from [insert low-end prediction] to [insert high-end prediction]. Several factors will influence its price:

- Widespread Adoption: Increased adoption by businesses and consumers is crucial for price appreciation.

- Institutional Investment: Continued investment from large institutions could drive up demand.

- Regulatory Developments: Clearer and more favorable regulatory frameworks could boost confidence and price.

- Technological Advancements: Scalability improvements and the development of new applications could increase Bitcoin's utility and value.

Bitcoin's Role in the Global Financial System

Bitcoin's potential role in the global financial system is a topic of intense debate. It could become:

- A widely accepted form of payment: Increased adoption by businesses could lead to broader use as a medium of exchange.

- A store of value: Bitcoin's limited supply could make it an attractive asset for long-term investors seeking to hedge against inflation.

- A catalyst for financial innovation: New financial products and services built on Bitcoin's blockchain technology could emerge.

Risks and Rewards of Investing Directly in Bitcoin

Investing directly in Bitcoin carries both substantial risks and rewards:

Risks:

- Extreme Volatility: Bitcoin's price is highly volatile, subject to significant swings in short periods.

- Security Risks: Losing access to your private keys could result in the loss of your Bitcoin.

- Regulatory Uncertainty: Regulatory changes could impact Bitcoin's legality and accessibility.

Rewards:

- High Potential Returns: Bitcoin's historical performance suggests a high potential for long-term returns.

- Decentralization: Bitcoin is decentralized, meaning it’s not controlled by any single entity.

- Limited Supply: Only 21 million Bitcoin will ever exist, making it a potentially deflationary asset.

MicroStrategy vs. Bitcoin: A Direct Comparison in 2025

Risk Tolerance and Investment Goals

Investing in MicroStrategy stock versus holding Bitcoin directly involves different levels of risk:

- MicroStrategy: Moderately high risk, offering exposure to both Bitcoin's price and MicroStrategy's business performance.

- Bitcoin: High risk, entirely dependent on Bitcoin's price movements.

Investors with a higher risk tolerance and a longer investment horizon might favor Bitcoin. Those seeking somewhat less risk might prefer MicroStrategy, although it’s still significantly correlated with Bitcoin's price.

Diversification and Portfolio Strategy

Both MicroStrategy and Bitcoin can play a role in a diversified portfolio, but careful consideration is necessary. The ideal allocation depends on the investor's risk tolerance and overall investment strategy. Including both in a portfolio might be considered overly correlated with Bitcoin's price.

Tax Implications and Regulatory Landscape

Tax implications and regulatory landscapes differ significantly:

- MicroStrategy: Subject to standard stock market taxation rules.

- Bitcoin: Taxation varies significantly depending on jurisdiction and usage (trading vs. holding). Regulatory changes are frequent and can impact the value and accessibility of Bitcoin.

Conclusion

Choosing between MicroStrategy and Bitcoin as an investment in 2025 requires careful consideration of your individual risk tolerance, investment timeline, and overall portfolio strategy. While MicroStrategy offers a more indirect route to Bitcoin exposure, it also carries the risks of a publicly traded company. Direct Bitcoin investment presents higher risk but also potentially higher rewards. Both options involve significant uncertainty. Remember that past performance is not indicative of future results.

Ultimately, the better investment—MicroStrategy or Bitcoin in 2025—depends on your individual risk tolerance and investment goals. Conduct thorough research, consult with a qualified financial advisor, and understand the risks involved before investing in either MicroStrategy or Bitcoin.

Featured Posts

-

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Intera 2024 2025

May 08, 2025

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Intera 2024 2025

May 08, 2025 -

Outer Banks Voice Longtime Coast Guard Member Ryan Gentry Celebrated

May 08, 2025

Outer Banks Voice Longtime Coast Guard Member Ryan Gentry Celebrated

May 08, 2025 -

Find The Winning Numbers Lotto Results For Wednesday April 16 2025

May 08, 2025

Find The Winning Numbers Lotto Results For Wednesday April 16 2025

May 08, 2025 -

Futbolli Luis Enrique Ben Pastrim Ne Psg Largohen Pese Yje

May 08, 2025

Futbolli Luis Enrique Ben Pastrim Ne Psg Largohen Pese Yje

May 08, 2025 -

Taiwans Reduced Exposure To Us Bond Etfs

May 08, 2025

Taiwans Reduced Exposure To Us Bond Etfs

May 08, 2025