MicroStrategy Vs. Bitcoin: Predicting The Better Investment For 2025

Table of Contents

Analyzing Bitcoin's Potential in 2025

Bitcoin's future price is a topic of endless debate. To gauge its potential in 2025, we must examine various factors.

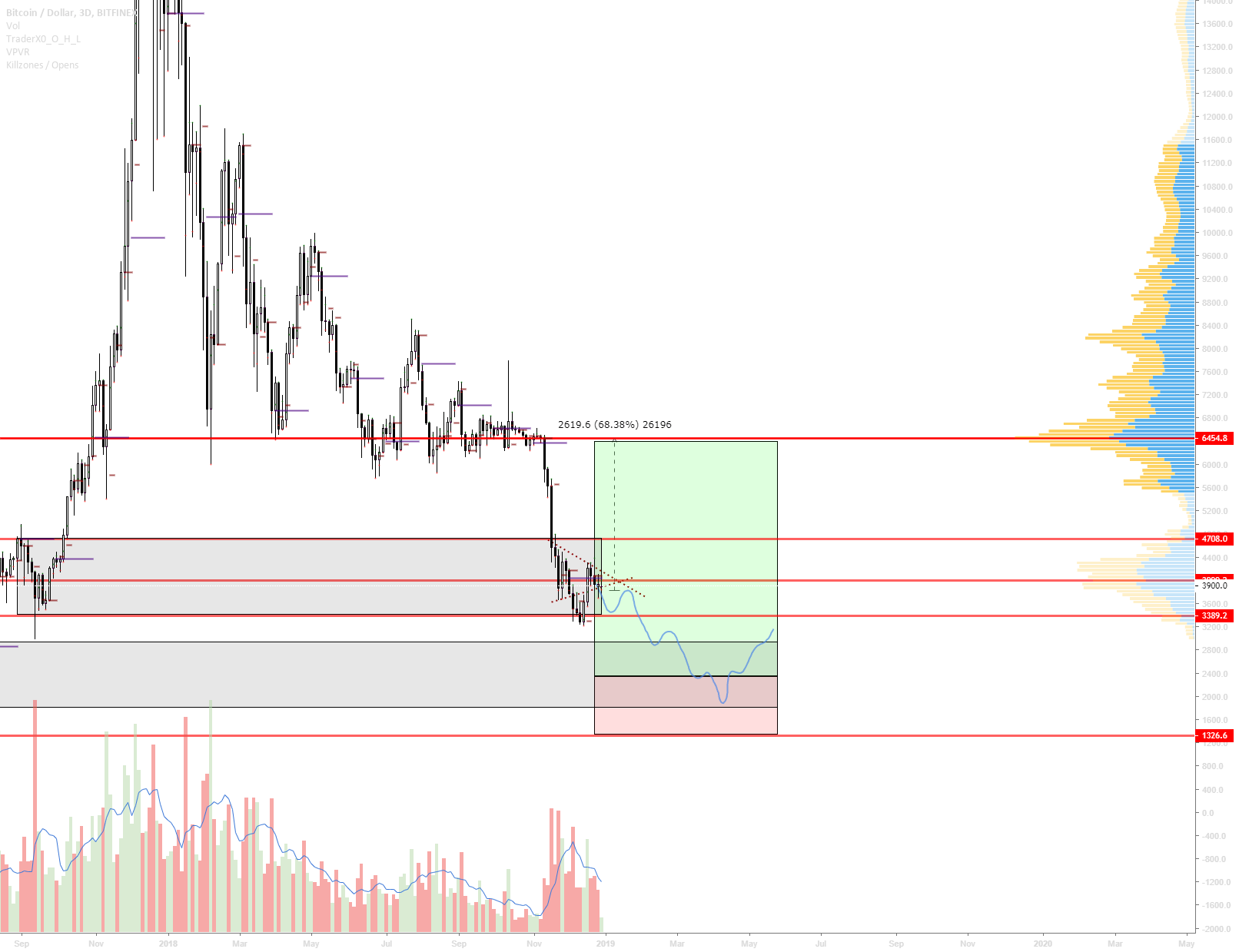

Bitcoin's Price Prediction Models: Numerous models attempt to predict Bitcoin's future price. The Stock-to-Flow model, for example, bases its predictions on the scarcity of Bitcoin and its halving cycles, often suggesting significantly higher prices in the coming years. Technical analysis, on the other hand, uses chart patterns and indicators to forecast price movements. While these models offer valuable insights, they are not foolproof and should be considered alongside other factors.

Adoption and Institutional Investment: Bitcoin's growing adoption by institutional investors is a powerful driver of its price. This trend is fueled by several key elements:

- Increased regulatory clarity: As governments worldwide grapple with Bitcoin regulation, clearer frameworks could lead to increased institutional participation.

- Growing acceptance as a store of value: Bitcoin's limited supply and decentralized nature make it attractive as a hedge against inflation and economic uncertainty.

- Integration into mainstream financial systems: The integration of Bitcoin into established financial systems through custodial services and exchange-traded products (ETPs) makes it more accessible to institutional investors.

Technological Advancements: Technological improvements are vital for Bitcoin's long-term success. The Lightning Network, for instance, aims to address Bitcoin's scalability issues by enabling faster and cheaper transactions. Further developments in this area could significantly enhance Bitcoin's usability and therefore its value.

Evaluating MicroStrategy as a Bitcoin Investment Vehicle

MicroStrategy's success as a Bitcoin investment vehicle hinges on several factors.

MicroStrategy's Business Model and Financial Health: MicroStrategy is primarily a business intelligence company. Its financial health and revenue streams are crucial to evaluating its investment potential. We need to consider:

- Revenue streams and profitability: Its core business profitability directly influences its ability to withstand Bitcoin price volatility.

- Debt levels and financial stability: High debt levels could exacerbate losses if Bitcoin's price declines.

- Dependence on Bitcoin's price: MicroStrategy's heavy investment in Bitcoin makes its valuation heavily dependent on Bitcoin's performance.

Risk Assessment of Investing in MicroStrategy: Investing in MicroStrategy carries specific risks:

- Correlation with Bitcoin price: MicroStrategy's stock price is highly correlated with Bitcoin's price, magnifying potential gains and losses.

- Potential for financial distress if Bitcoin's price declines significantly: A sharp drop in Bitcoin's price could significantly impact MicroStrategy's financial health.

- Competition in the business intelligence market: MicroStrategy faces competition from other established players in the business intelligence sector.

MicroStrategy's Bitcoin Strategy and Management: Understanding MicroStrategy's Bitcoin investment strategy, its long-term vision, and the competence of its management team is vital for assessing its potential. Their consistent buying of Bitcoin signals a long-term bullish outlook, but its success depends on the accuracy of this long-term prediction.

Comparing MicroStrategy and Direct Bitcoin Investment

To determine the better investment, we must compare the two options directly.

Risk vs. Reward Profile:

| Feature | Direct Bitcoin Investment | MicroStrategy Investment |

|---|---|---|

| Risk | High (price volatility) | High (correlated with Bitcoin, business risk) |

| Reward Potential | High (potential for significant price appreciation) | High (but potentially lower than direct Bitcoin) |

| Liquidity | Relatively high (easy to buy/sell) | Moderate (stock market liquidity) |

| Complexity | Relatively simple | More complex (involves understanding MicroStrategy's business) |

Diversification and Portfolio Allocation: Both Bitcoin and MicroStrategy can play a role in a diversified portfolio, but their inclusion should be carefully considered based on individual risk tolerance and investment goals. Direct Bitcoin investment offers higher potential returns but also significantly higher volatility. MicroStrategy offers a somewhat less volatile but still risky option.

Tax Implications: The tax implications of investing in Bitcoin and MicroStrategy vary significantly depending on jurisdiction and individual circumstances. This is a complex area requiring professional tax advice and is beyond the scope of this article.

Conclusion

Predicting the better investment between MicroStrategy and Bitcoin for 2025 is challenging due to the inherent volatility of the cryptocurrency market. While Bitcoin's long-term potential seems significant based on its adoption and technological advancements, investing directly exposes investors to high volatility. MicroStrategy offers a more indirect exposure to Bitcoin, but carries the added risk of its core business performance. Based on this analysis, for investors with a high-risk tolerance and a long-term horizon, direct Bitcoin investment might offer higher potential returns. However, a more conservative approach might favor MicroStrategy, accepting lower potential returns for reduced volatility. Both options, however, remain significantly risky.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in Bitcoin or MicroStrategy involves significant risk, and you could lose money.

Call to Action: Start your own research on MicroStrategy vs. Bitcoin investment strategies today to make informed decisions for 2025. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Has The Bitcoin Rebound Begun Exploring Future Price Predictions

May 08, 2025

Has The Bitcoin Rebound Begun Exploring Future Price Predictions

May 08, 2025 -

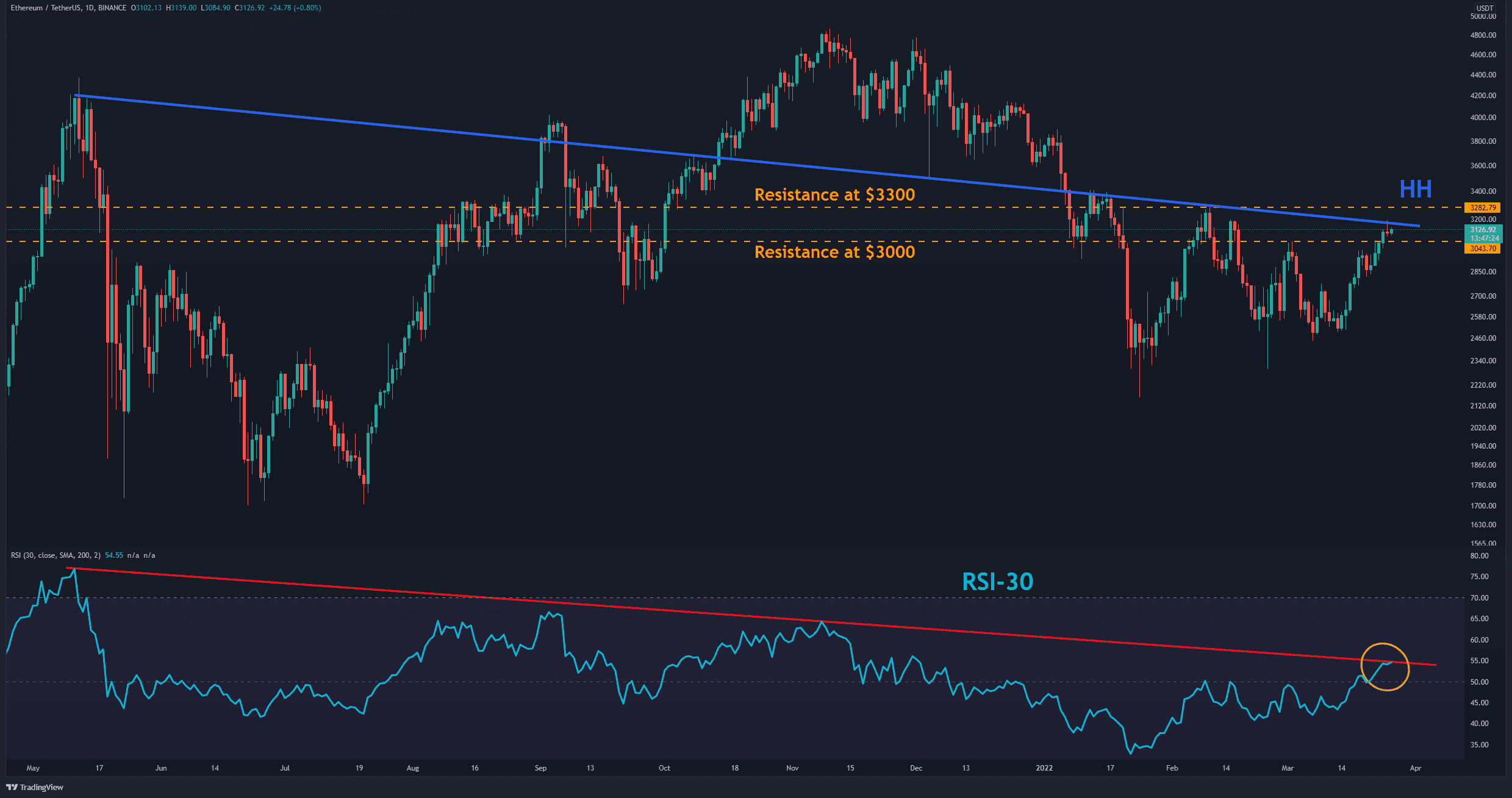

Is An Ethereum Price Breakout On The Horizon Analyzing Recent Resilience

May 08, 2025

Is An Ethereum Price Breakout On The Horizon Analyzing Recent Resilience

May 08, 2025 -

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025 -

Lyon Cede Ante El Psg En Casa

May 08, 2025

Lyon Cede Ante El Psg En Casa

May 08, 2025 -

Ligue 1 El Psg Se Impone Al Lyon En Casa

May 08, 2025

Ligue 1 El Psg Se Impone Al Lyon En Casa

May 08, 2025