Microsoft: A Reliable Software Investment In Uncertain Times

Table of Contents

Microsoft's Diversified Product Portfolio: A Hedge Against Risk

Microsoft's success stems from its remarkably diverse product portfolio, acting as a powerful hedge against risk. This diversification ensures that even if one sector experiences a downturn, others can compensate, providing stability for investors.

Cloud Computing Dominance with Azure

Microsoft's Azure cloud platform is a major force in the cloud computing market. Its market-leading position, fueled by consistent growth and widespread enterprise adoption, translates into a robust and recurring revenue stream.

- Market Leadership: Azure consistently ranks among the top cloud providers globally, competing head-to-head with AWS and Google Cloud.

- Growth Potential: The cloud computing market is experiencing explosive growth, providing significant upside potential for Azure and Microsoft as a whole.

- Enterprise Adoption: Major corporations rely on Azure for its scalability, security, and comprehensive suite of services.

- Recurring Revenue Model: Azure's subscription-based model ensures a steady flow of income, reducing reliance on one-time sales.

- Specific Services: Azure offers a vast array of services, including Azure Virtual Machines, Azure SQL Database, Azure Active Directory, and many more, catering to diverse business needs. This breadth of services further strengthens its market position within the cloud services sector. Keywords: Azure, cloud computing, cloud services, Microsoft cloud, SaaS, IaaS, PaaS.

Productivity Suite Powerhouse with Microsoft 365

Microsoft 365, the successor to Office 365, remains the gold standard for productivity software. Its subscription model, coupled with continuous innovation and unparalleled market penetration, ensures long-term value.

- Essential Business and Personal Tools: Word, Excel, PowerPoint, Outlook, and Teams are indispensable tools for individuals and businesses alike.

- Subscription Model: The subscription model fosters ongoing revenue and encourages users to stay up-to-date with the latest features and security updates.

- Ongoing Innovation: Microsoft continuously enhances Microsoft 365, adding new features and functionality to maintain its competitive edge.

- Market Penetration: Microsoft 365 boasts a massive user base, solidifying its dominance in the productivity software market. Keywords: Microsoft 365, Office 365, productivity software, subscription software, collaboration tools, business software.

Gaming and Entertainment Strength with Xbox and Gaming

Microsoft's expansion into gaming and entertainment through Xbox and its associated services demonstrates a shrewd diversification strategy. The ever-growing gaming market presents significant opportunities for future growth.

- Growing Gaming Market: The global gaming industry is booming, offering a substantial and resilient market for Microsoft's Xbox products and services.

- Subscription Services: Xbox Game Pass, a subscription service offering access to a vast library of games, provides a recurring revenue stream and fosters customer loyalty. This is a key aspect of Microsoft's strategic approach to the gaming industry.

- Diversification Beyond Core Software: This sector diversifies Microsoft's revenue streams beyond its traditional software offerings. Keywords: Xbox, gaming, Xbox Game Pass, entertainment software, Microsoft gaming.

Strong Financial Performance and Consistent Growth: A Sign of Stability

Microsoft's consistent financial performance underscores its stability as an investment. Its robust financials and steady growth provide reassurance in uncertain economic climates.

Robust Financial Statements and Dividend History

Microsoft's financial statements consistently demonstrate strong revenue streams, consistent profit growth, and robust cash flow. Its history of dividend payments further enhances its appeal to investors seeking stability and income. (Note: Specific financial data should be inserted here, sourced from reliable financial reporting websites like Yahoo Finance or the Microsoft Investor Relations page.)

- Stable Revenue Streams: Diverse product portfolio ensures stable and predictable revenue generation.

- Consistent Profit Growth: Year-over-year profit growth demonstrates Microsoft’s ability to manage its operations efficiently and effectively.

- Strong Cash Flow: Significant cash reserves allow the company to weather economic downturns and invest in future growth.

- Dividend History: A history of dividend payments provides a reliable income stream for investors. Keywords: Microsoft financials, Microsoft stock, revenue growth, profit margins, dividend yield, financial stability.

Long-Term Growth Outlook and Strategic Investments

Microsoft's strategic investments in research and development, coupled with strategic acquisitions, position the company for continued long-term growth.

- Strategic Acquisitions: Acquisitions of companies with complementary technologies and expertise expand Microsoft’s capabilities and market reach.

- Research and Development Investments: Significant investments in R&D drive innovation and ensure Microsoft remains at the forefront of technological advancements.

- Expansion into New Markets: Microsoft continues to explore and invest in promising new markets such as Artificial Intelligence, further driving growth. Keywords: Microsoft investments, future growth, technological innovation, artificial intelligence, AI investments.

Microsoft's Commitment to Innovation and Adaptability: Future-Proofing Your Investment

Microsoft's consistent commitment to innovation and its ability to adapt to changing market conditions make it a future-proof investment.

- Focus on Cutting-Edge Technologies: Microsoft actively invests in and develops cutting-edge technologies like AI, cloud computing, and quantum computing.

- Continuous Product Development: Regular product updates and new feature releases keep Microsoft’s products competitive and relevant.

- Adaptability to Market Changes: Microsoft demonstrates a remarkable ability to adapt its strategies and offerings to meet evolving market demands. Keywords: Microsoft innovation, technological advancements, future technologies, adaptive business model.

Conclusion: Microsoft: A Solid Software Investment for a Secure Future

In conclusion, Microsoft's diversified product portfolio, robust financial performance, and unwavering commitment to innovation make it a compelling and reliable software investment, even during times of economic uncertainty. Its dominance in cloud computing with Azure, its ubiquitous productivity suite Microsoft 365, and its strategic expansion into gaming all contribute to a resilient and future-proof business model.

Consider exploring the various Microsoft products and services available to find the best fit for your needs. Visit the official Microsoft website and their investor relations page for more information: [Link to Microsoft Website], [Link to Microsoft Investor Relations]. Investing in Microsoft represents a dependable software investment, a smart choice for a secure future.

Featured Posts

-

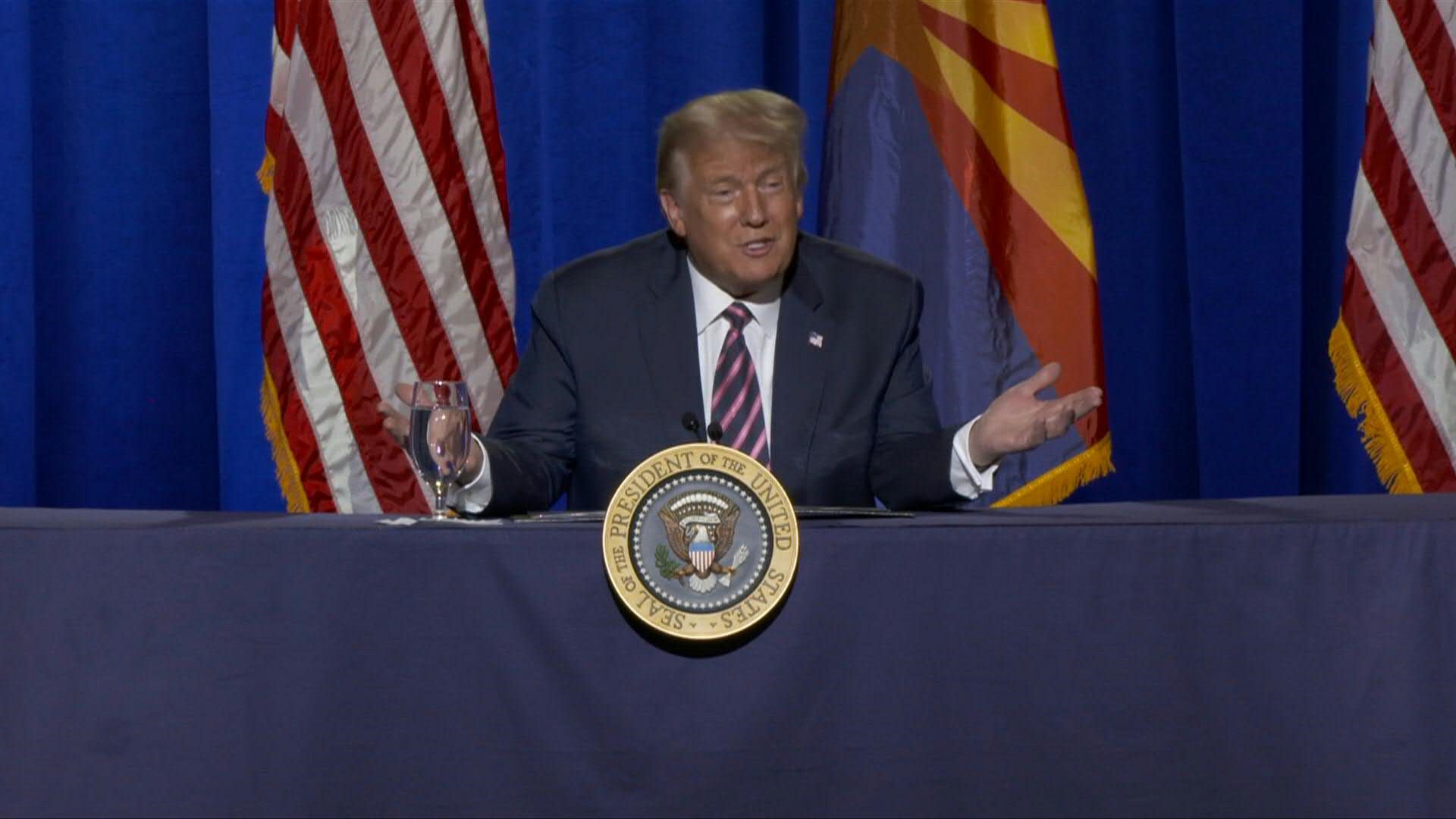

Bidens Gaffe Trump Exploits Sleepy Joe Image In Latest Attack

May 15, 2025

Bidens Gaffe Trump Exploits Sleepy Joe Image In Latest Attack

May 15, 2025 -

The Awkward Truth About Paddy Pimblett Vs Michael Chandler A Ufc Veterans Breakdown

May 15, 2025

The Awkward Truth About Paddy Pimblett Vs Michael Chandler A Ufc Veterans Breakdown

May 15, 2025 -

Pimblett Targets Ufc Gold Chandler Fight A Stepping Stone

May 15, 2025

Pimblett Targets Ufc Gold Chandler Fight A Stepping Stone

May 15, 2025 -

Snelle Actie Beloofd Na Gesprek Over Frederieke Leeflang En De Npo

May 15, 2025

Snelle Actie Beloofd Na Gesprek Over Frederieke Leeflang En De Npo

May 15, 2025 -

Berlin Bvg Streik Aktuelle Infos Und Auswirkungen Auf Den Fahrgastverkehr

May 15, 2025

Berlin Bvg Streik Aktuelle Infos Und Auswirkungen Auf Den Fahrgastverkehr

May 15, 2025

Latest Posts

-

Analysis Trumps Sleepy Joe Strategy And Its Effectiveness

May 15, 2025

Analysis Trumps Sleepy Joe Strategy And Its Effectiveness

May 15, 2025 -

Presidential Debate Highlights Trump Targets Bidens Knowledge

May 15, 2025

Presidential Debate Highlights Trump Targets Bidens Knowledge

May 15, 2025 -

Spiker Na Zakhodi Poslugi Dzho Baydena Za 300 000

May 15, 2025

Spiker Na Zakhodi Poslugi Dzho Baydena Za 300 000

May 15, 2025 -

Ukraine Policy Debate Jd Vances Strong Rebuttal To Biden

May 15, 2025

Ukraine Policy Debate Jd Vances Strong Rebuttal To Biden

May 15, 2025 -

Dzho Bayden Vartist Vistupu 300 000

May 15, 2025

Dzho Bayden Vartist Vistupu 300 000

May 15, 2025