Microsoft-Activision Deal: FTC's Appeal Throws Future Into Doubt

Table of Contents

The FTC's Argument Against the Merger

The FTC's opposition to the Microsoft-Activision merger centers on concerns about anti-competitive practices and the inadequacy of the proposed remedies. The regulatory body argues that the deal, if allowed to proceed, would significantly harm competition in the gaming market.

Concerns about Anti-competitive Practices

The FTC's primary concern revolves around Microsoft's potential to leverage its ownership of Activision Blizzard to stifle competition. This fear is rooted in several key areas:

- Call of Duty Exclusivity: A major point of contention is the possibility of Microsoft making popular titles like Call of Duty exclusive to its Xbox ecosystem. This would severely disadvantage PlayStation and other competing platforms, potentially driving players towards Xbox and harming competition. The FTC argues this move could significantly reduce the competitiveness of the gaming market.

- Domination of the Game Subscription Market: The merger would combine Microsoft's Xbox Game Pass with Activision Blizzard's extensive game library. The FTC fears this consolidated power could lead to a dominant market position, stifling innovation and potentially harming rival subscription services. The concern is not just about the size of the combined service but also its potential to exclude competing games and developers.

- Harm to Rival Game Developers and Publishers: The FTC argues that Microsoft's increased market power could negatively impact rival game developers and publishers. Smaller companies might struggle to compete against a behemoth controlling popular franchises and a massive subscription service. This concern underscores the broader implications of the merger for the overall health of the gaming industry's competitive landscape.

Lack of Sufficient Concessions

The FTC contends that Microsoft’s proposed concessions to address competition concerns were insufficient to mitigate the potential harm. These concessions, primarily focused on licensing agreements for Call of Duty, were deemed inadequate by the regulatory body.

- Inadequate Call of Duty Licensing: While Microsoft offered licensing agreements to keep Call of Duty on PlayStation, the FTC argues these agreements lacked sufficient guarantees to ensure fair and equitable access for competitors. The details of these agreements remain under scrutiny, with the FTC expressing doubts about their effectiveness in maintaining a competitive market.

- Insufficient Broader Concessions: Beyond Call of Duty, the FTC found other concessions offered by Microsoft to be insufficient to address the broader concerns about anti-competitive practices in the subscription service and game development markets. These additional aspects of the FTC's argument highlight the complexity of evaluating the potential impact of the merger.

Microsoft's Defense and Counterarguments

Microsoft counters the FTC's arguments by emphasizing the benefits of the merger for consumers and the gaming industry as a whole. They argue that the deal will foster innovation, increase competition, and ultimately improve the gaming experience.

Maintaining Competition

Microsoft insists that the merger will actually increase competition and choice for gamers. Their arguments center on several key points:

- Expanded Game Availability Through Xbox Game Pass: Microsoft highlights the potential for a broader range of games to be available through Xbox Game Pass, providing greater value to subscribers. They argue this would benefit consumers by offering more games at a lower cost.

- Arguments Against Exclusivity: Microsoft vehemently denies plans to make key titles like Call of Duty exclusive to Xbox. They assert that keeping these games available across multiple platforms is in their best interest to maximize reach and revenue.

- Investment in Game Development and Market Expansion: Microsoft emphasizes their commitment to invest in game development and expand the overall gaming market. They argue this investment would lead to more innovation and a more vibrant gaming ecosystem.

Legal Challenges and Precedents

Microsoft is also challenging the FTC's case on legal grounds, citing past successful mergers in the tech industry and arguing that the FTC's concerns are unwarranted and based on weak evidence.

- Relevant Legal Precedents: Microsoft's defense team points to various legal precedents where similar mergers were approved, arguing that the FTC’s concerns are not supported by established legal principles. They are employing a robust legal strategy to counter the FTC's claims.

- Weaknesses in the FTC’s Case: Microsoft is actively highlighting perceived weaknesses in the FTC's evidence and arguments, challenging the agency’s claims about the potential for anti-competitive behavior. They are striving to demonstrate that the merger will not harm competition.

Potential Outcomes and Implications

The FTC's appeal has significant implications for the future of the gaming industry, influencing both the immediate outcome of the Microsoft-Activision merger and setting precedents for future mergers and acquisitions.

Impact on the Gaming Industry

A successful FTC appeal could significantly alter the landscape of the gaming industry:

- Delayed or Blocked Merger: A ruling in favor of the FTC could delay or even permanently block the merger, potentially preventing the integration of Activision Blizzard's properties into Microsoft's ecosystem.

- Impact on Game Prices and Availability: The outcome will affect game pricing strategies and the availability of titles across different platforms. A blocked merger might lead to a different competitive structure, impacting consumers.

- Future of Activision Blizzard Franchises: The fate of Call of Duty, World of Warcraft, and other Activision Blizzard franchises hangs in the balance, depending on the final resolution.

Setting Precedents for Future Mergers

The outcome of this case will undoubtedly impact future mergers and acquisitions in the tech and gaming industries:

- Antitrust Regulations: The decision could set a precedent for future antitrust regulations concerning mergers in the technology sector, influencing how such deals are reviewed and potentially leading to stricter enforcement.

- Regulatory Landscape: The long-term consequences for the regulatory landscape of the gaming industry will be significant, impacting how future mergers and acquisitions are assessed and potentially shaping the competitive dynamics of the market for years to come.

Conclusion

The FTC's appeal of the Microsoft-Activision deal significantly clouds the future of this major merger. The arguments from both sides highlight crucial questions surrounding competition, consumer welfare, and the future regulatory environment of the gaming industry. The outcome will profoundly impact the gaming landscape, affecting everything from game prices and availability to the future of major franchises. Stay informed on the latest developments regarding the Microsoft-Activision merger to understand its ultimate consequences. Closely monitoring the legal battle surrounding this significant Microsoft-Activision deal will be crucial for understanding the shaping of the future gaming landscape.

Featured Posts

-

Escape To The Countryside The Costs And Benefits Of Rural Living

May 25, 2025

Escape To The Countryside The Costs And Benefits Of Rural Living

May 25, 2025 -

100 Let Innokentiyu Smoktunovskomu Dokumentalnaya Istoriya Velikogo Aktera

May 25, 2025

100 Let Innokentiyu Smoktunovskomu Dokumentalnaya Istoriya Velikogo Aktera

May 25, 2025 -

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I I Trillerakh

May 25, 2025

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I I Trillerakh

May 25, 2025 -

Avrupa Borsalarinda Son Durum Ecb Faiz Kararinin Etkisi

May 25, 2025

Avrupa Borsalarinda Son Durum Ecb Faiz Kararinin Etkisi

May 25, 2025 -

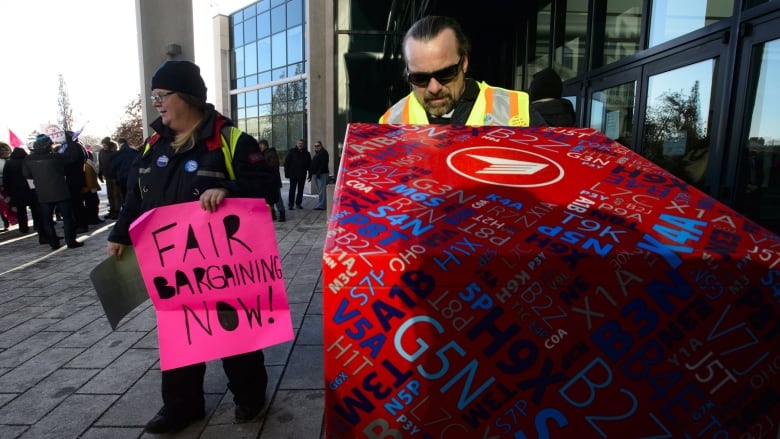

Alternative Delivery Services Capitalize On Canada Post Shortcomings

May 25, 2025

Alternative Delivery Services Capitalize On Canada Post Shortcomings

May 25, 2025

Latest Posts

-

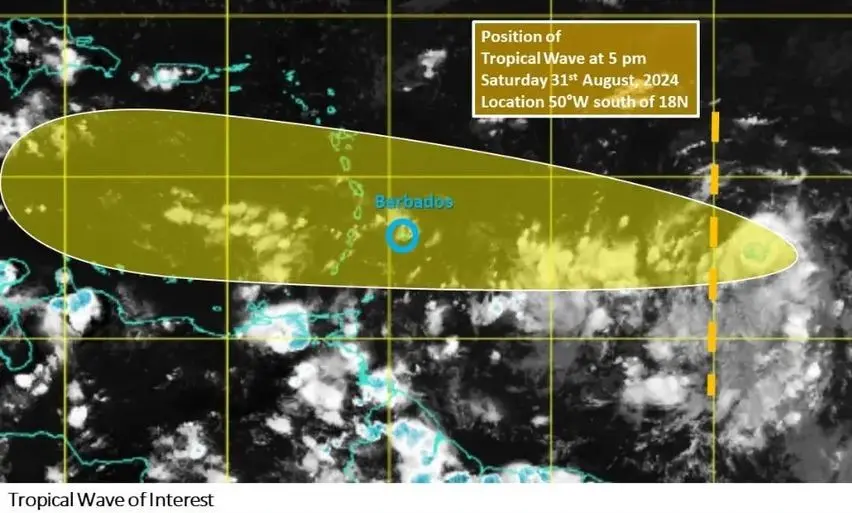

Flash Flood Emergency Response Protecting Yourself And Your Family

May 25, 2025

Flash Flood Emergency Response Protecting Yourself And Your Family

May 25, 2025 -

Flood Warning Your Action Plan With Nws Safety Tips

May 25, 2025

Flood Warning Your Action Plan With Nws Safety Tips

May 25, 2025 -

Nws Issues Flash Flood Warning For South Florida Due To Intense Rainfall

May 25, 2025

Nws Issues Flash Flood Warning For South Florida Due To Intense Rainfall

May 25, 2025 -

South Florida Flash Flood Warning Heavy Rainfall Prompts Urgent Alert

May 25, 2025

South Florida Flash Flood Warning Heavy Rainfall Prompts Urgent Alert

May 25, 2025 -

Understanding Flood Warnings Your Guide From The Nws

May 25, 2025

Understanding Flood Warnings Your Guide From The Nws

May 25, 2025