Missing HMRC Refunds? Check Your Savings Account Now

Table of Contents

Common Reasons for Missing HMRC Refunds

Sometimes, HMRC refunds go unnoticed. Understanding why this happens is the first step to reclaiming your money.

Overpayments of Tax

Overpaying tax is more common than you might think. This can happen through various channels:

- Self-assessment tax returns: Errors in calculations or incorrect deductions can lead to overpayment.

- PAYE (Pay As You Earn): Your employer might deduct too much tax from your salary, especially if your circumstances change (e.g., marriage, change in employment status).

Here are some examples of overpayment scenarios:

- You claimed too many allowances on your tax return.

- Your employer incorrectly calculated your tax code.

- You paid tax on income that was exempt.

HMRC usually processes refunds automatically once an overpayment is identified, but it's crucial to check your records.

Incorrect Bank Details

Providing incorrect bank details to HMRC is a major reason for missed refunds. Even a small error can cause delays or failed payments.

- Consequences of incorrect details: Your refund may be delayed indefinitely, or it might be returned to HMRC.

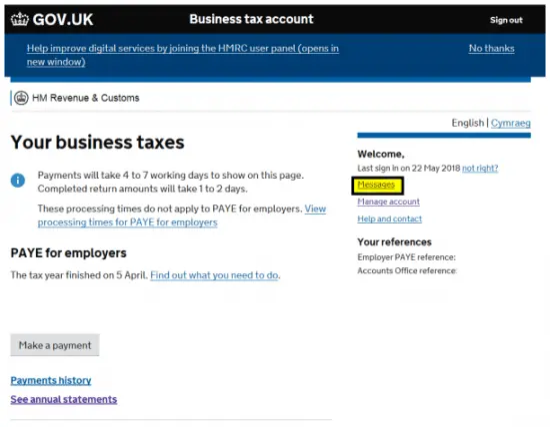

- Checking your HMRC records: Log into your HMRC online account to ensure your bank details are up-to-date and accurate. Any discrepancies should be corrected immediately.

Ensure you regularly update HMRC with any changes to your bank account information.

Unclaimed Tax Credits

Many people are entitled to tax credits but don't claim them. This can result in significant unclaimed refunds.

- Checking eligibility and claiming: Use the HMRC website to check if you're eligible for tax credits. You can claim online, by phone, or by post.

- Time limits: Be aware of the deadlines for claiming tax credits; they may vary depending on the type of credit. Don't delay!

Don't hesitate to contact HMRC for assistance if you're unsure about your eligibility.

Refunds Paid to an Old Account

HMRC may send refunds to an old bank account, especially if you've changed accounts and haven't updated your details.

- Checking old bank statements: Scrutinize your old bank statements, focusing on payments around the time you expect a refund. Look for any payments from "HMRC," "Tax Refund," or similar descriptions.

- Contacting previous banks: If you can't find the payment, contacting your previous banks to request older statements might be necessary. They may have a fee for this service.

How to Check Your Savings Account for HMRC Refunds

Actively searching for HMRC refunds is key to reclaiming any owed money.

Review Your Bank Statements

Thoroughly check your bank statements for any potential HMRC refunds.

- Checking online statements: Most banks offer online access to your statements; this makes searching much easier.

- Keywords to search for: Use keywords like "HMRC," "tax refund," "payment," "tax repayment," and the tax year in question.

- Statement download features: Download your statements to your computer for easier searching using "find" or "control+F" functions.

Regularly review your statements; don't wait for a potential refund to be flagged by the bank.

Contact Your Bank

If you're struggling to locate a refund, contacting your bank is a worthwhile step.

- What information to provide: Be prepared to provide your account number, approximate dates of potential payments, and any payment references you might have.

- Fees for retrieving older statements: Be aware that some banks might charge fees for accessing very old statements.

Your bank may have records of payments that you may have overlooked.

What to Do if You Find an HMRC Refund

Once you've found a potential HMRC refund, take the necessary steps to verify and report it appropriately.

Verify the Payment

Before celebrating, ensure the payment is a legitimate HMRC refund.

- Check the payment reference: The payment should include a reference number that can be verified with HMRC.

- Contact HMRC: If you're unsure, contact HMRC directly to confirm the payment.

Report any discrepancies

If there are any discrepancies between the amount received and what you believe you are owed, report this to HMRC immediately.

- Contact HMRC: Use their official website or helpline to report any inconsistencies.

- Providing relevant details: Be prepared to provide your full name, National Insurance number, tax year, and any other relevant information.

Contact HMRC directly to ensure the correct amount is credited to your account, and to keep a clear record of communications.

Conclusion

This article highlighted common reasons for missing HMRC refunds and provided practical steps to check your savings accounts for unclaimed money. Many people unknowingly leave money unclaimed, so diligent checking is crucial. Don't miss out on your money! Check your savings account now for forgotten HMRC refunds. Take action today and reclaim what's rightfully yours. If you're unsure about anything, contact HMRC directly for assistance.

Featured Posts

-

Hmrc Website Down Widespread Access Issues Reported In The Uk

May 20, 2025

Hmrc Website Down Widespread Access Issues Reported In The Uk

May 20, 2025 -

Druhe Dieta Jennifer Lawrence Herecka Potvrdila Radostnu Novinu

May 20, 2025

Druhe Dieta Jennifer Lawrence Herecka Potvrdila Radostnu Novinu

May 20, 2025 -

Mick Schumacher Confirmado Soltero Y Buscando Pareja En Aplicacion De Citas

May 20, 2025

Mick Schumacher Confirmado Soltero Y Buscando Pareja En Aplicacion De Citas

May 20, 2025 -

Plyuschenko Sikharulidze Kuznetsova Uspeshnye Restoratory I Drugie Proekty

May 20, 2025

Plyuschenko Sikharulidze Kuznetsova Uspeshnye Restoratory I Drugie Proekty

May 20, 2025 -

Suki Waterhouses Baby Doll Makeup A Fresh Spring Look

May 20, 2025

Suki Waterhouses Baby Doll Makeup A Fresh Spring Look

May 20, 2025

Latest Posts

-

Novo Dijete Jennifer Lawrence Objavljeni Detalji

May 20, 2025

Novo Dijete Jennifer Lawrence Objavljeni Detalji

May 20, 2025 -

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025 -

Iznenadenje Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Iznenadenje Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025