Navigating The Chinese Market: The Struggles Of BMW, Porsche, And Other Automakers

Table of Contents

Intense Domestic Competition

The rise of powerful domestic brands like BYD, Nio, and Xpeng has dramatically reshaped the Chinese automotive landscape, posing a significant challenge to foreign automakers. These Chinese auto brands are not only gaining market share rapidly but are also setting a new standard for innovation and aggressive business practices. This intense domestic competition significantly impacts the strategies of established players like BMW and Porsche.

- Aggressive pricing strategies from domestic players: Chinese brands often leverage cost advantages and government subsidies to offer highly competitive pricing, undercutting established luxury brands. This price war puts pressure on profit margins for international automakers.

- Rapid technological advancements and innovation from Chinese brands: Domestic brands are rapidly advancing in electric vehicle (EV) technology, autonomous driving features, and connected car services, directly challenging the technological leadership of international competitors. The focus on cutting-edge technology is a key driver of their success in the Chinese EV market.

- Strong government support and subsidies for domestic automakers: The Chinese government actively supports domestic automakers through various policies, including subsidies, tax breaks, and preferential treatment in procurement. This significant support gives Chinese brands a considerable competitive advantage.

- Growing preference among Chinese consumers for domestic brands: A rising sense of national pride and trust in homegrown technologies is driving increased consumer preference for domestic brands, especially among younger generations. This shift in consumer sentiment presents a considerable hurdle for international brands. Understanding this shift in the Chinese consumer preferences is crucial.

Navigating Regulatory Hurdles and Bureaucracy

The Chinese automotive market is known for its complex regulatory environment, presenting significant hurdles for international automakers. Navigating import tariffs, licensing requirements, and evolving regulations demands significant resources and expertise. Understanding and adapting to these regulations is crucial for long-term success in the Chinese automotive regulations.

- Strict emission standards and environmental regulations: China has stringent emission standards and environmental regulations, requiring significant investment in research and development to comply. Meeting these standards can be costly and time-consuming.

- Lengthy and complicated approval processes for new models: The approval process for introducing new models in China is notoriously lengthy and complex, requiring substantial documentation and bureaucratic navigation. This delays market entry and slows down product launches.

- Navigating differing regional regulations and standards: Regulations can vary significantly across different regions within China, adding further complexity to the approval process and market entry strategies. This necessitates a tailored approach for different provinces.

- Challenges in intellectual property protection: Protecting intellectual property in China remains a concern for international automakers, requiring robust legal strategies and proactive measures to safeguard their innovations. This is crucial for maintaining a competitive edge.

Understanding Unique Consumer Preferences

Chinese consumers have unique preferences and demands that significantly influence the automotive market. Understanding these preferences is crucial for international brands seeking success. The Chinese automotive market is not a monolithic entity; there are significant variations in consumer preferences across different demographics.

- Emphasis on technology and advanced features: Chinese consumers highly value technology and advanced features in their vehicles, including connectivity, autonomous driving capabilities, and infotainment systems. This demand for technological innovation needs to be met by international carmakers.

- Preference for larger vehicles and SUVs: There's a strong preference for larger vehicles, particularly SUVs, driven by factors like family size and status symbol. Adapting product offerings to cater to this preference is essential.

- Growing interest in electric and hybrid vehicles: The Chinese government's push towards electric vehicles and growing environmental awareness are driving increased consumer interest in EVs and hybrids. This presents opportunities and challenges simultaneously.

- Importance of brand image and social status: Brand image and social status play a significant role in purchasing decisions, emphasizing the importance of targeted marketing and brand building within the Chinese context. This requires a nuanced understanding of Chinese culture and consumer psychology.

- Influence of social media and online reviews: Social media and online reviews have a considerable influence on purchasing decisions, highlighting the need for proactive online reputation management and engagement strategies. This requires a strong online presence and engagement with influencers.

Building a Successful Supply Chain and Distribution Network

Establishing a reliable supply chain and distribution network in China is a complex undertaking. The vast geographical size, diverse infrastructure, and logistical challenges require careful planning and execution. A strong supply chain management China is crucial for efficient operations.

- Finding reliable local suppliers and partners: Identifying and partnering with reliable local suppliers is essential for efficient production and cost management. This requires thorough due diligence and strong relationship building.

- Managing complex logistics and transportation networks: Efficiently managing logistics and transportation across the vast Chinese market demands a robust and well-integrated network. This necessitates strategic planning and investment in logistics infrastructure.

- Building an effective dealer network across the vast Chinese market: Establishing a comprehensive and effective dealer network covering China’s diverse regions is crucial for reaching a broad customer base. This requires careful selection and training of dealers.

- Adapting to the unique characteristics of the Chinese retail landscape: The Chinese retail landscape differs significantly from other markets, requiring an understanding of the nuances of local consumer behavior and retail practices. This necessitates local market expertise.

Conclusion

Successfully navigating the Chinese automotive market requires a deep understanding of the unique challenges and opportunities presented. International automakers like BMW and Porsche face intense domestic competition, complex regulatory hurdles, and diverse consumer preferences. Building a strong local presence, adapting to evolving consumer demands, and navigating the intricacies of the Chinese business environment are crucial for long-term success. By carefully considering these factors and investing in localized strategies, foreign automakers can increase their chances of achieving sustainable growth in this dynamic market. To learn more about optimizing your strategy for success in the Chinese automotive market, continue researching best practices and consult with experts in the field. Remember, understanding the intricacies of this market is key to unlocking its potential.

Featured Posts

-

Microsofts Approach To Ethical Ai Design A Human First Perspective

Apr 26, 2025

Microsofts Approach To Ethical Ai Design A Human First Perspective

Apr 26, 2025 -

Orlandos Hottest New Restaurants Beyond The Theme Parks 2025

Apr 26, 2025

Orlandos Hottest New Restaurants Beyond The Theme Parks 2025

Apr 26, 2025 -

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025 -

Abb Vie Abbv Raises Profit Outlook Strong Sales Growth Fueled By New Drugs

Apr 26, 2025

Abb Vie Abbv Raises Profit Outlook Strong Sales Growth Fueled By New Drugs

Apr 26, 2025 -

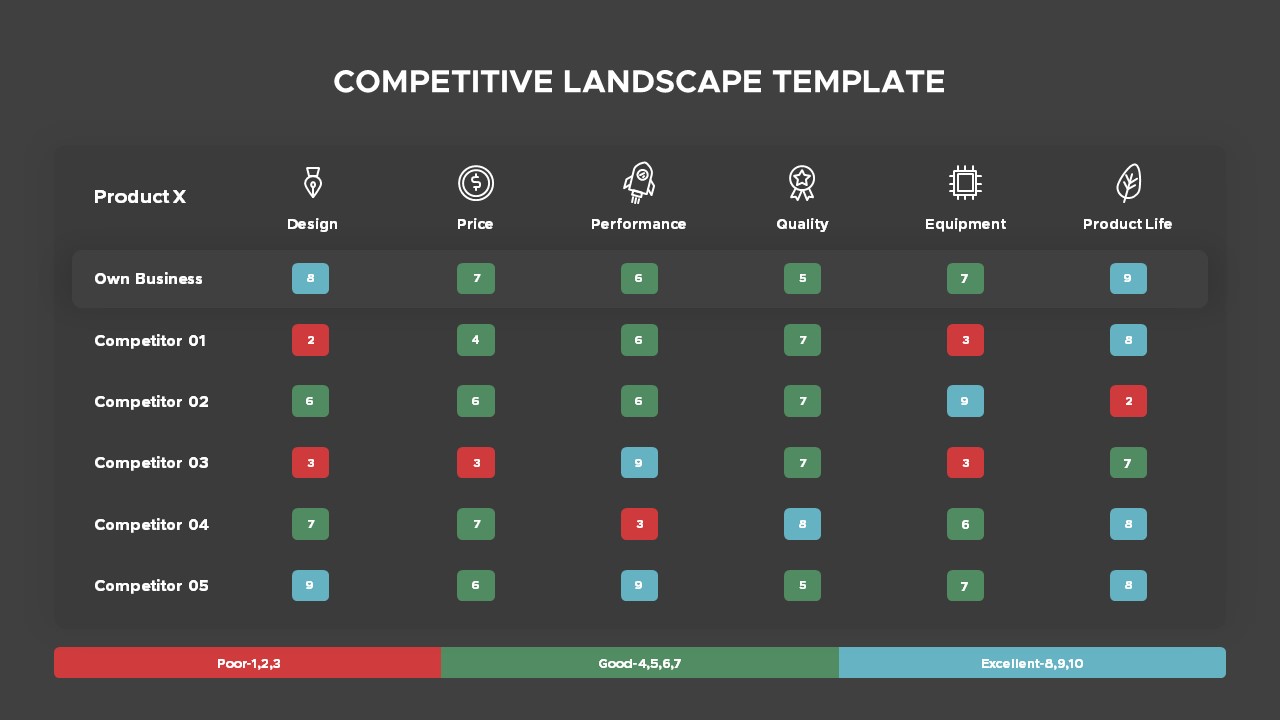

Growth Challenges In China A Look At Bmw Porsche And The Competitive Landscape

Apr 26, 2025

Growth Challenges In China A Look At Bmw Porsche And The Competitive Landscape

Apr 26, 2025