Navigating The Private Credit Job Market: 5 Dos And Don'ts

Table of Contents

DO: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit job market. It's not just about who you know, but also about how you cultivate those relationships.

Leverage LinkedIn Effectively:

- Optimize your profile: Use relevant keywords like private credit, leveraged finance, distressed debt, credit analysis, private debt, direct lending, mezzanine financing, and special situations. Highlight your experience in areas relevant to private credit investment.

- Engage actively: Participate in discussions, share insightful articles, and comment on posts from industry leaders.

- Join relevant groups: Connect with professionals in private credit groups on LinkedIn. Engage thoughtfully in conversations to showcase your expertise.

- Follow key players: Follow companies and individuals in the private credit space to stay updated on industry trends and opportunities.

Attend Industry Events:

- Conferences and workshops: Prioritize events focused on private credit, alternative investments, and leveraged finance.

- Meaningful engagement: Prepare talking points and insightful questions to demonstrate your genuine interest and knowledge. Don't just collect business cards; build relationships.

- Follow-up diligently: Send personalized thank-you notes or emails to the people you connect with, referencing specific conversations.

Informational Interviews:

- Reach out strategically: Identify professionals in roles you aspire to and request informational interviews. Frame your request as a chance to learn from their experience.

- Prepare thoughtful questions: Ask insightful questions about their career path, the industry landscape, and their firm's culture. Show that you've done your homework.

- Express gratitude and stay in touch: Send a thank-you note and maintain contact through occasional updates or relevant articles.

DO: Highlight Relevant Skills and Experience

Your resume and interview performance must showcase your qualifications for the private credit job market.

Tailor Your Resume and Cover Letter:

- Customization is key: Don't use a generic resume. Tailor your resume and cover letter to each specific job description, highlighting the skills and experience most relevant to the role.

- Quantify achievements: Use numbers and data to demonstrate the impact of your work. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15% through process optimization."

- Showcase relevant skills: Emphasize your proficiency in financial modeling, credit analysis, underwriting, due diligence, portfolio management, and deal structuring.

Showcase Financial Modeling Proficiency:

- Master Excel and specialized software: Proficiency in Excel is essential, while knowledge of Argus, Bloomberg Terminal, or other relevant software is highly advantageous.

- Develop a portfolio: Include examples of your financial models in your portfolio to demonstrate your skills to potential employers.

- Explain your methodology: Be prepared to discuss your modeling assumptions, methodologies, and conclusions during interviews.

Emphasize Analytical and Problem-Solving Abilities:

- Highlight your analytical skills: Show your ability to analyze complex financial data, identify key risks, and assess investment opportunities. Use the STAR method (Situation, Task, Action, Result) to illustrate these abilities.

- Showcase problem-solving: Provide specific examples of how you've solved challenging problems in previous roles, highlighting your critical thinking skills and decision-making process.

- Demonstrate strong quantitative skills: Emphasize your ability to interpret financial statements, conduct valuation analyses, and understand key financial metrics.

DO: Prepare for Behavioral and Technical Interviews

The interview process is crucial for securing a private credit job. Thorough preparation is vital.

Practice Common Interview Questions:

- Research typical questions: Prepare for common behavioral questions (e.g., "Tell me about a time you failed") and technical questions (e.g., "Walk me through a DCF model").

- Craft compelling answers: Use the STAR method to structure your answers and provide concrete examples of your skills and experiences.

- Practice your delivery: Practice answering questions aloud to refine your responses and improve your confidence.

Demonstrate Financial Acumen:

- Master key concepts: Be prepared to discuss complex financial concepts such as discounted cash flow (DCF) analysis, leveraged buyouts (LBOs), and different types of private credit instruments (e.g., unitranche, senior secured, subordinated debt).

- Understand key metrics: Demonstrate a strong understanding of financial ratios, credit metrics, and key performance indicators (KPIs) used in private credit.

- Discuss market trends: Stay updated on current market trends and challenges in the private credit industry.

Research the Firm and Interviewers:

- Thorough research: Research the firm's investment strategy, recent transactions, portfolio companies, and team members. Understand their investment thesis and target markets.

- Prepare insightful questions: Prepare thoughtful questions to showcase your genuine interest and understanding of the firm's activities.

- Align with the culture: Tailor your responses to align with the firm's values and culture.

DON'T: Neglect the Importance of Soft Skills

Technical skills are vital, but soft skills are equally important in the private credit job market.

Communication:

- Clarity and precision: Practice clearly explaining complex financial concepts in a concise and understandable manner, both verbally and in writing.

- Active listening: Pay attention to what others are saying and respond thoughtfully.

Teamwork:

- Collaboration skills: Highlight your ability to work effectively in teams and collaborate with individuals from diverse backgrounds.

- Contribution to team success: Provide examples of how you’ve contributed to team goals and improved team dynamics.

Professionalism:

- Maintain a professional demeanor: Dress appropriately for interviews, maintain punctual communication, and demonstrate respect for everyone you interact with.

- Follow up promptly: Respond promptly to emails and communications throughout the job search process.

Attention to Detail:

- Accuracy and precision: Demonstrate meticulousness in your work, applications, and communications. Errors can create a negative impression.

- Thoroughness: Pay attention to every detail, ensuring your applications are complete and error-free.

DON'T: Settle for the First Offer

Don't rush into accepting the first job offer you receive. Carefully consider your options.

Consider Your Career Goals:

- Long-term aspirations: Evaluate whether the role aligns with your long-term career goals within the private credit industry. Think about growth opportunities and potential career progression.

- Firm's reputation: Research the firm's reputation and track record within the private credit market.

Negotiate Compensation:

- Research industry salaries: Research industry salaries for similar roles to understand the market rate.

- Prepare your negotiation strategy: Be prepared to negotiate your compensation package, including salary, benefits, and bonuses.

Assess Company Culture:

- Company values: Research the company culture to ensure it aligns with your personal values and working style.

- Work environment: Consider the overall work environment, including work-life balance and opportunities for professional development.

Conclusion

Securing a position in the competitive private credit job market demands a strategic and well-rounded approach. By following these dos and don'ts, focusing on networking, showcasing your skills, preparing for interviews, and paying attention to soft skills, you'll significantly increase your chances of success. Remember to continuously refine your approach and don't be discouraged – perseverance is key to navigating the private credit job market effectively. Start your journey today and unlock the opportunities within the exciting world of private credit!

Featured Posts

-

Sertijab 7 Pamen Polda Bali Irjen Daniel Sampaikan Pesan Penting

May 28, 2025

Sertijab 7 Pamen Polda Bali Irjen Daniel Sampaikan Pesan Penting

May 28, 2025 -

Infrastruktur Jalan Raya Di Bali Kritik Surya Paloh Dan Solusinya

May 28, 2025

Infrastruktur Jalan Raya Di Bali Kritik Surya Paloh Dan Solusinya

May 28, 2025 -

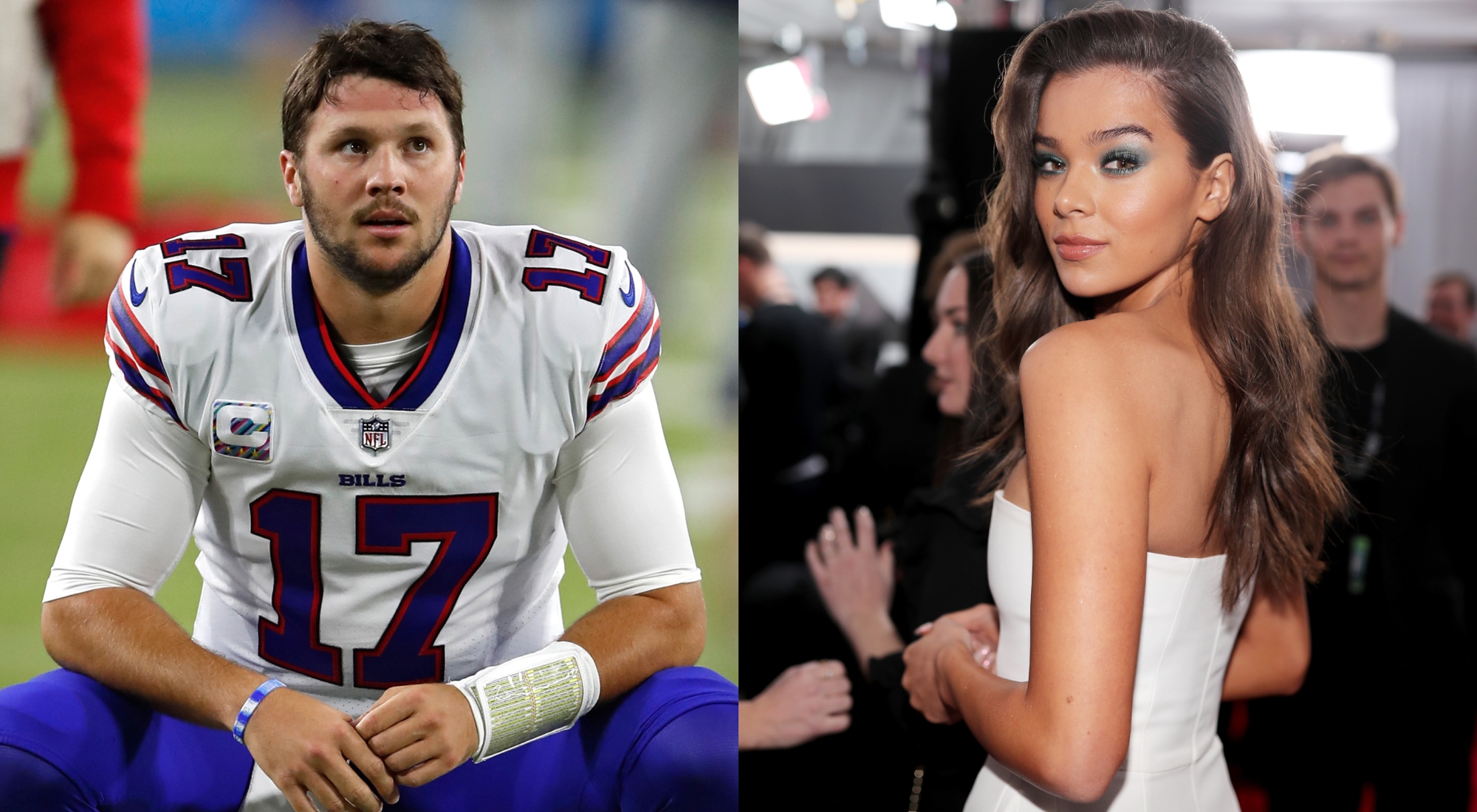

Hailee Steinfeld Addresses Engagement Rumors And Future With Josh Allen

May 28, 2025

Hailee Steinfeld Addresses Engagement Rumors And Future With Josh Allen

May 28, 2025 -

Satu Kursi Senayan Jadi Prioritas Nas Dem Bali Tunda Pembangunan Kedai Kopi

May 28, 2025

Satu Kursi Senayan Jadi Prioritas Nas Dem Bali Tunda Pembangunan Kedai Kopi

May 28, 2025 -

Dubbo Championship Wrestling Musical The Full Cast Revealed

May 28, 2025

Dubbo Championship Wrestling Musical The Full Cast Revealed

May 28, 2025