Navigating The Risks Of Japan's Steep Bond Curve: A Guide For Investors

Table of Contents

Understanding Japan's Steep Bond Curve

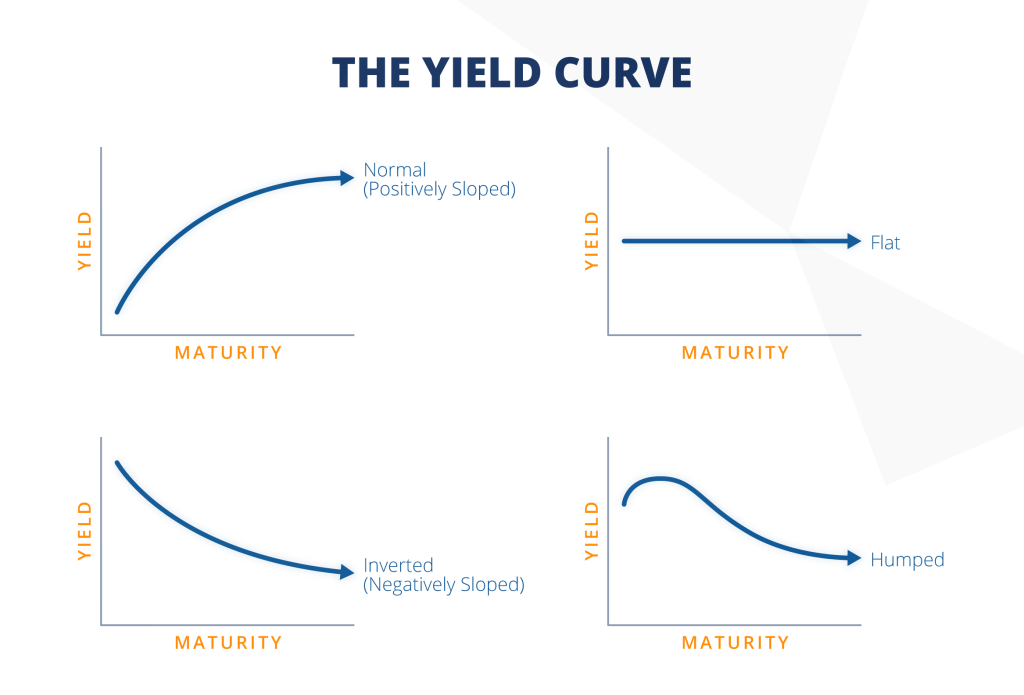

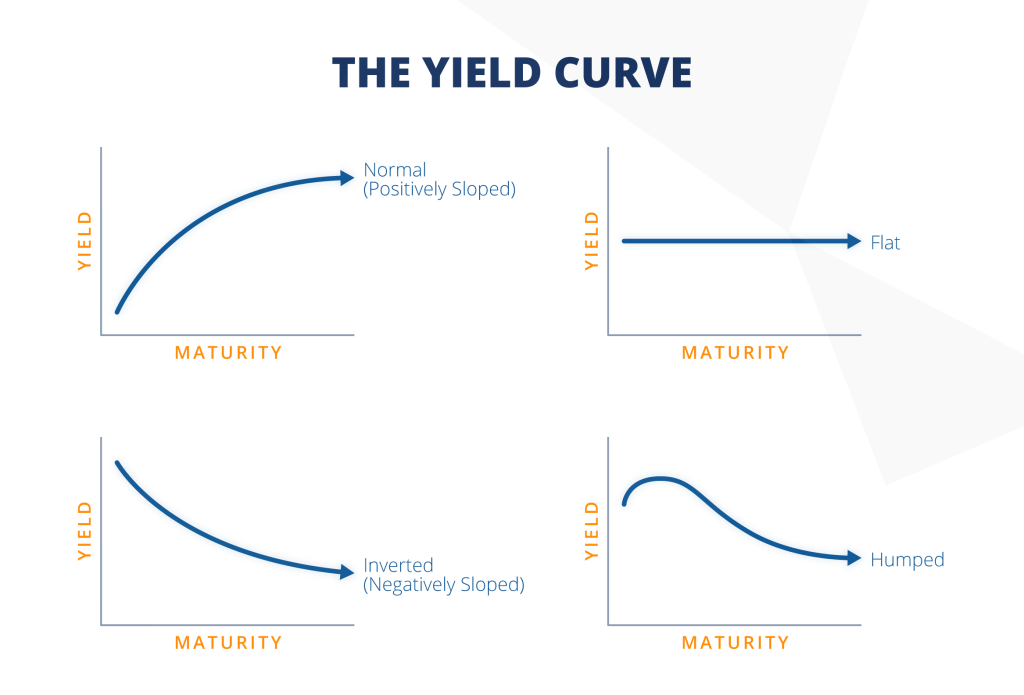

A steep yield curve represents a significant difference between short-term and long-term bond yields. In Japan's context, this steepness is particularly pronounced, reflecting a unique interplay of factors. This divergence creates both potential for higher returns and increased risk compared to a flatter curve. Several key elements contribute to the steepness of Japan's yield curve:

-

BOJ's Yield Curve Control (YCC) policy and its impact: The Bank of Japan's (BOJ) YCC policy, aimed at stimulating economic growth, has kept short-term interest rates exceptionally low. This policy, while intended to lower borrowing costs, has inadvertently contributed to the yield curve's steepness by creating a significant gap between short and long-term yields. The BOJ's recent adjustments to YCC have created considerable volatility in the market.

-

Inflationary pressures and their effect on bond yields: While Japan has historically experienced low inflation, recent increases, although modest compared to global standards, have impacted inflation expectations. Rising inflation generally pushes long-term bond yields higher as investors demand greater returns to compensate for the erosion of purchasing power.

-

Influence of global interest rate hikes on Japanese bonds: Global central banks, including the Federal Reserve, have implemented significant interest rate hikes to combat inflation. This has influenced investor sentiment and capital flows, affecting the demand for Japanese bonds and contributing to the yield curve's steepness. The relative attractiveness of Japanese bonds versus those in other developed economies plays a key role.

-

Supply and demand dynamics within the Japanese bond market: The substantial issuance of JGBs by the Japanese government, coupled with shifts in investor demand based on global economic conditions, also impacts yield curve dynamics.

Risks Associated with Investing in Japanese Government Bonds (JGBs)

The steep yield curve in Japan presents several key risks for investors in JGBs:

-

Interest rate risk: The potential for capital losses is substantial if interest rates rise unexpectedly. A steepening yield curve implies that a rise in short-term rates is likely to impact long-term bond prices disproportionately.

-

Reinvestment risk: Reinvesting the proceeds from maturing bonds at comparable yields can be challenging in a volatile environment. The steep yield curve suggests that reinvestment opportunities may offer lower yields than those of the maturing bonds.

-

Inflation risk: If inflation outpaces bond yields, investors face a decline in their purchasing power, effectively reducing their real returns. This risk is heightened in the current global inflationary environment.

-

Currency risk: Fluctuations in the yen exchange rate affect the returns earned by non-yen investors. A weakening yen can offset gains or amplify losses depending on the investor's currency exposure.

Mitigation Strategies for Investors

Investors can employ several strategies to mitigate the risks associated with Japan's steep bond curve:

-

Diversification: Spreading investments across various asset classes, including other fixed-income instruments and equities, helps to reduce overall portfolio volatility. Diversification is crucial to reducing the impact of adverse movements in the JGB market.

-

Hedging: Using financial instruments, like derivatives, can help protect against adverse movements in interest rates or currency exchange rates. Sophisticated hedging strategies can minimize potential losses.

-

Duration management: Adjusting the average maturity of a bond portfolio (duration) allows investors to manage their sensitivity to interest rate changes. Shorter-duration portfolios are less sensitive to interest rate fluctuations.

-

Active management: Employing experienced bond managers who can actively navigate the complexities of the Japanese bond market offers significant advantages in terms of risk management and return optimization.

The Future of Japan's Bond Market and Outlook for Investors

Predicting the future trajectory of Japan's bond market is inherently challenging, but several key factors will shape its development:

-

Potential unwinding of YCC and its impact on the yield curve: Any significant shift in the BOJ's YCC policy will likely have a profound effect on the yield curve, potentially leading to significant volatility. The market will closely monitor any changes to BOJ policy.

-

Projections for inflation and their influence on bond yields: Future inflation trends in Japan will heavily influence long-term bond yields. Higher-than-expected inflation could lead to further steepening of the yield curve.

-

Analysis of future opportunities for savvy investors: Despite the risks, selective investment opportunities may emerge for investors who understand the market dynamics and can effectively manage risk.

-

Cautionary notes and potential pitfalls to watch out for: Significant volatility is likely to persist, and investors need to be prepared for unexpected market movements. Thorough due diligence is paramount.

Conclusion

Navigating the risks of Japan's steep bond curve requires a thorough understanding of the underlying factors contributing to its steepness. Interest rate risk, reinvestment risk, inflation risk, and currency risk are all significant concerns for investors in JGBs. However, through careful planning, diversification, and the implementation of appropriate mitigation strategies, investors can potentially harness the opportunities presented by this complex market. Conduct thorough research and seek professional financial advice before making any investment decisions related to Japan's steep bond curve. Remember, understanding the nuances of this unique market is key to successful investing.

Featured Posts

-

30 Tariffs On China The Lasting Legacy Of Trumps Trade Policies

May 17, 2025

30 Tariffs On China The Lasting Legacy Of Trumps Trade Policies

May 17, 2025 -

Dubai Issues Eid Al Fitr 2025 Travel Advisory Airline Predicts High Traffic At Dxb Terminal 3

May 17, 2025

Dubai Issues Eid Al Fitr 2025 Travel Advisory Airline Predicts High Traffic At Dxb Terminal 3

May 17, 2025 -

Best Bitcoin And Crypto Casinos Your 2025 Gambling Guide

May 17, 2025

Best Bitcoin And Crypto Casinos Your 2025 Gambling Guide

May 17, 2025 -

Anunoby Brilla Con 27 Puntos En Victoria De Knicks Sobre Sixers

May 17, 2025

Anunoby Brilla Con 27 Puntos En Victoria De Knicks Sobre Sixers

May 17, 2025 -

Japans Economy Contracts In Q1 2018 Pre Tariff Impact Analysis

May 17, 2025

Japans Economy Contracts In Q1 2018 Pre Tariff Impact Analysis

May 17, 2025