Net Asset Value (NAV) Of Amundi MSCI World Catholic Principles UCITS ETF Acc: What You Need To Know

Table of Contents

What is the Amundi MSCI World Catholic Principles UCITS ETF Acc?

The Amundi Catholic Principles ETF is an exchange-traded fund that invests in a globally diversified portfolio of companies adhering to Catholic social principles. This means it aligns with ethical and socially responsible investing (SRI) principles, appealing to investors who want their money to reflect their values. The fund excludes companies involved in activities considered contrary to Catholic teachings, such as:

- Alcohol production: Companies heavily involved in the production and distribution of alcoholic beverages are excluded.

- Weapons manufacturing: Companies primarily involved in the production of weapons or military equipment are not included.

- Gambling: Businesses heavily involved in gambling activities are screened out.

- Pornography: Companies producing or distributing pornography are excluded from the investment portfolio.

This ETF is designed for investors who prioritize ethical investing and want exposure to a broad range of companies that align with their values. It provides geographical diversification across developed markets and sector diversification across various industries, excluding those mentioned above.

Key Features:

- Globally diversified portfolio: Provides exposure to a wide range of companies across multiple countries.

- Faith-based screening: Invests only in companies aligned with Catholic social principles.

- Transparency: Provides clear information on its investment strategy and holdings.

- Low expense ratio: Typically offers a competitive fee structure compared to actively managed funds.

How is the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc Calculated?

The NAV of the Amundi Catholic Principles ETF is calculated daily, reflecting the total market value of its underlying assets. This calculation involves:

- Determining the market value of each holding: The fund's managers determine the current market price of each security held within the ETF.

- Summing the values: The market values of all holdings are added together to obtain a total portfolio value.

- Accounting for liabilities: Any liabilities, such as expenses and accrued fees, are subtracted from the total portfolio value.

- Dividing by the number of shares: The resulting net asset value is then divided by the total number of outstanding shares of the ETF.

The NAV differs from the ETF's market price. While the market price fluctuates throughout the trading day based on supply and demand, the NAV reflects the intrinsic value of the ETF's assets.

Factors Influencing NAV:

- Market fluctuations: Changes in the prices of the underlying assets directly impact the NAV.

- Currency exchange rates: For globally diversified ETFs, fluctuations in exchange rates between currencies can affect the NAV.

- Dividend payments: Dividend payments received from the underlying assets will adjust the NAV.

Interpreting the NAV and its Impact on Investment Decisions

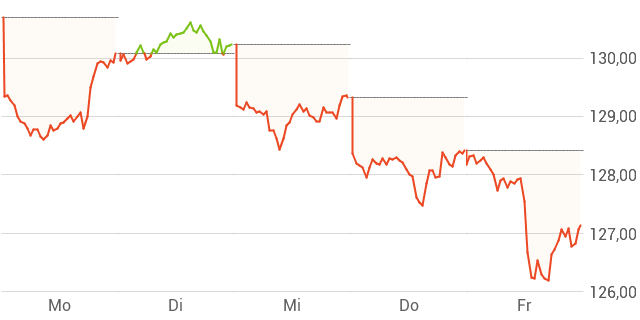

The NAV is a key indicator of the Amundi Catholic Principles ETF's performance. By tracking the NAV over time, investors can assess the growth or decline in the value of their investment. A rising NAV indicates positive performance, while a falling NAV signifies negative performance. It's important to remember that the ETF's share price generally tracks the NAV closely, but short-term discrepancies can occur due to market supply and demand.

Tips for Monitoring NAV and Making Informed Decisions:

- Regularly check the NAV: Most ETF providers and financial websites publish daily NAV data.

- Compare NAV to past performance: Look at the NAV's trend over time to assess long-term growth.

- Consider the ETF's expense ratio: Factor in the expense ratio to determine the net return.

- Use financial charting tools: Utilize online resources to visualize NAV trends and make comparisons.

You can typically find the daily NAV on the Amundi website or through your brokerage account.

Comparing the NAV to Similar ETFs

Comparing the NAV performance of the Amundi Catholic Principles ETF to similar ethically-focused or faith-based ETFs is essential for evaluating its relative performance. Benchmarking against relevant indices, such as the MSCI World Index (excluding the companies screened out by the ETF's strategy), can provide a broader context for assessing its success in delivering returns while adhering to its investment principles.

Examples of Comparable ETFs (Note: Specific ETFs and their performance will vary; this is for illustrative purposes only):

- [Insert Example ETF 1 and typical NAV performance data – Disclaimer: Add a disclaimer mentioning that past performance is not indicative of future results]

- [Insert Example ETF 2 and typical NAV performance data – Disclaimer: Add a disclaimer mentioning that past performance is not indicative of future results]

Comparative analysis helps investors determine if the Amundi Catholic Principles ETF's NAV performance aligns with their expectations and risk tolerance.

Risks Associated with Investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc

Investing in ETFs, including the Amundi Catholic Principles ETF, involves inherent risks.

- Market risk: The overall market performance significantly influences the ETF's NAV. Bear markets can lead to NAV declines.

- Sector concentration risk: Although diversified, concentration in specific sectors could lead to higher volatility.

- Geographic concentration risk: Similarly, higher exposure to specific regions may increase risk.

- ESG (Environmental, Social, and Governance) risk: While aligned with ethical principles, the ESG profile of the holdings could change, impacting the ETF's performance.

Key Risks to Consider:

- Market downturns can negatively affect the NAV.

- The ETF's investment strategy might underperform compared to broader market indices in certain market conditions.

- Changes in the ESG ratings of holdings could impact investor sentiment and NAV.

Conclusion: Making Informed Decisions about the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Understanding the Net Asset Value of the Amundi MSCI World Catholic Principles UCITS ETF Acc is crucial for making informed investment decisions. Regularly monitoring the NAV, comparing it to similar ETFs, and understanding the associated risks are all vital steps. Remember, the NAV closely reflects the underlying value of your investment, and tracking its changes over time provides valuable insights into the ETF's performance. By understanding the NAV and its relationship to the ETF's price, you can assess the suitability of this ethically-focused investment for your portfolio. Further research into the ETF's holdings and its performance history is recommended before making any investment decisions. Visit the Amundi website for more detailed information and documentation.

Featured Posts

-

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025 -

Yevrobachennya Peremozhtsi Ostannikh 10 Rokiv Ta Yikhni Dosyagnennya

May 24, 2025

Yevrobachennya Peremozhtsi Ostannikh 10 Rokiv Ta Yikhni Dosyagnennya

May 24, 2025 -

Ot Evroviziya Do Dnes Promyanata V Zhivota Na Konchita Vurst

May 24, 2025

Ot Evroviziya Do Dnes Promyanata V Zhivota Na Konchita Vurst

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Application And Information

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Application And Information

May 24, 2025 -

Is A Us Band Secretly Playing Glastonbury Unofficial Hints Surface Online

May 24, 2025

Is A Us Band Secretly Playing Glastonbury Unofficial Hints Surface Online

May 24, 2025

Latest Posts

-

M56 Road Closure Live Traffic And Travel Updates Due To Accident

May 24, 2025

M56 Road Closure Live Traffic And Travel Updates Due To Accident

May 24, 2025 -

Severe M56 Crash Causes Significant Traffic Disruption Live Updates

May 24, 2025

Severe M56 Crash Causes Significant Traffic Disruption Live Updates

May 24, 2025 -

M56 Motorway Crash Current Traffic Conditions And Delays

May 24, 2025

M56 Motorway Crash Current Traffic Conditions And Delays

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025