New Student Loan Legislation: Analyzing The GOP's Pell Grant And Repayment Proposals

Table of Contents

Proposed Changes to Pell Grant Funding

Current Pell Grant System

The Pell Grant program is a cornerstone of federal student aid, providing need-based grants to eligible undergraduate students pursuing higher education. Eligibility is determined by factors such as financial need, enrollment status, and citizenship. Funding is allocated annually by Congress and distributed to students through participating colleges and universities. The current system aims to increase higher education affordability and expand access for students from low-income families. Keywords related to this include "federal student aid," "need-based grants," and "higher education affordability."

GOP's Proposed Modifications

The specifics of the GOP's proposed modifications to Pell Grant funding vary depending on the specific legislation. Some proposals suggest altering eligibility criteria, potentially making it harder for certain groups to qualify. Other proposals focus on adjusting funding amounts, potentially resulting in funding cuts or increases depending on the specifics of the plan. This could significantly impact college access and affordability for many students. Key terms associated with these changes include "grant reform," "funding cuts," or "funding increases."

- Example 1: A proposal might suggest increasing the Expected Family Contribution (EFC) threshold, thus reducing the number of eligible students.

- Example 2: Another proposal could involve tying Pell Grant funding to specific program choices or institutional performance metrics.

- Impact: These changes could disproportionately affect students from low-income backgrounds, limiting their access to higher education. This could exacerbate existing inequalities in higher education attainment.

Repayment Plan Reforms Under GOP Proposals

Current Student Loan Repayment Options

Currently, borrowers have several repayment plan options for federal student loans, including Standard, Extended, and various Income-Driven Repayment (IDR) plans. IDR plans, in particular, tie monthly payments to a borrower's income and family size, offering more manageable repayment schedules for those with lower incomes. Keywords such as "income-based repayment," "loan forgiveness," and "student loan debt relief" are relevant here.

GOP's Proposed Repayment Plan Changes

The GOP's proposals regarding repayment plan reforms may include changes to interest rates, repayment periods, or eligibility criteria for existing plans. Some proposals might suggest the introduction of new repayment plans, while others may focus on reforming existing ones. The changes could significantly affect borrowers' monthly payments and total repayment costs. Keywords like "repayment reform," "interest rate caps," and "debt management" are pertinent in this context.

- Example 1: A proposal might involve increasing interest rates on certain loan types, leading to higher monthly payments for borrowers.

- Example 2: Another potential change could be shortening the repayment period, resulting in larger monthly payments.

- Impact: These changes would significantly affect borrowers with varying debt levels and incomes. Those with higher debt loads or lower incomes could face increased financial burdens.

Potential Impacts and Criticisms of the GOP Proposals

Economic Impacts

The GOP's student loan legislation proposals could have far-reaching economic consequences. Funding cuts to Pell Grants might reduce college enrollment, potentially impacting the future workforce and economic growth. Changes to repayment plans could increase the overall cost of higher education for borrowers, potentially impacting consumer spending and overall economic activity. Keywords such as "economic effects," "fiscal responsibility," and "budget implications" are relevant here.

Political Ramifications

These proposals are likely to spark intense political debate. Students, universities, and other stakeholders will likely express concerns about the potential impact of these changes on college access and affordability. The proposals could also become a focal point in larger discussions about higher education funding and the role of government in supporting college access.

- Arguments For: Proponents may argue that the proposals promote fiscal responsibility and encourage greater efficiency in the student loan and grant systems.

- Arguments Against: Critics may argue that the changes could exacerbate existing inequalities and limit access to higher education for disadvantaged students.

- Unintended Consequences: Unintended consequences could include decreased college enrollment, increased student debt defaults, and a widening gap in higher education attainment between different socioeconomic groups.

Conclusion: New Student Loan Legislation: A Summary and Call to Action

The GOP's proposed changes to Pell Grants and student loan repayment plans have the potential to significantly reshape the landscape of higher education financing. Changes to Pell Grant eligibility and funding could limit access for low-income students, while repayment plan reforms could increase the financial burden on borrowers. These proposals carry significant economic and political implications, sparking debates about affordability, access, and fiscal responsibility. Stay informed about new student loan legislation by researching the proposed bills, contacting your representatives, and participating in relevant discussions. Advocate for responsible student loan reform that balances fiscal concerns with the need to ensure access to higher education for all. Learn more about the GOP’s Pell Grant and repayment proposals and make your voice heard.

Featured Posts

-

Reddit Down For Us Users Page Not Found Error Reports Surge

May 17, 2025

Reddit Down For Us Users Page Not Found Error Reports Surge

May 17, 2025 -

Impact Of Us Tariffs On Hondas Production And Canadian Plant Exports

May 17, 2025

Impact Of Us Tariffs On Hondas Production And Canadian Plant Exports

May 17, 2025 -

Palmeiras Vs Bolivar Resumen Del Partido 2 0 Y Goles

May 17, 2025

Palmeiras Vs Bolivar Resumen Del Partido 2 0 Y Goles

May 17, 2025 -

Nba Refs Admit Missed Crucial Foul Call In Knicks Win Over Pistons

May 17, 2025

Nba Refs Admit Missed Crucial Foul Call In Knicks Win Over Pistons

May 17, 2025 -

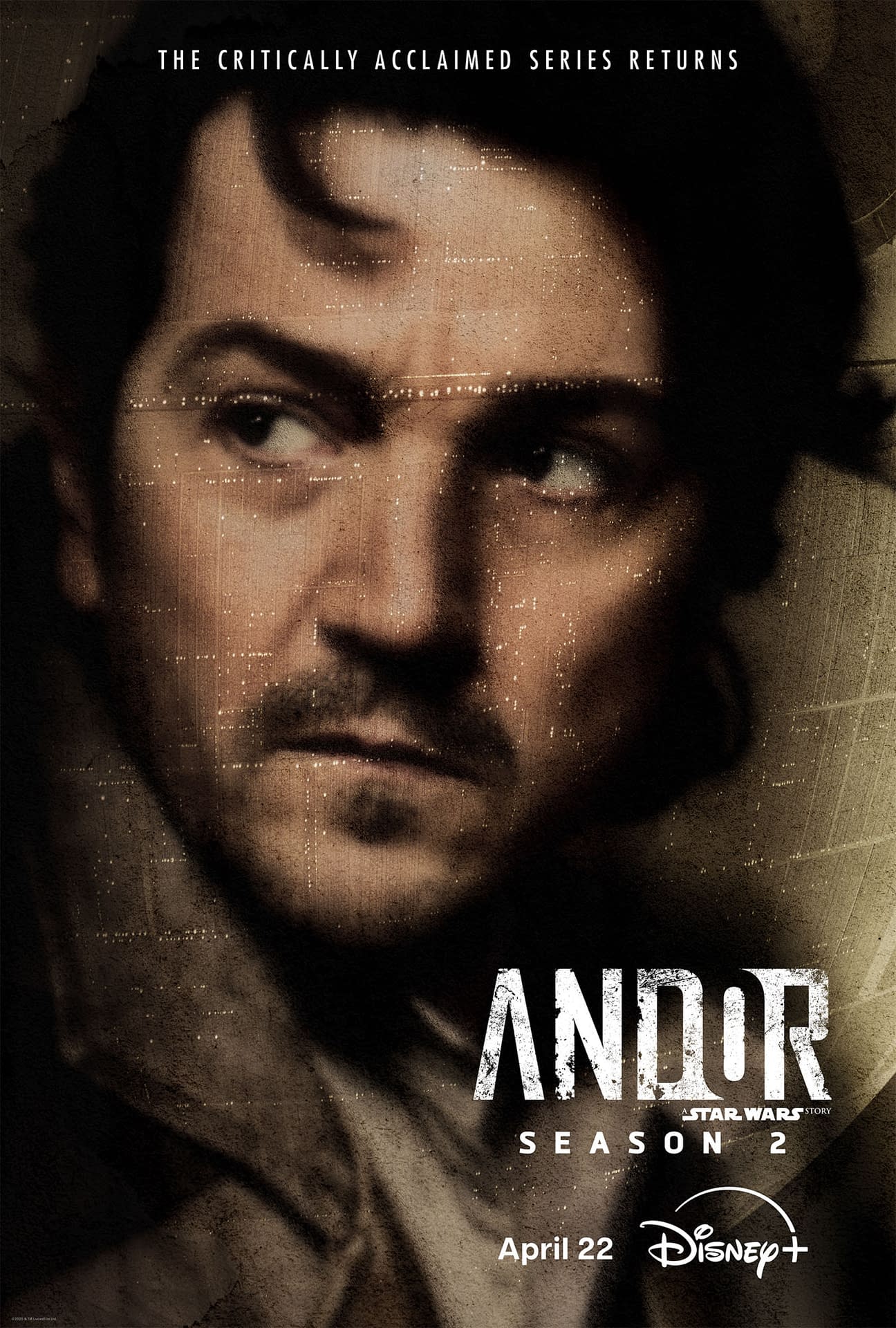

Andor Season 2 X Wings How The Designs Differ From The Original Trilogy

May 17, 2025

Andor Season 2 X Wings How The Designs Differ From The Original Trilogy

May 17, 2025