New Tax Codes From HMRC: What You Need To Know About Your Savings

Table of Contents

Decoding Your New HMRC Tax Code

Your HMRC tax code, often appearing as a combination of numbers and letters (e.g., 1257L), is a vital piece of information determining how much income tax you pay. Understanding its structure is the first step to managing your finances effectively.

-

Understanding the Numbers: The numbers represent your personal allowance – the amount of income you can earn tax-free. For example, 1257L indicates a personal allowance of £12,570. Changes in this number directly impact your take-home pay and therefore your savings potential.

-

Understanding the Letters: The letter (e.g., L) signifies additional factors, such as adjustments for student loan repayments or other deductions. These letters can subtly alter the overall tax calculation.

-

How Changes Affect Savings: An altered tax code, whether resulting from a pay rise, a change in employment status, or other adjustments, directly impacts your disposable income. A higher tax code might mean less money available for savings each month. Conversely, a lower code (though potentially undesirable from a salary perspective) might mean more savings.

-

Examples:

- 1257L: Standard personal allowance.

- 1100L: Lower personal allowance, possibly due to additional income from other sources.

- 0T: Indicates no personal allowance and potentially high tax liability.

Understanding these nuances is crucial for maximizing your savings within the context of your HMRC tax code.

How New Tax Codes Affect Your Savings Accounts

Different savings accounts react differently to HMRC tax codes. The impact on your overall savings strategy depends heavily on the type of account you're using.

-

ISAs (Individual Savings Accounts): These accounts are generally tax-free, meaning your savings grow without being subject to income tax, regardless of your tax code. They remain a highly tax-efficient savings option.

-

Other Savings Accounts: Interest earned on standard savings accounts is usually subject to income tax. Your tax code determines the rate of tax applied to this interest, directly impacting your net return. Higher tax bands mean a larger portion of your interest is taxed.

-

Tax-Efficient Savings Options: Exploring tax-efficient savings options like ISAs or pensions is vital in mitigating the effects of potentially higher tax codes. Tax-free savings allowances should be maximized to preserve your savings growth.

-

Higher Tax Bands & Savings Growth: As your income rises and you move into higher tax bands, the proportion of your savings interest going to tax increases. Careful planning is key to offsetting this.

Checking Your Tax Code and Making Adjustments

Checking and updating your tax code is a simple yet crucial step in managing your finances.

-

Checking Your Tax Code: Access your tax code easily through your HMRC online account or app. This provides up-to-date information and allows you to verify accuracy.

-

Notifying HMRC of Changes: Any changes impacting your tax code (e.g., new job, change in income) must be promptly reported to HMRC to avoid incorrect tax calculations and potential penalties.

-

Consequences of Incorrect Tax Codes: An incorrect tax code can lead to overpayment or underpayment of tax. Overpayments can be reclaimed, but underpayments may result in additional charges. Addressing any discrepancies quickly is important.

-

HMRC Resources: Utilize the official HMRC website and helpline for assistance with checking, updating, and correcting your tax code. They offer extensive resources and support.

Planning for the Future with the New HMRC Tax Codes

Proactive financial planning is essential in light of new HMRC tax codes.

-

Adjusting Savings Strategies: Review your current savings strategies and adapt them based on your updated tax code. Consider adjusting contributions to ISAs or pensions to maximize tax efficiency.

-

Long-Term Savings Goals: Your tax code directly impacts long-term savings goals, including retirement planning. Proper tax planning now can significantly benefit your future financial security.

-

Tax Planning Strategies: Seek advice from a financial advisor to explore more advanced tax planning strategies that align with your individual financial situation and risk tolerance.

-

Professional Financial Advice: Don't hesitate to seek professional financial advice to help you navigate these changes and optimize your savings strategy.

Conclusion: Taking Control of Your Savings with Updated HMRC Tax Codes

Understanding your HMRC tax code and its impact on your savings is crucial for effective financial management. Regularly checking your tax code, using tax-efficient savings options, and proactively planning for the future are key steps to taking control of your financial future. Visit the HMRC website today to understand how the new tax codes affect your savings and take control of your financial future. Don't let changes to your tax code negatively impact your long-term savings goals; take action today!

Featured Posts

-

Assessing The Impact Amorims High Profile Man Utd Forward Signing

May 20, 2025

Assessing The Impact Amorims High Profile Man Utd Forward Signing

May 20, 2025 -

Nyt Mini Crossword Solutions For April 25

May 20, 2025

Nyt Mini Crossword Solutions For April 25

May 20, 2025 -

Nyt Mini Crossword Answers For March 15 Complete Solutions

May 20, 2025

Nyt Mini Crossword Answers For March 15 Complete Solutions

May 20, 2025 -

Ris Former Us Attorney Zachary Cunha Begins New Chapter In Private Practice

May 20, 2025

Ris Former Us Attorney Zachary Cunha Begins New Chapter In Private Practice

May 20, 2025 -

How Agatha Christies Genius Shaped Shyamalans The Village

May 20, 2025

How Agatha Christies Genius Shaped Shyamalans The Village

May 20, 2025

Latest Posts

-

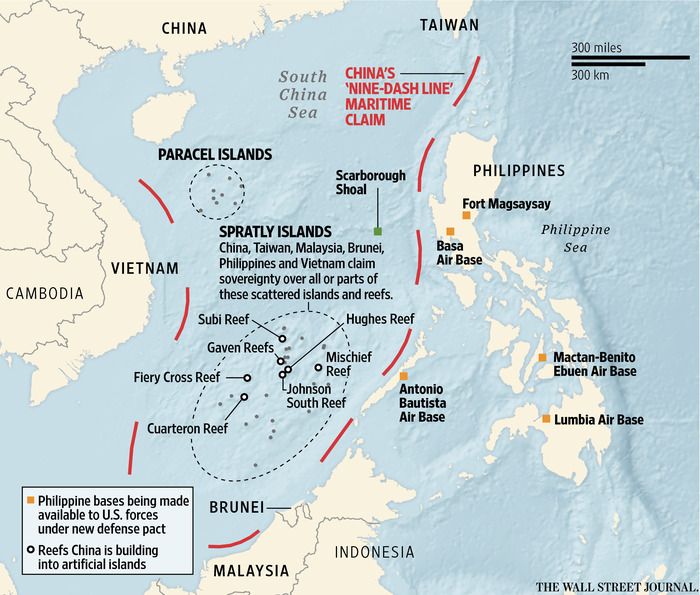

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025 -

South China Sea Tensions China Pressures Philippines On Missile Deployment

May 20, 2025

South China Sea Tensions China Pressures Philippines On Missile Deployment

May 20, 2025 -

Drone Truck For Tomahawk Missiles A Usmc Army Collaboration

May 20, 2025

Drone Truck For Tomahawk Missiles A Usmc Army Collaboration

May 20, 2025 -

Usmc Tomahawk Missile Launch Army Eyes Drone Truck Technology

May 20, 2025

Usmc Tomahawk Missile Launch Army Eyes Drone Truck Technology

May 20, 2025 -

Philippines Should Withdraw Missile System Chinas Demand In South China Sea

May 20, 2025

Philippines Should Withdraw Missile System Chinas Demand In South China Sea

May 20, 2025