News Corp's Undervalued Assets: A Potential Investment Opportunity

Table of Contents

Analyzing News Corp's Undervalued Real Estate Holdings

News Corp owns a substantial real estate portfolio across key global markets, a largely overlooked aspect of its overall valuation. These properties, often located in prime areas, are not fully reflected in the company's market capitalization, presenting a potential avenue for significant returns.

-

Prime Real Estate Locations: News Corp holds significant real estate in major cities like New York, London, and Sydney. These properties, often in highly desirable locations, possess considerable potential for appreciation due to ongoing urban development and increasing property values in these markets. This represents a significant, yet often overlooked, component of News Corp's total asset value.

-

Competitive Benchmarking: Comparing News Corp's real estate holdings to those of similar media conglomerates reveals a possible undervaluation. A detailed analysis of comparable properties and their respective valuations suggests that News Corp's real estate assets are significantly undervalued relative to market rates. This discrepancy offers a compelling investment thesis.

-

Future Development Opportunities: Many of News Corp's properties offer potential for future development or redevelopment. These opportunities, such as building expansions or adaptive reuse projects, could substantially increase the value of these assets over time. This potential for future growth should be considered in any comprehensive investment strategy focused on News Corp.

The Value of News Corp's Digital and Publishing Assets

While the media landscape continues to evolve, News Corp's digital and publishing arms, including Dow Jones (publisher of the Wall Street Journal) and News Corp Australia, retain considerable value and market influence. These businesses are strategically positioned to leverage their strong brands and established audiences for future growth.

-

Brand Strength and Market Position: Dow Jones and News Corp Australia command significant market share and brand recognition within their respective sectors. Their established reputation for quality journalism and trusted information provides a strong foundation for long-term growth and profitability in the digital age. This inherent value is often not fully captured in short-term market fluctuations.

-

Successful Transition to Digital Subscription Models: News Corp has successfully transitioned many of its publishing assets to digital subscription models, generating recurring revenue streams that are less susceptible to market volatility than traditional advertising-based models. This transition is a testament to their adaptation to the changing media environment.

-

Growth Potential from Online Advertising and New Digital Initiatives: News Corp continues to explore new opportunities for revenue generation in the digital space, including online advertising and new digital initiatives. The potential for growth in these areas adds another layer of value to the company's overall portfolio. This growth potential is a key factor in understanding the long-term value of News Corp.

Strategic Acquisitions and Synergies Within the News Corp Portfolio

News Corp has a history of strategic acquisitions, and a closer examination of the potential synergies between different parts of its portfolio could unlock significant hidden value. Effective integration and cross-promotion opportunities across its diverse businesses could significantly boost overall profitability.

-

Past Acquisition Successes: Analyzing past successful acquisitions highlights News Corp's ability to identify and integrate businesses that complement its existing operations. This historical success demonstrates the potential for future acquisitions to further enhance its portfolio value.

-

Potential Future Acquisition Targets: Identifying potential future acquisition targets that align with News Corp's strategic priorities could enhance its market position and drive further growth. This strategic approach to growth is a key differentiator for News Corp.

-

Improving Asset Integration: Improved integration of existing assets within the News Corp portfolio could lead to greater operational efficiencies, cost savings, and increased profitability. This focus on optimization is an important factor in assessing the overall value of the company.

Assessing the Market's Undervaluation of News Corp

The current market valuation of News Corp may not fully reflect the intrinsic value of its diverse assets and future growth potential. A thorough financial analysis is needed to truly understand its undervaluation.

-

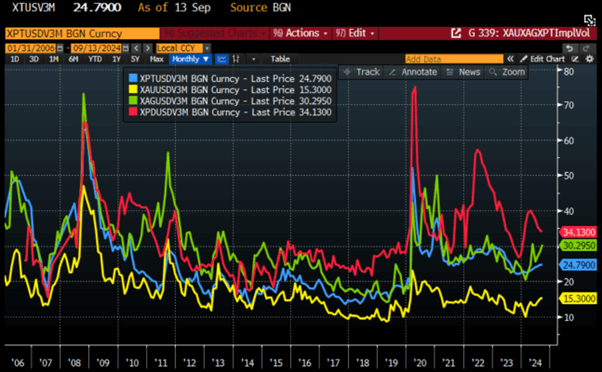

Financial Metric Comparison: Comparing News Corp's price-to-earnings ratio (P/E) and other key financial metrics to its competitors reveals a potentially undervalued position. This quantitative analysis is crucial for objective valuation.

-

Factors Contributing to Undervaluation: Several factors, including short-term market sentiment and a lack of understanding of the long-term value of News Corp’s diverse assets, could be contributing to its undervaluation by the market.

-

Intrinsic Value Estimation: Utilizing discounted cash flow (DCF) analysis and other financial modeling techniques can provide a more accurate estimate of News Corp's intrinsic value, highlighting the potential upside for investors. This rigorous financial modeling provides a more comprehensive understanding of the investment opportunity.

Conclusion

News Corp's portfolio, encompassing valuable real estate, strong digital media and publishing assets, and the potential for strategic synergies, suggests a significant market undervaluation. A comprehensive financial analysis reveals the long-term potential of its various segments, strengthening the case for its undervalued status.

Call to Action: Consider News Corp as a component of your diversified investment portfolio. Its undervalued assets and potential for future growth make it a strong contender for long-term investors seeking significant returns. Conduct your own thorough due diligence, focusing on News Corp’s undervalued assets, before making any investment decisions. Remember, investing in News Corp, or any stock, involves inherent risk.

Featured Posts

-

Bmw And Porsches China Challenges A Growing Trend

May 25, 2025

Bmw And Porsches China Challenges A Growing Trend

May 25, 2025 -

17 Celebrities Whose Careers Ended Suddenly

May 25, 2025

17 Celebrities Whose Careers Ended Suddenly

May 25, 2025 -

Kyle Walker Spotted With Models In Milan Following Wifes Uk Trip

May 25, 2025

Kyle Walker Spotted With Models In Milan Following Wifes Uk Trip

May 25, 2025 -

Waiting For The Call A Personal Narrative

May 25, 2025

Waiting For The Call A Personal Narrative

May 25, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

Latest Posts

-

Bidens Post Presidency Examining A Week Of Setbacks

May 25, 2025

Bidens Post Presidency Examining A Week Of Setbacks

May 25, 2025 -

The Tumultuous Week How Bidens Post Presidency Plans Went Off Track

May 25, 2025

The Tumultuous Week How Bidens Post Presidency Plans Went Off Track

May 25, 2025 -

10 Inmates Escape New Orleans Jail A Detailed Account Of The Breakout

May 25, 2025

10 Inmates Escape New Orleans Jail A Detailed Account Of The Breakout

May 25, 2025 -

New Orleans Jailbreak Uncovering The 10 Inmate Escape

May 25, 2025

New Orleans Jailbreak Uncovering The 10 Inmate Escape

May 25, 2025 -

How 10 New Orleans Inmates Pulled Off A Jailbreak

May 25, 2025

How 10 New Orleans Inmates Pulled Off A Jailbreak

May 25, 2025