Nigeria's Petrol Prices: Examining The Roles Of Dangote And NNPC

Table of Contents

The NNPC's Role in Determining Petrol Prices

The Nigerian National Petroleum Company (NNPC) plays a dominant role in shaping Nigeria's petrol prices. Its influence stems from its historical control over the entire fuel value chain, from importation to retail sales.

NNPC's Subsidy Regime

For years, the NNPC has implemented a fuel subsidy regime, aiming to keep petrol prices artificially low for consumers. However, this policy has been plagued by transparency issues and significant financial burdens on the government.

- Costs of subsidies: The cost of fuel subsidies has been astronomically high, placing a strain on the national budget and diverting funds from other crucial sectors like healthcare and education.

- Transparency issues: Lack of transparency in the management of subsidy funds has led to allegations of corruption and mismanagement, further exacerbating the problem.

- Impact on inflation: The subsidy regime, while intended to curb inflation, can ironically contribute to it indirectly by diverting funds and creating distortions in the market.

- Alternative solutions: Experts suggest exploring alternative solutions like targeted cash transfers to vulnerable populations, which could be more efficient and transparent than blanket subsidies.

NNPC's Import Dependency

The NNPC's heavy reliance on petrol imports makes Nigeria vulnerable to global price fluctuations and foreign exchange rate volatility. This dependence directly impacts the cost of fuel for Nigerian consumers.

- Sources of imports: The NNPC imports significant quantities of refined petroleum products from various international sources, making the country susceptible to global supply chain disruptions.

- Price fluctuations: Changes in global crude oil prices immediately affect the landed cost of imported fuel, resulting in price adjustments at the pump.

- Impact of geopolitical events: Global geopolitical events, such as wars or sanctions, can significantly disrupt oil supplies and lead to even greater price volatility.

NNPC's Retail Presence

The NNPC also maintains a substantial retail presence in the Nigerian fuel market, directly competing with private fuel retailers. Its pricing strategies significantly influence the overall market dynamics.

- Market share: The NNPC holds a considerable share of the retail fuel market, giving it significant pricing power.

- Price comparisons with private retailers: The NNPC's pricing decisions often set the benchmark for other retailers, influencing their pricing strategies.

- Potential for anti-competitive practices: Concerns regarding potential anti-competitive practices have been raised, highlighting the need for robust market regulation.

Dangote Refinery's Potential Impact on Petrol Prices

The completion and operation of the Dangote Refinery represent a significant potential game-changer for Nigeria's petrol prices. Its enormous capacity promises to disrupt the existing dynamics.

Refinery Capacity and Production

The Dangote Refinery, with its projected capacity to refine 650,000 barrels of crude oil per day, is poised to drastically reduce Nigeria's dependence on imported refined petroleum products.

- Planned production capacity: The refinery's massive capacity promises to meet a significant portion of Nigeria's domestic fuel demand.

- Timeline for full operation: The refinery's full operational capacity will significantly impact the supply of petrol, potentially leading to price stabilization.

- Impact on import bills: Reduced reliance on imports will lead to significant savings in foreign exchange and lower the burden on the national budget.

Pricing Strategies and Competition

Dangote's pricing strategies will undoubtedly influence the competitive landscape of the Nigerian fuel market. This could lead to more affordable petrol prices for consumers.

- Potential price points: The refinery's pricing will likely be a key factor in shaping overall market prices, potentially sparking competition among retailers.

- Market dynamics: The increased competition will put pressure on all players to offer more competitive prices.

- Impact on consumer prices: The anticipated outcome is a reduction in petrol prices for Nigerian consumers.

- Influence on NNPC: Dangote's entry will likely force the NNPC to adapt its strategies and pricing to remain competitive.

Long-Term Effects on Energy Security

The Dangote Refinery promises to significantly enhance Nigeria's energy security and contribute to its economic stability.

- Reduced reliance on imports: The refinery's output will significantly reduce the country's dependence on unreliable and volatile international fuel markets.

- Job creation: The refinery's operations will create numerous jobs across various sectors of the Nigerian economy.

- Economic diversification: The refinery represents a vital step towards diversifying Nigeria's economy away from its heavy reliance on crude oil exports.

- Foreign exchange savings: Reduced imports will significantly conserve foreign exchange reserves, strengthening the Naira.

Other Factors Influencing Nigeria's Petrol Prices

Beyond the NNPC and Dangote Refinery, several other factors influence Nigeria's petrol prices.

Global Oil Prices

Global crude oil prices are a major determinant of petrol prices in Nigeria, as the cost of crude oil constitutes a significant portion of the final price.

- Impact of OPEC decisions: Decisions by OPEC (Organization of the Petroleum Exporting Countries) regarding oil production quotas directly impact global oil prices.

- Geopolitical instability: Geopolitical instability in major oil-producing regions often leads to price spikes.

- Demand variations: Seasonal variations in global demand for oil also impact prices.

Exchange Rate Fluctuations

Fluctuations in the Naira's exchange rate against the US dollar directly affect the cost of importing fuel, influencing petrol prices.

- Impact of devaluation/appreciation: A weaker Naira increases import costs, while a stronger Naira reduces them.

- Hedging strategies: The NNPC and other importers employ hedging strategies to mitigate exchange rate risk.

- Import cost increases: Devaluation of the Naira significantly impacts import costs, leading to higher petrol prices.

Transportation and Distribution Costs

The cost of transporting and distributing petrol across Nigeria also contributes to the final price at the pump.

- Infrastructure limitations: Poor infrastructure, including inadequate road networks and storage facilities, increases transportation costs.

- Fuel theft: Significant fuel theft along transportation routes adds to the cost.

- Logistics bottlenecks: Inefficient logistics and distribution systems contribute to higher prices.

Conclusion: Understanding Nigeria's Petrol Price Dynamics

The dynamics of Nigeria's petrol prices are complex, shaped by the interplay of several factors. The NNPC's historical control, its subsidy regime, and import dependency have significantly influenced prices. The Dangote Refinery's potential to disrupt this paradigm by reducing import reliance and increasing competition is highly significant. However, global oil prices, exchange rate fluctuations, and logistical challenges remain considerable influences.

Stay updated on the latest developments regarding Nigeria's petrol prices, the ongoing impact of the NNPC, and the anticipated influence of the Dangote Refinery to make informed decisions. Transparency and effective regulation are crucial to ensure fair and affordable fuel prices for Nigerian consumers, fostering economic growth and stability.

Featured Posts

-

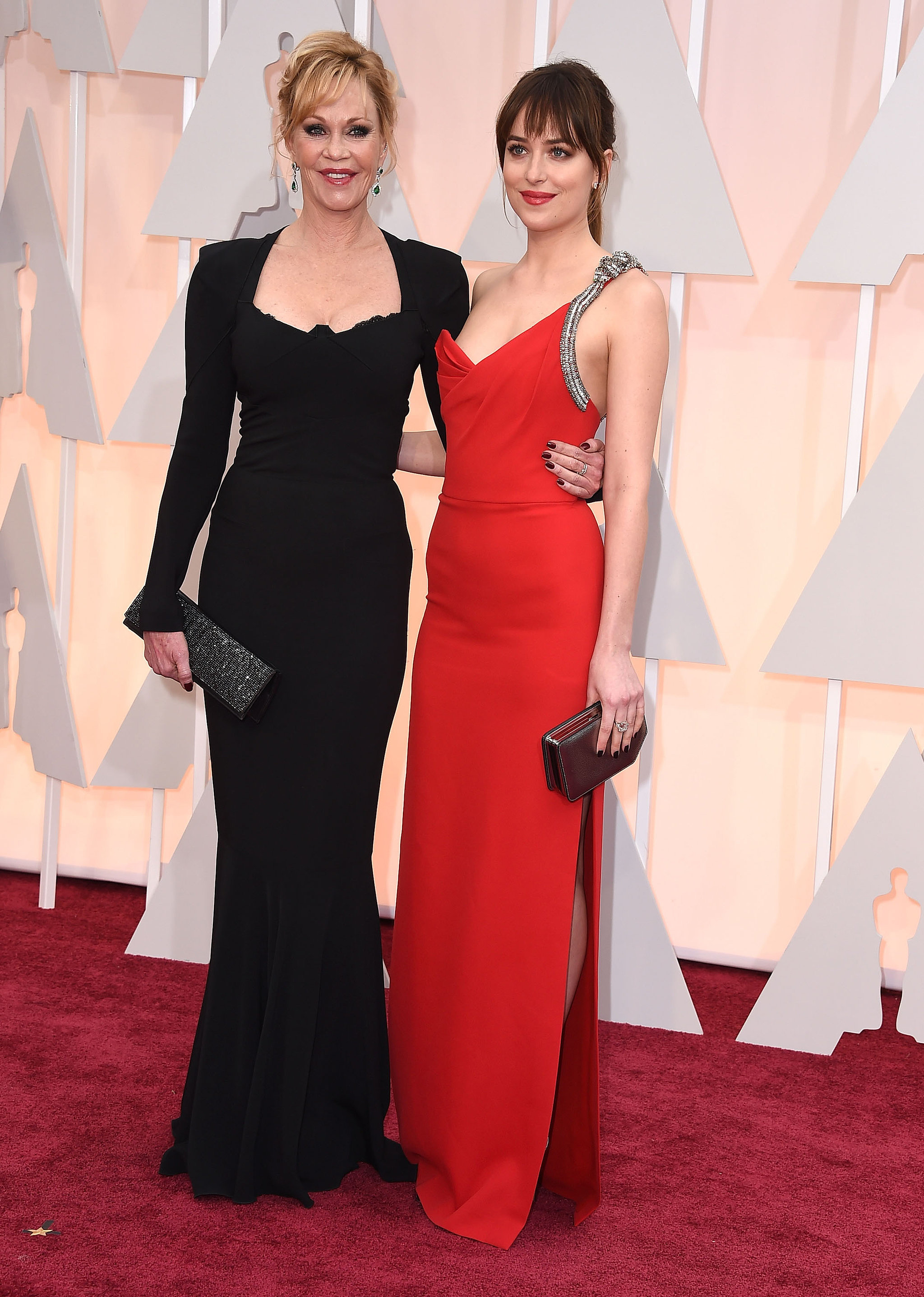

Spring Fashion Inspiration Dakota Johnson And Melanie Griffiths Looks

May 10, 2025

Spring Fashion Inspiration Dakota Johnson And Melanie Griffiths Looks

May 10, 2025 -

Slovenska Dvojnicka Dakoty Johnson

May 10, 2025

Slovenska Dvojnicka Dakoty Johnson

May 10, 2025 -

Shifting Sands Chinas Canola Imports After The Canada Rift

May 10, 2025

Shifting Sands Chinas Canola Imports After The Canada Rift

May 10, 2025 -

Lynk Lee Sau Chuyen Gioi Hanh Trinh Lot Xac Va Cau Chuyen Tinh Yeu Dep

May 10, 2025

Lynk Lee Sau Chuyen Gioi Hanh Trinh Lot Xac Va Cau Chuyen Tinh Yeu Dep

May 10, 2025 -

Alexandria Ocasio Cortez Calls Out Trump And His Fox News Supporters

May 10, 2025

Alexandria Ocasio Cortez Calls Out Trump And His Fox News Supporters

May 10, 2025