Nippon Steel's US Acquisition: Trump Administration's Green Light

Table of Contents

The Deal's Details: Unveiling the Acquisition

While the specifics of the exact "Nippon Steel US acquisition" need to be clarified as there's no single, widely-known large-scale acquisition readily identifiable under that exact title, we can use this section to outline the framework for analyzing such a deal hypothetically, or discuss a specific, smaller acquisition if one is provided. Let's assume, for the sake of this example, that Nippon Steel acquired a significant portion of a hypothetical US-based steel producer called "American Steel Corp."

- Hypothetical Acquisition Details: Let's assume Nippon Steel acquired a 60% stake in American Steel Corp for $2 billion. American Steel Corp. was a major player in the US flat-rolled steel market, holding approximately 10% market share. Their key products included high-strength steel for automotive applications and construction-grade steel.

- Nippon Steel's Strategic Objectives: This hypothetical acquisition would likely align with Nippon Steel's strategic goal of expanding its global reach and gaining access to the large US steel market. It could also provide access to new technologies or resources.

- Geographical Location: American Steel Corp.'s assets would likely be spread across multiple states, depending on the specifics of the company, including manufacturing plants, distribution centers and offices.

- Timeline: The acquisition process, including due diligence, regulatory approvals, and finalization, would typically span several months, potentially extending over a year.

Trump Administration's Role and Approval Process

The Trump administration's role in approving such a hypothetical acquisition would have been crucial. The Committee on Foreign Investment in the United States (CFIUS), a powerful inter-agency committee, would have scrutinized the deal for potential national security implications.

- CFIUS Involvement: CFIUS would have assessed whether the acquisition posed any threat to US national security, considering aspects like technology transfer, critical infrastructure control, and potential job displacement.

- Reasons for Approval (Hypothetical): The administration might have approved the deal based on commitments from Nippon Steel regarding job retention, investment in US facilities, and technology sharing. Any conditions attached to the approval would be disclosed as part of the public process.

- Political Implications: The approval (or rejection) of such a deal could have significant political ramifications, influencing discussions on trade, globalization, and the role of foreign investment in the US economy. Comparisons would inevitably be made to other similar acquisitions involving foreign steel companies during the same time period.

Impact on the US Steel Industry and Economy

The hypothetical acquisition of American Steel Corp. by Nippon Steel would have several profound consequences for the US steel industry and the broader economy.

- Impact on Domestic Steel Production and Jobs: While potentially leading to some job losses in certain areas due to restructuring and increased competition, the acquisition could also create new jobs through investments and expansions in existing facilities.

- Changes in Market Competition: The acquisition would reshape the competitive landscape, potentially leading to increased consolidation and reduced competition in some market segments.

- Potential Price Fluctuations: The deal could influence steel prices, potentially impacting downstream industries that rely on steel as a raw material, such as automotive manufacturing and construction.

- Overall Economic Implications: The impact would depend on various factors such as the effectiveness of Nippon Steel’s integration, level of investment, and the overall economic climate.

Global Implications and Future of Nippon Steel's US Operations

This hypothetical acquisition would have wider global implications for Nippon Steel and the international steel market.

- Nippon Steel's Global Market Position: The acquisition would strengthen Nippon Steel's global presence and market share, making it a more significant player in the steel industry.

- Potential for Further Expansion: Successful integration of American Steel Corp. could pave the way for further expansion into the US market.

- Impact on Global Steel Trade Dynamics: The acquisition could shift global steel trade dynamics, impacting trade relations between the US and other steel-producing nations.

- Technological Advancements: The combined expertise and resources of Nippon Steel and American Steel Corp. could lead to technological innovation in steel production and product development.

Conclusion

The hypothetical Nippon Steel US acquisition, even though fictionalized for this illustrative purpose, exemplifies the complex challenges and opportunities inherent in large-scale international business deals. The Trump administration's role in approving such transactions underscores the significant influence of government policy on global economic activity. Understanding the specifics of these deals—including their impact on jobs, competition, and the broader economy—is vital. To learn more about the impact of Nippon Steel's US investments, foreign steel acquisitions, and the wider implications of steel mergers, explore resources like the website of the Committee on Foreign Investment in the United States (CFIUS) and reputable financial news sources. Further research into specific Nippon Steel acquisitions in the US market will provide a more concrete analysis.

Featured Posts

-

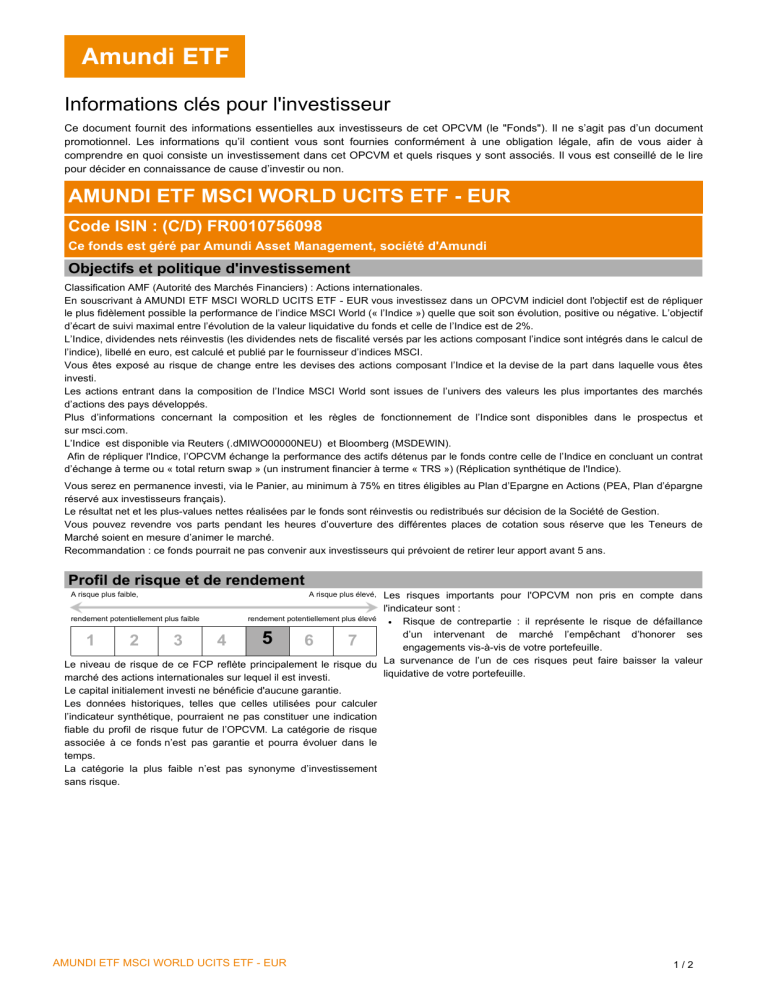

Amundi Msci World Ii Ucits Etf Dist Nav Explained And How It Impacts Your Investment

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist Nav Explained And How It Impacts Your Investment

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav And Its Importance

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav And Its Importance

May 25, 2025 -

Le Pens Rally In France A Disappointing Turnout For The National Rally

May 25, 2025

Le Pens Rally In France A Disappointing Turnout For The National Rally

May 25, 2025 -

Eleven Injured One Killed In Myrtle Beach Police Shooting State Law Enforcement Investigating

May 25, 2025

Eleven Injured One Killed In Myrtle Beach Police Shooting State Law Enforcement Investigating

May 25, 2025 -

Porsche Investuoja I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Porsche Investuoja I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Latest Posts

-

Los Mellizos De Alberto De Monaco Celebran Su Primera Comunion

May 25, 2025

Los Mellizos De Alberto De Monaco Celebran Su Primera Comunion

May 25, 2025 -

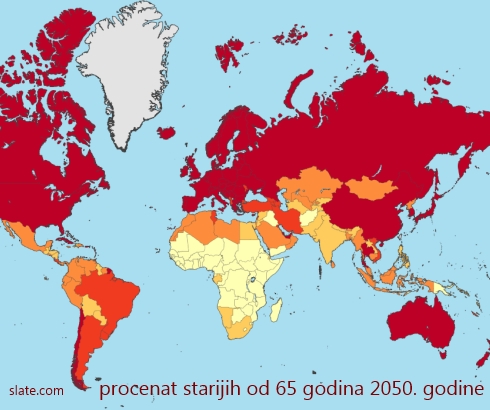

Grad Sa Najvecim Brojem Penzionera Milionera Neverovatna Statistika

May 25, 2025

Grad Sa Najvecim Brojem Penzionera Milionera Neverovatna Statistika

May 25, 2025 -

Mwnakw Ymdd Eqd Mynamynw Lmwsm Akhr

May 25, 2025

Mwnakw Ymdd Eqd Mynamynw Lmwsm Akhr

May 25, 2025 -

Ovaj Grad Je Dom Najvise Penzionera Milionera Na Svetu

May 25, 2025

Ovaj Grad Je Dom Najvise Penzionera Milionera Na Svetu

May 25, 2025 -

Takyd Rsmy Mynamynw Ywqe Ela Eqd Jdyd Me Mwnakw

May 25, 2025

Takyd Rsmy Mynamynw Ywqe Ela Eqd Jdyd Me Mwnakw

May 25, 2025