Oil Market Trends And Predictions: May 16, 2024

Table of Contents

Global Oil Supply and Production

OPEC+ Influence

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) significantly influence global oil supply and, consequently, crude oil prices. Recent decisions regarding production quotas have had a considerable impact on the market. Analyzing OPEC+'s future strategies is vital for accurate oil future predictions.

- Impact of production cuts: Recent production cuts implemented by OPEC+ have led to increased oil prices, reflecting the cartel's influence on market supply.

- Member country compliance: Adherence to production quotas by member countries varies, creating uncertainty and impacting the effectiveness of the collective decisions. Non-compliance from certain members can lead to price volatility.

- Potential for future adjustments: Future adjustments to production quotas will depend on factors such as global demand, economic growth, and geopolitical stability. Predicting these adjustments is crucial for oil market analysis.

- Geopolitical considerations influencing decisions: Geopolitical tensions and conflicts significantly influence OPEC+'s decision-making, creating unpredictability in the market. For example, the ongoing conflict in Ukraine has significantly impacted oil supply and prices.

Non-OPEC Production

Non-OPEC producers play a substantial role in shaping global oil supply. The US, Russia, and Canada are key players in this segment.

- US shale oil production trends: The US shale oil industry's production levels impact global supply significantly. Recent trends show fluctuating production depending on investment levels and energy prices.

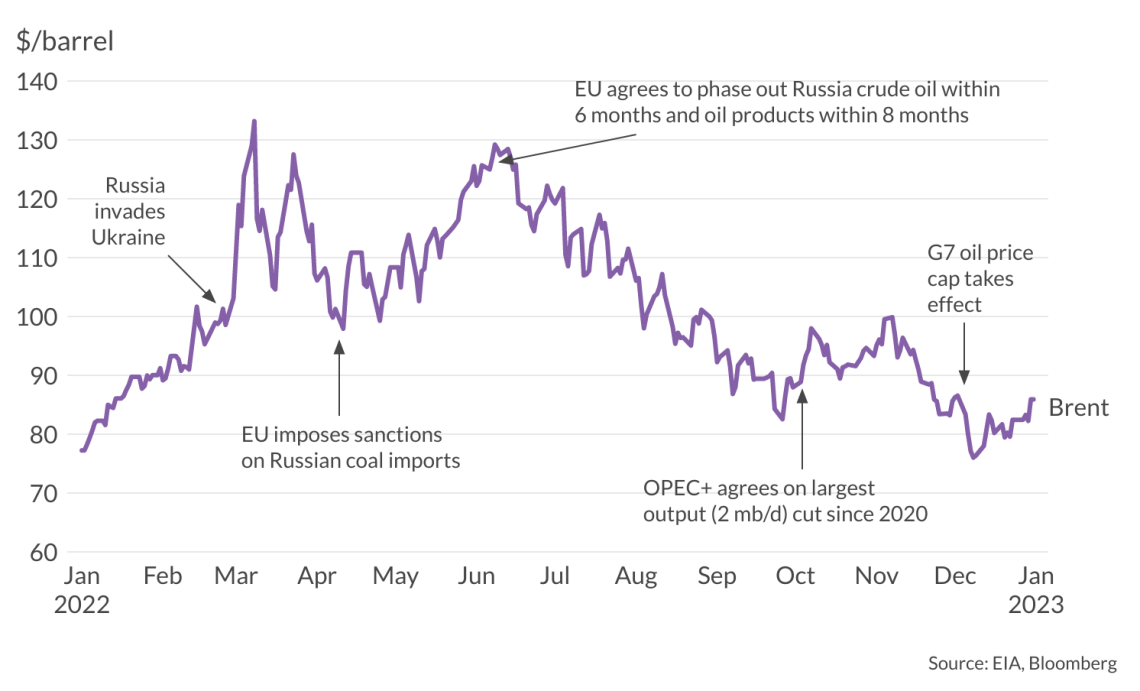

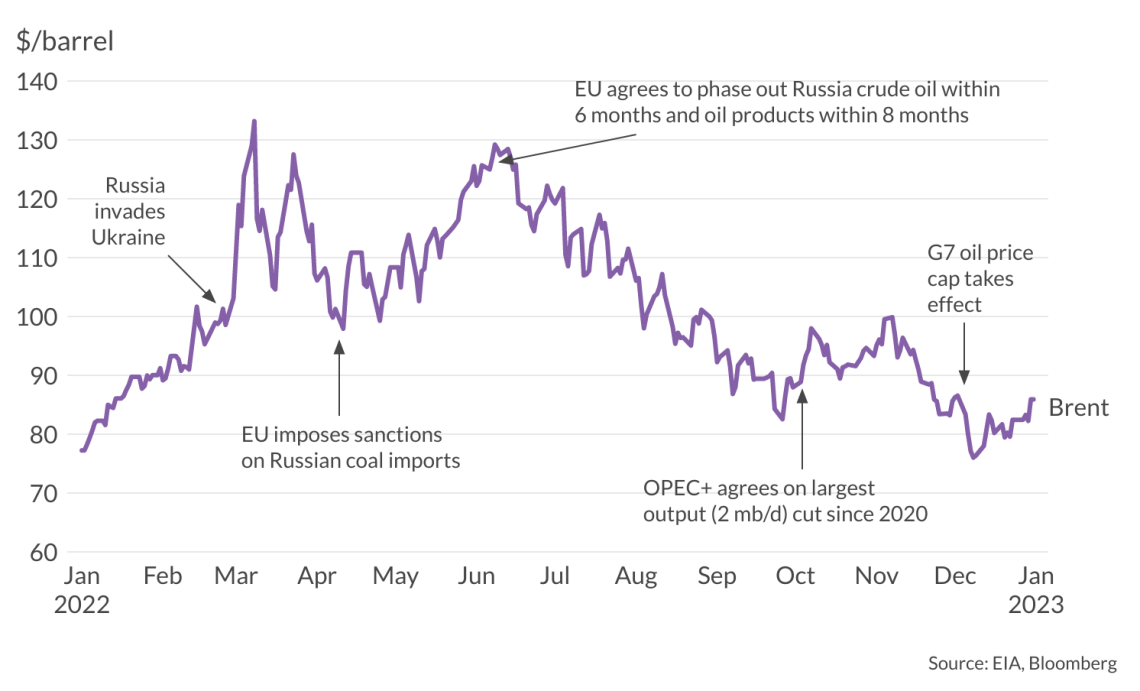

- Russian oil exports and sanctions: Sanctions imposed on Russia have disrupted global oil markets, reducing its export capacity and causing significant price volatility. The impact of sanctions and potential future changes remains a key factor in oil price predictions.

- Canadian oil sands development: The development of Canada's oil sands continues to influence global oil supply, but faces environmental and logistical challenges affecting its overall contribution.

- Impact of technological advancements on production: Technological advancements in exploration and extraction continuously improve efficiency and productivity in non-OPEC oil production, potentially leading to increased supply.

Supply Chain Disruptions

Disruptions to the global oil supply chain can severely impact oil prices. Geopolitical instability and natural disasters are primary causes of these disruptions.

- Specific examples of disruptions and their projected impact on oil prices: Recent disruptions, such as pipeline attacks or port closures, illustrate the sensitivity of oil markets to logistical challenges. These events can significantly influence short-term price volatility.

- Logistical challenges: Transportation bottlenecks, refinery outages, and infrastructure limitations contribute to supply chain disruptions, impacting the availability and price of oil.

- Insurance costs: Increased risks associated with geopolitical instability and natural disasters can lead to higher insurance costs, potentially increasing the overall price of oil.

Global Oil Demand and Consumption

Economic Growth and its Impact

Global economic growth directly influences oil demand. Strong economic growth in major economies typically leads to increased oil consumption.

- Impact of economic slowdown or expansion in major economies on oil consumption: Economic downturns significantly reduce oil demand, while periods of expansion increase it. This relationship is crucial in forecasting future oil consumption.

- Forecasts for future demand based on economic indicators: Analyzing key economic indicators like GDP growth, industrial production, and consumer confidence helps predict future oil demand accurately.

Shifting Energy Consumption Patterns

The increasing adoption of renewable energy sources is gradually impacting long-term oil demand.

- Growth of electric vehicles: The widespread adoption of electric vehicles (EVs) is gradually reducing demand for gasoline and diesel, affecting the oil market.

- Investment in renewable energy sources: Significant investments in solar, wind, and other renewable energy sources are diverting resources away from fossil fuels and reducing future oil demand.

- Government policies promoting energy transition: Government policies supporting renewable energy and discouraging fossil fuel consumption are accelerating the shift away from oil.

- Their impact on long-term oil demand: The combined impact of these factors will gradually decrease the long-term demand for oil, impacting the petroleum market.

Seasonal Demand Fluctuations

Seasonal variations in oil demand influence price volatility throughout the year.

- Peak demand seasons: Specific periods, like winter heating seasons in colder climates, witness higher oil demand, contributing to price fluctuations.

- Impact of weather patterns: Extreme weather events can impact oil production, transportation, and consumption, causing temporary price spikes.

- Seasonal price adjustments: Oil prices often reflect seasonal demand patterns, adjusting to accommodate increased or decreased consumption.

Geopolitical Factors and their Influence

Geopolitical Risks

Geopolitical risks are major drivers of oil price volatility. Conflicts, sanctions, and political instability all significantly impact oil markets.

- Specific examples of ongoing geopolitical tensions and their potential impact on oil supply and prices: The ongoing war in Ukraine, tensions in the Middle East, and other conflicts create uncertainty and significantly impact oil prices.

- Analysis of potential escalation scenarios: Assessing the potential for escalation in geopolitical conflicts is vital for accurately predicting future oil price movements.

Strategic Petroleum Reserves (SPR)

Strategic Petroleum Reserve (SPR) releases can influence oil market dynamics by increasing supply temporarily.

- Recent SPR releases: Recent releases from various countries' SPRs have aimed to stabilize prices during periods of supply disruption or high prices.

- Their impact on prices: SPR releases generally lead to short-term decreases in oil prices due to the increased supply.

- Potential for future releases: The possibility of future SPR releases influences market sentiment and investor expectations.

- The implications: The timing and scale of future SPR releases will have an impact on oil market behavior, affecting both short-term and long-term price stability.

Oil Price Predictions for the Next Quarter

Price Range Forecast

Based on the current oil market trends and analysis, we forecast a WTI crude oil price range of $70-$80 per barrel and a Brent crude oil price range of $75-$85 per barrel for the next three months (June-August 2024).

- Justification for the forecast range: This forecast considers the factors discussed above, including OPEC+ policies, global economic growth, geopolitical risks, and seasonal demand fluctuations.

- Factors considered in the prediction: The prediction incorporates diverse factors, weighted according to their perceived influence on the market.

- Potential upside and downside risks: Upside risks include unexpected geopolitical events or further production cuts by OPEC+, while downside risks include stronger-than-expected economic slowdown or increased renewable energy adoption.

Key Factors Affecting the Forecast

Several critical factors influence the predicted price range:

- OPEC+ production decisions: Future decisions by OPEC+ regarding production quotas remain the most significant factor impacting oil prices.

- Global economic growth: The pace of global economic growth will heavily influence oil demand and, therefore, prices.

- Geopolitical risks: Escalation of geopolitical tensions can cause sudden price spikes.

- Unexpected events: Unforeseen events like natural disasters or major supply disruptions can significantly alter the predicted price range.

Conclusion

This analysis of oil market trends and predictions for May 16, 2024, reveals a complex interplay of factors influencing crude oil prices. While OPEC+ policies, global economic growth, and geopolitical events remain dominant drivers, the growing adoption of renewable energy sources presents a long-term challenge to the oil industry. Our predictions suggest a range for oil prices in the coming quarter, but considerable uncertainty remains. Continuous monitoring of these dynamic factors is essential for navigating the volatile oil market successfully.

Call to Action: Stay informed on the latest developments in the oil market trends by regularly checking our website for updates and in-depth analyses of the crude oil price. Subscribe to our newsletter for timely oil future predictions and insightful commentary on the energy market outlook. Understanding the oil market analysis is crucial for making sound investment decisions.

Featured Posts

-

Red Carpet Rule Breakers Understanding Guest Misconduct

May 17, 2025

Red Carpet Rule Breakers Understanding Guest Misconduct

May 17, 2025 -

The Bromance Factor Examining Trumps Relationships With Middle Eastern Leaders

May 17, 2025

The Bromance Factor Examining Trumps Relationships With Middle Eastern Leaders

May 17, 2025 -

Budget Friendly Buys Quality On A Dime

May 17, 2025

Budget Friendly Buys Quality On A Dime

May 17, 2025 -

Blue Origin Postpones Launch Technical Glitch Halts Mission

May 17, 2025

Blue Origin Postpones Launch Technical Glitch Halts Mission

May 17, 2025 -

Giants Vs Mariners Tracking Injuries Ahead Of The April 4 6 Series

May 17, 2025

Giants Vs Mariners Tracking Injuries Ahead Of The April 4 6 Series

May 17, 2025

Latest Posts

-

Numero De Vitimas Em Acidente Com Onibus Universitario Aumenta

May 17, 2025

Numero De Vitimas Em Acidente Com Onibus Universitario Aumenta

May 17, 2025 -

Eagleson Named Outstanding Science Educator At Sheyenne High School

May 17, 2025

Eagleson Named Outstanding Science Educator At Sheyenne High School

May 17, 2025 -

Grave Acidente Com Onibus De Universidade Balanco De Vitimas

May 17, 2025

Grave Acidente Com Onibus De Universidade Balanco De Vitimas

May 17, 2025 -

Fargos Sheyenne High Recognizes Eaglesons Excellence In Science Education

May 17, 2025

Fargos Sheyenne High Recognizes Eaglesons Excellence In Science Education

May 17, 2025 -

Tragedia Acidente Com Onibus Universitario Causa Diversas Vitimas

May 17, 2025

Tragedia Acidente Com Onibus Universitario Causa Diversas Vitimas

May 17, 2025