Oil Price Analysis: A Comprehensive Overview For May 16

Table of Contents

Geopolitical Factors Influencing Oil Prices on May 16th

Geopolitical risk remains a primary driver of oil price volatility. The global oil market is highly sensitive to international relations, and events on May 16th were no exception.

Impact of the Russia-Ukraine Conflict

- Sanctions: Ongoing sanctions against Russia significantly impacted its oil exports, creating supply chain disruptions and pushing up global crude oil prices.

- Supply Disruptions: The conflict directly affected oil production and transportation routes, exacerbating existing supply constraints. Any specific events impacting supply on May 16th (e.g., attacks on infrastructure, sanctions enforcement) would need to be mentioned here with relevant data.

- Geopolitical Risk Premium: The uncertainty surrounding the conflict introduced a "geopolitical risk premium" into oil prices, reflecting the market's anticipation of further disruptions.

The Russia-Ukraine conflict continues to be a major source of uncertainty in the global oil market. The sanctions imposed on Russia, coupled with the disruption of its energy infrastructure, have had a demonstrably upward effect on global crude oil prices. The degree of this impact fluctuates daily, depending on the evolving geopolitical landscape. Analysis of satellite imagery, shipping data, and official statements from involved parties is crucial for accurate assessments of the impact on global supply.

OPEC+ Decisions and Their Influence

- OPEC+ Meeting: If an OPEC+ meeting occurred around May 16th, this section would detail the decisions made regarding production quotas.

- Production Quotas: Any changes in production quotas, whether increases or decreases, significantly influence the global oil supply and therefore impact prices.

- Market Response: The market's reaction to OPEC+ announcements, including immediate price movements and analyst predictions, should be included. (Example: "OPEC+'s decision to maintain production levels on May 15th was met with a slight increase in crude oil prices, reflecting concerns about tightening supply.")

OPEC+'s actions are a key determinant in the global oil market. Their decisions regarding production quotas directly influence the oil supply, impacting both short-term and long-term price forecasts. Analyzing past OPEC+ decisions and their market consequences is vital for predicting future price trends.

Economic Indicators and Their Correlation with Oil Prices on May 16th

Economic factors play a crucial role in determining oil demand and subsequently, its price. Strong economic growth often translates to increased oil consumption, while economic downturns can lead to reduced demand.

Global Demand and its Impact

- Economic Growth: The economic growth rate in major oil-consuming countries (like the US, China, and the EU) directly impacts global oil demand.

- Seasonal Changes: Seasonal variations in demand (e.g., increased demand for heating oil in winter) can also influence prices.

- Industrial Activity: The level of industrial activity in various sectors is another key driver of oil demand.

For accurate Oil Price Analysis, economic forecasts are essential. The health of global economies directly correlates with oil consumption. For example, a slowdown in manufacturing in China might signal a drop in oil demand, potentially putting downward pressure on prices. Conversely, robust economic growth in the US could drive up demand and push prices higher.

US Dollar Strength and its Effect on Oil Prices

- US Dollar Index: The US dollar index (DXY) measures the value of the dollar against other major currencies.

- Inverse Relationship: Oil is priced in US dollars, so a stronger dollar generally leads to lower oil prices (as it becomes more expensive for holders of other currencies to buy oil).

- Currency Fluctuations: Fluctuations in the US dollar's value can significantly impact the price of oil.

Oil prices and the US dollar have an inverse relationship. A strong US dollar makes oil more expensive for buyers using other currencies, thus decreasing demand and potentially lowering prices. Tracking the US Dollar Index is, therefore, a critical part of any comprehensive Oil Price Analysis.

Supply Chain Dynamics and their Influence on Oil Prices for May 16th

The efficiency and stability of the global oil supply chain directly affect prices. Bottlenecks and disruptions can lead to price increases, while smooth operations can contribute to price stability.

Inventory Levels and Their Significance

- Crude Oil Inventories: Tracking crude oil inventory levels in major consuming countries (like the US) provides insights into supply and demand dynamics.

- Strategic Petroleum Reserve: Government-held strategic petroleum reserves can be released to stabilize prices during periods of supply disruption.

- Supply and Demand Balance: The balance between supply and demand, reflected in inventory levels, is a major determinant of oil prices.

Monitoring inventory levels is a crucial aspect of Oil Price Analysis. High inventory levels generally indicate ample supply, which can put downward pressure on prices. Conversely, low inventory levels suggest tighter supply, potentially leading to price increases.

Infrastructure Bottlenecks and Refining Capacity

- Pipeline Capacity: Limitations in pipeline capacity can constrain the flow of oil to refineries and markets.

- Refining Margins: The profitability of refining operations impacts the supply of refined products and their prices.

- Logistics Challenges: Disruptions in shipping, port congestion, or other logistical issues can also affect oil supply.

Infrastructure limitations and logistical bottlenecks can create significant challenges in the oil market. For example, a pipeline shutdown can disrupt oil flow, leading to localized shortages and price spikes. Similarly, refinery capacity constraints can affect the supply of refined products, leading to price volatility.

Conclusion: Key Takeaways and Call to Action

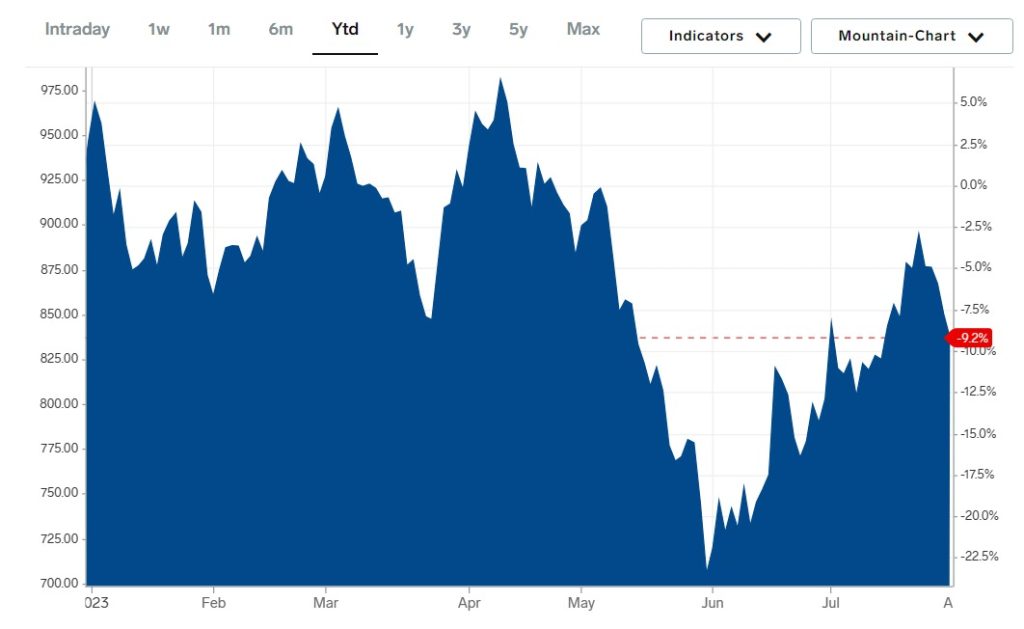

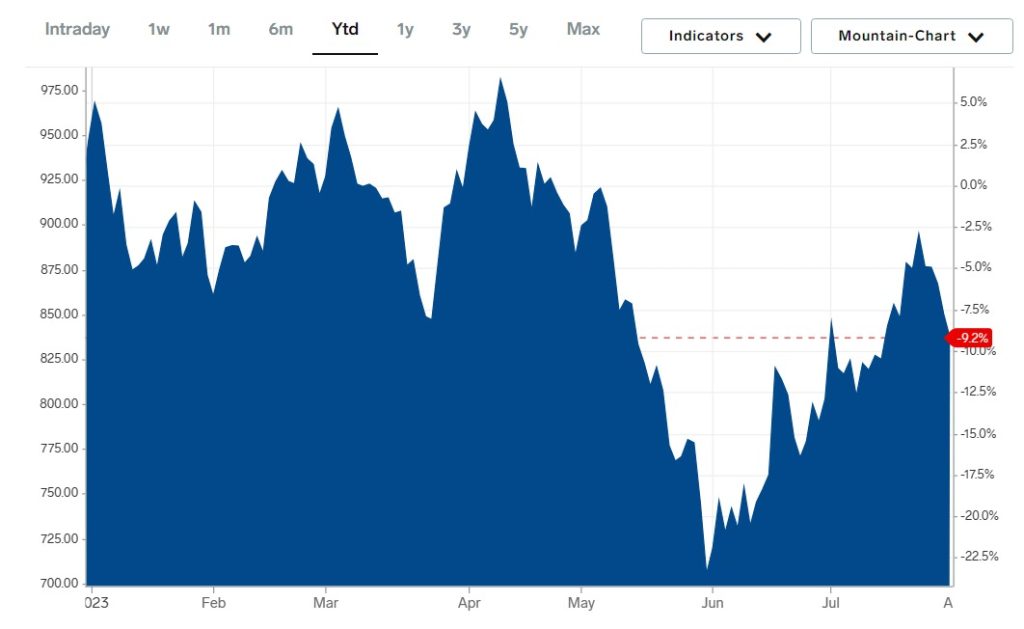

On May 16th, oil prices were influenced by a complex interplay of geopolitical events, economic indicators, and supply chain dynamics. The Russia-Ukraine conflict, OPEC+ decisions, global demand, US dollar strength, inventory levels, and infrastructure bottlenecks all played significant roles in shaping the day's price fluctuations. Understanding these interconnected factors is crucial for accurate Oil Price Analysis.

The overall trend in oil prices on May 16th (upward/downward/stable) needs to be stated here, along with a brief outlook based on the information provided. For example: "Based on the factors discussed, the overall trend on May 16th showed a slight upward movement in crude oil prices, primarily driven by geopolitical uncertainty and concerns about supply."

Stay informed about future oil price fluctuations with our regular Oil Price Analysis reports. Subscribe today to receive timely updates and expert insights!

Featured Posts

-

Navigating Student Loans Expert Advice From A Financial Planner

May 17, 2025

Navigating Student Loans Expert Advice From A Financial Planner

May 17, 2025 -

E

May 17, 2025

E

May 17, 2025 -

Best No Kyc Online Casinos For Fast Payouts 7 Bit Casino Review And Comparison

May 17, 2025

Best No Kyc Online Casinos For Fast Payouts 7 Bit Casino Review And Comparison

May 17, 2025 -

Ben Stillers Severance A Comparison Of Lumon Industries And Apple

May 17, 2025

Ben Stillers Severance A Comparison Of Lumon Industries And Apple

May 17, 2025 -

Trumps Approach To The Middle East Personality Politics And Partnerships

May 17, 2025

Trumps Approach To The Middle East Personality Politics And Partnerships

May 17, 2025