Omada Health IPO Filing: Details On The Andreessen Horowitz-Backed Digital Health Company's Public Offering

Table of Contents

Omada Health's Business Model and Target Market

Omada Health's core offering centers on a telehealth platform designed for chronic disease management. Their digital therapeutics and virtual care programs primarily target individuals with conditions like type 2 diabetes and hypertension. The company leverages technology to deliver personalized care, combining remote monitoring with coaching and support to help patients manage their conditions effectively. This business model directly addresses a massive and growing market.

- Detailed description of Omada Health's digital therapeutics and telehealth programs: Omada employs a multi-pronged approach, including personalized education materials, remote monitoring devices, and regular virtual check-ins with certified health coaches. Their programs are designed to be scalable and adaptable to individual patient needs.

- Analysis of the target patient population and their needs: The target demographic includes adults with chronic conditions who may benefit from increased access to affordable and convenient healthcare. This population is significant and growing rapidly, driven by aging demographics and rising rates of chronic diseases.

- Market size estimations and growth projections for chronic disease management: The market for chronic disease management is enormous, with projections indicating substantial growth in the coming years. Omada Health is well-positioned to capitalize on this growth given the increasing demand for accessible and effective virtual care solutions.

- Competitive landscape analysis and Omada Health's competitive advantages: While the telehealth and digital therapeutics markets are becoming increasingly competitive, Omada Health differentiates itself through its established track record, strong partnerships, and comprehensive programs tailored to specific chronic conditions.

Financial Performance and Key Metrics

Omada Health's financial performance, as detailed in its IPO filing, will be crucial for prospective investors. While specific figures will depend on the final prospectus, analyzing revenue growth, profitability, and key financial metrics is vital for assessing the company's valuation and potential returns.

- Revenue figures for the past few years, highlighting growth trends: Examining past revenue growth provides insights into the company's ability to scale its operations and attract new customers. Significant year-over-year increases would indicate strong market traction.

- Key financial ratios (e.g., gross margin, operating margin): These ratios offer a detailed look at the company's profitability and efficiency. High gross margins suggest a strong pricing strategy and effective cost control.

- Details on funding rounds and investor participation (especially Andreessen Horowitz's role): Andreessen Horowitz's substantial investment signifies confidence in Omada Health's potential. Analyzing previous funding rounds provides a historical perspective on investor interest and the company's valuation.

- Projected financial performance post-IPO, including revenue forecasts: The IPO filing will include projections for future financial performance, which are essential for evaluating potential returns on investment. Investors will carefully scrutinize these forecasts for realism and sustainability.

The Role of Andreessen Horowitz and Investor Interest

Andreessen Horowitz's involvement in Omada Health is a significant factor contributing to the IPO. Their reputation and experience in the tech and digital health sectors lend credibility to the company and attract other investors.

- History of Andreessen Horowitz's involvement with Omada Health: Understanding the duration and extent of Andreessen Horowitz's investment provides context for their confidence in the company's long-term prospects.

- Details on other significant investors and their investment amounts: A diverse investor base strengthens the company's financial standing and indicates a broad belief in its potential.

- Analysis of the investor sentiment and its influence on the IPO pricing: Positive investor sentiment is generally reflected in a higher IPO valuation, potentially offering greater returns for early investors.

- Potential impact of investor involvement on post-IPO growth strategies: Existing investors often have significant influence on the company's strategic direction, which could impact its future growth trajectory.

Risks and Challenges Facing Omada Health

Despite its potential, Omada Health faces several challenges that could impact its post-IPO performance. Understanding these risks is essential for informed investment decisions.

- Identification of major competitors in the digital health space: The telehealth market is increasingly competitive, with numerous established players and emerging startups vying for market share. Omada Health's ability to maintain a competitive edge is crucial.

- Potential regulatory changes that could impact Omada Health's business: Changes in healthcare regulations could significantly affect Omada Health's operations, reimbursement models, and market access.

- Challenges associated with patient adoption and engagement with virtual care: Ensuring high levels of patient engagement and satisfaction is critical for the success of any telehealth platform. Omada Health must address potential barriers to adoption.

- Scalability issues and the potential for increased operational costs: Scaling operations to meet growing demand can present significant challenges, particularly in terms of managing infrastructure and personnel costs.

Conclusion

Omada Health's IPO filing presents a significant opportunity for investors interested in the digital health sector. The company's established business model, impressive growth trajectory, and strong investor support are all positive indicators. However, potential investors must carefully consider the competitive landscape, regulatory risks, and challenges associated with scaling a telehealth platform. This comprehensive overview of the Omada Health IPO provides valuable insights for investors and industry professionals interested in the future of digital health. Further research into Omada Health's SEC filings and related news is recommended for a complete understanding of this significant public offering. Stay informed about the latest developments in the Omada Health IPO and the broader digital health investment landscape to make informed decisions.

Featured Posts

-

Understanding The Iron Ore Price Decline Chinas Steel Industry Role

May 10, 2025

Understanding The Iron Ore Price Decline Chinas Steel Industry Role

May 10, 2025 -

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

May 10, 2025

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

May 10, 2025 -

14 Edmonton Schools Minister Speeds Up Construction Projects

May 10, 2025

14 Edmonton Schools Minister Speeds Up Construction Projects

May 10, 2025 -

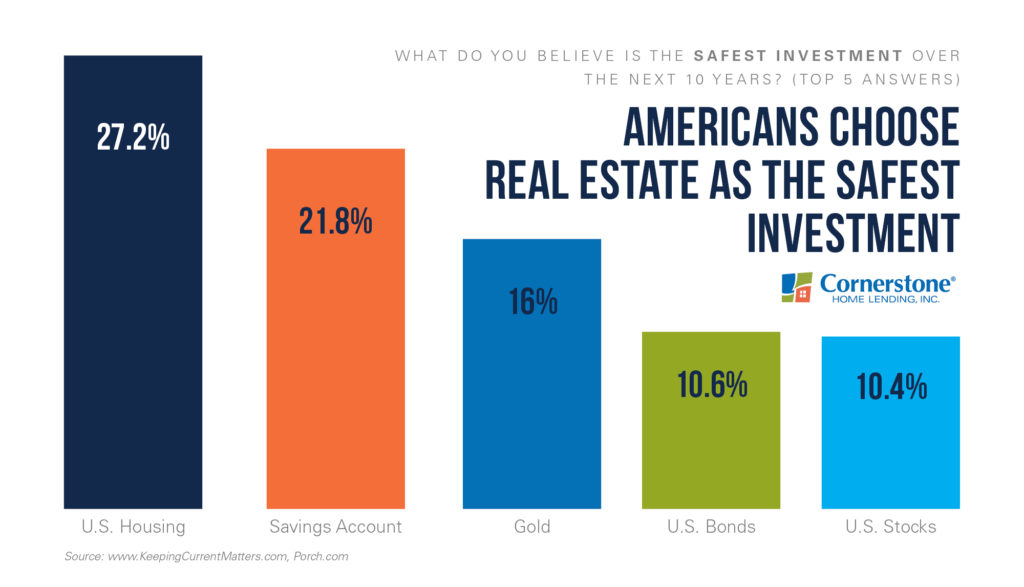

Is This Investment Really A Safe Bet A Practical Guide

May 10, 2025

Is This Investment Really A Safe Bet A Practical Guide

May 10, 2025 -

Navigating The Elizabeth Line A Wheelchair Users Guide To Gap Safety

May 10, 2025

Navigating The Elizabeth Line A Wheelchair Users Guide To Gap Safety

May 10, 2025