One Crypto Survivor: How To Navigate The Trade War's Impact

Table of Contents

Understanding the Trade War's Impact on Crypto

The complexities of international trade disputes significantly influence the cryptocurrency market. Understanding this impact is crucial for navigating the challenges and potentially capitalizing on opportunities.

Geopolitical Uncertainty and Market Volatility

Trade tensions create a climate of geopolitical uncertainty, directly impacting cryptocurrency markets. This uncertainty leads to increased market volatility, characterized by significant price swings.

- Increased risk aversion: Investors often move away from riskier assets, including cryptocurrencies, during periods of geopolitical instability.

- Capital flight to safe haven assets: Investors may shift funds towards assets perceived as safer, such as gold or government bonds, potentially reducing investment in crypto.

- Regulatory uncertainty in affected countries: Trade wars can lead to unpredictable regulatory changes in various countries, impacting the legal landscape for cryptocurrency trading and operations.

For example, during past periods of heightened trade tensions, we've seen significant drops in Bitcoin's price as investors sought safer havens. This illustrates the direct link between global trade conflicts and cryptocurrency market volatility.

Regulatory Changes and Their Ripple Effects

Trade wars often trigger a wave of regulatory changes, impacting cryptocurrency trading and exchanges. Governments may tighten regulations in response to perceived risks associated with cryptocurrencies, potentially limiting access and liquidity.

- Increased KYC/AML compliance requirements: Expect stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures for cryptocurrency exchanges and platforms.

- Restrictions on cross-border crypto transactions: Governments might impose limitations on international cryptocurrency transactions to control capital flows and prevent circumvention of trade sanctions.

- Impact on decentralized finance (DeFi): The regulatory landscape for DeFi protocols could become more challenging, potentially hindering innovation and growth.

Countries have historically responded to economic pressures by increasing regulatory scrutiny of financial markets, including cryptocurrencies. Understanding these potential regulatory shifts is vital for navigating the crypto trade war.

Strategies for Navigating the Crypto Trade War

While the crypto trade war presents challenges, proactive strategies can help investors mitigate risks and potentially profit.

Diversification: Your Best Defense

Diversification is paramount in mitigating risks associated with the crypto trade war. A well-diversified portfolio reduces your exposure to any single cryptocurrency or market segment.

- Invest in a range of cryptocurrencies: Don't put all your eggs in one basket. Spread investments across different cryptocurrencies with varying market caps and functionalities.

- Consider stablecoins: Stablecoins, pegged to fiat currencies, can provide stability in your portfolio during periods of high volatility.

- Explore alternative investment options (e.g., DeFi): Decentralized finance (DeFi) offers a range of investment options that might be less correlated with traditional markets.

Effective portfolio allocation and risk management are key to navigating volatility. Consider consulting with a financial advisor to tailor a strategy to your individual risk tolerance and financial goals.

Fundamental Analysis and Due Diligence

Thorough research is crucial before investing in any cryptocurrency. Don't let market hype cloud your judgment; focus on fundamentals.

- Examine the technology behind the cryptocurrency: Understand the underlying technology, its scalability, and its potential for future development.

- Assess the team's competence: Research the team behind the project, their experience, and their track record.

- Analyze market trends and adoption rates: Evaluate the cryptocurrency's market capitalization, trading volume, and overall adoption rate.

Resources like white papers, developer documentation, and independent research reports can provide valuable insights into a cryptocurrency's potential.

Long-Term Perspective and Emotional Discipline

The crypto market is inherently volatile. A long-term investment approach, coupled with emotional discipline, is essential for success.

- Avoid panic selling: Don't make rash decisions based on short-term price fluctuations. Stick to your investment strategy.

- Focus on your investment strategy: Maintain a well-defined investment plan and avoid impulsive trades driven by fear or greed.

- Maintain a realistic expectation of returns: Cryptocurrency investments carry inherent risks. Don't expect overnight riches.

Managing emotions during market downturns is crucial. Consider developing a strategy for managing stress and sticking to your long-term plan.

Opportunities Within the Crypto Trade War

While the crypto trade war presents challenges, it also creates opportunities for those who can adapt and innovate.

Increased Demand for Privacy Coins

Increased regulatory scrutiny and concerns about capital controls might lead to higher demand for privacy-focused cryptocurrencies.

- Discuss the benefits and risks of privacy coins: Privacy coins offer increased anonymity, but they also carry risks, including potential use in illicit activities.

- Mention specific examples of privacy-focused cryptocurrencies: Examples include Monero (XMR) and Zcash (ZEC).

The increased demand for privacy and security could potentially drive the adoption of privacy-focused cryptocurrencies.

Growth of Decentralized Finance (DeFi)

DeFi platforms could become increasingly attractive as they offer alternative financial systems less susceptible to trade war disruptions.

- Briefly explain DeFi: DeFi refers to financial applications built on blockchain technology, offering decentralized services like lending, borrowing, and trading.

- Discuss its potential benefits and risks: DeFi offers greater accessibility and transparency but carries risks associated with smart contract vulnerabilities and regulatory uncertainty.

- Mention specific DeFi applications: Examples include decentralized exchanges (DEXs) and lending protocols.

The potential for DeFi to offer resilient and accessible financial services could lead to increased adoption during periods of geopolitical instability.

Conclusion

The crypto trade war presents challenges, but also opportunities. By understanding the impact of geopolitical events, diversifying your portfolio, conducting thorough due diligence, and maintaining emotional discipline, you can significantly increase your chances of success. Remember, a long-term perspective and a focus on fundamental analysis are key to becoming a crypto trade war survivor. Don't wait – start building your resilient crypto portfolio today!

Featured Posts

-

The Long Walk A Chillingly Simple First Trailer

May 08, 2025

The Long Walk A Chillingly Simple First Trailer

May 08, 2025 -

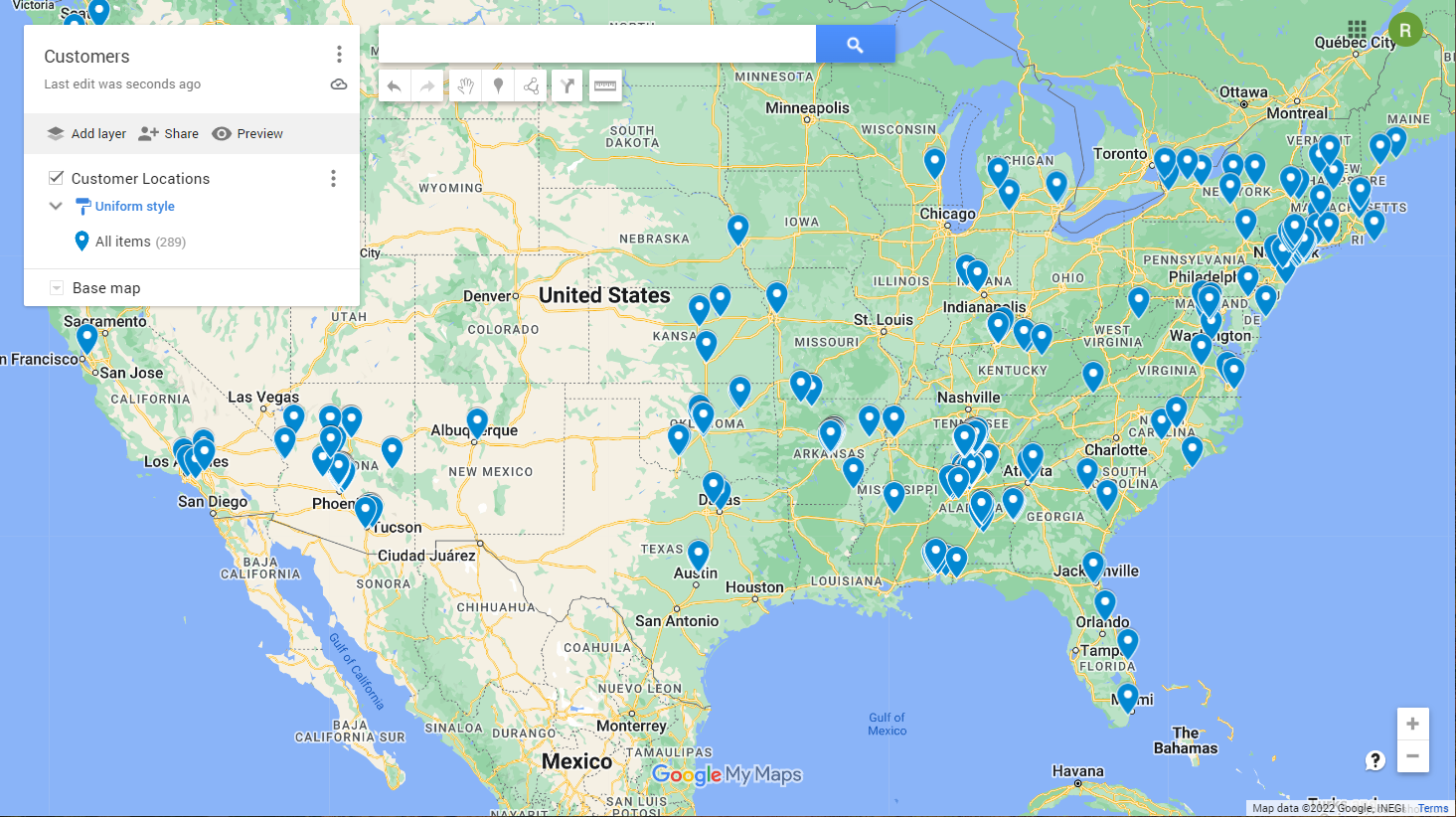

New Business Hotspots Regional Trends And Future Growth Potential

May 08, 2025

New Business Hotspots Regional Trends And Future Growth Potential

May 08, 2025 -

Nba Playoffs Alex Carusos Historic Game 1 Performance For The Thunder

May 08, 2025

Nba Playoffs Alex Carusos Historic Game 1 Performance For The Thunder

May 08, 2025 -

Dembele Injury Worry For Arsenal As Artetas Plans Are Jeopardised

May 08, 2025

Dembele Injury Worry For Arsenal As Artetas Plans Are Jeopardised

May 08, 2025 -

Exploring Promising Business Locations A Comprehensive National Map

May 08, 2025

Exploring Promising Business Locations A Comprehensive National Map

May 08, 2025