Onex Fully Recoups WestJet Investment With 25% Stake Sale

Table of Contents

The Details of the WestJet Stake Sale

The sale of Onex's 25% stake in WestJet represents a complete exit strategy, marking a successful conclusion to their investment. While the exact sale price remains undisclosed, sources suggest a highly profitable outcome for Onex, indicating a significant return on their initial investment. The timeline involved a strategic process, likely involving multiple potential buyers before a final agreement was reached.

- The Buyer: While the specific buyer hasn't been publicly named, industry analysts speculate the acquisition could be attributed to a larger airline or a strategic investor seeking to consolidate market share. This could potentially indicate a belief in WestJet's future growth potential.

- Stake Sold: Onex divested 25% of its ownership in WestJet. This represents a substantial portion of the company's equity.

- Return on Investment (ROI): Although the precise figures are confidential, it's clear that Onex has achieved a substantial and highly successful ROI, exceeding their initial projections.

- Future Relationship: While Onex has exited its ownership stake, it's plausible there's an ongoing professional relationship between Onex and WestJet's new shareholder, potentially through consulting or strategic partnerships.

Onex's Investment Strategy and Success

Onex's acquisition of the WestJet stake was a calculated move reflecting their established expertise in the transportation sector. Their investment strategy likely involved identifying undervalued assets with high growth potential and implementing operational improvements to enhance profitability before a strategic exit.

- Successful Transportation Investments: Onex has a proven track record of successful investments within the transportation industry, demonstrating a deep understanding of the sector's complexities and nuances. Their due diligence and risk management are clearly factors in this successful WestJet investment.

- Portfolio Management and Exit Strategies: Onex's approach to portfolio management is characterized by a disciplined exit strategy, strategically timing divestments to maximize returns. The WestJet sale perfectly exemplifies this strategic approach.

- Other Successful Investments: Onex's portfolio boasts a number of successful investments across diverse sectors. This WestJet success adds another noteworthy achievement to their impressive track record, further solidifying their reputation as a leading private equity firm.

Implications for Private Equity Investments

Onex's success with WestJet sends a positive signal to other private equity firms considering investments in the airline industry or related transportation sectors.

- Increased Confidence: The deal boosts investor confidence in the potential for significant returns within the airline sector, even after the recent challenges brought on by the pandemic.

- Future Investments: We can expect to see a surge of interest and potential increased private equity investment in undervalued airline companies or related businesses, aiming to replicate Onex’s success.

- Similar Successful Exits: This success mirrors successful private equity exits in other transportation-related sectors, potentially encouraging further investment in the broader transportation and logistics industry.

WestJet's Future Following the Stake Sale

The sale of the 25% stake will undoubtedly impact WestJet's future direction. While the immediate effects might be subtle, long-term implications will depend largely on the new shareholder's strategic vision.

- New Ownership Structure: The shift in ownership structure will likely influence WestJet's strategic decision-making. The new shareholder's goals and expertise could shape WestJet's future business plans.

- Business Model and Expansion: Potential changes to WestJet’s business model or expansion plans could involve route optimization, fleet modernization, or new partnerships. The new investor may introduce innovations or changes to enhance WestJet’s competitiveness.

- Stock Price Impact (if applicable): Although WestJet's current ownership structure might not directly lead to visible stock price fluctuations, the long-term effects of the stake sale will undoubtedly impact its financial performance, influencing the stock price if it is ever publicly traded again.

Analyzing the Market Conditions and their Role

The success of Onex's WestJet divestment can't be viewed in isolation; it's crucial to consider the current market conditions within the airline industry.

- Post-Pandemic Recovery: The airline industry is experiencing a robust post-pandemic recovery, with increased travel demand driving higher revenue and profitability. This positive market environment undoubtedly played a significant role in the high value of the WestJet stake.

- Market Trends: Favorable market trends, such as an increase in leisure travel and business travel, contributed to the improved financial performance of WestJet, thereby increasing the attractiveness of the investment for Onex.

- Geopolitical Factors: While the impact of geopolitical factors on this specific deal might be relatively minor, broader global stability and the reduction of international travel restrictions have undoubtedly contributed to the recovery of the airline industry.

Conclusion

Onex's complete recoupment of its investment in WestJet, achieved through the strategic sale of a 25% stake, is a testament to their astute investment strategy and adept market timing within the challenging airline sector. This deal showcases the substantial profit potential within the transportation industry and serves as a compelling case study for other private equity firms. The sale also sets a precedent for future investment opportunities, highlighting the potential for significant returns in airline-related ventures.

Call to Action: Learn more about successful private equity investments and stay updated on the latest financial news related to Onex, WestJet, and other key players in the airline industry. Follow our blog for more articles on successful Onex investments and the latest developments in the airline investment market.

Featured Posts

-

Thomas Mueller De Bayern Munich Un Echange Vif D Esprit Avec La Presse

May 11, 2025

Thomas Mueller De Bayern Munich Un Echange Vif D Esprit Avec La Presse

May 11, 2025 -

Tasman Road A Realistic Assessment Of Proposed Closure Impact

May 11, 2025

Tasman Road A Realistic Assessment Of Proposed Closure Impact

May 11, 2025 -

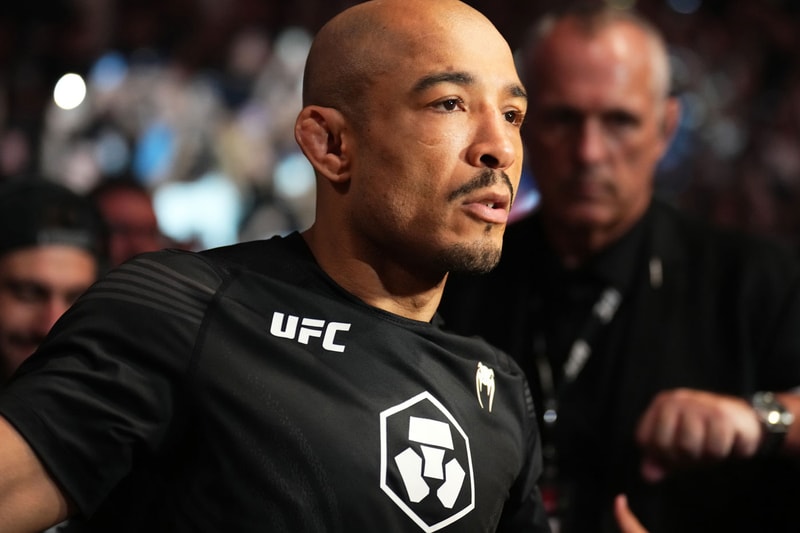

Ufc News Jose Aldo Returns To Featherweight

May 11, 2025

Ufc News Jose Aldo Returns To Featherweight

May 11, 2025 -

Usmnt Weekend Analyzing Dests Return And Pulisics Performance

May 11, 2025

Usmnt Weekend Analyzing Dests Return And Pulisics Performance

May 11, 2025 -

Trump Weighs Tariffs On Commercial Aircraft And Engines Impact On The Industry

May 11, 2025

Trump Weighs Tariffs On Commercial Aircraft And Engines Impact On The Industry

May 11, 2025