Onex's WestJet Investment: A Successful Exit Strategy

Table of Contents

Onex's Initial Investment and Strategic Goals

Acquisition Strategy and Due Diligence

Onex's acquisition of a significant stake in WestJet involved a rigorous due diligence process. This included a comprehensive valuation using discounted cash flow (DCF) analysis, comparable company analysis, and precedent transaction analysis. Key value drivers identified included WestJet's strong brand recognition, its established route network, and its loyal customer base. The competitive landscape was carefully assessed, considering factors like Air Canada's market dominance and the presence of low-cost carriers.

- Key Value Drivers Identified: Strong brand, established route network, loyal customer base, efficient operations.

- Risk Assessment: Included analysis of fuel price volatility, economic downturns, and potential regulatory changes.

- Financial Metrics Considered: EBITDA, revenue growth, passenger load factor, operating margin, debt levels.

- Negotiation Strategy: Focused on securing favorable terms, including control over key strategic decisions.

Value Creation Initiatives

Once the acquisition was complete, Onex implemented a series of value-creation initiatives designed to enhance WestJet's profitability and market position. These strategies focused on operational improvements, cost reduction measures, and strategic expansion.

- Operational Improvements: Streamlining processes, improving scheduling efficiency, and enhancing customer service.

- Cost Reduction Measures: Negotiating better deals with suppliers, optimizing fuel consumption, and implementing lean management principles. These resulted in significant savings.

- Expansion into New Markets: Strategic expansion into new domestic and international routes to capture additional market share.

- Fleet Modernization: Upgrading the aircraft fleet with more fuel-efficient planes to reduce operating costs and improve passenger experience.

- Technological Upgrades: Implementing new technology to improve booking systems, enhance customer experience, and optimize operational efficiency. This led to a quantifiable improvement in customer satisfaction and operational efficiency, increasing revenue and decreasing costs.

Navigating Market Challenges and Economic Headwinds

The Impact of the COVID-19 Pandemic

The COVID-19 pandemic presented an unprecedented challenge to WestJet and the entire airline industry. Passenger numbers plummeted, leading to significant revenue losses. Onex responded by working closely with WestJet's management team to implement several crucial strategies:

- Government Support Measures: Securing government aid and financial support programs to maintain liquidity.

- Restructuring Efforts: Implementing cost-cutting measures, such as temporary layoffs and route suspensions, to preserve cash flow.

- Operational Adjustments: Adapting to changing travel restrictions and implementing enhanced hygiene protocols.

- Strategic Partnerships: Collaborating with other airlines and industry stakeholders to navigate the crisis.

Adapting to Industry Disruptions

Beyond the pandemic, Onex had to address broader industry disruptions, including:

- Fuel Price Volatility: Implementing hedging strategies to mitigate the impact of fluctuating fuel prices.

- Competitive Pressures: Adapting to the competitive landscape by offering competitive pricing and enhancing customer service.

- Technological Advancements: Investing in new technologies to improve operational efficiency and enhance the customer experience.

The Exit Strategy: IPO and Subsequent Sale

Timing the IPO

Onex strategically timed WestJet's Initial Public Offering (IPO). The decision was influenced by several factors:

- Market Conditions: Favorable market conditions, including strong investor sentiment and a healthy IPO market.

- WestJet's Financial Performance: Improved financial performance post-pandemic recovery demonstrating a strong trajectory for future growth.

- Strategic Rationale: The IPO provided an opportunity to realize a significant return on investment while maintaining a stake in the company.

Maximizing Returns Through the IPO Process

Onex employed several strategies to maximize the IPO valuation:

- Investor Relations: Building strong relationships with potential investors to generate excitement and demand for WestJet shares.

- Marketing: Effectively communicating WestJet's value proposition and growth prospects to potential investors.

- Financial Projections: Presenting a realistic but optimistic outlook for WestJet's future financial performance.

- Experienced Advisors: Utilizing the expertise of leading investment bankers and financial advisors.

Post-IPO Share Sales

Following the successful IPO, Onex gradually divested its remaining shares in WestJet through a series of carefully planned share sales, maximizing returns while maintaining market stability.

Conclusion

Onex's investment in WestJet stands as a prime example of a successful private equity exit strategy. By implementing a comprehensive value creation plan, navigating significant market challenges, and carefully timing their exit through an IPO and subsequent share sales, Onex achieved a substantial return on their investment. The strategic decisions made throughout the investment lifecycle, from initial due diligence to the final divestment, provide valuable insights for other private equity firms. The lessons learned from Onex's WestJet investment highlight the importance of thorough due diligence, proactive value creation, and strategic adaptability.

Call to Action: Learn from Onex's success with their WestJet investment and discover how to apply similar strategies to maximize returns on your own private equity portfolio. Explore further resources on successful private equity exit strategies and plan your next investment with a focus on long-term value creation and strategic exits. Further research into Onex's investment philosophy can provide valuable lessons for future investments.

Featured Posts

-

Celtics Impressive Victory Division Title Celebration

May 12, 2025

Celtics Impressive Victory Division Title Celebration

May 12, 2025 -

Prins Andrew Onderzoek Naar Vermeende Banden Met Chinese Spionnen

May 12, 2025

Prins Andrew Onderzoek Naar Vermeende Banden Met Chinese Spionnen

May 12, 2025 -

Daily Dispatch Superman Headlines Daredevil Vs Bullseye Showdown And 1923 Updates

May 12, 2025

Daily Dispatch Superman Headlines Daredevil Vs Bullseye Showdown And 1923 Updates

May 12, 2025 -

Mdah Tam Krwz Ke Jwte Pr Chrh Gyy Haly Wwd Astar Ka Rdeml Wayrl

May 12, 2025

Mdah Tam Krwz Ke Jwte Pr Chrh Gyy Haly Wwd Astar Ka Rdeml Wayrl

May 12, 2025 -

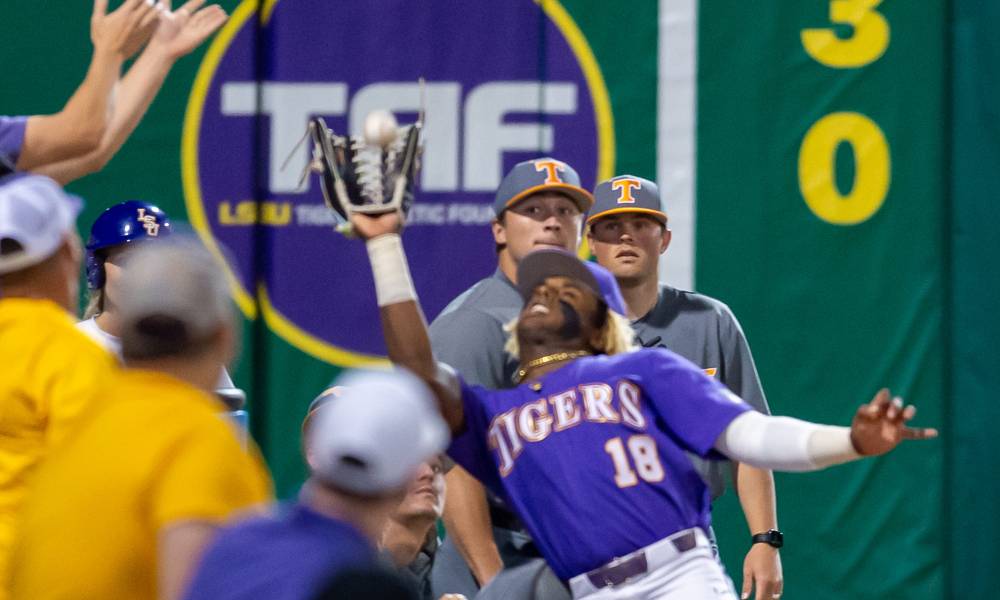

Tennessee Rallies Past Lsu To Split Series

May 12, 2025

Tennessee Rallies Past Lsu To Split Series

May 12, 2025