Onex's WestJet Investment: A Successful Exit Strategy With 25% Stake Sale

Table of Contents

Onex Corporation, a prominent private equity firm, recently made headlines with its strategic decision to sell a 25% stake in WestJet, a long-term airline investment. This sale represents a significant milestone in Onex's investment journey and offers a compelling case study in successful private equity exit strategies. This article delves into the specifics of this transaction, analyzing its implications for both Onex and WestJet, and exploring the broader context within the private equity and aviation industries.

Onex's Initial WestJet Investment and Value Creation

Acquisition Strategy and Objectives

Onex's acquisition of WestJet marked a significant investment in the Canadian aviation industry. The precise details of the initial investment and acquisition year may not be publicly available, but the rationale was likely centered around WestJet's growth potential within the Canadian and potentially international markets. Onex likely saw opportunities for operational improvements, strategic market consolidation, and revenue enhancement.

- Acquisition Year: [Insert Year if publicly available, otherwise remove this bullet point]

- Initial Ownership Percentage: [Insert Percentage if publicly available, otherwise remove this bullet point]

- Key Investment Thesis: Growth potential in the Canadian airline market, opportunities for operational efficiency improvements, and potential for strategic market consolidation.

Value Enhancement Initiatives

During Onex's ownership, several initiatives were undertaken to significantly increase WestJet's value. These initiatives encompassed various aspects of the airline's operations:

- Cost Reduction Measures: Implementing streamlined processes, negotiating better deals with suppliers, and optimizing staffing levels.

- Revenue Growth Strategies: Expanding routes, implementing dynamic pricing models, enhancing customer loyalty programs, and exploring ancillary revenue streams.

- Fleet Modernization: Upgrading the aircraft fleet with more fuel-efficient models, improving operational efficiency and reducing maintenance costs.

- Expansion into New Markets: Exploring new domestic and international routes to tap into new customer bases and diversify revenue streams.

- Operational Efficiency Improvements: Implementing advanced technologies to optimize scheduling, ground handling, and customer service.

Financial Performance Under Onex Ownership

Under Onex's ownership, WestJet likely experienced significant financial growth and improved profitability. Specific financial figures might not be publicly accessible due to the private nature of the investment, but general trends can be inferred:

- Revenue Growth: Significant revenue growth driven by expansion strategies and improved operational efficiency.

- Profit Margins: Improved profit margins reflecting successful cost-reduction measures and revenue growth initiatives.

- Return on Investment (ROI): A substantial ROI is expected, justifying Onex's initial investment and subsequent exit strategy.

- Stock Performance (if applicable): If WestJet was publicly traded during this period, stock performance would be another key indicator of success.

The 25% Stake Sale: Rationale and Strategic Implications

Reasons for Partial Exit

Onex's decision to sell a 25% stake rather than the entire company suggests a strategic approach. This could be attributed to several factors:

- Strategic Portfolio Rebalancing: Diversifying Onex's investment portfolio across different sectors and risk profiles.

- Capital Recycling: Reinvesting the proceeds from the stake sale into new investment opportunities with potentially higher returns.

- Maximizing Returns: A phased exit strategy allows Onex to capitalize on market conditions and potentially maximize returns over time.

- Maintaining Influence: Retaining a significant ownership stake allows Onex to maintain influence over WestJet's strategic direction.

- Market Conditions: Favorable market conditions may have presented an opportune moment for realizing part of Onex's investment.

Buyer Profile and Transaction Details

The identity of the buyer(s) and specific transaction details are likely subject to confidentiality agreements. However, the sale likely involved a significant purchase price, reflecting WestJet's value enhancement under Onex's ownership.

- Buyer Identity: [Insert buyer information if publicly available]

- Purchase Price: [Insert purchase price if publicly available]

- Transaction Structure: [Insert transaction structure details if publicly available]

- Deal Closing Date: [Insert deal closing date if publicly available]

Impact on Onex's Portfolio and Future Strategy

The 25% stake sale will undoubtedly have an impact on Onex's overall investment portfolio (AUM) and future investment strategy. It suggests a focus on:

- Impact on Overall AUM: The sale will directly affect Onex's assets under management (AUM).

- Future Investment Focus Areas: The proceeds from the sale might be channeled towards other promising sectors or investment opportunities.

- Potential for Further Divestments: This partial divestment could pave the way for a complete exit in the future or further strategic portfolio adjustments.

Implications for WestJet and the Aviation Industry

Impact on WestJet's Operations and Future Growth

The change in ownership structure will undoubtedly influence WestJet's operations and future growth trajectory:

- Potential Changes in Management: The new investor(s) might influence management appointments and strategic decisions.

- Strategic Partnerships: The sale might lead to new strategic alliances or partnerships to enhance WestJet's competitiveness.

- Impact on Future Expansion Plans: The new investor(s) might support or alter existing expansion plans.

Broader Implications for the Aviation Sector

Onex's strategic move has broader implications for the aviation industry and private equity investment within this sector:

- Consolidation in the Airline Industry: This transaction reflects the ongoing trend of consolidation within the airline industry.

- Implications for Other Airline Investments: This deal sets a precedent for other private equity firms considering investments in or divestments from the airline sector.

- Impact of the Current Economic Climate on the Sector: The transaction's success could influence investment decisions based on current market conditions and economic forecasts.

Conclusion

Onex's strategic sale of a 25% stake in WestJet showcases a successful private equity exit strategy. By enhancing WestJet's value and strategically timing the partial divestment, Onex demonstrated its expertise in generating substantial returns. This transaction offers valuable insights for private equity firms aiming for similar successes. Understanding Onex's WestJet investment and exit strategy provides crucial lessons in portfolio management and value creation within the competitive aviation industry. Continue exploring successful private equity exit strategies and learn from this compelling case study.

Featured Posts

-

Jay Kelly I Ploki Kai To Kast Tis Neas Tainias Toy Netflix

May 11, 2025

Jay Kelly I Ploki Kai To Kast Tis Neas Tainias Toy Netflix

May 11, 2025 -

Astros Foundation College Classic A Showcase Of Collegiate Baseball Talent In Houston

May 11, 2025

Astros Foundation College Classic A Showcase Of Collegiate Baseball Talent In Houston

May 11, 2025 -

Sydney Mc Laughlin Levrone Sets New 400m Hurdle World Lead At Miami Grand Slam

May 11, 2025

Sydney Mc Laughlin Levrone Sets New 400m Hurdle World Lead At Miami Grand Slam

May 11, 2025 -

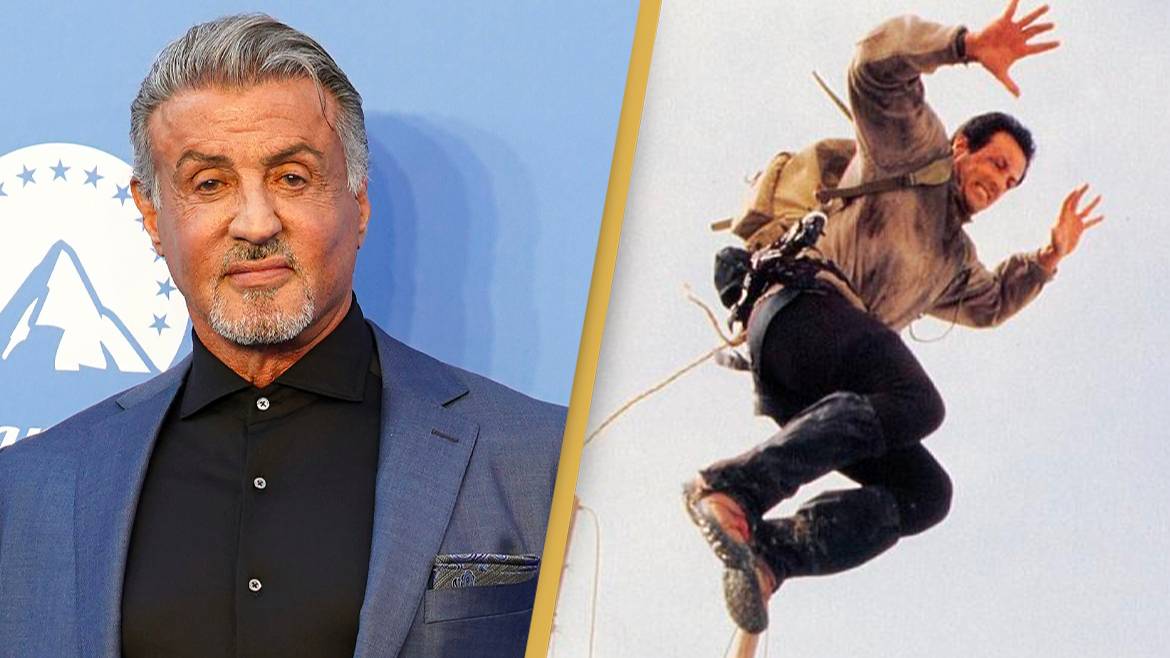

Cobra Les Regrets De Sylvester Stallone Sur Un Classique Des Annees 80

May 11, 2025

Cobra Les Regrets De Sylvester Stallone Sur Un Classique Des Annees 80

May 11, 2025 -

Office365 Data Breach Crook Makes Millions Targeting Executive Inboxes

May 11, 2025

Office365 Data Breach Crook Makes Millions Targeting Executive Inboxes

May 11, 2025