Ontario Budget: $14.6 Billion Deficit And The Impact Of Tariffs

Table of Contents

Understanding the $14.6 Billion Deficit

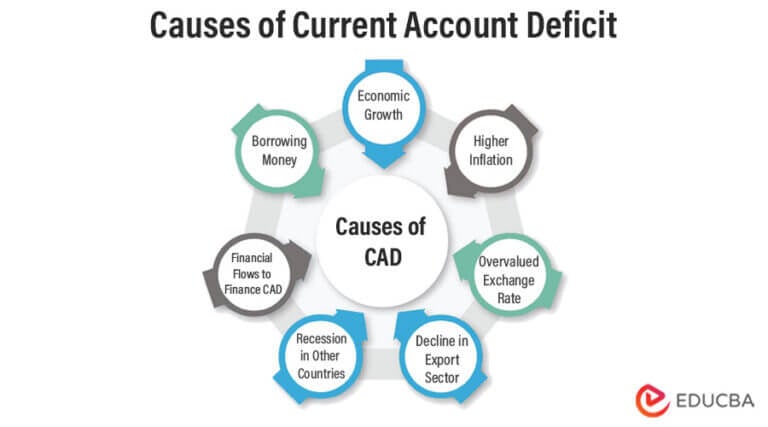

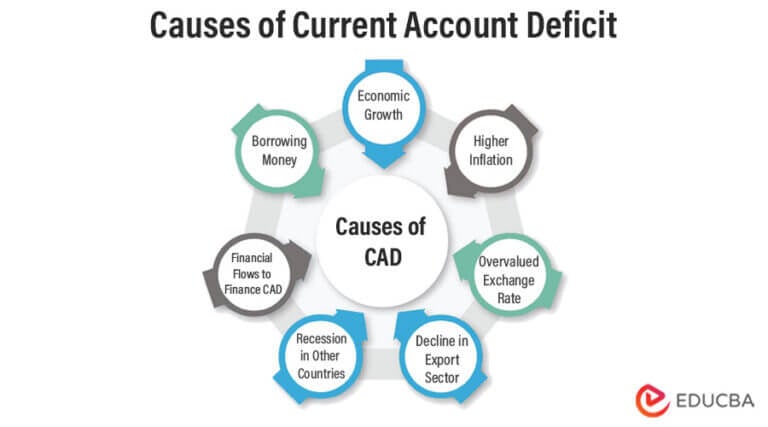

The sheer scale of the $14.6 billion deficit demands a thorough understanding of its contributing factors. This is not simply a matter of short-term fiscal mismanagement, but rather a reflection of complex economic pressures and policy choices.

Key Contributors to the Deficit:

Several factors have converged to create this substantial budget deficit. These include:

- Increased healthcare spending: The aging population and rising healthcare costs continue to place immense pressure on provincial finances. This includes increased demand for hospital services, long-term care, and prescription drugs. The budget outlines a significant portion allocated to healthcare, but whether it's sufficient remains a key question.

- Investment in infrastructure projects: While essential for long-term economic growth, infrastructure projects represent significant upfront costs. The budget includes substantial investment in roads, bridges, and public transit, but these investments impact the immediate fiscal outlook. Balancing the long-term benefits against short-term costs is a critical aspect of the budget's analysis.

- Decreased revenue due to economic slowdown: A softening economy, both globally and domestically, has resulted in lower-than-projected tax revenue. This reduction in income from corporate taxes, personal income taxes, and sales taxes directly contributes to the widening deficit.

- Tax cuts and their impact on government revenue: Recent tax cuts, while intended to stimulate economic activity, have inevitably reduced government revenue. The trade-off between stimulating the economy and maintaining fiscal stability is a key element of the budget debate.

Here's a breakdown of some specific spending areas and their associated costs (hypothetical figures for illustrative purposes):

- Healthcare: $70 billion

- Education: $30 billion

- Infrastructure: $25 billion

- Social Services: $15 billion

Government's Response to the Deficit:

The Ontario government's response to the deficit involves a multi-pronged approach, encompassing:

- Planned austerity measures: The budget likely includes measures to curb spending in certain areas, although the specifics may be subject to ongoing debate. These measures could include streamlining government operations and reducing inefficiencies.

- Proposed tax increases: To address the deficit, the government may consider introducing new taxes or increasing existing ones. This could include adjustments to sales tax, income tax brackets, or other revenue streams. The political feasibility and economic impact of such measures will be key considerations.

- Potential spending cuts in specific sectors: Specific sectors may face reduced funding to help balance the budget. This could lead to difficult decisions impacting various social programs and public services.

- Long-term fiscal strategies for deficit reduction: The government is expected to outline a long-term plan for addressing the deficit, including targets for deficit reduction and sustainable fiscal management. This strategy will likely involve a combination of spending controls and revenue enhancement initiatives.

The Impact of Tariffs on the Ontario Economy

The Ontario economy is not immune to the global impact of tariffs. These trade barriers have a direct and indirect impact on various sectors.

Direct Impact on Specific Industries:

Tariffs have a particularly sharp impact on specific Ontario industries:

- Analysis of tariffs' effects on key Ontario industries (e.g., manufacturing, agriculture): Industries reliant on imported goods or exporting to international markets are directly affected by tariffs. The manufacturing sector, for instance, may face higher input costs, reducing competitiveness. The agricultural sector might see reduced export opportunities due to retaliatory tariffs.

- Examples of businesses negatively affected by tariffs: Specific case studies of businesses struggling due to tariffs could highlight the real-world consequences. This could involve reduced production, layoffs, and business closures.

- Price increases for consumers due to tariffs: Ultimately, many tariffs lead to higher prices for consumers as businesses pass on increased costs. This can dampen consumer spending and overall economic growth.

- Job losses or reduced hiring due to tariff-related challenges: Businesses facing tariff-related challenges may be forced to reduce their workforce or postpone hiring. This leads to job losses and heightened unemployment within the affected sectors.

Indirect Economic Consequences:

The effects of tariffs extend beyond directly impacted industries:

- Ripple effects on supply chains and related industries: Tariffs disrupt supply chains, affecting businesses dependent on timely delivery of goods and materials. This can have cascading effects throughout the economy.

- Impact on investment and business confidence: Uncertainty around trade policies and tariff implications can discourage investment and reduce business confidence, hindering economic growth.

- Potential for reduced economic growth: The cumulative effect of tariffs on various sectors can significantly reduce overall economic growth, affecting employment and income.

- Analysis of the overall economic climate considering both the deficit and tariff impacts: The combined pressures of the deficit and tariffs create a challenging economic climate in Ontario, necessitating a comprehensive response.

Potential Long-Term Effects and Mitigation Strategies

The combined effects of the deficit and tariffs have significant implications for Ontario's long-term economic outlook.

Long-Term Economic Outlook:

- Prediction for future economic growth in Ontario considering the deficit and tariffs: The projected economic growth will likely be lower than it would have been without the deficit and the negative effects of tariffs.

- Potential for increased debt levels and their consequences: The deficit could lead to further increases in provincial debt levels, potentially impacting the province's credit rating and increasing borrowing costs.

- Analysis of the province’s credit rating and its potential change: A lower credit rating could make it more expensive for the province to borrow money, exacerbating the fiscal challenges.

Strategies for Economic Recovery and Growth:

The Ontario government needs to implement effective strategies for economic recovery and growth:

- Government's plans to stimulate economic growth: The budget should outline specific measures to stimulate economic growth, such as investment in innovation, education, and skills development.

- Investment in new technologies and industries: Investing in emerging technologies and fostering the growth of new industries can diversify the economy and reduce reliance on tariff-sensitive sectors.

- Trade diversification strategies to mitigate tariff impacts: Exploring new trade partnerships and diversifying export markets can help reduce the vulnerability to disruptions caused by tariffs.

- Focus on export opportunities and market diversification: A strategic focus on expanding export opportunities and diversifying markets is crucial for mitigating the negative impacts of tariffs.

Conclusion

The Ontario Budget's $14.6 billion deficit, compounded by the substantial economic impact of tariffs, presents a formidable challenge. Addressing this requires a comprehensive approach, carefully balancing short-term fiscal responsibility with long-term economic growth strategies. A proactive approach to mitigating the negative consequences of tariffs, coupled with responsible spending priorities and innovative economic strategies, is crucial for ensuring Ontario's economic stability and prosperity.

Call to Action: Stay informed about the evolving economic situation in Ontario by closely following updates on the provincial budget and the ongoing effects of tariffs. Understanding the implications of the Ontario Budget and the impact of tariffs is vital for businesses and individuals alike. Engage in informed discussions and participate in shaping the future of the Ontario economy. Let's work together to navigate this challenging period and build a strong and resilient Ontario.

Featured Posts

-

David Del Valle Uribe Su Participacion En La Olimpiada Nacional Por Reynosa

May 17, 2025

David Del Valle Uribe Su Participacion En La Olimpiada Nacional Por Reynosa

May 17, 2025 -

Knicks Overtime Loss Nightmare Scenario Averted

May 17, 2025

Knicks Overtime Loss Nightmare Scenario Averted

May 17, 2025 -

Jalen Brunsons Disappointment Missing Cm Punk Vs Seth Rollins On Raw

May 17, 2025

Jalen Brunsons Disappointment Missing Cm Punk Vs Seth Rollins On Raw

May 17, 2025 -

Page Not Found On Reddit Us Specific Outage Reported By Users

May 17, 2025

Page Not Found On Reddit Us Specific Outage Reported By Users

May 17, 2025 -

Detroit Pistons Vs New York Knicks Key Factors Determining Their Success

May 17, 2025

Detroit Pistons Vs New York Knicks Key Factors Determining Their Success

May 17, 2025