Organic Growth Strategy Leads Cenovus CEO To Dismiss MEG Bid

Table of Contents

Cenovus's Organic Growth Strategy: A Deep Dive

Cenovus's commitment to organic growth is not merely a statement; it's a comprehensive plan encompassing several key initiatives.

Internal Expansion Initiatives:

Cenovus's existing infrastructure and operational expertise form the bedrock of its organic growth strategy. The company is focusing on expanding its existing operations across its diverse portfolio. This includes:

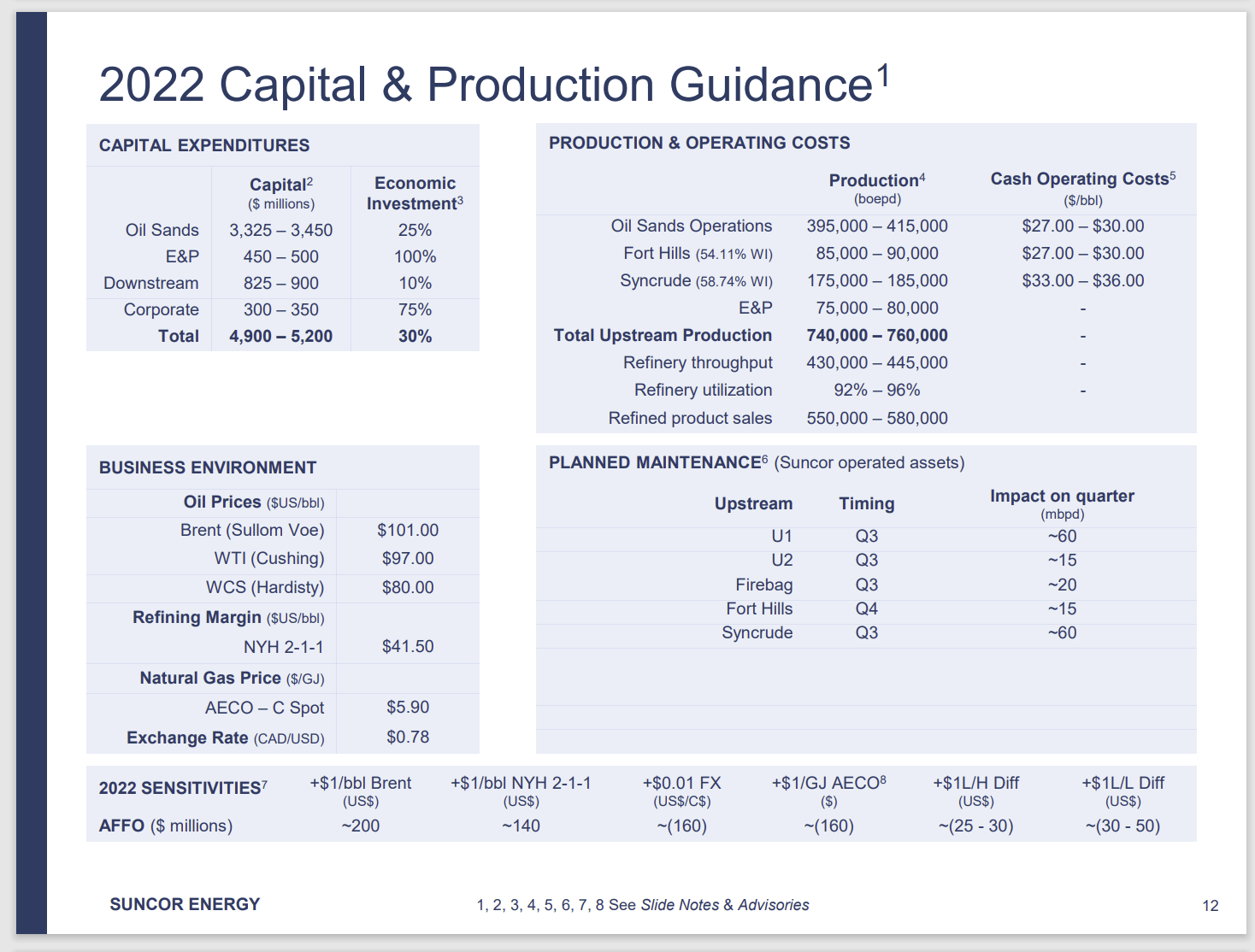

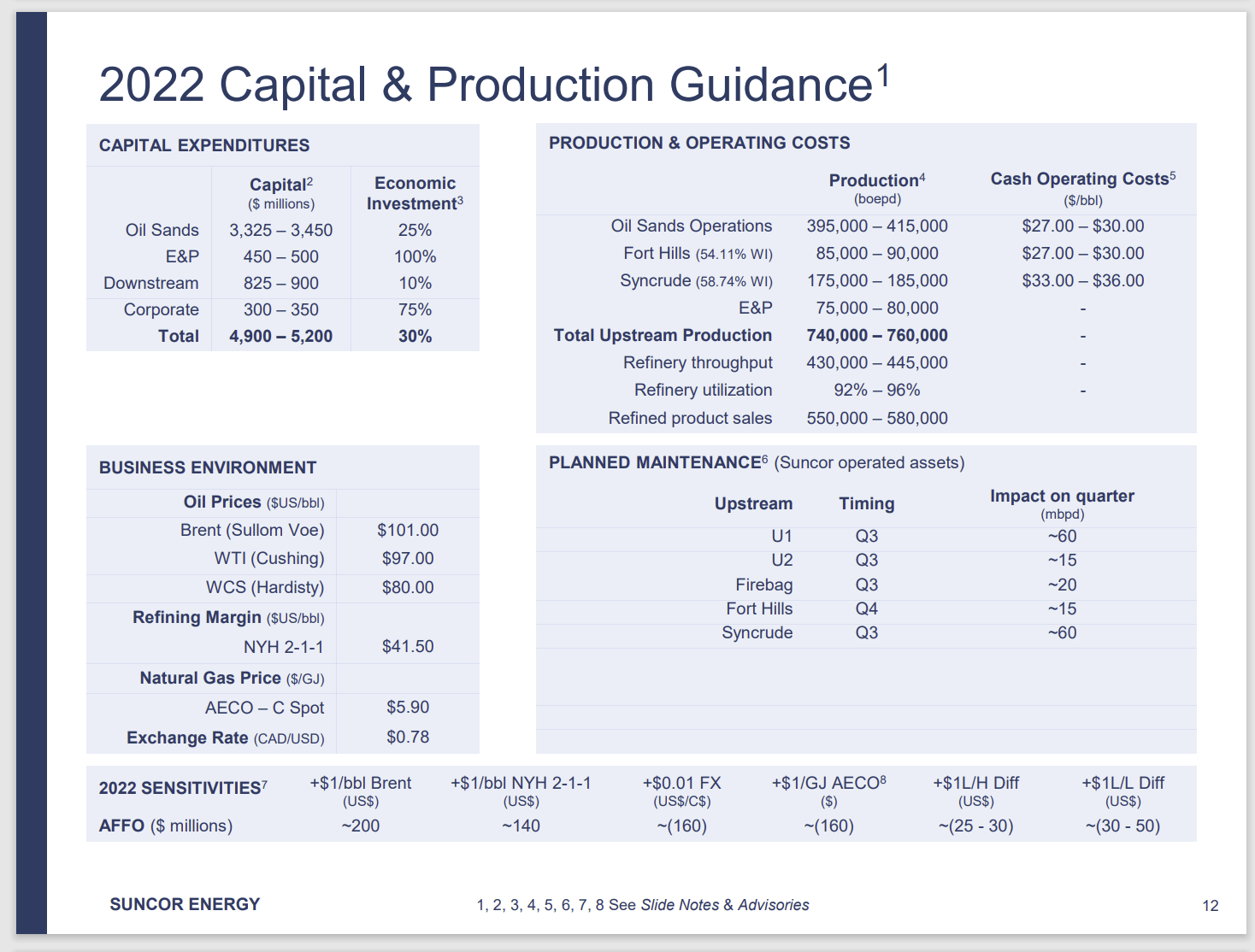

- Increased Oil Sands Production: Significant investments are being channeled into boosting production capacity at existing oil sands facilities, leveraging technological advancements to enhance efficiency and reduce environmental impact. This involves optimizing extraction processes and implementing cutting-edge technologies to maximize output while minimizing operational costs.

- Downstream Refining Expansion: Cenovus is also focusing on enhancing its downstream refining capabilities. This includes investments in upgrading existing refineries and exploring opportunities to expand refining capacity to meet growing market demands. This vertical integration strategy reduces reliance on third-party processors and improves profit margins.

- Technological Advancements and Efficiency Improvements: Cenovus is actively adopting and developing new technologies across its operations to streamline processes, reduce operational costs, and enhance overall efficiency. This includes implementing advanced analytics, automation, and data-driven decision-making to optimize resource allocation and improve production yields.

Financial Benefits of Organic Growth:

The financial advantages of Cenovus's chosen path are considerable. An organic growth strategy offers several key benefits compared to acquisitions:

- Higher Return on Investment (ROI): By focusing on internal expansion, Cenovus retains greater control over capital expenditure and can direct resources to projects with the highest potential ROI. This targeted approach maximizes the return on investment compared to the often unpredictable outcomes of mergers and acquisitions.

- Improved Capital Allocation: Organic growth allows for more precise capital allocation, enabling Cenovus to prioritize projects aligned with its long-term strategic goals. This targeted approach minimizes financial risk and ensures that investments yield the maximum possible returns.

- Cost Savings and Enhanced Profitability: Increased operational efficiency, technological advancements, and improved production processes contribute to significant cost savings and enhanced profitability in the long run.

Risk Mitigation and Operational Control:

Choosing organic growth significantly mitigates the risks associated with mergers and acquisitions.

- Reduced Integration Challenges: Avoiding the complexities and potential disruptions of merging operations minimizes integration challenges and ensures operational continuity. This eliminates the potential for conflicts of interest, operational overlaps, and cultural clashes often associated with mergers.

- Enhanced Risk Management: Organic growth provides greater control over the expansion process, allowing Cenovus to better manage and mitigate potential risks associated with new projects and initiatives. This proactive risk management approach ensures the stability and long-term sustainability of the company's operations.

- Maintaining Operational Control: By focusing on internal expansion, Cenovus retains complete operational control, allowing for a more streamlined and efficient decision-making process. This autonomy minimizes external influences and ensures the company can adapt quickly to changing market conditions.

Why the MEG Bid Was Rejected: A Strategic Perspective

The rejection of MEG Energy's bid wasn't arbitrary; it was a strategic decision based on several factors.

Valuation Concerns and Strategic Fit:

Cenovus's CEO likely deemed the offered valuation for MEG Energy unacceptable. Furthermore, there may have been concerns about the strategic alignment between the two companies. Potential conflicts of interest or operational overlaps could have hindered a successful integration.

- Market Valuation Discrepancies: The perceived market valuation of MEG Energy might not have aligned with Cenovus's assessment of its intrinsic value.

- Lack of Synergies: Insufficient synergies between the two companies' operations might have rendered the acquisition less attractive from a financial perspective.

Focus on Core Competencies and Sustainable Growth:

Rejecting the MEG bid reinforces Cenovus's commitment to focusing on its core competencies and building sustainable long-term growth.

- Prioritizing Core Businesses: The decision allows Cenovus to concentrate resources on its existing oil sands and downstream operations, leveraging existing expertise and infrastructure.

- Sustainable Growth Principles: This strategy aligns with broader industry trends towards sustainability and responsible resource management, fostering a long-term focus on operational excellence.

Conclusion: The Future of Cenovus and Organic Growth in the Energy Sector

Cenovus's decision to prioritize an organic growth strategy over the MEG acquisition represents a calculated move focused on maximizing long-term value. By focusing on internal expansion, operational efficiency, and minimizing risk, Cenovus aims to achieve sustainable growth and enhance shareholder value. The financial benefits, improved risk management, and enhanced operational control offered by this approach make it a compelling strategy within the energy sector. This decision highlights the potential of a well-executed organic growth strategy to create significant value in the long run. Learn more about Cenovus's successful organic growth strategy and its implications for the future of the energy industry.

Featured Posts

-

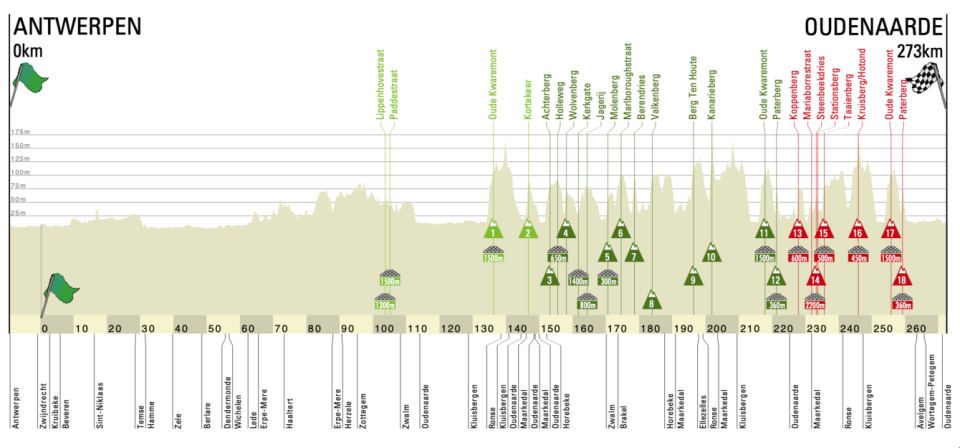

Will Pogacar Or Van Der Poel Conquer The Tour Of Flanders

May 26, 2025

Will Pogacar Or Van Der Poel Conquer The Tour Of Flanders

May 26, 2025 -

Myrtle Beach Rebuts Safety Study Ranking

May 26, 2025

Myrtle Beach Rebuts Safety Study Ranking

May 26, 2025 -

Kiefer Sutherland To Honor Father Donald Sutherland At Canadian Screen Awards

May 26, 2025

Kiefer Sutherland To Honor Father Donald Sutherland At Canadian Screen Awards

May 26, 2025 -

Les Consequences Du Deblocage Illegal De La Rtbf

May 26, 2025

Les Consequences Du Deblocage Illegal De La Rtbf

May 26, 2025 -

Der Hsv Und Die 2 Bundesliga Aufstieg Konzerte Und Hafengeburtstag

May 26, 2025

Der Hsv Und Die 2 Bundesliga Aufstieg Konzerte Und Hafengeburtstag

May 26, 2025

Latest Posts

-

Europe 1 Soir Version Integrale Du 19 03 2025

May 30, 2025

Europe 1 Soir Version Integrale Du 19 03 2025

May 30, 2025 -

19 Mars 2025 Ecouter L Integrale D Europe 1 Soir

May 30, 2025

19 Mars 2025 Ecouter L Integrale D Europe 1 Soir

May 30, 2025 -

Podcast Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025

Podcast Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025 -

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025 -

Marine Le Pen Et La Presidentielle 2027 Un Possible Empechement Selon Jacobelli

May 30, 2025

Marine Le Pen Et La Presidentielle 2027 Un Possible Empechement Selon Jacobelli

May 30, 2025