Pakistan, Sri Lanka, Bangladesh: A New Era Of Capital Market Cooperation

Table of Contents

Strengthening Regional Economic Ties Through Capital Market Integration

The rationale behind deeper cooperation among Pakistan, Sri Lanka, and Bangladesh's capital markets is compelling. Reducing over-reliance on traditional trading partners and expanding market access are crucial for long-term economic stability. Integration leads to increased market depth and liquidity, boosting investor confidence and attracting both domestic and foreign investment.

- Diversification of investment portfolios: Investors in each country gain access to a broader range of assets, reducing their overall risk exposure.

- Access to wider investment opportunities: The combined markets offer a more diverse array of financial instruments, catering to a wider spectrum of investor preferences and risk appetites.

- Improved risk management: Diversification across national borders mitigates the impact of country-specific economic shocks.

- Stimulating regional economic growth: Increased capital flows facilitate investment in infrastructure projects, businesses, and other growth-driving initiatives across the region.

However, challenges remain. Significant regulatory differences exist across the three nations. Political instability in any one country could negatively impact investor confidence across the region. Furthermore, currency volatility poses a significant risk to cross-border investments. Addressing these challenges requires a concerted effort towards regulatory harmonization and building a stable, predictable macroeconomic environment.

Facilitating Cross-Border Investments

Facilitating cross-border investments is key to unlocking the full potential of regional capital market integration. This requires several strategic initiatives:

- Streamlined regulatory frameworks: Harmonizing regulations across the three countries is crucial. This includes simplifying listing requirements, reducing bureaucratic hurdles, and establishing clear, consistent legal frameworks for investor protection.

- Improved information sharing: Transparent and timely information dissemination is vital for attracting investors. A centralized platform for disseminating market data and corporate disclosures would boost investor confidence.

- Investor protection agreements: Robust investor protection mechanisms are essential. This includes clear dispute resolution processes, ensuring fair treatment for both domestic and foreign investors.

Specific steps include:

- Establishment of a regional regulatory body: A coordinated regulatory framework is crucial for achieving harmonization and promoting consistency in rules and regulations.

- Development of a common platform: Creating a unified platform for listing and trading securities will enhance liquidity and accessibility.

- Implementation of robust investor protection measures: This includes strong legal frameworks, effective enforcement mechanisms, and independent dispute resolution systems.

- Promotion of financial literacy: Educating investors about the opportunities and risks associated with cross-border investments is critical.

Building trust and transparency is paramount to attracting Foreign Direct Investment (FDI) and portfolio investment. A commitment to good governance and the rule of law is crucial for attracting long-term investment.

Developing Infrastructure for Capital Market Cooperation

Robust infrastructure is fundamental to successful capital market integration. This includes technological advancements, efficient clearing and settlement systems, and effective communication networks.

- Investment in modern trading platforms: Adopting advanced trading technologies will enhance market efficiency and transparency.

- Development of efficient clearing and settlement systems: This minimizes counterparty risk and ensures the timely execution of transactions.

- Strengthening communication networks: Reliable and high-speed communication networks are crucial for seamless information sharing.

- Training and capacity building: Investing in training programs for market participants will enhance expertise and promote best practices.

International organizations and financial institutions can play a vital role in supporting infrastructure development by providing technical assistance, funding, and capacity building initiatives.

The Role of Technology in Capital Market Integration

Financial technology (FinTech) offers transformative potential for enhancing efficiency, transparency, and accessibility within the South Asian capital markets.

- Blockchain technology: Blockchain can enhance the security and transparency of transactions, reducing fraud and improving record-keeping.

- Mobile-based investment platforms: Mobile platforms can increase access to investment opportunities for a wider population, particularly in underserved areas.

- AI-powered risk management tools: Artificial intelligence can improve risk assessment and management, leading to more informed investment decisions.

- Big data analytics: Analyzing large datasets can provide valuable insights into market trends and investor behavior, enhancing market surveillance.

Conclusion: A Brighter Future Through Capital Market Cooperation

Enhanced capital market cooperation between Pakistan, Sri Lanka, and Bangladesh presents a compelling opportunity for substantial economic growth and improved investor confidence. While challenges exist, proactive measures to address regulatory differences, political instability, and currency volatility are crucial. Regional integration offers a transformative path towards a more prosperous future for these nations. The development of a robust and thriving regional capital market requires continued dialogue and collaboration amongst governments, regulatory bodies, and private sector players. Let’s work together to foster regional capital market development and South Asian financial integration.

Featured Posts

-

Dakota Johnson And Family At The Los Angeles Premiere Of Materialist

May 10, 2025

Dakota Johnson And Family At The Los Angeles Premiere Of Materialist

May 10, 2025 -

Investing In Palantir Stock Should You Buy Before May 5th

May 10, 2025

Investing In Palantir Stock Should You Buy Before May 5th

May 10, 2025 -

Young Thugs Uy Scuti Release Date Hints And Fan Speculation

May 10, 2025

Young Thugs Uy Scuti Release Date Hints And Fan Speculation

May 10, 2025 -

Rezoning Green Light For New Edmonton Nordic Spa Development

May 10, 2025

Rezoning Green Light For New Edmonton Nordic Spa Development

May 10, 2025 -

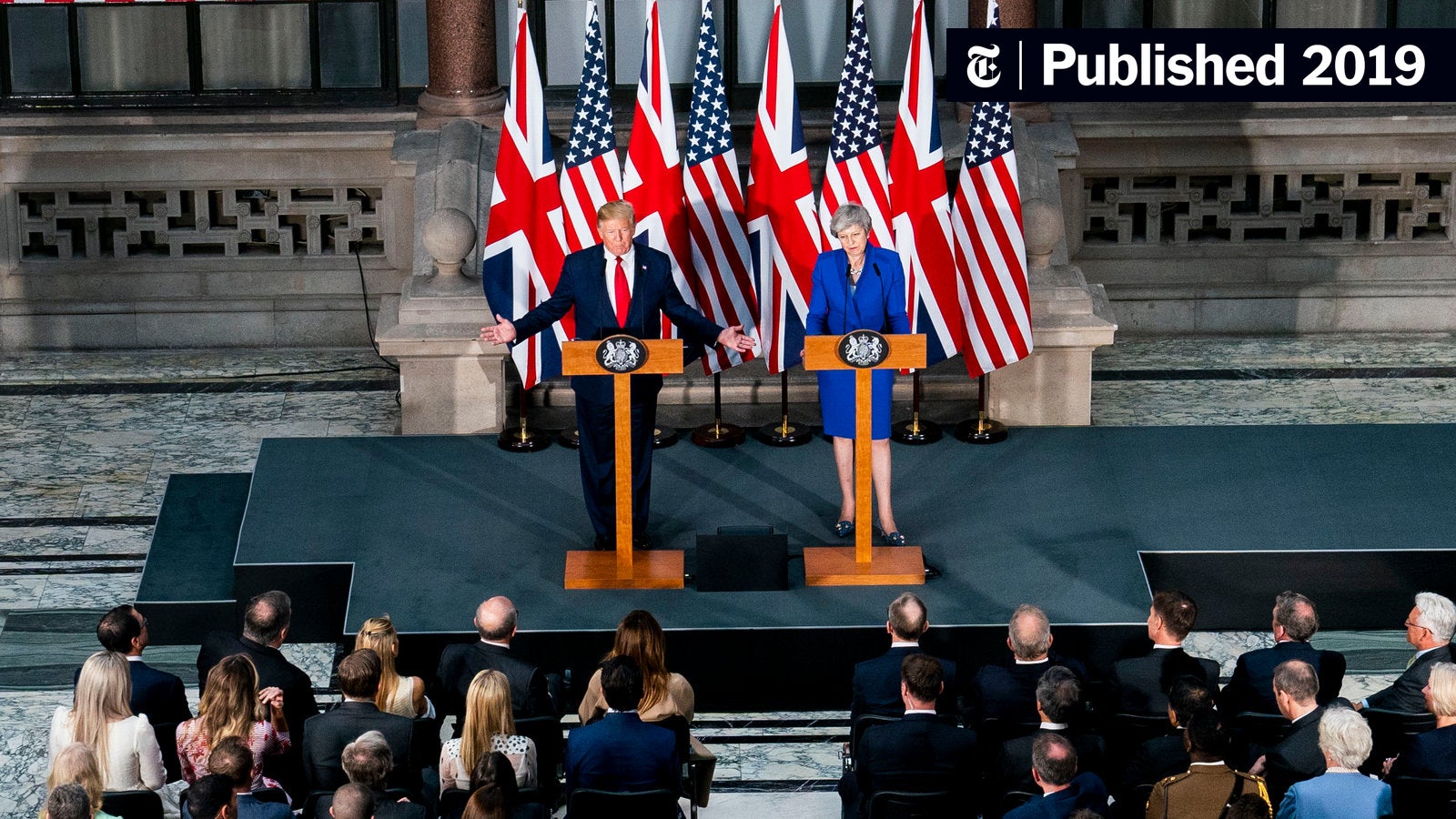

Trump And Britain Finalize New Trade Agreement

May 10, 2025

Trump And Britain Finalize New Trade Agreement

May 10, 2025