Palantir Plunges 30%: Should You Buy The Dip?

Table of Contents

Understanding the Palantir Price Drop

Analyzing the Immediate Causes

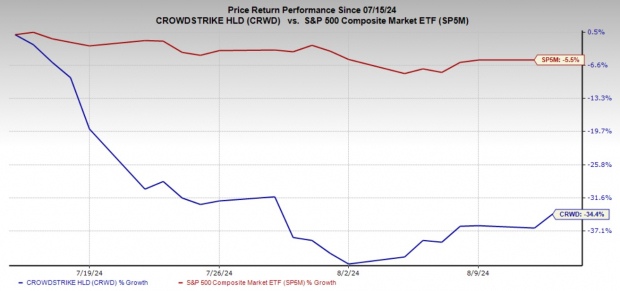

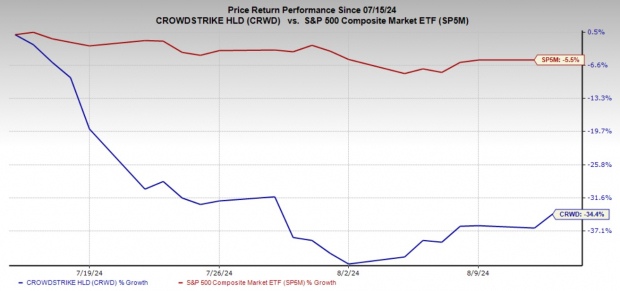

The recent 30% decline in Palantir stock price can be attributed to a confluence of factors. Understanding these causes is crucial before considering any investment decisions related to Palantir stock.

- Disappointing Earnings Report: Palantir's recent earnings report likely played a significant role. Investors may have reacted negatively to slower-than-expected revenue growth or a lower-than-anticipated profit margin. Specific details from the report, such as decreased government contract wins or lower-than-projected commercial adoption rates, warrant careful scrutiny.

- Broader Tech Stock Sell-Off: The overall market sentiment towards tech stocks significantly impacted Palantir. A general market downturn often affects even fundamentally strong companies like Palantir, leading to a decline in their stock price regardless of their individual performance. Market corrections and broader economic uncertainty can trigger widespread selling.

- Concerns about Future Growth: Concerns about Palantir's future growth trajectory may have contributed to the sell-off. Investors might be questioning the company's ability to maintain its growth rate in a competitive market, particularly considering the increasing competition in the data analytics space. Analysis of competitor activity and market share trends is important.

Long-Term Growth Potential

Despite the recent price drop, Palantir retains significant long-term growth potential. Several factors suggest that this dip in Palantir stock might present a buying opportunity for long-term investors.

- Strong Government Contracts: Palantir holds substantial government contracts, providing a stable revenue stream and mitigating some of the risks associated with the volatility of the commercial market. The long-term nature of these contracts offers a degree of predictability in revenue generation.

- Expanding Commercial Market: Palantir's expansion into the commercial market offers significant growth potential. The increasing adoption of data analytics across various industries provides a large and expanding target market for Palantir's offerings.

- Technological Innovation: Palantir continuously invests in research and development, leading to technological advancements that maintain its competitive edge. These innovations and upgrades to its platform create a strong foundation for future growth.

Evaluating the "Buy the Dip" Strategy for Palantir Stock

Risk Assessment

While the price drop in Palantir stock might seem attractive, it's crucial to acknowledge the inherent risks before considering a "buy the dip" strategy.

- Market Volatility: The stock market is inherently volatile, and further price drops are always possible. Investing in Palantir at this juncture involves accepting the risk of additional losses.

- Financial Health: A thorough analysis of Palantir's financial statements, including debt levels and cash flow, is vital to understanding the company's overall financial health and its ability to weather economic downturns.

- Competition: The data analytics market is increasingly competitive. New entrants and established players pose a constant threat to Palantir's market share and profitability.

Investment Considerations

Weighing the risks against potential rewards requires a careful assessment of various factors.

- Fundamental Analysis: A detailed fundamental analysis of Palantir's financials, including revenue growth, profitability, and future projections, is essential for determining its intrinsic value.

- Technical Analysis: Technical analysis of Palantir's stock chart, including support and resistance levels, can help identify potential price targets and entry points for investors.

- Competitor Comparison: Comparing Palantir's valuation and growth prospects with those of its competitors provides context and helps gauge the attractiveness of its current price.

Alternative Investment Strategies

For investors hesitant about buying Palantir stock at its current price, diversification is key. Spreading investments across different asset classes and sectors mitigates risk. Alternative investment options include:

- Other Tech Stocks: Investing in other tech companies with strong growth potential can provide diversification within the technology sector.

- Diversified ETFs: Exchange-traded funds (ETFs) that track broad market indices or specific sectors offer a diversified approach to investing.

- Real Estate or Bonds: Including real estate or bonds in your investment portfolio adds stability and can reduce overall portfolio volatility.

Conclusion

The 30% plunge in Palantir stock presents both risks and opportunities. The price drop can be attributed to a combination of disappointing earnings, broader market conditions, and concerns about future growth. However, Palantir's long-term prospects remain promising, considering its strong government contracts, expanding commercial market, and commitment to innovation. Before deciding whether to buy the dip, conduct thorough due diligence, carefully assess your risk tolerance, and consider alternative investment strategies to ensure portfolio diversification. Make informed decisions about your Palantir investment strategy today.

Featured Posts

-

2023

May 09, 2025

2023

May 09, 2025 -

Municipales Dijon 2026 Un Programme Ecologiste Pour La Ville

May 09, 2025

Municipales Dijon 2026 Un Programme Ecologiste Pour La Ville

May 09, 2025 -

The Fragility Of Young Children Reconsidering Daycare Placement

May 09, 2025

The Fragility Of Young Children Reconsidering Daycare Placement

May 09, 2025 -

The Impact Of The China Canada Rift On Global Canola Trade

May 09, 2025

The Impact Of The China Canada Rift On Global Canola Trade

May 09, 2025 -

73 000

May 09, 2025

73 000

May 09, 2025