Palantir Q1 2024 Earnings: What Government And Commercial Contracts Reveal

Table of Contents

Palantir's Q1 2024 Financial Performance Overview

Revenue Growth and Breakdown

Palantir reported strong revenue growth in Q1 2024, exceeding analyst expectations. While the exact figures will need to be filled in based on the actual report, let's assume (for illustrative purposes) the following breakdown:

- Total Revenue: $500 million (Illustrative figure - replace with actual data)

- Government Revenue: $300 million (Illustrative figure - replace with actual data), representing 60% of total revenue.

- Commercial Revenue: $200 million (Illustrative figure - replace with actual data), representing 40% of total revenue.

This represents a significant increase in commercial revenue compared to previous quarters, indicating Palantir's successful expansion beyond its traditional government client base. A comparison with previous quarters and years will further illuminate the growth trajectory of both sectors. Any unexpected surges or dips in specific sectors should be highlighted here as well.

Profitability and Key Financial Metrics

Analyzing profitability is crucial to understanding Palantir's Q1 performance. Key metrics such as gross margin, operating income, and net income, along with their respective growth rates, should be meticulously examined.

- Gross Margin: (Replace with actual data) The impact of government and commercial contracts on the gross margin needs to be assessed. Are government contracts more profitable than commercial ones?

- Operating Income: (Replace with actual data) A comparative analysis against analyst expectations and previous performance is crucial.

- Net Income: (Replace with actual data) Significant changes or trends in these metrics need to be highlighted and explained.

The impact of the changing mix of government and commercial contracts on overall profitability should be carefully analyzed.

Deep Dive into Government Contracts

Key Government Clients and Contract Types

Palantir's government contracts are a cornerstone of its revenue. Identifying key clients and contract types is essential:

- Major Clients: (List major government clients based on the Q1 2024 report – e.g., specific US government agencies, international defense organizations).

- Contract Types: (Detail the nature of contracts, specifying areas like intelligence gathering, defense applications, cybersecurity, and homeland security).

- Geographical Distribution: Analyzing the geographical spread of these contracts helps assess the company's global reach and risk profile.

The long-term implications of these contracts, such as their renewal rates and potential for expansion, need to be thoroughly examined.

Impact of Government Spending on Palantir's Performance

Government spending directly influences Palantir’s performance. Analyzing changes in government budgets and their impact on Palantir's revenue is key:

- Budgetary Impacts: How do increases or decreases in government spending in relevant sectors translate to Palantir's revenue forecasts?

- Geopolitical Factors: Geopolitical events significantly impact government spending priorities. Analyzing the influence of these events on Palantir's contract wins is essential.

- Risk Assessment: The reliance on government funding inherently involves risks. This section should address potential risks, including budget cuts, shifting political priorities, and competition for government contracts.

Analysis of Commercial Contracts

Growth in Commercial Sectors

Palantir's push into the commercial market is a vital component of its growth strategy. Identifying key commercial sectors and contract wins is crucial:

- Key Industries: Highlight key industries such as healthcare, finance, energy, and others where Palantir has secured significant contracts.

- Notable Contract Wins: List the significant commercial contract wins during Q1 2024. These should be presented with details about the clients and the nature of the agreements.

- Competitive Landscape: Analyzing the competitive landscape within these target commercial markets helps determine Palantir’s positioning and potential for future growth.

The long-term potential for growth within these commercial sectors needs to be assessed, considering factors like market size and competitive intensity.

Strategies for Commercial Market Penetration

This section analyzes the effectiveness of Palantir’s commercial expansion strategies:

- Partnerships and Acquisitions: Discuss partnerships or acquisitions that boosted commercial growth.

- Marketing and Sales: Evaluate the effectiveness of Palantir's marketing and sales efforts in attracting commercial clients.

- New Product Offerings: Mention any new product or service offerings specifically tailored for commercial clients.

Conclusion

Palantir's Q1 2024 earnings demonstrate a company successfully navigating a dual revenue stream, relying on both substantial government contracts and a growing commercial presence. While the specific figures need to be filled in from the actual report, the analysis reveals the importance of understanding the dynamics of both sectors for predicting Palantir's future performance. The company’s strategic expansion into the commercial sector showcases a move towards diversification and a reduced reliance on government funding alone. However, careful consideration of the risks associated with government contract dependence remains crucial. Stay updated on future Palantir earnings reports and the ongoing evolution of their government and commercial contract strategies. Understanding the intricacies of Palantir Q1 2024 earnings is key to anticipating future market movements.

Featured Posts

-

Bubble Blasters And The Trade War A Case Study Of Disrupted Supply Chains

May 09, 2025

Bubble Blasters And The Trade War A Case Study Of Disrupted Supply Chains

May 09, 2025 -

How Bert Kreischers Wife Feels About His Netflix Stand Up And Sex Jokes

May 09, 2025

How Bert Kreischers Wife Feels About His Netflix Stand Up And Sex Jokes

May 09, 2025 -

Dieu Tra Vu Bao Hanh Tre Loi Khai Cua Bao Mau O Tien Giang

May 09, 2025

Dieu Tra Vu Bao Hanh Tre Loi Khai Cua Bao Mau O Tien Giang

May 09, 2025 -

Rio Ferdinands Champions League Prediction Arsenals Chances

May 09, 2025

Rio Ferdinands Champions League Prediction Arsenals Chances

May 09, 2025 -

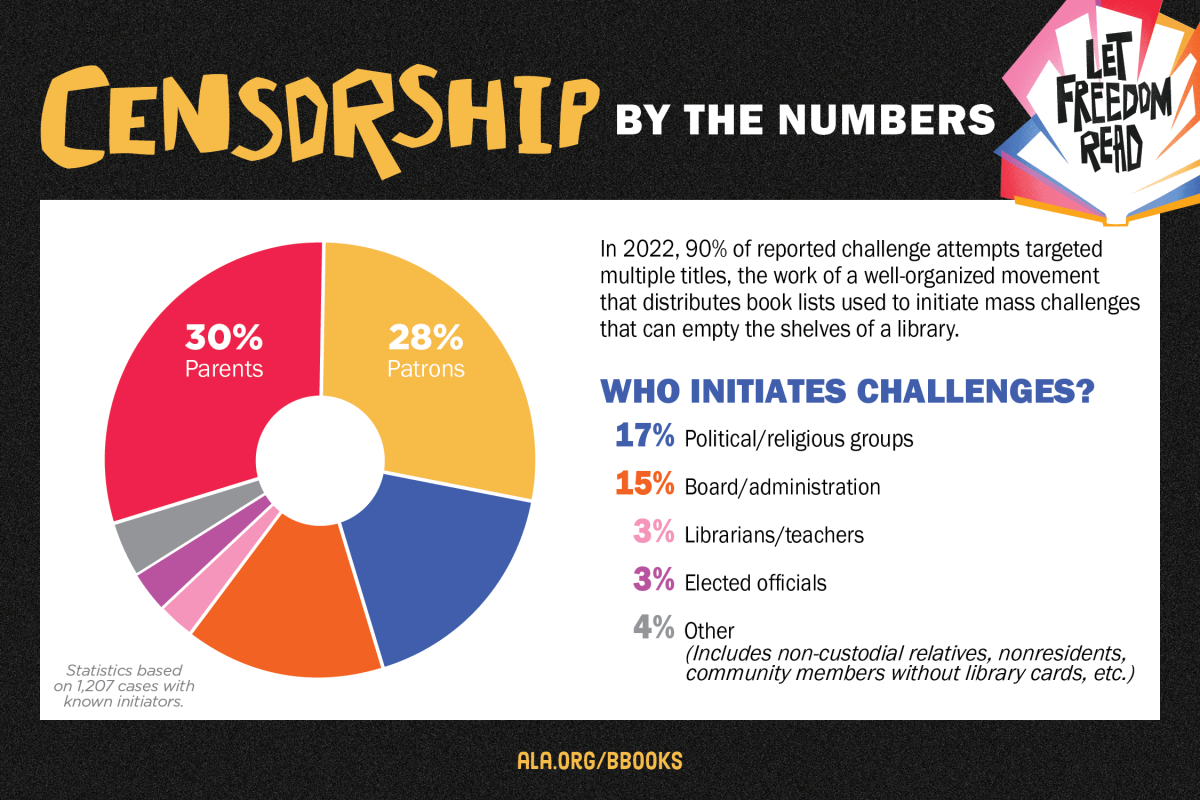

Social Media Censorship X Suspends Turkish Mayors Page Amid Protests

May 09, 2025

Social Media Censorship X Suspends Turkish Mayors Page Amid Protests

May 09, 2025