Palantir Stock Before May 5th: Is It A Buy, Sell, Or Hold?

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Understanding Palantir's financial health is crucial for any investment decision. Recent earnings reports reveal a mixed bag. While revenue growth has been impressive, driven by strong government contracts and expanding commercial partnerships, profitability remains a work in progress. Analyzing key metrics provides a clearer picture.

- Revenue growth rate (YoY and QoQ): Palantir has consistently shown positive year-over-year (YoY) revenue growth, although the quarter-over-quarter (QoQ) growth may fluctuate. Examining these trends helps gauge the sustainability of the company's growth trajectory. Investors should look for consistent upward trends in both YoY and QoQ revenue growth for a positive signal.

- Profitability margins (gross, operating, net): Palantir's profitability margins have shown improvement, but remain below industry benchmarks for some tech companies. This suggests that the company is still investing heavily in research and development and scaling its operations. Monitoring these margins is key to assessing its long-term financial health.

- Cash flow from operations: Strong positive cash flow from operations is a positive sign of financial stability and the ability to fund future growth initiatives. Consistent cash flow is important for investors to analyze.

- Debt-to-equity ratio: Investors should assess Palantir’s debt levels relative to its equity to understand its financial risk profile. A high ratio can indicate higher risk.

- Key growth drivers (e.g., government contracts, commercial partnerships): Palantir's growth is largely driven by its government contracts and its expanding commercial partnerships. Diversifying revenue streams is crucial for long-term growth and reduces the reliance on any single customer.

- Projected future financial performance based on analyst estimates: Analyst ratings and price targets provide insights into market expectations for Palantir's future performance. It's crucial to consider the range of estimates and the underlying assumptions. However, remember that analyst predictions are not guarantees.

Market Trends and Macroeconomic Factors Influencing Palantir Stock

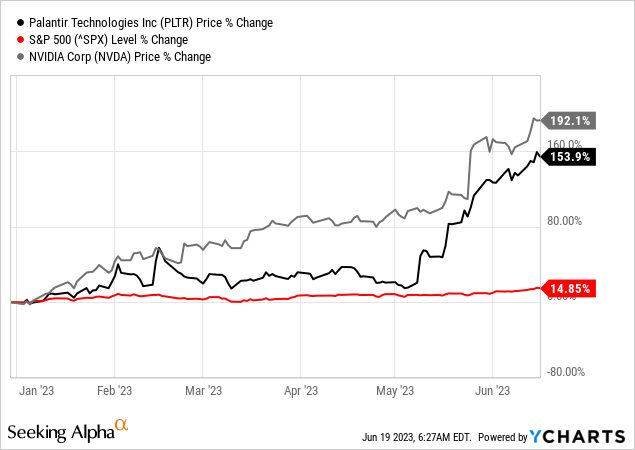

The broader stock market and macroeconomic environment significantly impact Palantir's stock price. The tech sector, to which Palantir belongs, is particularly sensitive to interest rate changes and investor sentiment.

- Overall market sentiment: A positive market sentiment generally boosts technology stocks, while negative sentiment can lead to significant sell-offs.

- Performance of the tech sector: The performance of other technology companies often correlates with Palantir's performance. If the tech sector is underperforming, Palantir may also experience downward pressure.

- Inflation rate and interest rate trends: Rising interest rates generally increase borrowing costs, which can negatively impact growth stocks like Palantir. High inflation also tends to negatively impact investor confidence.

- Geopolitical risks and their potential impact: Geopolitical uncertainty can significantly influence investor sentiment and the overall market, impacting Palantir's stock price.

- Industry growth forecasts: The growth of the data analytics market is a key driver of Palantir's long-term prospects. Positive industry growth forecasts generally benefit Palantir.

Key Events and Catalysts Affecting Palantir Stock Before May 5th

Several upcoming events could significantly impact Palantir's stock price before May 5th. Keeping an eye on these is critical for informed investment decisions.

- Upcoming earnings reports: Earnings reports often trigger significant price movements. Positive surprises typically lead to price increases, while negative surprises can cause sharp declines.

- New product releases or updates: Announcing new products or significant updates to existing products can boost investor confidence and drive stock price appreciation.

- Strategic partnerships or acquisitions: Strategic partnerships can broaden Palantir's market reach and create new revenue streams. Acquisitions can enhance its technology and capabilities.

- Regulatory changes or compliance issues: Changes in regulations or compliance issues can impact Palantir's operations and potentially affect its stock price.

- Any significant news or announcements: Unexpected news, whether positive or negative, can significantly affect investor sentiment and the stock price.

Risk Assessment for Palantir Stock

Investing in Palantir carries several risks that investors should carefully consider:

- Competitive landscape and major competitors: Palantir faces competition from established players and emerging startups in the data analytics market.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and procurement policies.

- Valuation compared to peers: Palantir's valuation relative to its peers is a crucial factor to consider. Overvaluation can lead to price corrections.

- Potential for future growth and innovation: Palantir's potential for future growth depends on its ability to innovate and adapt to changing market conditions.

- Financial risks: Investors should assess Palantir's financial risk profile, including its debt levels, cash flow, and profitability.

Conclusion: Palantir Stock Before May 5th – The Verdict

Analyzing Palantir's recent financial performance, market trends, upcoming events, and inherent risks reveals a complex picture. While the company shows promise with its innovative technology and expanding partnerships, profitability and reliance on government contracts remain concerns. The impact of upcoming events before May 5th will be crucial. Based on this analysis, a hold recommendation is advised before May 5th. However, this is not financial advice. Conduct your own thorough research and consider your individual risk tolerance before making any investment decisions.

Make informed decisions about your Palantir stock investments before May 5th. Consider the factors discussed above and develop your own strategy. Remember to always consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Tech Billionaire Losses A 100 Day Analysis Of Post Inauguration Wealth

May 09, 2025

Tech Billionaire Losses A 100 Day Analysis Of Post Inauguration Wealth

May 09, 2025 -

Blue Origin Rocket Launch Delayed Subsystem Issue Identified

May 09, 2025

Blue Origin Rocket Launch Delayed Subsystem Issue Identified

May 09, 2025 -

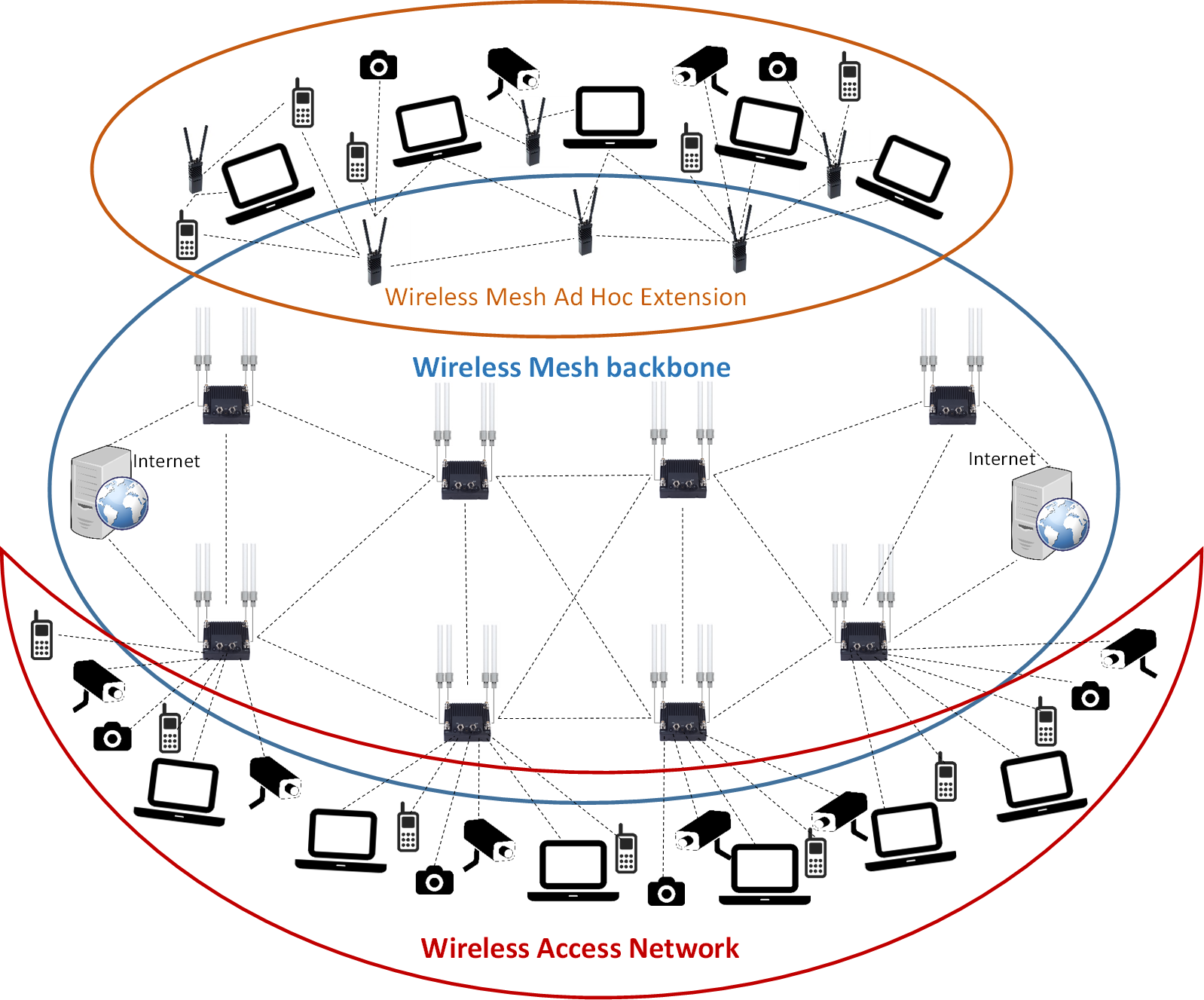

Future Of Wireless Mesh Networks 9 8 Cagr And Market Trends

May 09, 2025

Future Of Wireless Mesh Networks 9 8 Cagr And Market Trends

May 09, 2025 -

De Escalation Dominates Analysis Of U S China Trade Discussions This Week

May 09, 2025

De Escalation Dominates Analysis Of U S China Trade Discussions This Week

May 09, 2025 -

The Whats App Spyware Case Assessing Metas Response And Future Strategies

May 09, 2025

The Whats App Spyware Case Assessing Metas Response And Future Strategies

May 09, 2025