Palantir Stock Before May 5th: Is It A Buy? Wall Street's Verdict

Table of Contents

Palantir's Recent Performance and Future Projections

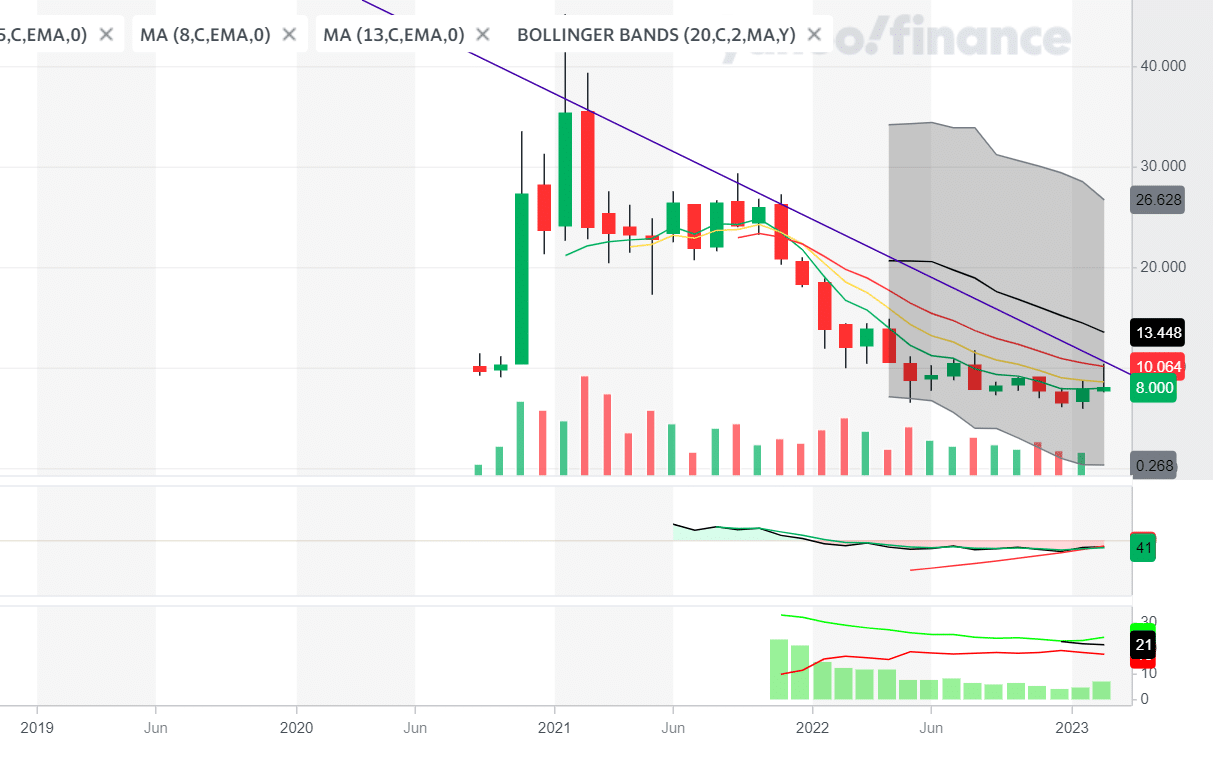

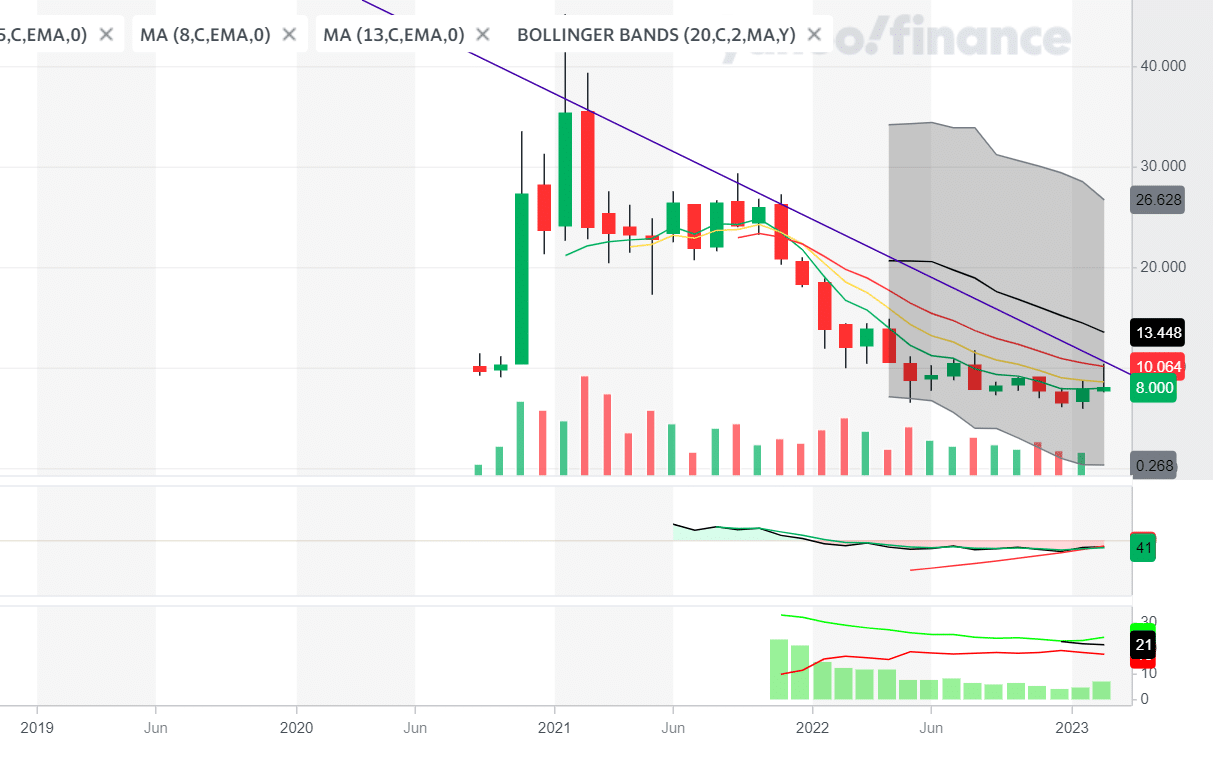

Palantir's stock price has shown a mixed bag recently, experiencing periods of growth followed by corrections. Examining key financial indicators provides a clearer picture of the company's trajectory. Revenue growth remains a key metric, with the company demonstrating consistent increases in recent quarters. However, profitability remains a focus area for investors. Significant partnerships and contract wins, particularly in the government and commercial sectors, play a major role in driving the Palantir share price.

- Q1 2024 Revenue Growth: (Insert projected or actual data here - e.g., 15%) This indicates a healthy growth rate, exceeding expectations in some analyses.

- Projected Annual Recurring Revenue (ARR): (Insert projected data here - e.g., $2 Billion) ARR is a key indicator of the company's long-term sustainability and growth potential.

- Key Contract Wins: (Insert specific examples here, e.g., "Large contract with a major defense agency," "Significant expansion of partnership with a Fortune 500 company"). These wins significantly impact Palantir's future revenue streams and overall valuation.

Wall Street Analysts' Ratings and Price Targets for Palantir Stock

Wall Street analysts hold a diverse range of opinions on Palantir stock, resulting in a spectrum of ratings and price targets. While some analysts remain bullish on the long-term potential of PLTR stock, others express concerns regarding its valuation and competition. Understanding the reasoning behind these diverse viewpoints is crucial before making any investment decisions.

- Analyst A (Example): Buy, Price Target: $25 (Source: [Link to reputable source]) Their bullish outlook is driven by [briefly explain their reasoning, e.g., projected growth in government contracts].

- Analyst B (Example): Hold, Price Target: $20 (Source: [Link to reputable source]) Their more conservative stance reflects concerns about [briefly explain their reasoning, e.g., the competitive landscape and potential for slower growth].

- Analyst C (Example): Sell, Price Target: $15 (Source: [Link to reputable source]) Their bearish outlook is primarily influenced by [briefly explain their reasoning, e.g., high valuation relative to earnings].

Key Factors Affecting Palantir Stock Before May 5th

Several factors could significantly impact the Palantir stock price before May 5th. Upcoming events, macroeconomic conditions, and competitive pressures all play critical roles.

- Upcoming Earnings Report: The release of Palantir's Q1 2024 earnings report is expected to be a significant catalyst for stock price movement. Positive surprises could lead to an increase in Palantir share price, while negative surprises may trigger a sell-off.

- Macroeconomic Conditions: Rising interest rates and persistent inflation could negatively impact investor sentiment towards high-growth technology stocks like Palantir, potentially putting downward pressure on the PLTR stock price.

- Competitive Threats: Increased competition from established players and new entrants in the data analytics and artificial intelligence markets could impact Palantir's market share and consequently its stock valuation.

Risks Associated with Investing in Palantir Stock

Investing in Palantir stock involves several inherent risks. Understanding these risks is crucial for making informed investment decisions.

- Valuation Risk: Palantir's current valuation is considered high by some analysts, raising concerns about potential overvaluation and the risk of a price correction.

- Geopolitical Risk: A significant portion of Palantir's revenue is derived from government contracts, making it susceptible to changes in geopolitical landscapes and government spending priorities.

- Competitive Risk: The data analytics market is highly competitive, and Palantir faces challenges from established technology giants and emerging startups.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Whether or not to buy Palantir stock before May 5th depends on your risk tolerance and investment strategy. While Palantir exhibits strong growth potential and holds a significant position in the data analytics market, investing in PLTR stock carries substantial risk. The company's high valuation, dependence on government contracts, and competitive pressures should be carefully considered. Before making any investment decisions regarding Palantir stock or investing in PLTR stock, conduct thorough due diligence, consult with a financial advisor, and diversify your portfolio. Remember that this analysis is for informational purposes only and does not constitute financial advice. For further research, refer to reputable financial news sources and SEC filings.

Featured Posts

-

Deborah Taylor Leading Nottingham Attacks Inquiry After Becker Case

May 09, 2025

Deborah Taylor Leading Nottingham Attacks Inquiry After Becker Case

May 09, 2025 -

Simplified Stock Trading The Jazz Cash And K Trade Solution

May 09, 2025

Simplified Stock Trading The Jazz Cash And K Trade Solution

May 09, 2025 -

Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025

Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025 -

Palantir Stock Forecast Revised A Deep Dive Into The Market Rally

May 09, 2025

Palantir Stock Forecast Revised A Deep Dive Into The Market Rally

May 09, 2025 -

Nyt Spelling Bee Puzzle April 4 2025 Tips And Strategies For Success

May 09, 2025

Nyt Spelling Bee Puzzle April 4 2025 Tips And Strategies For Success

May 09, 2025