Palantir Stock Down 30%: Is This A Buying Opportunity?

Table of Contents

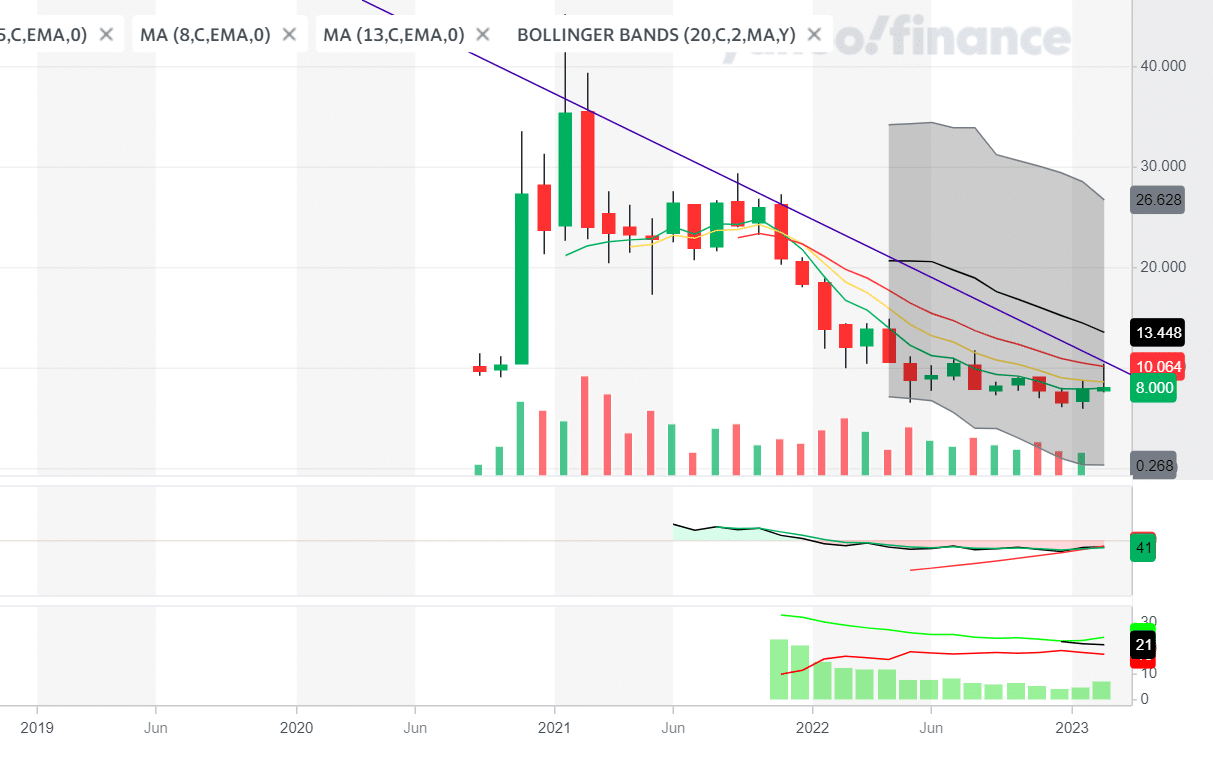

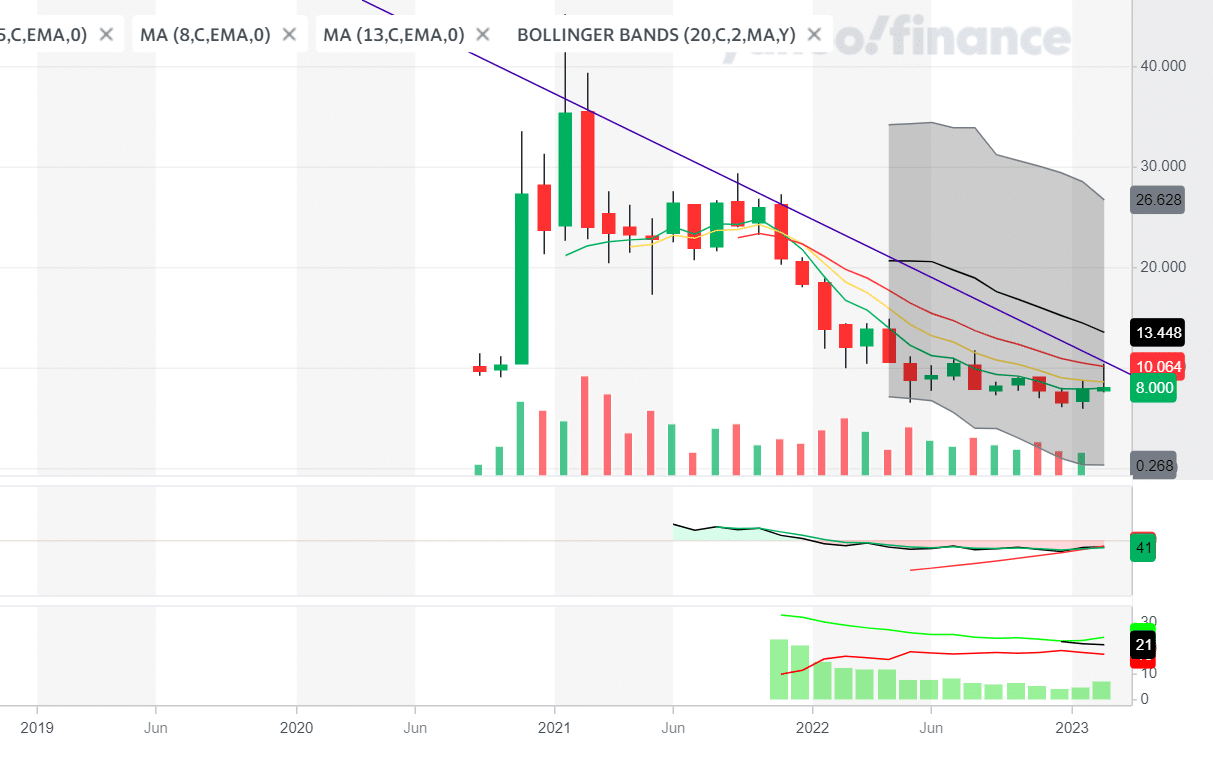

Understanding the 30% Drop in Palantir Stock Price

Recent Financial Performance and Market Sentiment

Palantir's recent earnings reports have played a significant role in the stock's decline. While the company has shown consistent revenue growth, investors have been scrutinizing the company's path to profitability. Concerns over slowing growth rates, particularly in the commercial sector, have fueled negative market sentiment. This, coupled with a broader tech stock downturn and increased market volatility, has contributed significantly to the PLTR stock price decline. The prevailing market sentiment towards Palantir, and the tech sector as a whole, reflects a cautious outlook in the face of economic uncertainty. Key factors contributing to the negative sentiment include:

- Disappointing Guidance: Palantir's earnings reports often include future guidance that shapes investor expectations. If this guidance falls short of analyst predictions, it can trigger a sharp stock price drop, as seen recently.

- Broader Market Corrections: The overall stock market's performance plays a crucial role. During periods of market correction, even fundamentally sound companies like Palantir can experience significant price drops due to risk aversion among investors.

- Increased Interest Rates: Higher interest rates impact the valuation of growth stocks like PLTR, making bonds a more attractive alternative for investors.

Keywords: Palantir earnings, PLTR earnings, tech stock downturn, market volatility, PLTR stock price.

Analyzing Key Factors Affecting PLTR Stock

Several crucial factors influence Palantir's stock performance. Its substantial reliance on government contracts, while providing a stable revenue stream, also limits its exposure to the more dynamic and potentially higher-growth commercial sector. The company is actively trying to diversify its client base, but the success of these efforts will be key to future growth.

- Growth Prospects and Future Potential: Palantir's cutting-edge data analytics platform and its applications in artificial intelligence (AI) hold significant long-term potential. The company's expansion into new markets and development of innovative products will be key indicators of its future success.

- Competitive Landscape: Palantir faces intense competition in the data analytics and AI markets from established players and emerging startups. Its ability to maintain its competitive edge will be crucial in driving future growth.

- Government Contracts vs. Commercial Clients: Palantir's significant revenue from government contracts provides stability but also limits its exposure to the potentially higher-growth commercial market. Diversification into the commercial sector is essential for long-term growth.

Keywords: Palantir growth, PLTR growth prospects, government contracts, commercial clients, competition, AI, data analytics.

Evaluating the Risk and Reward of Investing in Palantir Now

Potential Upsides

Despite the recent drop, Palantir's long-term prospects remain compelling. The increasing demand for data analytics and AI solutions across various sectors offers substantial growth opportunities.

- Data Analytics and AI Market Growth: The market for data analytics and AI is expanding rapidly, presenting a significant opportunity for Palantir to capitalize on this growth.

- New Contracts and Market Expansion: Securing new government and commercial contracts will be critical for boosting revenue and driving the stock price higher. Expansion into new geographical markets could unlock significant growth potential.

- Stock Rebound Potential: Past stock price declines have been followed by substantial rebounds in the past. The current price drop might present a buying opportunity for long-term investors.

Keywords: data analytics, artificial intelligence, AI, growth potential, stock rebound, PLTR stock.

Potential Downsides

Investing in Palantir carries inherent risks. The stock's volatility, dependence on large government contracts, and competitive landscape should be carefully considered.

- Stock Volatility: Palantir's stock price is known for its volatility, making it a higher-risk investment compared to more stable companies.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts, which can be subject to political and budgetary changes.

- Profitability Concerns: Investors are closely watching Palantir's path to sustained profitability. The company's ability to efficiently manage its expenses and increase its profit margins will be crucial.

Keywords: stock volatility, investment risks, profitability, financial risks, PLTR stock price.

Comparing Palantir to Competitors

Comparing Palantir to its competitors in the data analytics and software sectors provides valuable context. While a detailed competitive analysis requires in-depth research, a brief comparison of valuation metrics (like price-to-sales ratio) and growth rates against similar companies can help assess whether the current Palantir stock price reflects its potential. This comparison will highlight if Palantir is undervalued or if its current price accurately reflects market sentiment. Keywords: data analytics competitors, software competitors, market capitalization, valuation.

Conclusion: Is Palantir Stock a Buy After the 30% Drop?

The 30% drop in Palantir's stock price is a complex issue influenced by several factors, including recent earnings reports, market sentiment, and broader economic concerns. While the current price might seem attractive, investors need to carefully weigh the potential upsides against the considerable risks involved. Palantir's long-term prospects in the rapidly growing data analytics and AI markets remain strong. However, its dependence on government contracts and the competitive landscape pose significant challenges. Before making any investment decisions, thorough due diligence is essential. Analyze Palantir's financials, understand the competitive landscape, and assess your own risk tolerance. Consider the potential for further price declines alongside the possibility of a significant rebound. This analysis serves as a starting point for your own research; consider consulting a financial advisor before investing in Palantir stock or any other investment opportunity. Do your own research and weigh the potential rewards against the risks before making any investment decisions related to Palantir investment, PLTR stock analysis, or whether to invest in Palantir. The Palantir stock opportunity is significant, but it's crucial to proceed cautiously.

Featured Posts

-

Wall Streets Palantir Prediction Should You Invest Before May 5th

May 09, 2025

Wall Streets Palantir Prediction Should You Invest Before May 5th

May 09, 2025 -

6

May 09, 2025

6

May 09, 2025 -

Exploring New Business Opportunities A Map Of High Growth Areas

May 09, 2025

Exploring New Business Opportunities A Map Of High Growth Areas

May 09, 2025 -

Alaska Residents Rally Against Doge And Trump Administration Actions A Detailed Look

May 09, 2025

Alaska Residents Rally Against Doge And Trump Administration Actions A Detailed Look

May 09, 2025 -

Former Becker Jailer To Chair Nottingham Attacks Investigation

May 09, 2025

Former Becker Jailer To Chair Nottingham Attacks Investigation

May 09, 2025