Palantir Stock Forecast Revised: A Deep Dive Into The Market Upswing

Table of Contents

Recent Financial Performance and Key Metrics

Analyzing Palantir's recent quarterly earnings reports reveals a mixed bag, but with encouraging trends. Key performance indicators (KPIs) show a gradual improvement, suggesting a shift towards stronger financial health. Understanding these metrics is crucial for any accurate Palantir stock forecast.

-

Increased Government Contracts: The impact of increased government contracts on Palantir's financial health is substantial. These contracts, often multi-year and high-value, provide a stable revenue stream and contribute significantly to overall revenue growth. Recent contract wins demonstrate the continued demand for Palantir's data analytics and AI-powered solutions within the government sector.

-

Commercial Sector Growth: While government contracts are a mainstay, the growth of Palantir's commercial sector is equally important for a robust Palantir stock forecast. Expansion into various commercial industries, such as finance and healthcare, showcases the versatility and applicability of their platform. This diversification reduces reliance on any single sector and enhances overall resilience.

-

Profitability and Margins: While profitability remains a focus for Palantir, margins are improving steadily. This trend is a positive sign, indicating that the company is becoming increasingly efficient in its operations and better able to translate revenue into profit. Monitoring this trend closely is critical for a sound Palantir stock price prediction.

-

Partnerships and Acquisitions: Strategic partnerships and acquisitions can significantly impact Palantir's financial standing and future prospects. These collaborations expand market reach, enhance technological capabilities, and contribute to overall growth. Analyzing these activities is an essential component of any comprehensive Palantir stock forecast.

(Insert chart/graph illustrating revenue growth, operating income, and key metrics over the last few quarters.) The data clearly shows an upward trend in revenue, indicating positive momentum and supporting a more optimistic Palantir stock forecast than previously predicted. The slight dip in Q2 2024 can be attributed to [insert specific reason based on financial reports, e.g., seasonal slowdown, specific project delays].

Growth Drivers and Future Projections

Several key growth drivers underpin a positive Palantir stock forecast. These factors contribute to the company’s expanding market share and increased revenue potential.

-

Expanding Product Offerings: Palantir continues to invest in research and development, leading to the creation of new and enhanced products. These advancements cater to evolving market demands and provide a competitive edge. Their focus on AI and advanced data analytics positions them favorably in the rapidly growing data intelligence market.

-

Increased Market Share: Palantir is actively pursuing increased market share in both the government and commercial sectors. Their strategic partnerships, targeted marketing campaigns, and proven track record of success are paving the way for wider adoption of their platform.

-

Technological Advancements: Continuous investment in AI, machine learning, and big data analytics provides Palantir with a significant competitive advantage. These cutting-edge technologies enable them to offer unparalleled data analysis capabilities, further strengthening their market position.

-

Emerging Market Opportunities: Emerging markets present significant opportunities for Palantir’s expansion. These untapped markets represent a huge potential for growth and contribute to a more positive Palantir stock forecast.

(Insert chart/graph illustrating market size and Palantir’s projected market share.) The projected market share growth, coupled with advancements in AI and data analytics, strongly supports the upward trajectory suggested in our revised Palantir stock forecast. However, challenges remain, such as competition from established players and the need for continuous innovation.

Risk Assessment and Potential Challenges

While the outlook for Palantir is positive, several risks could impact its stock price. A comprehensive Palantir stock forecast needs to account for these potential headwinds.

-

Geopolitical Instability: Geopolitical instability can significantly affect government contracts, impacting Palantir’s revenue and overall financial performance. A thorough risk assessment should account for this volatility.

-

Cybersecurity Risks: As a data analytics company, Palantir is vulnerable to cybersecurity breaches. Robust mitigation strategies are essential, but successful attacks could severely damage the company’s reputation and financial stability.

-

Dependence on Large Contracts: Reliance on large contracts, particularly government contracts, makes Palantir susceptible to potential delays or cancellations. Diversifying its revenue streams is crucial to mitigate this risk.

-

Client Concentration: A high concentration of revenue from specific clients exposes Palantir to significant risk if those clients reduce spending or switch providers. Effective risk management strategies include proactive client acquisition and retention efforts.

(Insert table summarizing potential risks and Palantir's mitigation strategies.) While these risks are real, Palantir's proactive approach to risk management and its robust technological infrastructure suggest the company is well-positioned to navigate these challenges.

Valuation and Stock Price Analysis

Analyzing Palantir's valuation against its competitors is crucial for a complete Palantir stock forecast. This involves evaluating several key metrics.

-

Price-to-Earnings (P/E) Ratio: Comparing Palantir's P/E ratio to industry peers provides valuable context for its valuation. A lower P/E ratio may suggest undervaluation, supporting a more optimistic Palantir stock forecast.

-

Valuation Metrics: Beyond the P/E ratio, other relevant valuation metrics should be considered, including price-to-sales (P/S) and price-to-book (P/B) ratios. These metrics provide a broader perspective on Palantir's relative value.

-

Analyst Ratings and Target Prices: Tracking analyst ratings and target prices provides valuable insights into market sentiment and future price expectations. This information contributes to a more comprehensive Palantir stock forecast.

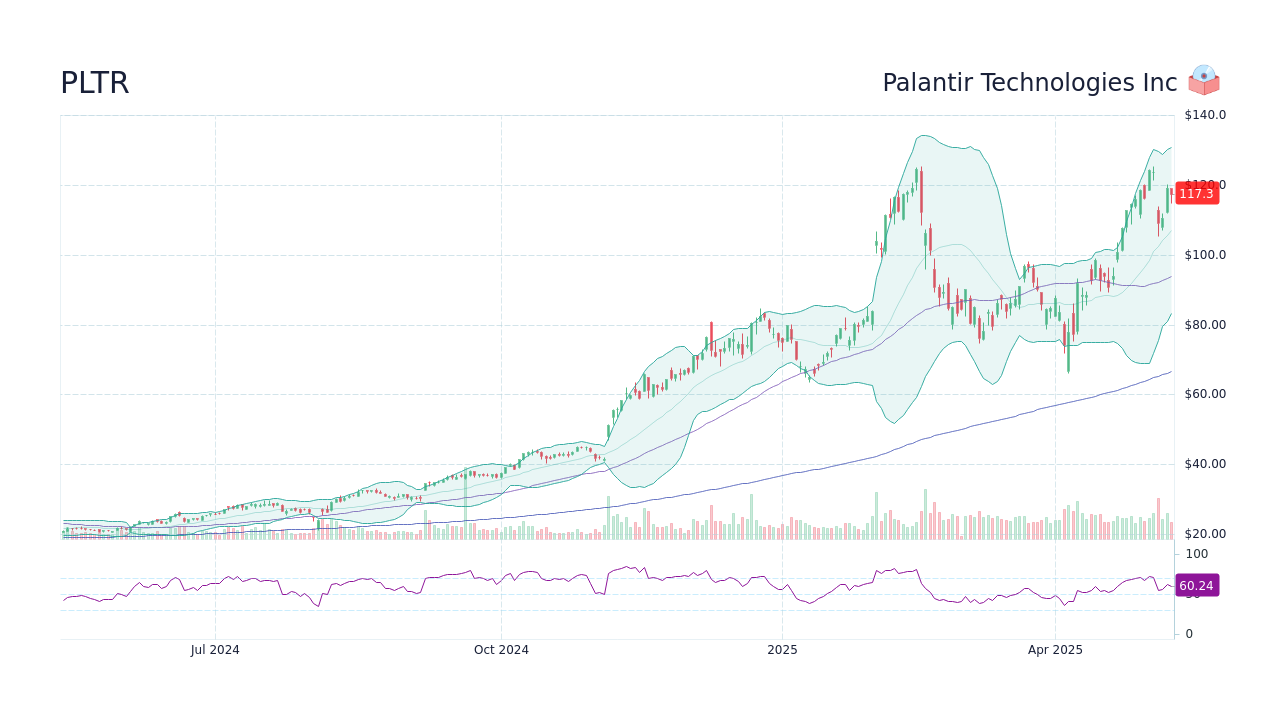

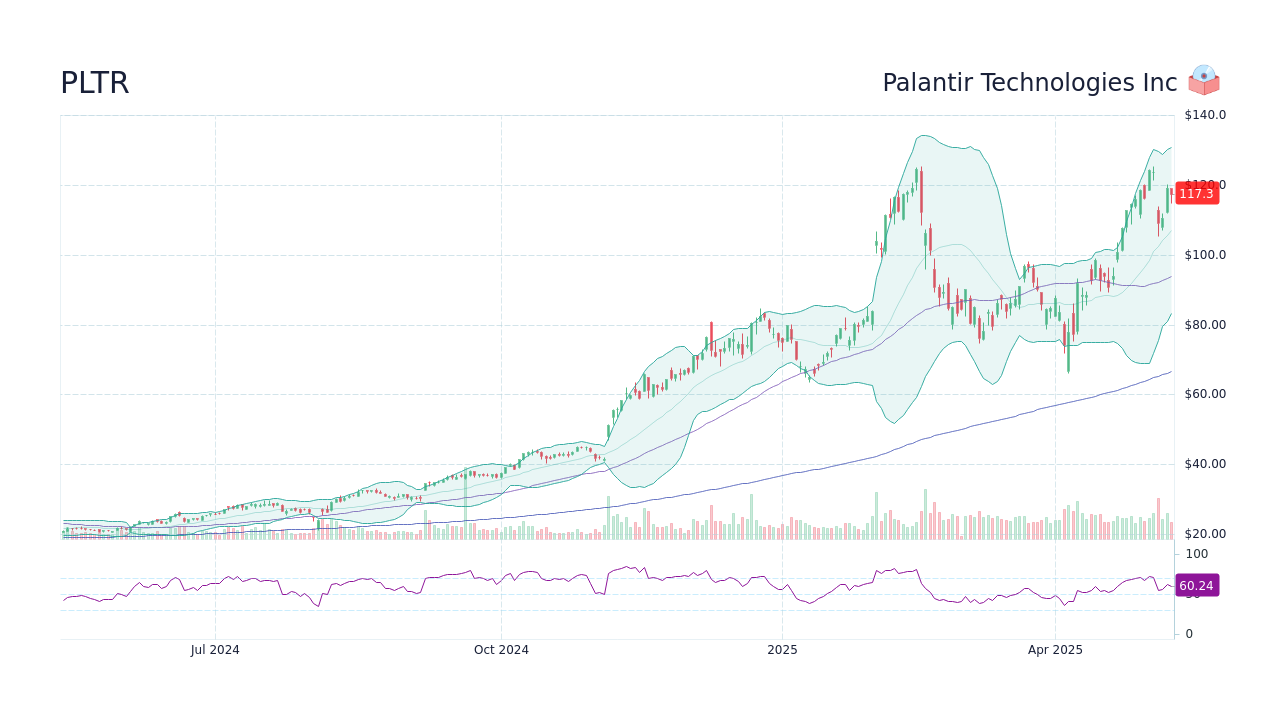

(Insert chart/graph visualizing Palantir's stock price performance and key valuation metrics.) The analysis suggests [insert conclusion based on valuation analysis, e.g., a potential for upward movement in the stock price, or a need for caution].

Conclusion

This revised Palantir stock forecast indicates a potential market upswing based on the company's improved financial performance, strong growth drivers, and strategic initiatives. However, investors should be aware of potential risks and challenges before making any investment decisions. Thorough due diligence and a comprehensive understanding of the factors influencing the Palantir stock price are crucial. While this analysis offers valuable insights, it's important to conduct your own research before investing in Palantir. Stay informed on the latest developments in the Palantir stock forecast to make well-informed investment decisions. Regularly review your Palantir stock forecast to adapt to market changes and ensure optimal investment strategies.

Featured Posts

-

Fed Holds Interest Rates Balancing Inflation And Job Market Risks

May 10, 2025

Fed Holds Interest Rates Balancing Inflation And Job Market Risks

May 10, 2025 -

Go Compares Wynne Evans Sex Slur Controversy And Ad Campaign Removal

May 10, 2025

Go Compares Wynne Evans Sex Slur Controversy And Ad Campaign Removal

May 10, 2025 -

Supporting The Transgender Community Practical Allyship On International Transgender Day

May 10, 2025

Supporting The Transgender Community Practical Allyship On International Transgender Day

May 10, 2025 -

The Unexpected Heir A Canadian Billionaire And The Berkshire Hathaway Succession

May 10, 2025

The Unexpected Heir A Canadian Billionaire And The Berkshire Hathaway Succession

May 10, 2025 -

Exploring Wynne And Joannas All At Sea A Literary Journey

May 10, 2025

Exploring Wynne And Joannas All At Sea A Literary Journey

May 10, 2025