Palantir Stock Outlook: To Buy Or Not To Buy Before May 5th?

Table of Contents

Palantir's Recent Performance and Financial Health

Q4 2022 Earnings and Beyond:

Palantir's Q4 2022 earnings report will be a key factor in shaping the Palantir stock outlook. Analyzing key metrics is crucial. We need to look beyond headline numbers to understand the underlying trends.

- Revenue Figures: (Insert actual Q4 2022 revenue figures here once available. For example: "$X Billion, representing a Y% year-over-year increase.")

- Net Income/Loss: (Insert actual Q4 2022 net income/loss figures here. For example: "Net income of $Z million, or a net loss of $Z million.")

- EPS (Earnings Per Share): (Insert actual Q4 2022 EPS figures here. For example: "EPS of $W.")

- Key Highlights from the Earnings Call: (Summarize key takeaways from the earnings call, focusing on management commentary regarding future growth and challenges.) Did they exceed expectations? Did they lower guidance? This will significantly impact the Palantir stock outlook.

Did the Q4 results meet or exceed analyst expectations? Any positive or negative surprises will heavily influence the short-term Palantir stock outlook.

Government vs. Commercial Revenue Growth:

Palantir's revenue streams are divided between government and commercial sectors. Understanding the growth trajectory of each is vital for assessing the Palantir stock outlook.

- Percentage of Revenue from Each Sector: (Insert percentages here, e.g., "X% from government, Y% from commercial.")

- Growth Rates: (Insert growth rates for each sector here. For example: "Government sector revenue grew by A%, while commercial sector revenue grew by B%").

- Future Projections: (Discuss management's guidance on future revenue growth for each sector. Are they expecting continued growth, or a slowdown?)

The stability and predictability of each revenue stream are key considerations for long-term Palantir stock outlook. A strong commercial sector can balance potential fluctuations in the government sector.

Debt and Cash Position:

A strong financial foundation is crucial for any company's long-term success, impacting the Palantir stock outlook.

- Total Debt: (Insert Palantir's total debt figures here.)

- Cash on Hand: (Insert Palantir's cash reserves here.)

- Debt-to-Equity Ratio: (Insert the debt-to-equity ratio here. A lower ratio generally indicates better financial health.)

- Free Cash Flow: (Insert the free cash flow figures here. Positive free cash flow suggests the company is generating cash from its operations.)

Market Sentiment and Analyst Predictions

Current Stock Price and Volatility:

Analyzing the current stock price and its recent volatility provides valuable insight into the market's sentiment towards Palantir.

- (Include a chart or graph showing the stock price trend over the past few months.)

- Significant Price Movements: (Discuss any recent significant price movements and the events that triggered them.)

Understanding the reasons behind these price fluctuations is vital for a realistic Palantir stock outlook.

Analyst Ratings and Price Targets:

Analyst opinions provide another lens through which to view the Palantir stock outlook.

- Average Price Target: (State the average price target set by analysts.)

- Range of Price Targets: (Provide the range of price targets to illustrate the spread of opinions.)

- Buy/Sell/Hold Recommendations: (Summarize the distribution of buy, sell, and hold recommendations from analysts.)

- Rationale Behind Differing Opinions: (Discuss the reasons behind the variations in analyst opinions.)

Competitor Analysis:

Competitive pressures can significantly affect a company's performance and market share. Assessing Palantir's competitive landscape helps in evaluating the Palantir stock outlook.

- Key Competitors: (List Palantir's main competitors, such as Databricks, Snowflake, etc.)

- Strengths and Weaknesses: (Compare Palantir's strengths and weaknesses against its competitors.)

- Market Share Comparison: (Discuss Palantir's market share compared to its competitors.)

Potential Risks and Opportunities Before May 5th

Geopolitical Risks:

Geopolitical instability can significantly impact Palantir's business, particularly its government contracts.

- Examples of Potential Risks: (Mention specific geopolitical events that could affect Palantir's business, such as international conflicts or changes in government policies.)

Technological Disruptions:

The technology landscape is constantly evolving. New technologies could pose challenges to Palantir's competitiveness.

- Emerging Technologies: (Discuss emerging technologies that could impact Palantir’s market position.)

- Potential Challenges: (Analyze potential threats from these new technologies.)

- Palantir's Response Strategy: (Assess Palantir’s strategies to adapt to technological advancements.)

Growth Opportunities:

Despite the risks, Palantir has significant growth opportunities.

- New Product Launches: (Discuss any new products or services Palantir is launching.)

- Expansion into New Markets: (Analyze potential for expansion into new geographic markets or customer segments.)

- Strategic Partnerships: (Discuss any strategic partnerships that could boost Palantir's growth.)

Conclusion: Palantir Stock Outlook – The Verdict Before May 5th

This comprehensive Palantir stock outlook analysis has considered various factors, including recent financial performance, market sentiment, analyst predictions, and potential risks and opportunities. Weighing the pros and cons, (Insert your final recommendation here: Buy, Sell, Hold, or Wait and See). This recommendation is based on the current information and analysis; however, significant changes could occur before May 5th.

The May 5th date remains crucial. The announcement could significantly impact the Palantir stock price. Make an informed decision on your Palantir stock investment strategy before May 5th based on this comprehensive outlook. Remember to conduct your own thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions. This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

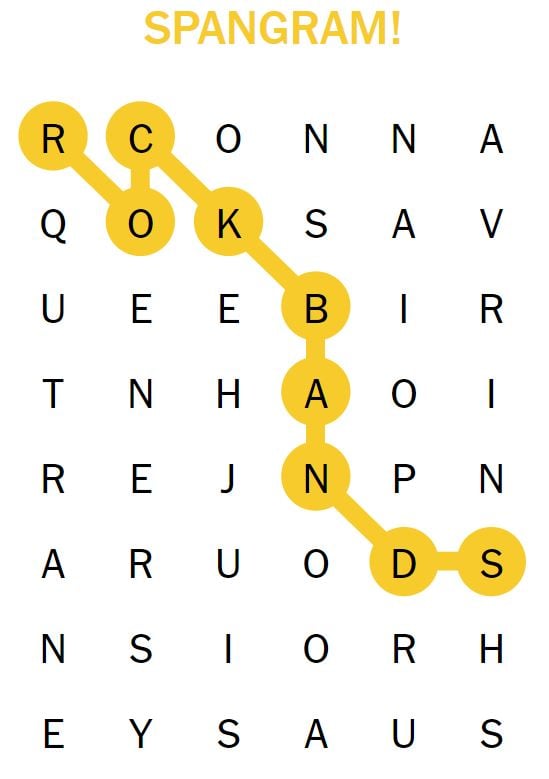

Nyt Spelling Bee April 4 2025 Find The Pangram And All Answers

May 10, 2025

Nyt Spelling Bee April 4 2025 Find The Pangram And All Answers

May 10, 2025 -

Family Demands Justice Following Racist Murder Of Loved One

May 10, 2025

Family Demands Justice Following Racist Murder Of Loved One

May 10, 2025 -

Months Of Unheeded Warnings Led To Critical Newark Air Traffic Control Failure

May 10, 2025

Months Of Unheeded Warnings Led To Critical Newark Air Traffic Control Failure

May 10, 2025 -

Edmonton Oilers Leon Draisaitl Suffers Injury Leaves Game

May 10, 2025

Edmonton Oilers Leon Draisaitl Suffers Injury Leaves Game

May 10, 2025 -

Strictly Come Dancing Wynne Evans Addresses Speculation About Return

May 10, 2025

Strictly Come Dancing Wynne Evans Addresses Speculation About Return

May 10, 2025