Palantir Stock Prediction: 2 Potential Outperformers In The Next 3 Years

Table of Contents

Scenario 1: Increased Government and Commercial Adoption of Palantir's Foundry Platform

Palantir's Foundry platform is a crucial driver for future growth, and a key element in any Palantir stock prediction. Its success hinges on increased adoption by both government and commercial clients.

Expanding Foundry's Market Share

-

Increased Government Contracts: Palantir's existing government contracts provide a strong foundation. Future growth depends on securing more large-scale contracts, both domestically and internationally. This includes expanding into new government agencies and departments focusing on national security, intelligence, and public health initiatives. Success here significantly impacts the Palantir stock forecast.

-

Commercial Sector Expansion: The commercial sector presents a vast untapped market. Palantir is targeting industries like healthcare, finance, and energy, where its data analytics capabilities can dramatically improve efficiency and decision-making. Securing major contracts within these sectors will be pivotal for a positive Palantir stock prediction.

-

Successful Case Studies: Highlighting successful deployments of Foundry and their quantifiable ROI for existing clients is critical. These case studies serve as compelling evidence of Foundry's effectiveness and boost confidence among potential clients, driving future adoption and influencing Palantir stock forecast models. This directly impacts a positive Palantir stock prediction.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions can significantly accelerate Foundry's adoption.

-

Industry-Specific Partnerships: Collaborating with leading players in various sectors (e.g., a major healthcare provider or a large financial institution) can provide access to new markets and customer bases. These partnerships will significantly boost the Palantir stock prediction.

-

Acquisitions Enhancing Capabilities: Acquiring companies with complementary technologies or expertise can expand Foundry's capabilities and address a wider range of customer needs. These acquisitions can accelerate growth and improve the long-term Palantir stock forecast.

-

Synergistic Partnerships Impacting PLTR Stock: Successful partnerships can lead to increased revenue streams, market share expansion, and enhanced brand reputation, all of which positively influence Palantir stock prediction models.

Scenario 2: Successful Expansion into New and Emerging Markets

International expansion and innovation are crucial factors in any comprehensive Palantir stock prediction.

International Growth and Market Penetration

-

Targeting High-Growth Markets: Focusing on emerging markets with high growth potential and a need for advanced data analytics solutions can significantly increase revenue. This strategy is crucial for a positive Palantir stock forecast.

-

Competitive Advantage: Palantir's unique technology and expertise give it a competitive edge in many international markets. Highlighting this advantage in marketing materials and investor presentations is key for influencing the Palantir stock prediction.

-

Successful International Deployments: Showcasing successful implementations in various international markets strengthens investor confidence and improves the Palantir stock prediction.

Innovation and Development of New Products and Services

Continuous innovation is vital for long-term growth and a positive Palantir stock prediction.

-

AI and Machine Learning Integration: Further integration of AI and machine learning capabilities into Foundry will enhance its functionality and appeal to a broader range of customers. This is a crucial element of any Palantir stock prediction.

-

New Product Development: Developing new products and services tailored to specific industry needs will attract new clients and strengthen Palantir's market position, influencing the Palantir stock forecast positively.

-

Impact on Revenue and Profitability: Successful innovation leads to increased revenue streams, improved margins, and enhanced profitability, all contributing to a strong Palantir stock prediction.

Conclusion

Two key scenarios—increased adoption of Foundry and expansion into new markets—could lead to a positive Palantir stock prediction for the next 3 years. Securing significant government and commercial contracts and successful international expansion are crucial for strong PLTR stock performance. A robust Palantir stock forecast relies heavily on these factors.

While this Palantir stock prediction offers a positive outlook, conducting your own thorough research before investing in PLTR stock is crucial. Consider consulting with a financial advisor for personalized guidance on Palantir investment strategies. Remember, this is not financial advice; this analysis is purely for informational purposes. Learn more about Palantir's potential by exploring their investor relations materials and conducting your own comprehensive due diligence on Palantir stock.

Featured Posts

-

Strands Nyt April 12 2024 Complete Answers And Hints For Game 405

May 10, 2025

Strands Nyt April 12 2024 Complete Answers And Hints For Game 405

May 10, 2025 -

Noviy Vitok Migratsii Germaniya Ozabochena Pritokom Ukrainskikh Bezhentsev Iz Za Politiki S Sh A

May 10, 2025

Noviy Vitok Migratsii Germaniya Ozabochena Pritokom Ukrainskikh Bezhentsev Iz Za Politiki S Sh A

May 10, 2025 -

January 6th Conspiracy Theories Ray Epps Defamation Suit Against Fox News

May 10, 2025

January 6th Conspiracy Theories Ray Epps Defamation Suit Against Fox News

May 10, 2025 -

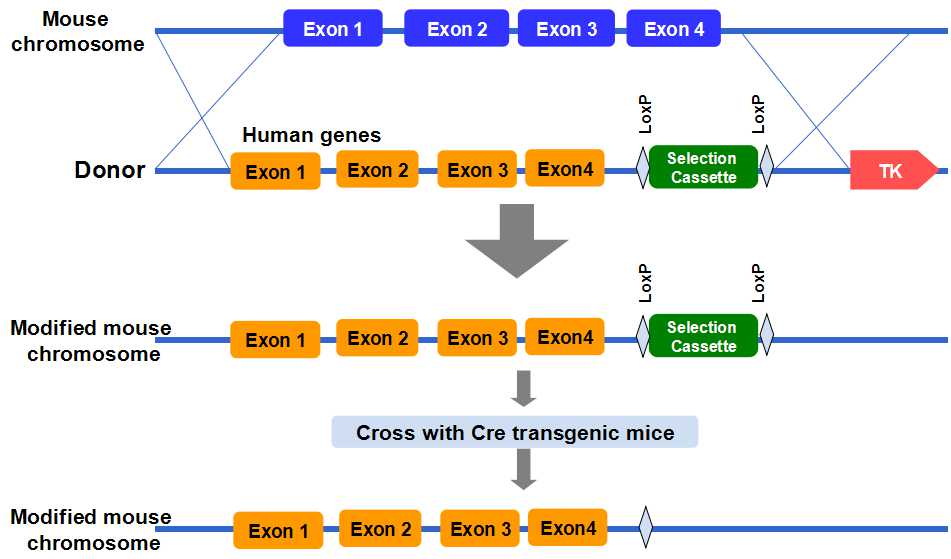

Is Us Taxpayer Money Funding Transgender Mouse Research

May 10, 2025

Is Us Taxpayer Money Funding Transgender Mouse Research

May 10, 2025 -

Incident Survenu Rue Michel Servet Dijon Un Vehicule Heurte Un Mur

May 10, 2025

Incident Survenu Rue Michel Servet Dijon Un Vehicule Heurte Un Mur

May 10, 2025