Palantir Stock Q1 Earnings: Government And Commercial Business Trends

Table of Contents

Palantir Q1 Earnings Overview: Key Financial Metrics

This section provides a detailed look at Palantir's key financial performance indicators for Q1.

Revenue Growth and Breakdown

Palantir's Q1 revenue showcased [Insert actual revenue figure here], representing a [Insert percentage]% year-over-year growth. This growth surpasses (or falls short of) analyst expectations of [Insert analyst expectation here]. A significant portion of this revenue stemmed from the government sector, contributing [Insert percentage]% to the total, while the commercial sector contributed [Insert percentage]%.

- Total Revenue: [Insert actual revenue figure here]

- Year-over-Year Growth: [Insert percentage]%

- Government Revenue: [Insert actual revenue figure here]

- Commercial Revenue: [Insert actual revenue figure here]

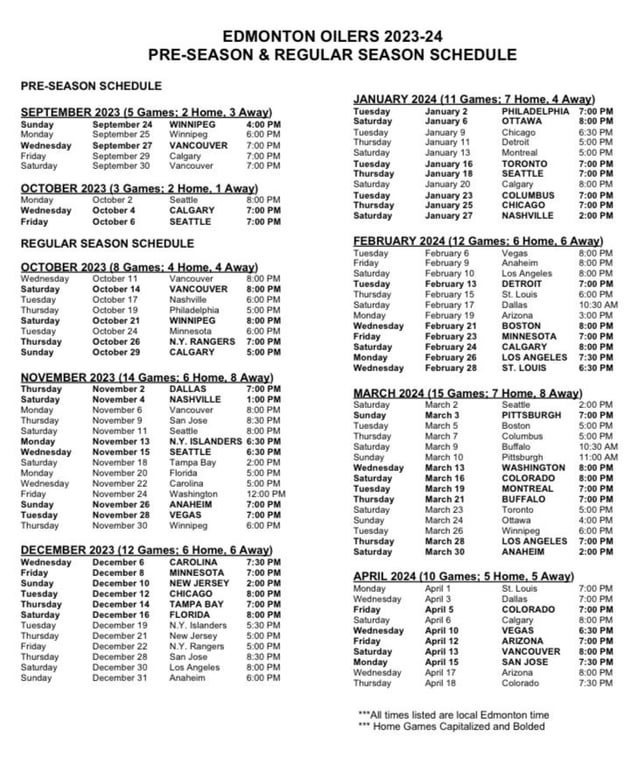

[Insert a chart or graph visually representing revenue growth from previous quarters and the current Q1.]

Profitability and Margins

Profitability remains a key metric for investors. Palantir reported a net income of [Insert actual net income figure here], representing [Insert percentage]% change compared to the previous quarter. Operating income stood at [Insert actual operating income figure here], with operating margins at [Insert percentage]%. This reflects [mention whether margins improved, declined or remained stable and provide reasons].

- Net Income: [Insert actual net income figure here]

- Operating Income: [Insert actual operating income figure here]

- Operating Margins: [Insert percentage]%

- Cost-cutting measures: [Detail any implemented cost-cutting measures and their impact]

Cash Flow and Liquidity

Palantir's cash flow from operations for Q1 was [Insert actual cash flow figure here], indicating [positive or negative trend and reasoning]. Free cash flow stood at [Insert actual free cash flow figure here]. This demonstrates [commentary on the company's liquidity position and financial health – strong, stable, or concerning].

- Cash Flow from Operations: [Insert actual cash flow figure here]

- Free Cash Flow: [Insert actual free cash flow figure here]

- Liquidity Position: [Assessment of the company's liquidity]

Government Business Trends: A Deep Dive

Palantir's government business segment continues to be a significant revenue driver.

Government Contracts and Spending

Q1 witnessed Palantir securing several substantial government contracts. Notable examples include [Insert examples of major contracts and their approximate values]. Increased government budget allocations towards data analytics and cybersecurity significantly boosted growth in this sector. [Mention any geopolitical factors influencing government spending].

- Major Contracts: [List examples with values, if available]

- Contract Types: [Specify types of contracts e.g., long-term, short-term]

- Geopolitical Factors: [Discuss relevant geopolitical impacts]

Government Sector Growth Outlook

The outlook for Palantir's government business remains positive, driven by [mention factors such as increasing demand, long-term contracts, and new partnerships]. However, challenges could arise from [mention potential risks such as budget cuts, changes in government priorities or competition]. [Include projections for future growth, if available].

- Growth Projections: [Insert predictions based on current trends and available data]

- Long-term Contracts: [Discuss the impact of long-term contracts on future revenue]

- Potential Risks: [Identify and discuss potential challenges to growth]

Commercial Business Trends: Growth and Challenges

Palantir's commercial sector is showing signs of growth, though it faces a competitive landscape.

Commercial Customer Acquisition and Revenue

Palantir added [Insert number] new commercial clients in Q1, primarily in the [mention key sectors e.g., finance, healthcare] sectors. Revenue generated from this sector reached [Insert actual revenue figure here], representing a [Insert percentage]% growth compared to the previous quarter. Customer churn remained at [Insert churn rate], indicating [positive or negative trend].

- New Clients: [Insert number of new clients and key sectors]

- Commercial Revenue: [Insert revenue figures]

- Customer Churn: [Insert churn rate and analysis]

Competition and Market Share

The commercial data analytics market is highly competitive, with key players including [list major competitors]. Palantir's competitive advantage lies in [mention Palantir's key strengths and differentiators]. [Analyze Palantir’s market share and competitive positioning].

- Major Competitors: [List key competitors and their strengths/weaknesses]

- Palantir's Competitive Advantage: [Highlight Palantir's unique selling propositions]

- Market Share: [Estimate or reference Palantir's market share if available]

Commercial Sector Growth Outlook

The long-term growth potential for Palantir's commercial sector is significant, driven by increasing demand for data-driven decision-making across various industries. However, potential challenges include [mention economic downturns, increased competition, and challenges in customer acquisition]. [Include growth projections, if available].

- Growth Projections: [Insert projections for future growth]

- Market Trends: [Discuss relevant market trends]

- Potential Risks: [Discuss potential challenges and risks]

Conclusion: Analyzing Palantir Stock Q1 Earnings and Future Outlook

Palantir's Q1 earnings reflect a mixed performance. While the government sector continues to be a strong contributor, the commercial sector is showing promising growth despite competitive pressures. These trends will undoubtedly influence Palantir's stock price and future valuation. The outlook for Palantir stock remains somewhat uncertain, dependent on the company's ability to navigate the challenges and capitalize on opportunities in both sectors. To stay informed on the evolving landscape of Palantir Stock Q1 Earnings and future quarterly reports, regularly check reputable financial news sources and Palantir's investor relations page. Understanding these trends is crucial for making informed investment decisions.

Featured Posts

-

Have Trumps Executive Orders Impacted Your Life As A Transgender Person

May 10, 2025

Have Trumps Executive Orders Impacted Your Life As A Transgender Person

May 10, 2025 -

Draisaitls Lower Body Injury Playoff Readiness For The Edmonton Oilers

May 10, 2025

Draisaitls Lower Body Injury Playoff Readiness For The Edmonton Oilers

May 10, 2025 -

El Bolso Hereu Preferido Por Dakota Johnson Minimalismo Y Estilo

May 10, 2025

El Bolso Hereu Preferido Por Dakota Johnson Minimalismo Y Estilo

May 10, 2025 -

Trumps Houthi Truce A Skeptical Shipping Industry Responds

May 10, 2025

Trumps Houthi Truce A Skeptical Shipping Industry Responds

May 10, 2025 -

Predicting The Top Storylines In The Nhls Remaining 2024 25 Season

May 10, 2025

Predicting The Top Storylines In The Nhls Remaining 2024 25 Season

May 10, 2025