Palantir Stock: Wall Street's Prediction Before May 5th - Should You Invest?

Table of Contents

Wall Street's Predictions for Palantir Stock Before May 5th

Predicting the future of any stock is inherently risky, but analyzing Wall Street's consensus can offer valuable insight. Before May 5th, analyst sentiment on Palantir stock showed a mixed bag. While some analysts remain bullish on PLTR's long-term prospects, others express caution due to recent market trends and the company's financial performance.

-

Divergent Opinions: The average price target among analysts varied significantly, reflecting the divergence in opinions. Some analysts predict a substantial increase in Palantir's share price, citing its growing government contracts and expansion into the commercial sector. Others are more conservative, pointing to the company's current profitability and the competitive landscape.

-

Specific Analyst Predictions:

- Analyst A (Example): JP Morgan analyst (hypothetical) issued a "buy" rating with a $12 price target, citing strong potential for growth in the AI sector and the increasing demand for Palantir's data analytics platform.

- Analyst B (Example): Goldman Sachs analyst (hypothetical) maintained a "hold" rating with a $9 price target, highlighting concerns about the company's profitability and the potential impact of increased competition.

-

Overall Sentiment: The overall sentiment surrounding Palantir stock before May 5th could be characterized as cautiously optimistic. While there is belief in the company's long-term potential, short-term uncertainty remains a significant factor influencing investment strategies. It's crucial to consult multiple sources and not rely on a single analyst's opinion.

Analyzing Palantir's Recent Performance and Financial Health

To assess the investment potential of Palantir stock, scrutinizing its recent financial performance is crucial. Analyzing key performance indicators (KPIs) provides a clearer picture of the company's health.

-

Recent Financial Reports: Palantir's recent earnings reports should be carefully examined. Look for trends in revenue growth, profit margins, and overall financial stability. Pay attention to the breakdown of revenue between government and commercial clients.

-

Key Performance Indicators (KPIs):

- Recent Revenue Growth Percentage: Analyze the year-over-year and quarter-over-quarter growth rates to understand the trajectory of Palantir's revenue.

- Profitability Metrics: Examine net income, operating margin, and free cash flow to determine the company's profitability and its ability to generate cash.

- Debt-to-Equity Ratio: Assessing this ratio helps gauge the company's financial risk and leverage.

- Customer Acquisition and Retention Rates: Understanding how effectively Palantir acquires and retains customers is essential for evaluating its long-term growth potential.

Assessing Palantir's Long-Term Growth Potential

Palantir's long-term prospects hinge on several factors, including its market position, technological advancements, and strategic goals.

-

Market Position and Competitive Landscape: Analyze Palantir's market share in key sectors like government intelligence and commercial data analytics. Identify its main competitors and assess its competitive advantages.

-

Impact of Emerging Technologies: Palantir's success depends heavily on its ability to leverage emerging technologies like AI and big data. Assess its investment in R&D and its capacity to adapt to evolving technological landscapes.

-

Long-Term Strategic Goals: Examine Palantir's strategic plans for expansion into new markets and its commitment to innovation. Understanding its long-term vision is vital for assessing its growth potential.

-

Growth Opportunities and Risks:

- Market Share: Identify areas where Palantir can expand its market share and capitalize on growth opportunities.

- Technological Advantages: Analyze Palantir's unique technologies and their competitive advantages.

- New Markets: Evaluate the potential for expansion into new markets and sectors.

- Risks and Challenges: Identify potential challenges, such as increasing competition and regulatory hurdles.

Risks and Considerations Before Investing in Palantir Stock

Before making any investment decision, it's crucial to acknowledge the inherent risks associated with Palantir stock.

-

Potential Downsides: The technology sector is inherently volatile, and Palantir is not immune to market fluctuations. Factors such as macroeconomic conditions, investor sentiment, and geopolitical events can significantly impact the stock price.

-

Negative Impact Factors:

- Competition: Increased competition from established players could hinder Palantir's growth.

- Government Contracts: Palantir's reliance on government contracts presents a degree of risk associated with political changes and budget cuts.

- Market Sentiment: Negative news or market downturns can significantly impact investor sentiment and lead to price drops.

- Regulatory Hurdles: Potential regulatory changes and compliance issues could impact the company's operations and profitability.

Conclusion: Should You Invest in Palantir Stock Before May 5th?

Our analysis of Wall Street predictions and Palantir's financial health reveals a mixed outlook. While the company possesses strong long-term potential, particularly in leveraging AI and big data, it also faces considerable risks. The volatility of the tech sector and Palantir's reliance on government contracts are significant factors to consider.

Ultimately, the decision of whether or not to invest in Palantir stock before May 5th is a personal one. Weigh the potential rewards against the considerable risks. Remember that past performance is not indicative of future results. Make an informed decision about investing in Palantir stock by conducting your own research and consulting a financial advisor before May 5th. Thorough due diligence is paramount before investing in any stock, and Palantir stock is no exception.

Featured Posts

-

Analyzing West Hams 25m Financial Shortfall

May 10, 2025

Analyzing West Hams 25m Financial Shortfall

May 10, 2025 -

Ray Epps Vs Fox News A Defamation Case Examining January 6th Narratives

May 10, 2025

Ray Epps Vs Fox News A Defamation Case Examining January 6th Narratives

May 10, 2025 -

Uk Government Considers Stricter Student Visa Rules For Certain Countries

May 10, 2025

Uk Government Considers Stricter Student Visa Rules For Certain Countries

May 10, 2025 -

Dijon 2500 M De Vignes Plantes Au Secteur Des Valendons

May 10, 2025

Dijon 2500 M De Vignes Plantes Au Secteur Des Valendons

May 10, 2025 -

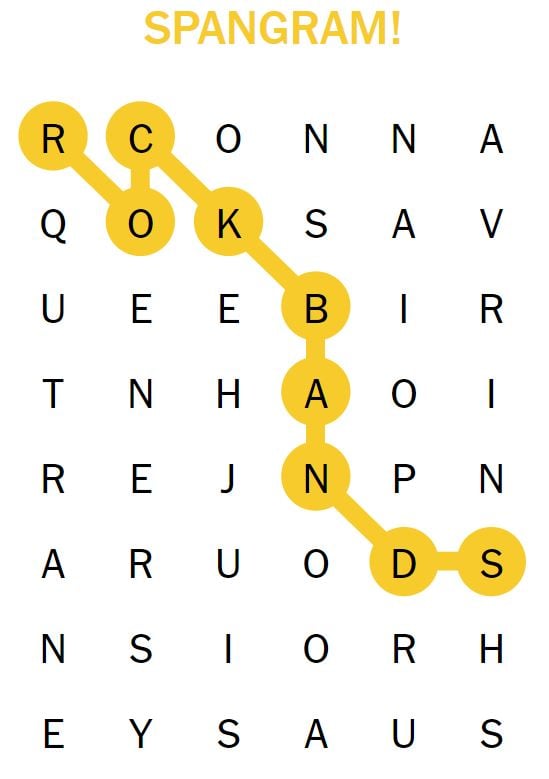

Nyt Spelling Bee April 4 2025 Find The Pangram And All Answers

May 10, 2025

Nyt Spelling Bee April 4 2025 Find The Pangram And All Answers

May 10, 2025