Palantir Stock: Weighing The Risks And Rewards Before May 5th

Table of Contents

Palantir's Strengths: Why Investors are Interested

Palantir's success hinges on several key strengths that attract investors. Its robust revenue streams, expanding commercial reach, and cutting-edge technology position it for continued growth.

Palantir Government Contracts and Revenue Growth

Palantir boasts a significant portfolio of government contracts, a cornerstone of its revenue generation. These contracts, often multi-year and high-value, provide a stable revenue base. Analyzing government spending trends related to technology is crucial to forecasting Palantir's future performance.

- Examples of significant government contracts: Palantir works with numerous agencies, including those within the US Department of Defense and intelligence communities, contributing significantly to its revenue.

- Projected growth rates: While precise figures are difficult to predict, analysts often project continued growth in government spending on data analytics and AI, bolstering Palantir's revenue stream.

- Analysis of government spending trends impacting Palantir: Increased focus on national security and data-driven decision-making within governments worldwide should positively impact Palantir's government contracts. However, budget fluctuations and shifts in political priorities pose risks. Understanding these trends is essential for accurate Palantir Stock price predictions. Keywords: Palantir Government Contracts, PLTR Revenue Growth, Government Spending on Technology.

Expanding Commercial Market Penetration

While government contracts form a significant portion of Palantir's revenue, its expansion into the commercial sector is vital for long-term growth. The company has successfully secured partnerships with major corporations across various industries.

- Examples of key commercial clients: Palantir has successfully onboarded numerous clients in sectors such as finance, healthcare, and manufacturing, showcasing the versatility of its platform.

- Success stories: Case studies highlighting successful implementations and the positive impact of Palantir's solutions on commercial clients' operations are crucial indicators of the platform's effectiveness.

- Market share analysis: Palantir aims to capture a significant share of the growing data analytics market, competing with established players and emerging startups. Analyzing its market share progression is key to understanding its future trajectory. Keywords: Palantir Commercial Clients, PLTR Commercial Growth, Data Analytics Market.

Cutting-Edge AI and Data Analytics Capabilities

Palantir's core strength lies in its advanced AI and data analytics capabilities. Its Foundry platform empowers organizations to integrate and analyze vast amounts of data, unlocking valuable insights and driving data-driven decisions.

- Discussion of Palantir's AI capabilities: Palantir leverages cutting-edge AI techniques for data integration, analysis, and predictive modeling, setting it apart from competitors.

- Comparison with competitors: A comparative analysis with industry giants like Salesforce, Microsoft, and IBM highlights Palantir's strengths and weaknesses in the competitive data analytics landscape.

- Potential future applications of the technology: Palantir continuously develops its technology, potentially expanding into new markets and applications as AI technology advances. Keywords: Palantir AI, Data Analytics Software, Artificial Intelligence in Business.

Palantir's Risks: Understanding the Potential Downsides

Despite its promising strengths, investing in Palantir Stock involves inherent risks. A thorough understanding of these potential downsides is crucial before committing capital.

High Valuation and Profitability Concerns

Palantir's current valuation has been a subject of debate among investors. Its high price-to-earnings ratio raises concerns about its sustainability given its current profitability.

- Price-to-earnings ratio analysis: Comparing Palantir's P/E ratio to industry peers and historical trends can help determine if its valuation is justified by its growth prospects.

- Revenue vs. expenses: Analyzing Palantir's revenue growth against its operating expenses is crucial for understanding its profitability and path to sustainable earnings.

- Profit margin comparison to competitors: Benchmarking Palantir's profit margins against competitors reveals its position in the market regarding profitability and efficiency. Keywords: Palantir Valuation, PLTR Stock Price, Profitability of Palantir.

Dependence on Government Contracts

Palantir's reliance on government contracts exposes it to the inherent risks associated with government spending and political shifts. Changes in budgets or policy could significantly impact its revenue.

- Potential impact of political changes: Changes in government administrations or policy shifts can lead to contract cancellations or delays, negatively impacting Palantir's revenue and stock price.

- Risks of contract loss: The competitive bidding process for government contracts always carries the risk of losing bids, impacting revenue streams.

- Strategies to diversify revenue streams: Palantir's efforts to expand its commercial client base are critical for mitigating the risk of over-reliance on government contracts. Keywords: Government Contract Risk, Palantir Revenue Diversification.

Competitive Landscape and Market Saturation

The data analytics market is highly competitive, with established players and emerging startups vying for market share. Market saturation poses a threat to Palantir's growth potential.

- Key competitors: Analyzing Palantir's key competitors, their strengths and weaknesses, and their market strategies is crucial for assessing Palantir's competitive advantage.

- Market share analysis: Tracking Palantir's market share and comparing it to competitors helps gauge its growth potential and competitiveness.

- Potential barriers to entry: Assessing the barriers to entry in the data analytics market helps determine the potential for new competitors to challenge Palantir's position. Keywords: Palantir Competitors, Data Analytics Market Competition.

Conclusion

Investing in Palantir Stock before May 5th, or any date, requires careful consideration of both its strengths and risks. While its cutting-edge technology, growing commercial presence, and substantial government contracts offer significant potential, concerns remain regarding its valuation, dependence on government contracts, and the competitive market landscape. Thorough due diligence is crucial before making any investment decision. Remember to research further and make informed decisions about Palantir Stock based on your own risk tolerance and investment objectives. Consider consulting with a financial advisor before investing in Palantir Technologies. Further research into financial news outlets and Palantir's investor relations materials can offer more insights into Palantir Stock and its potential.

Featured Posts

-

Harry Styles 70s Inspired Mustache A London Appearance

May 09, 2025

Harry Styles 70s Inspired Mustache A London Appearance

May 09, 2025 -

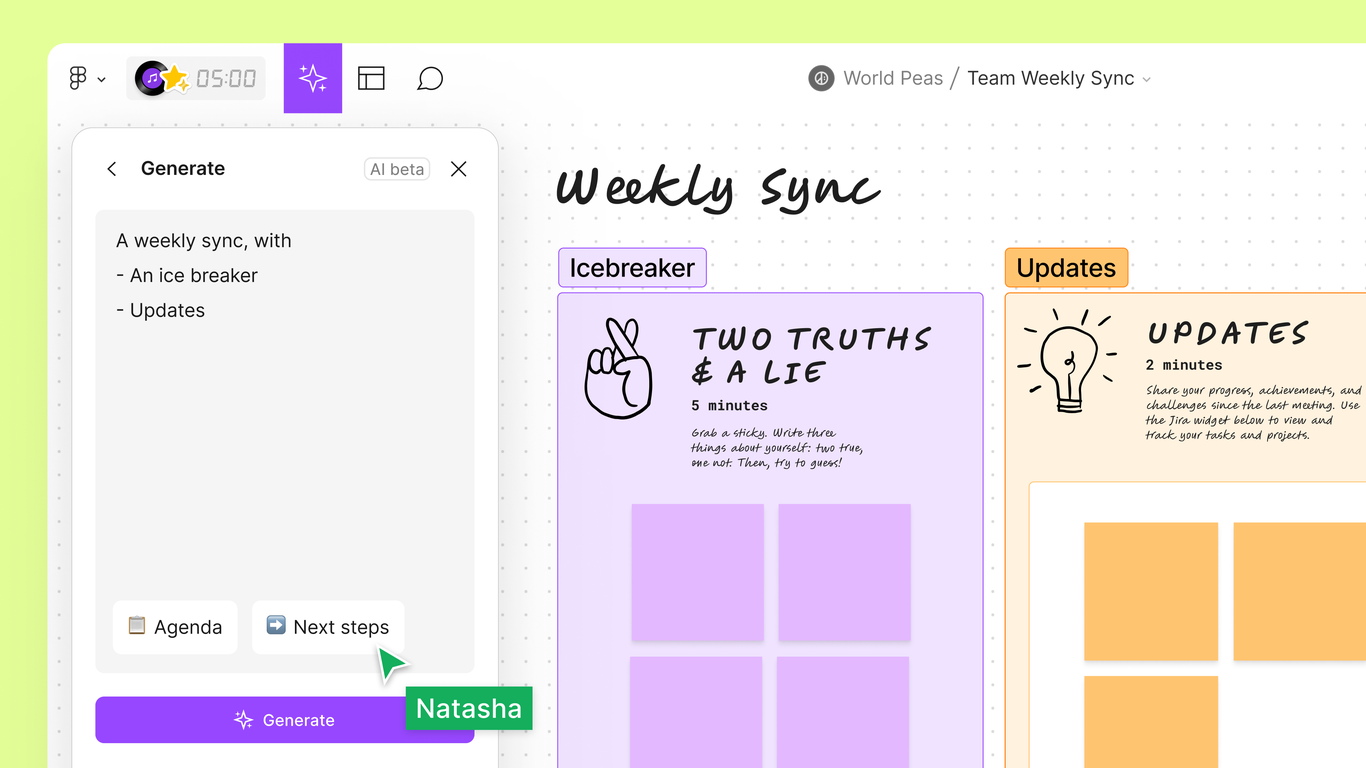

How Figmas Ai Is Disrupting Adobe Word Press And Canva

May 09, 2025

How Figmas Ai Is Disrupting Adobe Word Press And Canva

May 09, 2025 -

Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025

Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025 -

Young Thugs Loyalty Vow To Mariah The Scientist A New Snippet Emerges

May 09, 2025

Young Thugs Loyalty Vow To Mariah The Scientist A New Snippet Emerges

May 09, 2025 -

Golden Knights Defeat Blue Jackets 4 0 Hills Stellar Performance Leads The Way

May 09, 2025

Golden Knights Defeat Blue Jackets 4 0 Hills Stellar Performance Leads The Way

May 09, 2025