Palantir Technology Stock: A Pre-May 5th Investment Analysis

Table of Contents

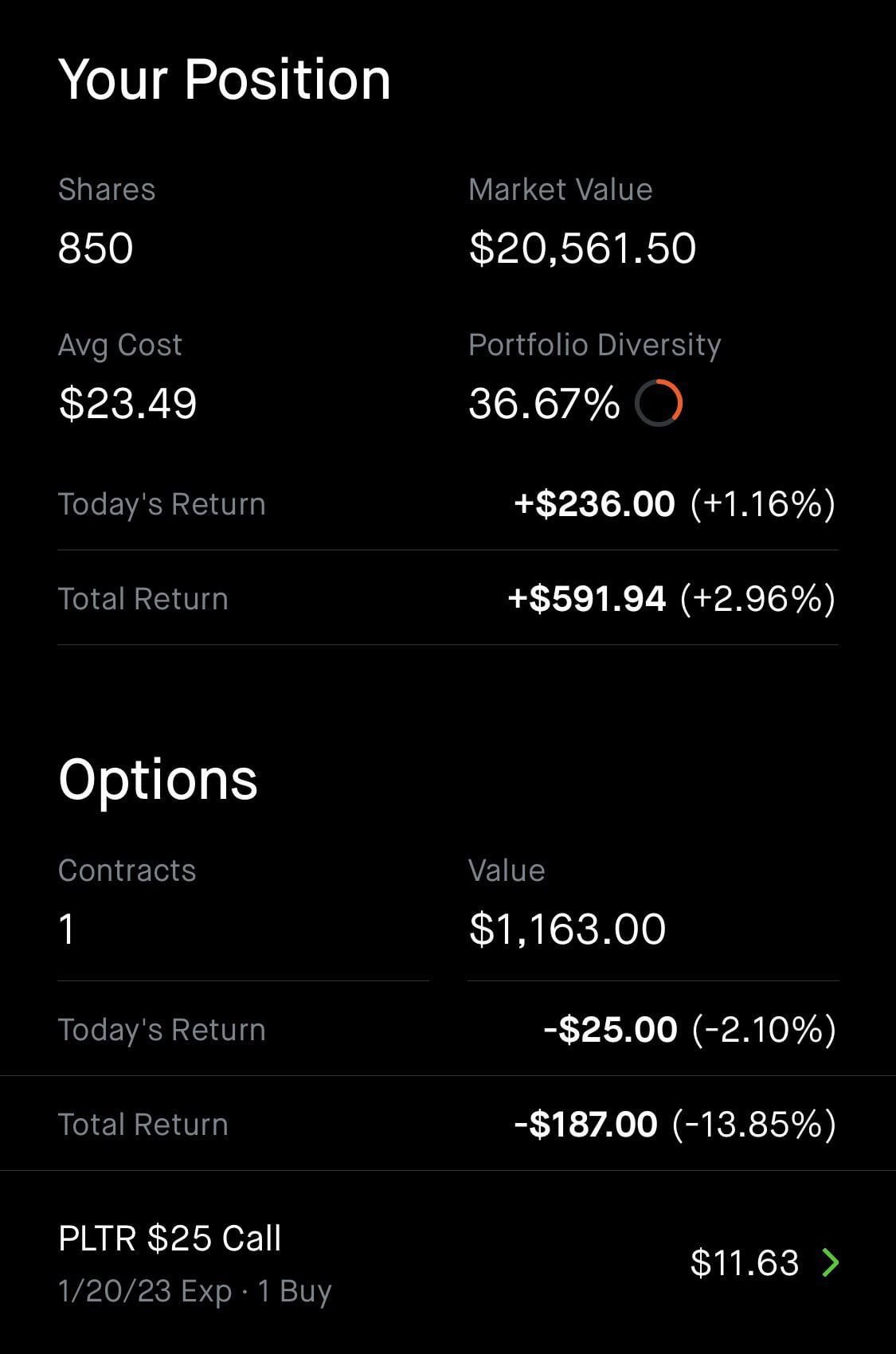

The Palantir Technologies stock (PLTR) has experienced significant price fluctuations, making it a compelling yet risky investment. This analysis delves into the crucial factors to consider before investing in PLTR stock, particularly in the period leading up to May 5th. We will examine the company's recent performance, future projections, and inherent risks to help you determine if Palantir stock aligns with your investment strategy.

Recent Financial Performance and Key Metrics

Revenue Growth and Profitability

Palantir's recent financial reports reveal a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus for investors. Examining the quarterly and annual reports reveals important trends.

- Q4 2023 Revenue: [Insert Actual Figure] showing a [Percentage]% increase year-over-year. This growth is primarily driven by [mention specific factors, e.g., increased government contracts, successful commercial partnerships].

- Gross Margin: [Insert Actual Figure] indicating [Analysis of the margin, e.g., improvement, stagnation, decline]. This can be attributed to [mention reasons behind margin changes].

- Operating Margin: [Insert Actual Figure], suggesting [Analysis of the margin, e.g., increasing profitability, ongoing investment in growth].

- Net Income: [Insert Actual Figure] highlighting [Analysis of the income, e.g., a move toward profitability, continued losses]. This should be compared to industry benchmarks for a fair assessment.

Cash Flow and Debt

Analyzing Palantir's cash flow provides insight into its financial health and ability to fund future growth.

- Cash Flow from Operations: [Insert Actual Figure], suggesting [Analysis of cash flow, e.g., strong operational cash generation, reliance on financing].

- Free Cash Flow: [Insert Actual Figure], which indicates [Analysis of free cash flow, e.g., the company's ability to reinvest in its business, potential for dividend payments or share buybacks].

- Debt-to-Equity Ratio: [Insert Actual Figure], showing [Analysis of debt levels, e.g., a manageable level of debt, potential concerns about high leverage]. This is a crucial metric to assess the company's financial risk.

Customer Acquisition and Retention

Palantir's success hinges on its ability to attract and retain customers in both the government and commercial sectors.

- Key Customer Wins: [Mention significant new customer acquisitions, highlighting their impact on revenue]. This demonstrates Palantir's success in penetrating new markets.

- Customer Retention Rate: [Insert data if available], indicating [Analysis of retention rate, e.g., strong customer loyalty, potential challenges in retaining clients]. A high retention rate is critical for sustainable growth.

- Customer Concentration: [Discuss the concentration of revenue from a few key customers, highlighting potential risks]. Diversification of the customer base is crucial to mitigate this risk.

Future Growth Prospects and Market Position

Market Opportunities and Competitive Landscape

Palantir operates in the rapidly expanding market for data analytics and AI-powered platforms. However, competition is fierce.

- Market Size and Growth: [Insert market size data and growth projections]. This showcases the potential for significant growth within the industry.

- Competitive Advantages: Palantir's strengths lie in its [mention key differentiators, e.g., sophisticated data integration capabilities, focus on specific sectors like government and finance].

- Key Competitors: Major players like AWS, Microsoft, and Google pose significant competitive threats. Palantir needs to continuously innovate to maintain its edge.

Product Innovation and Development

Palantir's ongoing investment in R&D is crucial for its future success.

- New Product Launches: [Mention any recent product launches or significant upgrades, highlighting their potential impact]. This demonstrates Palantir's commitment to innovation.

- Product Roadmap: [Discuss the company's product roadmap and future development plans]. This allows investors to anticipate future growth opportunities.

- Adoption Rates: [Discuss the adoption rates of existing and new products]. This shows the market's response to Palantir's offerings.

Government Contracts and Commercial Expansion

Palantir's revenue stream depends significantly on government contracts and its success in expanding into the commercial sector.

- Government Contract Pipeline: [Discuss the size and stability of the government contract pipeline]. This provides insights into the predictability of future revenue streams.

- Commercial Sector Growth: [Analyze the progress Palantir is making in expanding its commercial customer base]. This is essential for long-term sustainability.

- Geographic Diversification: [Discuss Palantir's geographic reach and future expansion plans]. This mitigates risks associated with relying on a single region.

Risk Factors and Potential Challenges

Dependence on Government Contracts

Palantir's reliance on government contracts poses a significant risk.

- Percentage of Revenue from Government Contracts: [Insert the percentage]. This highlights the vulnerability to changes in government spending.

- Political Risk: Changes in government policy or budget cuts could significantly impact Palantir's revenue.

- Geopolitical Events: Global events can also affect government spending priorities, influencing Palantir's prospects.

Competition and Market Saturation

The data analytics and AI market is highly competitive, with established players and new entrants constantly vying for market share.

- Competitive Pressure: The intense competition from large tech companies puts pressure on Palantir's pricing and market share.

- Market Saturation: The potential for market saturation could limit Palantir's future growth opportunities.

- Technological Disruption: Rapid technological advancements could render Palantir's technology obsolete.

Valuation and Stock Price Volatility

Palantir's stock price has been highly volatile. Investors need to carefully evaluate its valuation.

- P/E Ratio: [Insert the P/E ratio and compare it to industry benchmarks]. A high P/E ratio may indicate an overvalued stock.

- P/S Ratio: [Insert the P/S ratio and compare it to industry benchmarks]. This provides another measure of valuation.

- Future Price Volatility: Various factors, including market sentiment, financial performance, and competitive pressures, can significantly influence the future volatility of the stock price.

Conclusion

This pre-May 5th analysis of Palantir Technologies stock (PLTR) presents a nuanced picture. While Palantir possesses cutting-edge technology and promising growth potential, investors must carefully weigh the substantial risks involved, such as its dependence on government contracts and the intense competition within the data analytics market. Before making any investment decisions regarding PLTR stock, thorough due diligence is crucial. Consider your risk tolerance and consult with a financial advisor. Is Palantir the right investment for you? Only through comprehensive research can you make an informed decision about Palantir stock.

Featured Posts

-

Black Rock Etf A Billionaires Play For A Potential 110 Return In 2025

May 09, 2025

Black Rock Etf A Billionaires Play For A Potential 110 Return In 2025

May 09, 2025 -

How Figmas Ai Is Disrupting Adobe Word Press And Canva

May 09, 2025

How Figmas Ai Is Disrupting Adobe Word Press And Canva

May 09, 2025 -

West Ham Face 25m Financial Gap How Will They Plug It

May 09, 2025

West Ham Face 25m Financial Gap How Will They Plug It

May 09, 2025 -

Luis Enriques Psg Transformation How They Secured The Ligue 1 Win

May 09, 2025

Luis Enriques Psg Transformation How They Secured The Ligue 1 Win

May 09, 2025 -

Should You Buy Pltr Stock Before May 5th A Data Driven Approach

May 09, 2025

Should You Buy Pltr Stock Before May 5th A Data Driven Approach

May 09, 2025