Personal Loan Interest Rates Today: Financing Starting Under 6%

Table of Contents

Factors Affecting Your Personal Loan Interest Rate

Several key factors determine the personal loan interest rate you'll receive. Understanding these factors is crucial for securing the most favorable terms.

Credit Score: The Cornerstone of Your Rate

Your credit score is arguably the most significant factor influencing your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, how likely you are to repay the loan.

- Excellent Credit (750+): Expect significantly lower interest rates, potentially in the range of 6% to 10%, or even lower.

- Good Credit (700-749): You'll likely qualify for competitive rates, but they may be slightly higher than those for excellent credit.

- Fair Credit (650-699): Expect higher interest rates, possibly in the 10% to 20% range.

- Poor Credit (Below 650): Securing a loan may be challenging, and you'll likely face significantly higher interest rates, if approved at all.

Improving your credit score can dramatically lower your interest rate. Focus on paying bills on time, keeping your credit utilization low (the amount of credit you're using compared to your total available credit), and avoiding new credit applications.

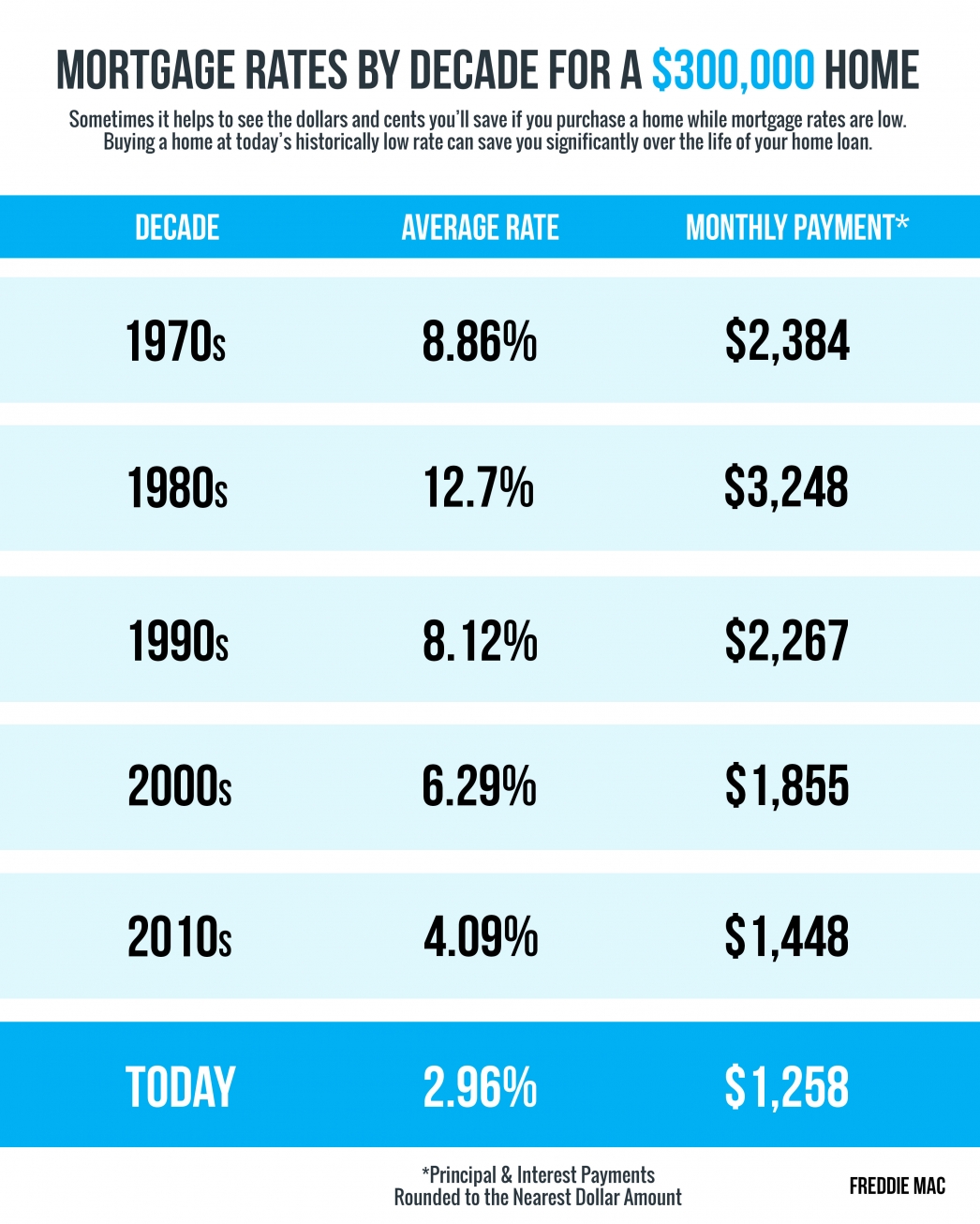

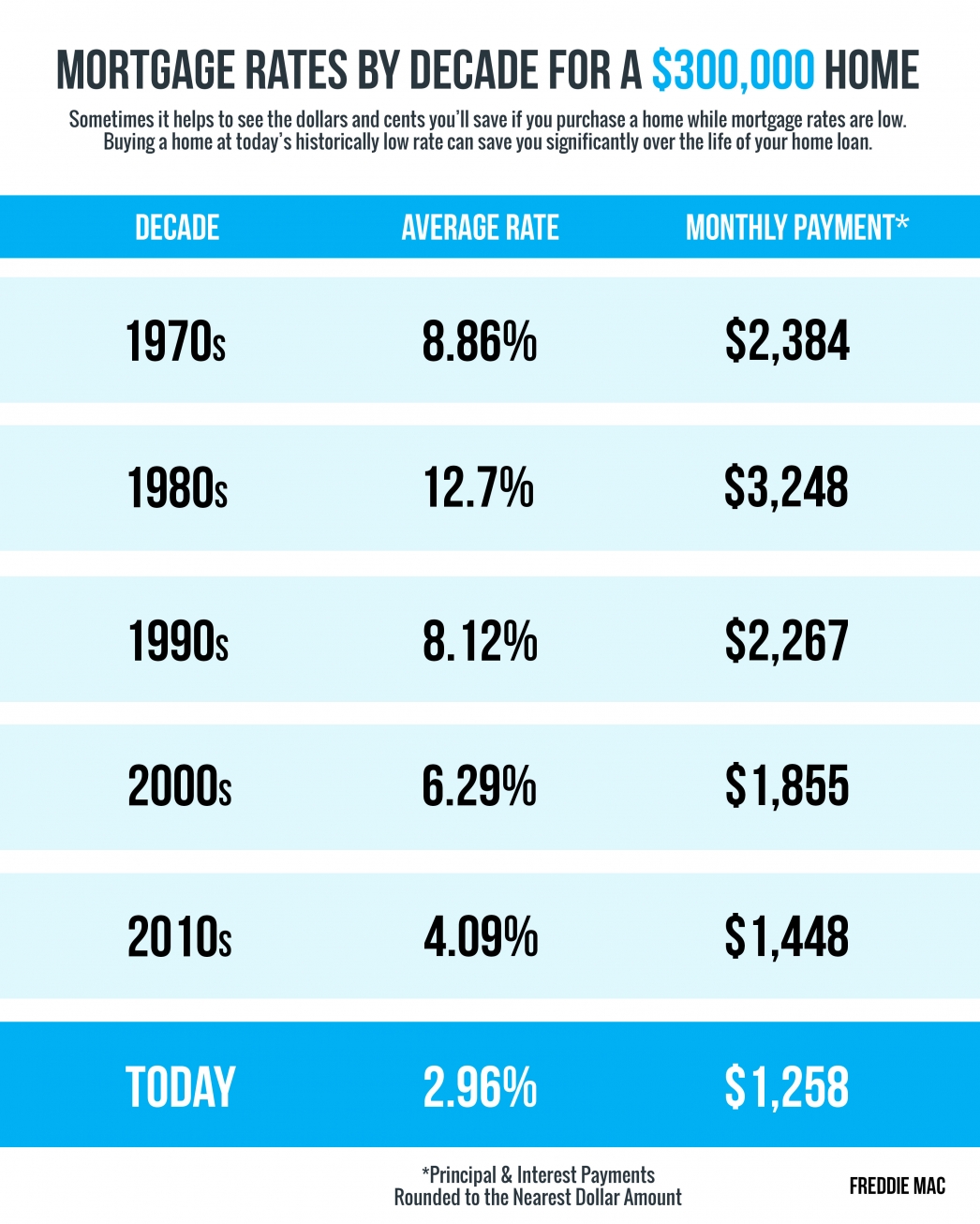

Loan Amount and Term: Balancing Payments and Interest

The amount you borrow and the loan repayment term (the length of time you have to repay the loan) both impact your interest rate.

- Loan Amount: Larger loan amounts often come with slightly higher interest rates.

- Loan Term: A shorter loan term generally results in higher monthly payments but lower overall interest paid. Conversely, a longer term leads to lower monthly payments but higher total interest.

For example, a $10,000 loan over 3 years will have higher monthly payments but less total interest than the same loan spread over 5 years. Carefully consider your budget and financial goals when choosing a loan term.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lenders offer varying interest rates.

- Banks: Often offer competitive rates, but their application process may be more rigorous.

- Credit Unions: May offer lower rates than banks, particularly to their members, but membership requirements might apply.

- Online Lenders: Can offer convenient application processes and sometimes competitive rates, but thoroughly research their reputation and fees.

Comparing offers from multiple lenders is key to finding the best personal loan rates today.

Debt-to-Income Ratio (DTI): Managing Your Financial Obligations

Your debt-to-income ratio (DTI), which is the percentage of your gross monthly income that goes towards debt payments, also plays a role. A lower DTI suggests you have more capacity to manage additional debt, making you a less risky borrower.

- Improve Your DTI: Reduce existing debt, increase your income, or both, to improve your DTI and increase your chances of securing a lower interest rate.

Types of Personal Loans and Their Interest Rates

Several types of personal loans exist, each with its own interest rate implications.

Unsecured Personal Loans

These loans don't require collateral. Interest rates depend on your creditworthiness, but they are generally higher than secured loans due to the increased risk for the lender.

- Advantages: No collateral required.

- Disadvantages: Higher interest rates compared to secured loans.

Secured Personal Loans

These loans use collateral (like a car or savings account) to secure the loan. The collateral reduces the risk for the lender, often resulting in lower interest rates.

- Advantages: Lower interest rates due to reduced risk.

- Disadvantages: Risk of losing your collateral if you default on the loan.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending connects borrowers with individual lenders through an online platform. Interest rates can be competitive, but it's crucial to thoroughly research the platform and understand its fees and risks.

How to Find the Best Personal Loan Interest Rates

Finding the best personal loan interest rate requires careful planning and comparison.

Shop Around and Compare

Don't settle for the first offer you receive. Compare offers from multiple banks, credit unions, and online lenders. Use online comparison tools to streamline the process and check lender reviews to ensure their reputation.

Negotiate

Don't be afraid to negotiate! If you have a strong credit score and have received competing offers with lower interest rates, use this leverage to negotiate a better rate with your preferred lender.

Check for Fees

Be aware of hidden fees that can significantly increase the overall cost of your loan. Check for origination fees, prepayment penalties, and other charges.

Conclusion

Securing a favorable personal loan interest rate depends on your credit score, loan amount, loan term, lender type, and DTI. By understanding these factors and diligently comparing offers from multiple lenders, you can significantly improve your chances of finding the best financing options, potentially securing a low interest personal loan with rates under 6%. Start comparing personal loan interest rates today and secure the financing you need at a competitive rate. Don't miss out on the opportunity to find low interest personal loan options! [Link to a loan comparison website]

Featured Posts

-

German Insider Rayan Cherki Update

May 28, 2025

German Insider Rayan Cherki Update

May 28, 2025 -

Winns Blast Leads Cardinals To Series Victory Against Diamondbacks

May 28, 2025

Winns Blast Leads Cardinals To Series Victory Against Diamondbacks

May 28, 2025 -

Bucks Pacers Game 5 Heated Exchange After Final Buzzer

May 28, 2025

Bucks Pacers Game 5 Heated Exchange After Final Buzzer

May 28, 2025 -

Hugh Jackman Deposition Rumors Fan Reactions To Blake Lively Legal Drama

May 28, 2025

Hugh Jackman Deposition Rumors Fan Reactions To Blake Lively Legal Drama

May 28, 2025 -

Dangerous Climate Whiplash A Report On Its Global City Impacts

May 28, 2025

Dangerous Climate Whiplash A Report On Its Global City Impacts

May 28, 2025

Latest Posts

-

Retraite Accord Possible Entre Le Rn Et La Gauche

May 30, 2025

Retraite Accord Possible Entre Le Rn Et La Gauche

May 30, 2025 -

La Moselle A L Assemblee Nationale Le Mandat De Laurent Jacobelli

May 30, 2025

La Moselle A L Assemblee Nationale Le Mandat De Laurent Jacobelli

May 30, 2025 -

Laurent Jacobelli Rn Un Regard Sur Son Action Politique

May 30, 2025

Laurent Jacobelli Rn Un Regard Sur Son Action Politique

May 30, 2025 -

Comprendre Le Role De Laurent Jacobelli A L Assemblee Nationale

May 30, 2025

Comprendre Le Role De Laurent Jacobelli A L Assemblee Nationale

May 30, 2025 -

Assemblee Nationale Laurent Jacobelli Un Depute Rn Influent

May 30, 2025

Assemblee Nationale Laurent Jacobelli Un Depute Rn Influent

May 30, 2025