Personal Loan Interest Rates Today: Find Your Lowest Rate

Table of Contents

Understanding Personal Loan Interest Rates

Understanding the terminology and factors affecting personal loan interest rates is the first step towards securing a favorable loan.

-

APR (Annual Percentage Rate): This is the annual interest rate charged on your loan, including all fees and charges. A lower APR translates to lower overall borrowing costs. Always compare APRs, not just interest rates, when shopping for a loan.

-

Fixed vs. Variable Interest Rates: A fixed interest rate remains constant throughout the loan term, providing predictable monthly payments. A variable interest rate fluctuates with market conditions, potentially leading to unpredictable payments. Fixed-rate loans offer stability, while variable-rate loans might offer initially lower rates but come with increased risk.

-

Factors Influencing Interest Rates: Several factors significantly impact the interest rate you'll qualify for:

-

Credit Score: Your credit score is a crucial determinant. A higher score (excellent or good) typically qualifies you for lower rates, while a lower score (fair or poor) will likely result in higher rates or even loan rejection.

-

Loan Amount and Term Length: Larger loan amounts and longer terms generally come with higher interest rates due to increased risk for the lender.

-

Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, indicates your ability to manage additional debt. A lower DTI improves your chances of securing a lower interest rate.

-

Type of Lender: Banks, credit unions, and online lenders often have different lending criteria and interest rate structures. Credit unions sometimes offer more competitive rates for their members.

-

Current Economic Conditions: Inflation, the prime rate, and overall economic stability significantly impact interest rates across the board. During periods of economic uncertainty, rates tend to be higher.

-

-

Comparing Rates: It's imperative to compare rates from multiple lenders before committing to a loan. Don't settle for the first offer you receive; shop around to ensure you're getting the best possible deal.

How to Find the Lowest Personal Loan Interest Rates Today

Finding the lowest personal loan interest rates requires a strategic approach.

-

Use Online Comparison Tools: Numerous online platforms offer comparison tools and loan calculators to help you quickly compare rates from various lenders.

-

Check Your Credit Report: Before applying for a loan, obtain a copy of your credit report from the major credit bureaus (Equifax, Experian, and TransUnion) to check for errors and understand your credit score.

-

Improve Your Credit Score: If your credit score is less than ideal, take steps to improve it before applying for a loan. This will significantly enhance your chances of securing a lower interest rate. Focus on paying down debt, making timely payments, and maintaining a healthy credit utilization ratio.

-

Apply Strategically: Gather all necessary documents (proof of income, identification, etc.) before applying. Complete applications accurately and thoroughly to avoid delays.

-

Pre-qualification vs. Formal Application: Pre-qualification allows you to check your eligibility and get a rate estimate without impacting your credit score. A formal application involves a hard credit inquiry, so proceed only when ready to commit.

-

Read the Fine Print: Always read the loan agreement meticulously before signing. Understand all terms, conditions, and fees to avoid surprises.

Types of Personal Loans and Their Interest Rates

Different types of personal loans carry varying interest rates.

-

Unsecured vs. Secured Loans: Unsecured loans don't require collateral, resulting in higher interest rates due to increased risk for the lender. Secured loans, backed by collateral (like a car or savings account), typically offer lower rates.

-

Loan Purpose: The purpose of your loan can also influence the interest rate. Some lenders offer specialized loans (e.g., debt consolidation loans, home improvement loans) with potentially lower rates for specific purposes.

-

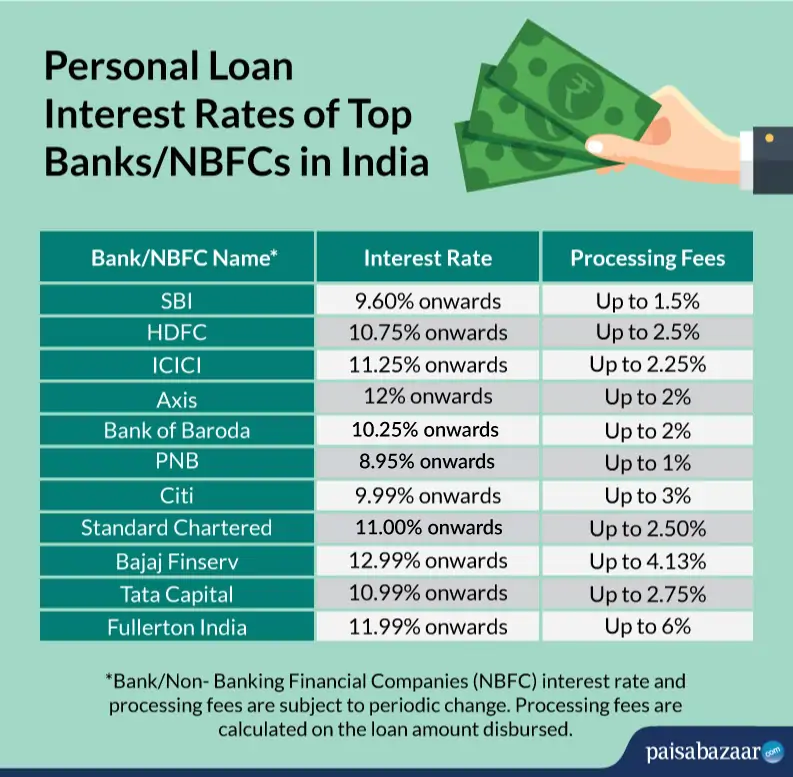

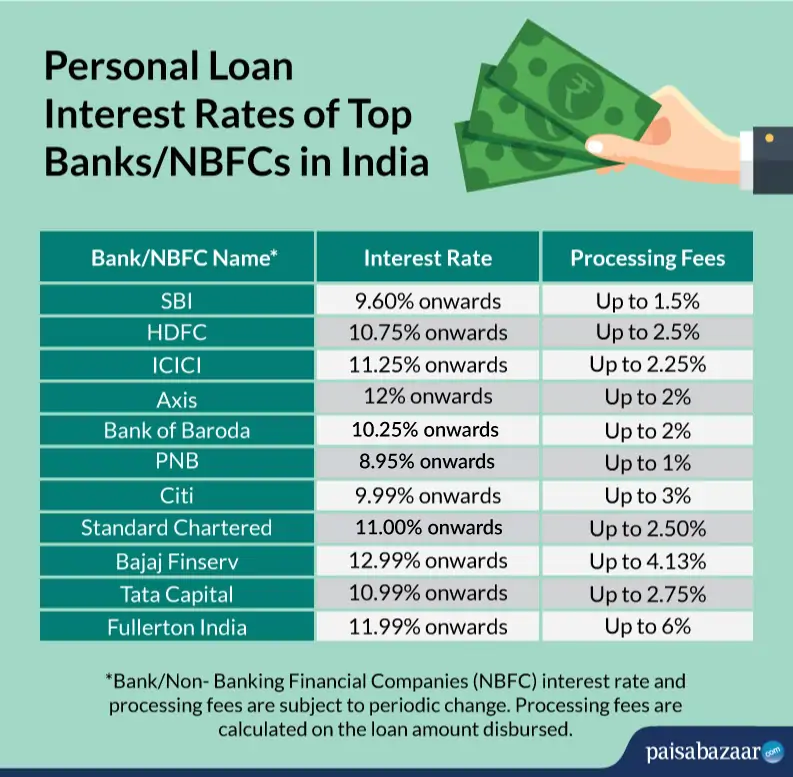

Average Interest Rates (Ranges): Interest rates vary greatly depending on the factors mentioned above, but you can generally expect the following ranges (these are estimates and may vary):

- Unsecured personal loans: 6% - 36% APR

- Secured personal loans: 4% - 24% APR

- Debt consolidation loans: 6% - 24% APR

- Home improvement loans: 5% - 20% APR

Negotiating a Lower Personal Loan Interest Rate

While securing a low interest rate is important, it's sometimes possible to negotiate even better terms.

-

Strong Financial Profile: A strong credit score and low DTI significantly improve your negotiating position.

-

Competing Offers: If you have multiple loan offers from different lenders, use them to negotiate a better rate with your preferred lender. Show them you have other options.

-

Loyalty Programs/Special Offers: Check if your bank or credit union offers any loyalty programs or special promotions that might lead to lower interest rates.

Secure Your Best Personal Loan Interest Rates Today

Finding the best personal loan interest rates requires understanding the factors influencing rates, diligent research, and strategic application. By comparing rates from multiple lenders, improving your credit score, and negotiating effectively, you can secure a loan with terms that meet your financial needs. Don't delay; start comparing personal loan rates now and find the lowest personal loan rates available to you. Use online comparison tools and remember that securing the best personal loan interest rates is a process that requires preparation and informed decision-making. Start your search for low interest personal loans today!

Featured Posts

-

Brewers Vs Diamondbacks Prediction Picks And Odds For Todays Mlb Game

May 28, 2025

Brewers Vs Diamondbacks Prediction Picks And Odds For Todays Mlb Game

May 28, 2025 -

Pacers Vs Knicks Game 1 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025

Pacers Vs Knicks Game 1 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025 -

Examining Nintendos Recent Decisions And Their Impact

May 28, 2025

Examining Nintendos Recent Decisions And Their Impact

May 28, 2025 -

Freeway Series Angels Triumph Over Dodgers With Series Sweep

May 28, 2025

Freeway Series Angels Triumph Over Dodgers With Series Sweep

May 28, 2025 -

Real Madrids 2 0 Victory Over Sevilla Instant Reactions And Match Breakdown

May 28, 2025

Real Madrids 2 0 Victory Over Sevilla Instant Reactions And Match Breakdown

May 28, 2025

Latest Posts

-

Laurent Jacobelli Activites Et Prises De Position A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Activites Et Prises De Position A L Assemblee Nationale

May 30, 2025 -

Biographie Et Mandat De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025

Biographie Et Mandat De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025 -

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025 -

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025 -

Andre Agassi Su Segundo Servicio En El Mundo Del Deporte

May 30, 2025

Andre Agassi Su Segundo Servicio En El Mundo Del Deporte

May 30, 2025