Personal Loan Interest Rates Today: How To Get The Lowest Rate

Table of Contents

Factors Influencing Personal Loan Interest Rates Today

Several key factors determine the personal loan interest rates you'll be offered. Understanding these is crucial to getting the lowest interest rates.

Your Credit Score: The Cornerstone of Your Rate

Your credit score is arguably the biggest factor influencing your personal loan interest rates. Lenders use your credit score, a three-digit number (typically a FICO score), to assess your creditworthiness – your ability to repay borrowed money. A higher credit score signifies lower risk to the lender, resulting in lower interest rates.

-

Credit Score Ranges and Interest Rate Implications:

- 750 and above (Excellent): Access to the best personal loan rates.

- 700-749 (Good): Competitive interest rates.

- 650-699 (Fair): Higher interest rates, potentially stricter lending criteria.

- Below 650 (Poor): Significantly higher interest rates, loan approval may be difficult.

-

Improving Your Credit Score:

- Check your credit report regularly for errors and dispute any inaccuracies.

- Pay all bills on time, consistently. This is the single most important factor.

- Reduce your debt-to-credit ratio by paying down existing debt.

- Avoid opening multiple new credit accounts within a short period.

Loan Amount and Term: Size and Duration Matter

The amount you borrow and the repayment period you choose also significantly impact your personal loan interest rates. Generally:

-

Larger loan amounts: Typically come with higher interest rates.

-

Longer loan terms: Result in higher total interest paid, although monthly payments are lower.

-

Examples:

- A $5,000 loan over 12 months might have a lower interest rate than a $20,000 loan over 60 months.

- A $10,000 loan over 36 months will likely have a higher monthly payment but a lower overall interest rate than the same loan over 60 months.

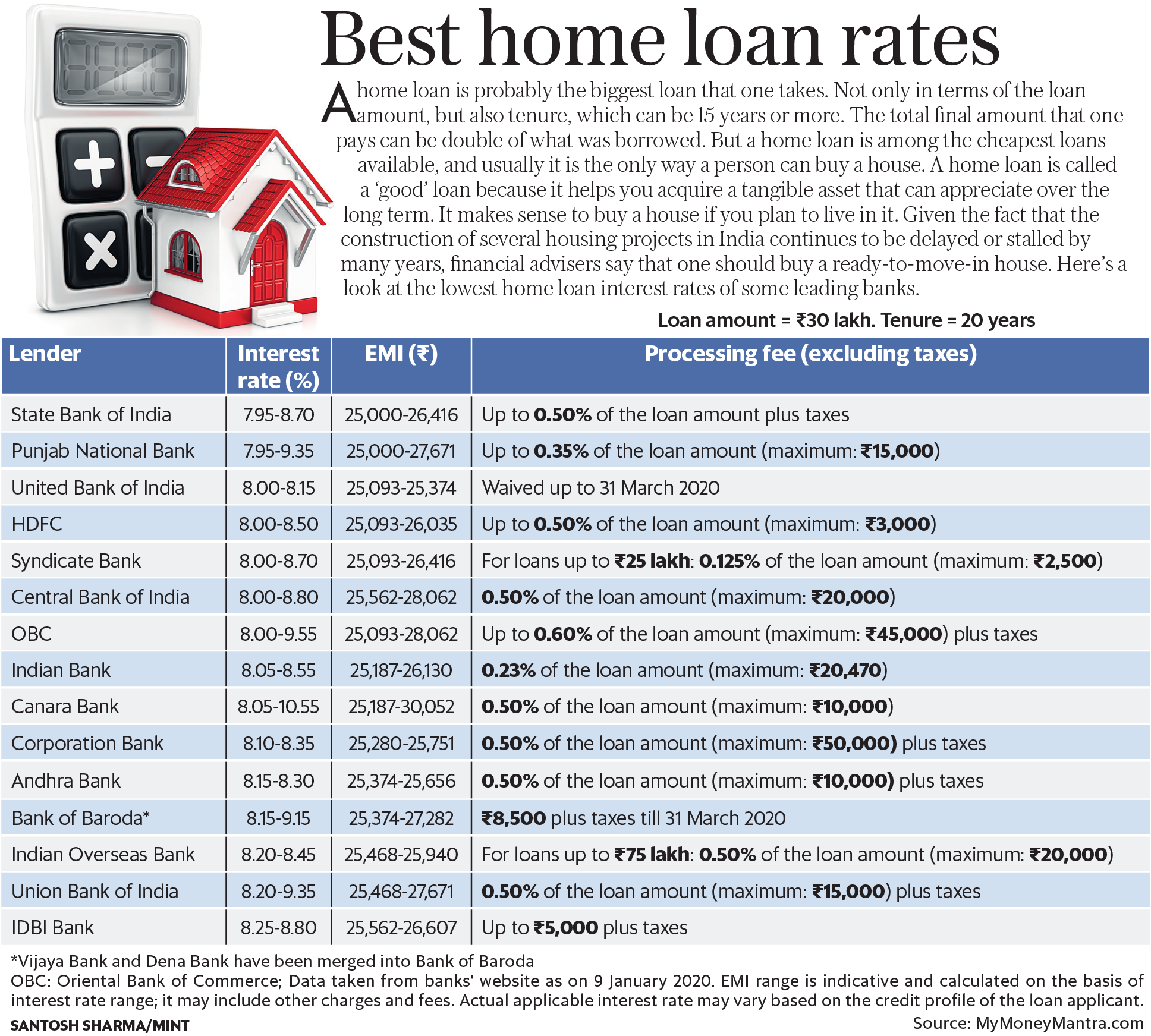

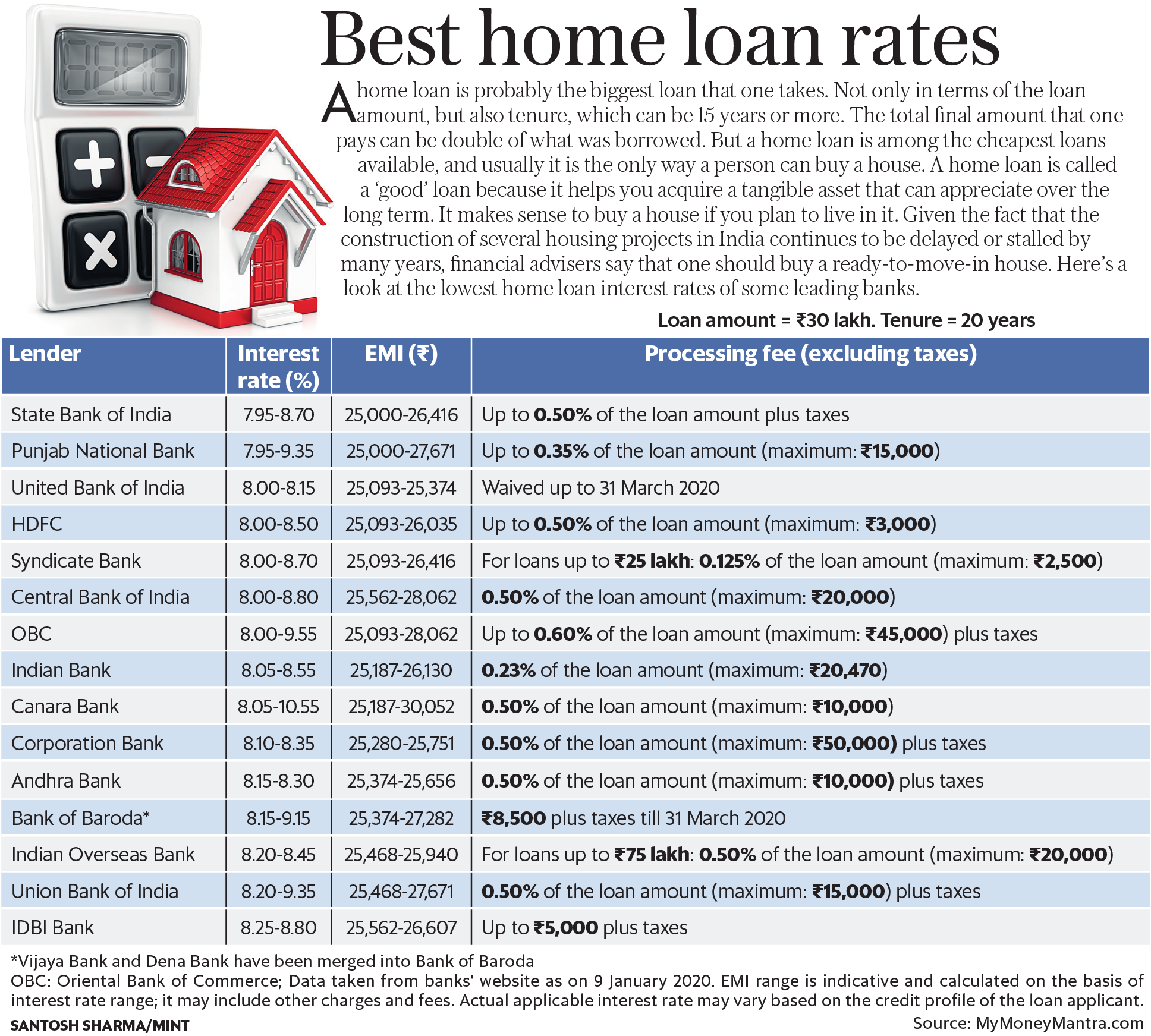

Lender Type: Banks, Credit Unions, and Online Lenders

Different types of lenders offer varying personal loan interest rates and terms.

-

Banks: Often have competitive rates for borrowers with excellent credit but may have stricter requirements.

-

Credit Unions: May offer slightly lower rates to their members, especially for those with good credit, and often prioritize member service.

-

Online Lenders: Can offer convenient application processes but may have higher rates or stricter requirements for less-than-perfect credit. Always check fees carefully.

-

Loan Comparison: It's crucial to compare offers from multiple lenders before making a decision.

Debt-to-Income Ratio (DTI): A Key Financial Indicator

Your debt-to-income ratio (DTI) – the percentage of your gross monthly income that goes towards debt payments – is another vital factor. A high DTI indicates you’re already carrying a substantial debt burden, making lenders less confident in your ability to repay a new loan.

- Lowering Your DTI:

- Pay down existing high-interest debt.

- Create a realistic budget to track income and expenses.

- Explore debt consolidation options to simplify repayments.

Strategies to Get the Lowest Personal Loan Interest Rates

Now that we understand the influencing factors, let’s discuss strategies to secure the best personal loan rates.

Improve Your Credit Score: A Proactive Approach

We've already highlighted the importance of a good credit score. Actively work to improve yours:

- Pay Bills on Time: This is paramount for a good credit score. Set up automatic payments to avoid late payments.

- Reduce Credit Utilization: Keep your credit card balances low compared to your credit limits. Aim for below 30%.

- Monitor Your Credit Report: Regularly review your credit report from all three major bureaus (Equifax, Experian, and TransUnion) to identify and address any errors.

Shop Around and Compare Offers: Don't Settle for the First Offer

Comparing loan offers is vital to getting the lowest personal loan interest rates.

- Use Online Comparison Tools: Many websites allow you to compare rates from multiple lenders simultaneously.

- Contact Lenders Directly: Don't hesitate to reach out to lenders to discuss your options and negotiate.

- Understand Loan Terms: Carefully review the terms and conditions of each loan offer, including fees, interest rates, and repayment schedules.

Negotiate with Lenders: Your Bargaining Power

If you have a strong credit score and multiple offers from different lenders, you may have leverage to negotiate a lower interest rate.

- Present Competing Offers: Show lenders you've shopped around and have better offers elsewhere.

- Highlight Your Financial Stability: Emphasize your strong credit history and responsible financial management.

Consider Secured Loans: Lower Risk, Lower Rates

Secured loans, which require collateral (like a car or savings account) to secure the loan, often come with lower interest rates than unsecured loans because the lender has less risk.

- Understand the Risks: If you default on a secured loan, you risk losing the collateral.

Conclusion: Finding Your Best Personal Loan Rate

Securing the lowest personal loan interest rates requires understanding the factors that influence them and proactively taking steps to improve your financial standing. A high credit score, comparing loan offers, and negotiating are essential. Remember to consider your debt-to-income ratio and carefully weigh the pros and cons of secured versus unsecured loans. Start comparing rates now and find the lowest personal loan interest rates today to secure your best personal loan rate! Use online comparison tools to help streamline the process.

Featured Posts

-

Padres Arraez Out 7 Day Concussion Injured List

May 28, 2025

Padres Arraez Out 7 Day Concussion Injured List

May 28, 2025 -

Arsenal Gyoekeres Atigazolas Szamok Adatok Elemzes

May 28, 2025

Arsenal Gyoekeres Atigazolas Szamok Adatok Elemzes

May 28, 2025 -

Analysis Sinners Path To French Open Success

May 28, 2025

Analysis Sinners Path To French Open Success

May 28, 2025 -

300k Euro Millions Prize National Lotterys Five Day Claim Deadline Notice

May 28, 2025

300k Euro Millions Prize National Lotterys Five Day Claim Deadline Notice

May 28, 2025 -

Hailee Steinfelds Sharp Gma Look Suit Style And More

May 28, 2025

Hailee Steinfelds Sharp Gma Look Suit Style And More

May 28, 2025

Latest Posts

-

Andre Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Adevarul Din Spatele Succesului

May 30, 2025

Andre Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Adevarul Din Spatele Succesului

May 30, 2025 -

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025 -

Tenis Declaratia Sincera A Lui Andre Agassi Despre Anxietate

May 30, 2025

Tenis Declaratia Sincera A Lui Andre Agassi Despre Anxietate

May 30, 2025 -

Agassi Dezvaluie Stresul Inainte De Meciuri Era Coplesitor

May 30, 2025

Agassi Dezvaluie Stresul Inainte De Meciuri Era Coplesitor

May 30, 2025 -

Steffi Graf Neuer Sport Und Die Ehe Mit Andre Agassi

May 30, 2025

Steffi Graf Neuer Sport Und Die Ehe Mit Andre Agassi

May 30, 2025