Personal Loan Interest Rates: Your Guide To Finding The Best Deal Today

Table of Contents

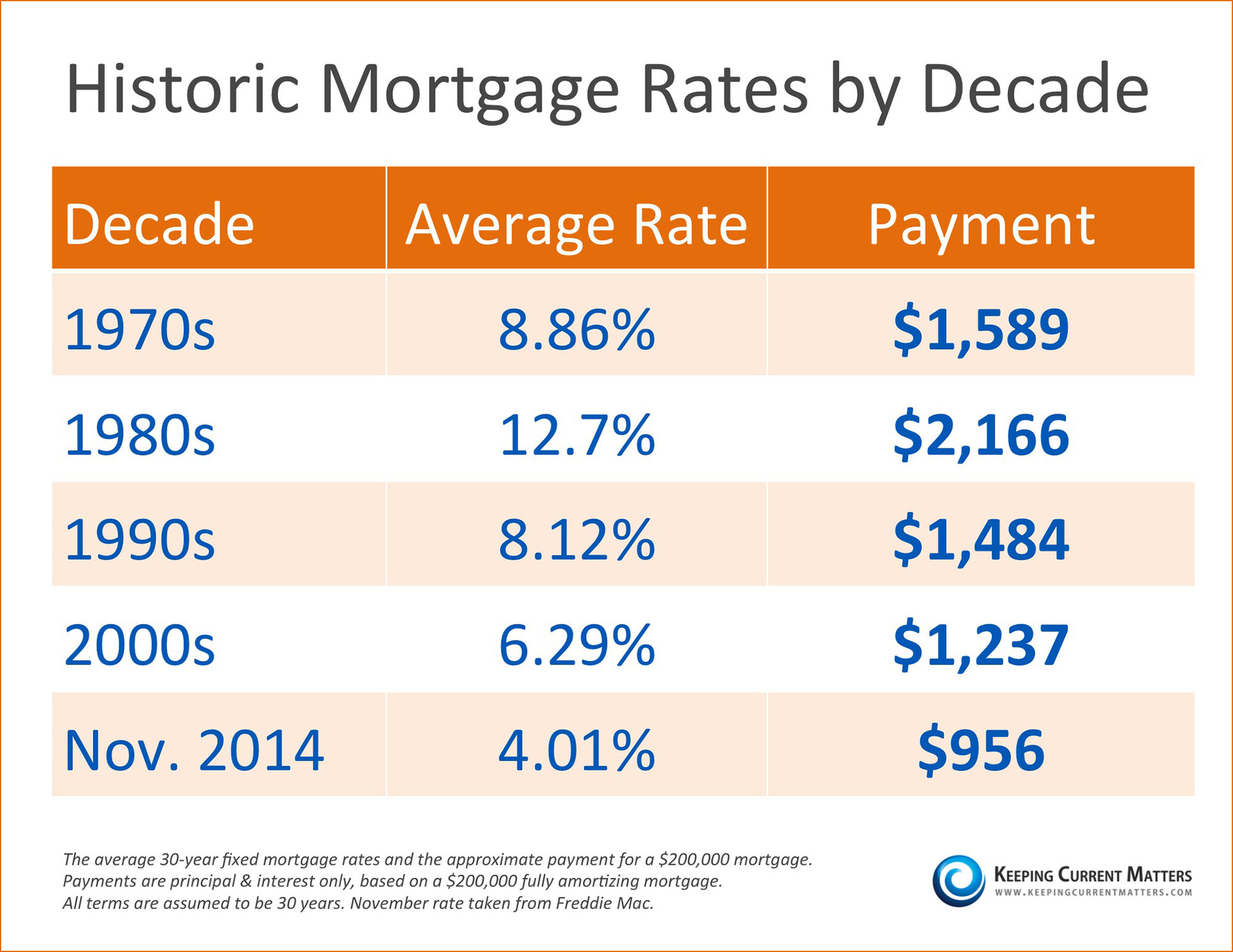

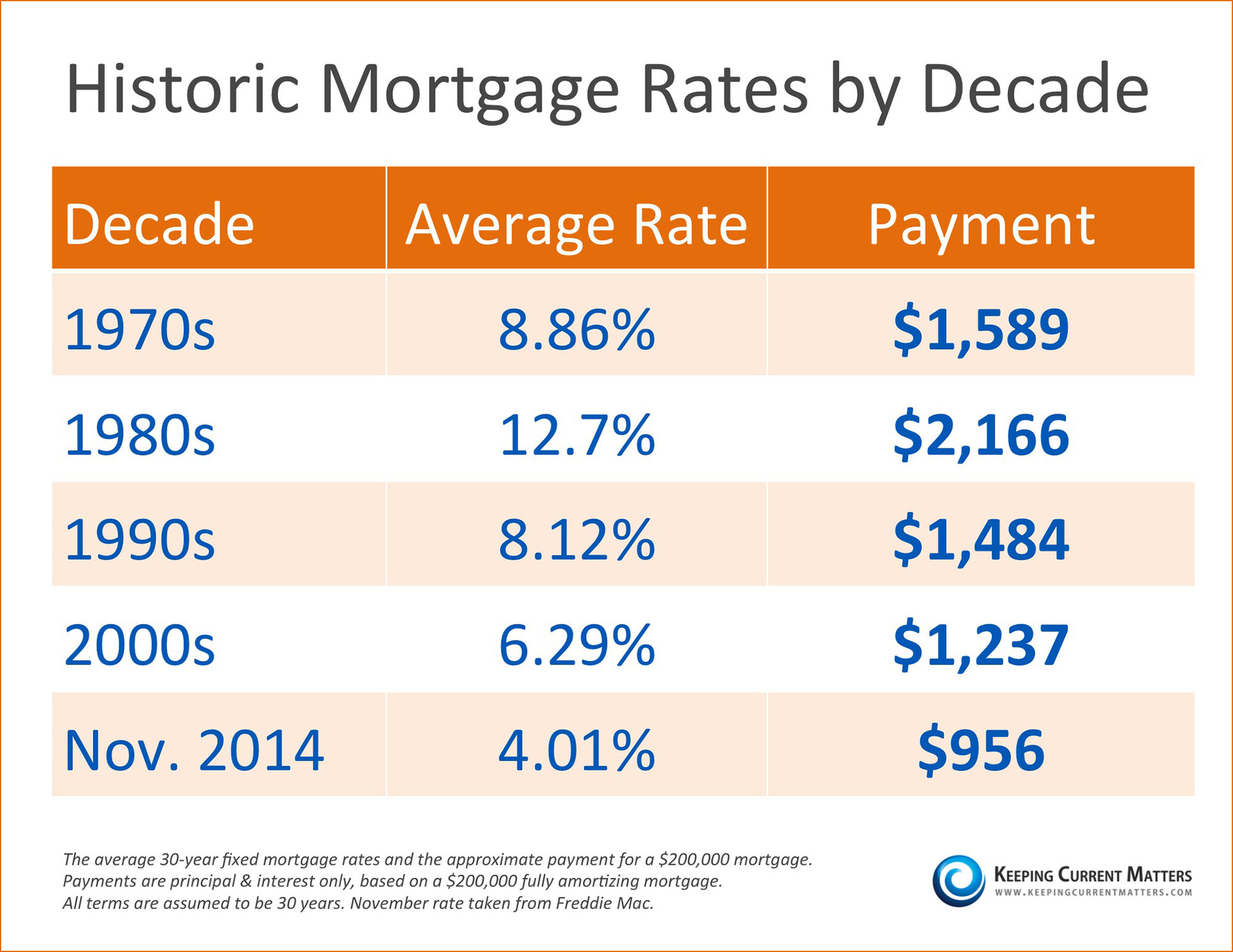

Personal loan interest rates represent the cost of borrowing money. The lower the rate, the less you'll pay in interest over the loan's term. Understanding how these rates are determined is essential to securing a loan that aligns with your budget and financial goals.

Factors Affecting Your Personal Loan Interest Rate

Several key factors influence the personal loan interest rate you'll receive. Let's explore the most important ones:

Credit Score

Your credit score is arguably the most significant factor determining your personal loan interest rate. Lenders use your credit score, often your FICO score, to assess your creditworthiness and risk.

- Higher Credit Score = Lower Interest Rate: A higher credit score indicates a lower risk to the lender, resulting in a more favorable interest rate.

- Credit Report Checks: Lenders will review your credit report from agencies like Equifax, Experian, and TransUnion, checking your payment history, credit utilization, and length of credit history.

- Impact of Payment History: Consistent on-time payments significantly improve your credit score and your chances of getting a low interest rate. Late or missed payments can severely impact your creditworthiness and increase your interest rate.

- Debt-to-Income Ratio (DTI): A high DTI, representing the percentage of your income used to pay debts, can negatively influence your interest rate.

Loan Amount and Term

The amount you borrow and the loan repayment period also impact your interest rate.

- Larger Loan Amounts: Generally, larger loan amounts may come with slightly higher interest rates due to the increased risk for the lender.

- Loan Term (Repayment Period): A longer loan term results in lower monthly payments, but you'll pay significantly more in total interest over the life of the loan. Shorter loan terms mean higher monthly payments but less interest paid overall. Carefully consider your budget and long-term financial goals when choosing a loan term.

Lender Type

Different types of lenders offer varying interest rates.

- Banks: Typically offer competitive rates, especially for borrowers with excellent credit.

- Credit Unions: Often provide lower interest rates than banks, particularly for members, but may have stricter eligibility criteria.

- Online Lenders: Can offer convenient application processes and potentially competitive rates, but always thoroughly research their reputation and fees.

- Peer-to-Peer Lending: This option connects borrowers with individual investors, potentially offering unique interest rate options, but requires careful consideration of risk. It's crucial to compare interest rates across different lenders to find the best option for your specific financial situation.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is a key indicator of your financial health and ability to repay a loan.

- DTI Definition: DTI is calculated by dividing your monthly debt payments by your gross monthly income.

- Lender Risk Assessment: Lenders use DTI to assess your risk. A high DTI suggests you may struggle to repay the loan, leading to higher interest rates or loan rejection.

- Improving DTI: To improve your DTI, consider strategies like debt consolidation to reduce your monthly payments or increase your income.

How to Find the Best Personal Loan Interest Rates

Finding the best personal loan interest rate requires proactive steps:

Shop Around and Compare

Never settle for the first offer you receive. Compare loan offers from multiple lenders.

- Loan Comparison Websites: Use online comparison tools to quickly see rates from various lenders.

- Contact Lenders Directly: Contact banks, credit unions, and online lenders to obtain personalized quotes.

- Pre-qualification Offers: Utilize pre-qualification offers to get an idea of your potential interest rate without impacting your credit score.

Negotiate with Lenders

Don't be afraid to negotiate! A strong credit score and comparing offers from competitors can strengthen your bargaining power.

- Highlight Strengths: Emphasize a strong credit history, stable income, and low DTI.

- Compare Offers: Show lenders competing offers to demonstrate your willingness to shop around.

Improve Your Credit Score

Improving your credit score is the most effective long-term strategy for securing better interest rates.

- Pay Bills On Time: Consistent on-time payments are crucial for a healthy credit score.

- Reduce Debt: Lower your debt-to-income ratio to improve your creditworthiness.

- Monitor Credit Reports: Regularly check your credit reports for errors and inaccuracies.

Understanding APR and Other Loan Fees

Understanding the Annual Percentage Rate (APR) and other associated fees is crucial for making an informed decision.

Annual Percentage Rate (APR)

The APR is the annual interest rate charged on the loan, including fees and interest.

- All-Inclusive Rate: The APR represents the total cost of borrowing, allowing for easier comparison between loan offers.

- Impact on Total Cost: A higher APR increases the total amount you'll repay over the loan's lifespan.

Other Fees

Be aware of additional fees that can significantly impact the overall cost.

- Origination Fees: Fees charged by lenders for processing your loan application.

- Prepayment Penalties: Fees charged if you pay off your loan early.

- Late Payment Fees: Charged if you miss a payment.

- Processing Fees: Additional fees for handling administrative tasks.

Conclusion: Securing the Best Personal Loan Interest Rates

Securing the best personal loan interest rates involves understanding factors like your credit score, loan amount, lender type, and DTI. By shopping around, negotiating, and improving your credit score, you can significantly reduce the cost of borrowing. Don't wait! Start comparing personal loan interest rates today and find the perfect loan to fit your financial goals. Remember, a lower interest rate translates to significant savings over the life of your loan. Choose wisely and secure the best personal loan interest rate possible!

Featured Posts

-

Hailee Steinfelds Angel Margarita A Premium Beer Experience

May 28, 2025

Hailee Steinfelds Angel Margarita A Premium Beer Experience

May 28, 2025 -

Jawa Tengah 26 Maret 2024 Update Cuaca Semarang Dan Prediksi Hujan

May 28, 2025

Jawa Tengah 26 Maret 2024 Update Cuaca Semarang Dan Prediksi Hujan

May 28, 2025 -

Ajaxs Title Hopes Shattered Analyzing The Crucial Nine Points Lost In The 99th Minute

May 28, 2025

Ajaxs Title Hopes Shattered Analyzing The Crucial Nine Points Lost In The 99th Minute

May 28, 2025 -

California Dreaming German Reality An Expats Honest Comparison

May 28, 2025

California Dreaming German Reality An Expats Honest Comparison

May 28, 2025 -

Psv Amankan Gelar Liga Belanda Dengan Menang 3 1 Atas Sparta

May 28, 2025

Psv Amankan Gelar Liga Belanda Dengan Menang 3 1 Atas Sparta

May 28, 2025

Latest Posts

-

Andre Agassi Su Segundo Servicio En El Mundo Del Deporte

May 30, 2025

Andre Agassi Su Segundo Servicio En El Mundo Del Deporte

May 30, 2025 -

El Legado De Marcelo Rios La Admiracion De Un Tenista Argentino

May 30, 2025

El Legado De Marcelo Rios La Admiracion De Un Tenista Argentino

May 30, 2025 -

De Las Pistas De Tenis A Un Nuevo Desafio La Sorprendente Regreso De Andre Agassi

May 30, 2025

De Las Pistas De Tenis A Un Nuevo Desafio La Sorprendente Regreso De Andre Agassi

May 30, 2025 -

Un Tenista Argentino Declara A Marcelo Rios Como Una Leyenda Del Tenis

May 30, 2025

Un Tenista Argentino Declara A Marcelo Rios Como Una Leyenda Del Tenis

May 30, 2025 -

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025