Podcast: Making The Most Of Low Inflationary Periods

Table of Contents

Understanding Low Inflationary Environments

Defining Low Inflation:

Low inflation is generally defined as a sustained increase in the general price level of goods and services at a rate below 2% per year. This differs significantly from deflation (a decrease in the general price level), which can be economically damaging. Low inflation, while not necessarily negative, indicates slow economic growth and can impact consumer behavior and investment strategies.

- Examples: Periods of low inflation can be observed historically, such as certain stretches in the early 2000s and more recently. Analyzing these periods offers valuable insights into potential market trends.

- Low Inflation vs. Deflation: While low inflation represents a slow increase in prices, deflation represents a decrease. Deflation can be detrimental, as consumers delay purchases anticipating further price drops, leading to decreased demand and economic stagnation.

The causes of low inflation are multifaceted:

- Weak Demand: Reduced consumer spending and business investment can contribute to low inflation.

- Increased Productivity: Improvements in technology and efficiency can lead to lower production costs, resulting in lower prices.

- Technological Advancements: Technological advancements frequently drive down the cost of goods and services, contributing to lower inflation rates.

The Impact of Low Inflation on Spending and Saving:

Low inflation significantly impacts spending and saving habits.

- Psychology of Spending: With prices increasing slowly, consumers may feel more comfortable with larger purchases, believing their purchasing power remains relatively stable.

- Increased Purchasing Power: Low inflation means each dollar stretches further, allowing for increased savings and investment opportunities.

- Potential Drawbacks: The primary drawback is the risk of deflation, where falling prices discourage spending and investment, potentially leading to a deflationary spiral and economic recession. This is a critical point to understand when developing your low inflation strategy.

Strategic Investing During Low Inflationary Periods

Diversifying Your Investment Portfolio:

Diversification is crucial during low-inflation environments. Don't put all your eggs in one basket!

- Asset Allocation: A well-diversified portfolio includes a mix of stocks, bonds, real estate, and potentially alternative investments.

- High-Performing Assets: Dividend-paying stocks, which offer a consistent income stream, and real estate, which can appreciate in value over time, are often favored during low inflation. Consider these strong additions to a portfolio designed for low inflationary periods.

- Risk Assessment: Each investment carries risks. Carefully research and understand the potential downsides before investing. Understanding risk tolerance is a key part of managing investments during low inflation.

Long-Term Investment Strategies:

Long-term strategies are paramount during low-inflation periods.

- Dollar-Cost Averaging: Regularly investing a fixed amount, regardless of market fluctuations, helps mitigate risk and potentially benefit from lower prices during dips.

- Index Funds and ETFs: These provide diversified exposure to a broad market index at low cost, making them suitable for long-term growth.

- Retirement Planning: Low inflation doesn't negate the importance of retirement planning. In fact, strategic planning during these times can maximize your long-term financial security.

Budgeting and Financial Planning in a Low Inflationary Economy

Creating a Realistic Budget:

A well-structured budget is essential, regardless of the inflation rate.

- Expense Tracking: Monitor your spending habits to identify areas for potential savings.

- Savings Strategies: Implement effective saving strategies such as automating transfers to savings accounts or setting up separate accounts for specific goals.

- Debt Reduction: Low inflation presents a great opportunity to aggressively pay down high-interest debt, freeing up funds for investments and other goals.

Setting Financial Goals:

Clearly defined financial goals provide direction and motivation.

- SMART Goals: Utilize the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) to set effective goals.

- Goal Examples: Set goals such as homeownership, funding higher education, or securing a comfortable retirement.

- Regular Review: Regularly review and adjust your financial goals and budget as circumstances change. Consistent monitoring is crucial in low inflation economies.

Conclusion:

Navigating low inflationary periods requires a proactive approach. Understanding the economic landscape, diversifying your investments across a range of assets, and developing a robust budget and financial plan are crucial for capitalizing on the opportunities and mitigating the potential risks. By carefully managing your finances and adapting your strategies, you can successfully navigate low inflation and build a secure financial future. Learn more about how to successfully manage your finances during low inflation by exploring additional resources on this topic. Find out how to maximize your financial potential during periods of low inflation—don't miss out on expert advice on leveraging low inflationary periods for your benefit.

Featured Posts

-

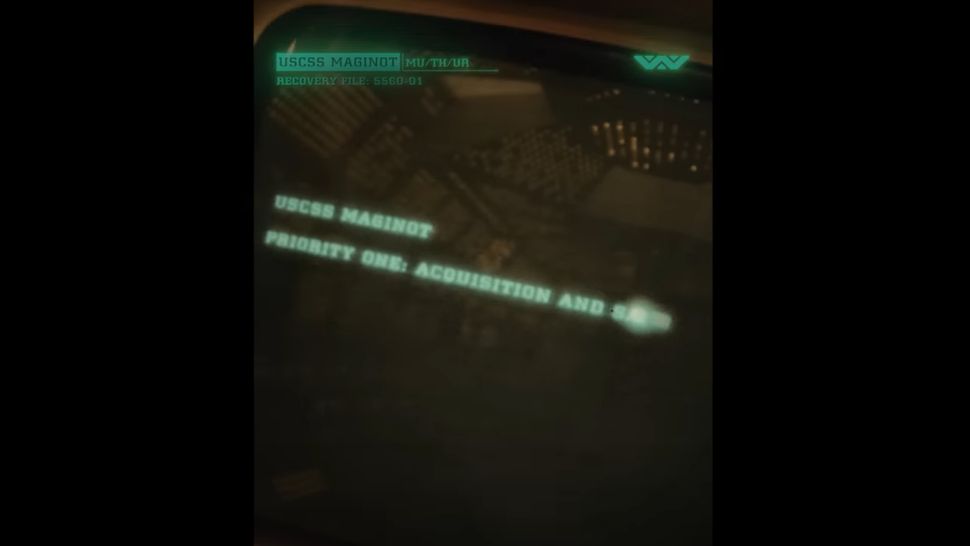

6 Hidden Easter Eggs In The Alien Earth Sxsw 2025 Shorts

May 27, 2025

6 Hidden Easter Eggs In The Alien Earth Sxsw 2025 Shorts

May 27, 2025 -

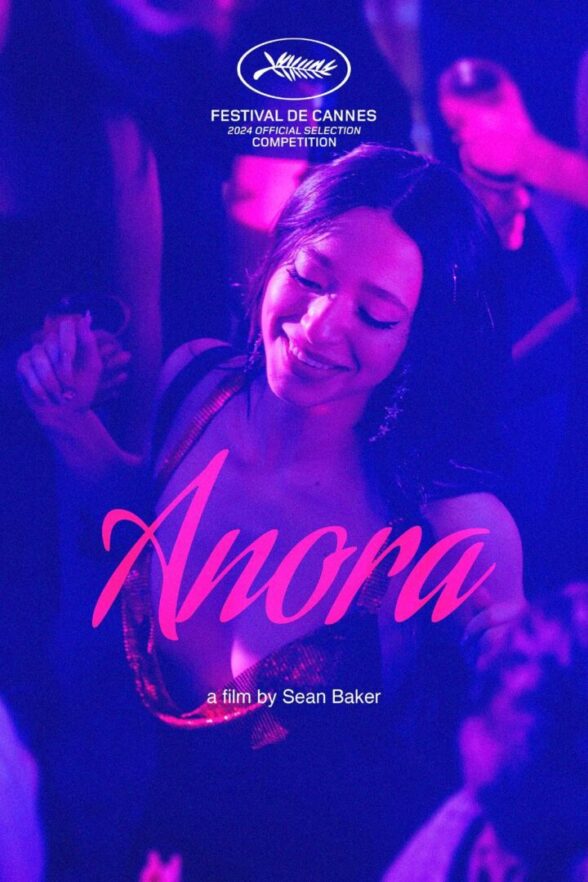

Von Anora Bis Emilia Perez Die Oscar Gewinnerfilme Im Stream

May 27, 2025

Von Anora Bis Emilia Perez Die Oscar Gewinnerfilme Im Stream

May 27, 2025 -

Understanding Yellowstones Magma Reservoir Implications For Future Eruptions

May 27, 2025

Understanding Yellowstones Magma Reservoir Implications For Future Eruptions

May 27, 2025 -

Osimhen Turkish Pundit Highlights His Impact On Galatasaray

May 27, 2025

Osimhen Turkish Pundit Highlights His Impact On Galatasaray

May 27, 2025 -

Nra Convention 2024 Reduced Political Presence In Atlanta

May 27, 2025

Nra Convention 2024 Reduced Political Presence In Atlanta

May 27, 2025

Latest Posts

-

Czy Flowers Miley Cyrus Zapowiada Rewolucje W Jej Muzyce

May 31, 2025

Czy Flowers Miley Cyrus Zapowiada Rewolucje W Jej Muzyce

May 31, 2025 -

Rechtszaak Miley Cyrus Wegens Plagiaat Van Bruno Mars Hit

May 31, 2025

Rechtszaak Miley Cyrus Wegens Plagiaat Van Bruno Mars Hit

May 31, 2025 -

Flowers Debiutancki Singiel Miley Cyrus Z Nowej Plyty Szczegolowa Analiza

May 31, 2025

Flowers Debiutancki Singiel Miley Cyrus Z Nowej Plyty Szczegolowa Analiza

May 31, 2025 -

Miley Cyrus Plagiaatzaak Voortgezet Nieuwe Ontwikkelingen In De Rechtszaak

May 31, 2025

Miley Cyrus Plagiaatzaak Voortgezet Nieuwe Ontwikkelingen In De Rechtszaak

May 31, 2025 -

Miley Cyrus Flowers Pierwszy Smak Jej Nowego Albumu

May 31, 2025

Miley Cyrus Flowers Pierwszy Smak Jej Nowego Albumu

May 31, 2025