Podcast: Rethinking Your Approach To Finances

Table of Contents

Understanding Your Current Financial Situation

Before charting a course toward your financial goals, you need to understand your current financial landscape. This involves a clear-eyed assessment of your income and expenses, and a thorough analysis of any outstanding debt.

Assessing Your Income and Expenses

Effective budgeting is the cornerstone of sound personal finance management. Accurately tracking your income and expenses is crucial. This can be done using various methods:

- Budgeting Apps: Mint, YNAB (You Need A Budget), and Personal Capital offer user-friendly interfaces to track spending, categorize expenses, and create budgets.

- Spreadsheets: A simple spreadsheet can be just as effective, allowing for customization and detailed analysis of your spending habits.

By meticulously tracking your finances, you can:

- Identify areas where you're overspending. Are you subscribing to services you rarely use? Could you reduce your dining-out expenses?

- Differentiate between needs and wants. This crucial distinction helps prioritize spending and allocate resources effectively. Needs are essential for survival (food, shelter, transportation), while wants are non-essential items that enhance your lifestyle.

- Discover opportunities for significant savings. Even small adjustments can add up over time, building a strong foundation for your financial well-being. This includes exploring financial tracking software for better expense management.

Analyzing Your Debt

Debt can significantly impact your financial health. Understanding the types of debt you hold – credit card debt, student loans, personal loans, etc. – and their associated interest rates is vital.

- High-Interest Debt: Prioritize tackling high-interest debt, like credit card debt, using strategies like the debt avalanche (paying off highest interest debt first) or debt snowball (paying off smallest debt first) methods.

- Debt Consolidation: Explore debt consolidation options if you're managing multiple debts. This can streamline payments and potentially lower your overall interest rate.

- Seek Professional Help: If you're overwhelmed by debt, don't hesitate to seek professional advice from a credit counselor or financial advisor. They can provide personalized debt management strategies and guide you towards a debt-free future. Understanding debt reduction plans is crucial for reclaiming your financial stability.

Setting Financial Goals and Creating a Plan

Once you understand your current financial standing, it's time to define your financial goals and create a plan to achieve them.

Defining Short-Term and Long-Term Goals

Financial goals provide direction and motivation. They should be a mix of short-term and long-term objectives:

- Short-Term Goals (1-3 years): Building an emergency fund (3-6 months of living expenses), paying off high-interest debt, saving for a down payment on a car.

- Long-Term Goals (5+ years): Buying a house, funding your children's education, planning for retirement.

Utilizing the SMART goal framework is essential:

- Specific: Clearly define your goal.

- Measurable: Set quantifiable targets.

- Achievable: Ensure your goals are realistic.

- Relevant: Align your goals with your values and priorities.

- Time-bound: Set deadlines for achieving your goals.

Developing an Actionable Financial Plan

Your financial plan should be a roadmap to achieving your goals. This involves:

- Budgeting: Create a detailed budget that aligns with your short-term and long-term goals.

- Investing: Explore diverse investment options based on your risk tolerance and time horizon. This might include stocks, bonds, mutual funds, real estate, and more. Diversification is key to mitigating risk in your investment portfolio.

- Retirement Planning: Start saving for retirement early to take advantage of compound interest. Explore different retirement accounts like 401(k)s and IRAs.

Implementing and Monitoring Your Financial Plan

Creating a plan is only half the battle. Consistent implementation and monitoring are crucial for success.

Staying Disciplined and Consistent

Maintaining financial discipline requires commitment and consistent effort.

- Regular Monitoring: Review your budget and track your progress regularly.

- Adjustments: Be prepared to make adjustments to your plan as needed, based on unexpected expenses or changes in your financial circumstances.

- Financial Habits: Cultivate healthy financial habits such as automatic savings transfers and mindful spending.

Seeking Professional Advice When Needed

While you can manage many aspects of your finances independently, seeking professional advice can be invaluable.

- Financial Advisor: A financial advisor can provide personalized guidance on investment strategies, retirement planning, and other complex financial matters.

- Financial Planner: A financial planner can help you create a comprehensive financial plan that encompasses all aspects of your financial life.

Conclusion: Rethinking Your Approach to Finances – Taking the Next Steps

Rethinking your approach to finances involves a proactive, multi-step process. Understanding your current financial situation, setting clear goals, and developing a comprehensive plan are crucial for achieving financial wellness. Consistent implementation, monitoring, and seeking professional advice when needed are equally important. By adopting these strategies and building strong personal finance management habits, you can take control of your financial future and achieve lasting financial security. Listen to the full episode to dive deeper into budgeting techniques, debt management strategies, and smart investment options for a more secure financial future, ensuring your smart money management leads to lasting financial wellness and successful personal finance management.

Featured Posts

-

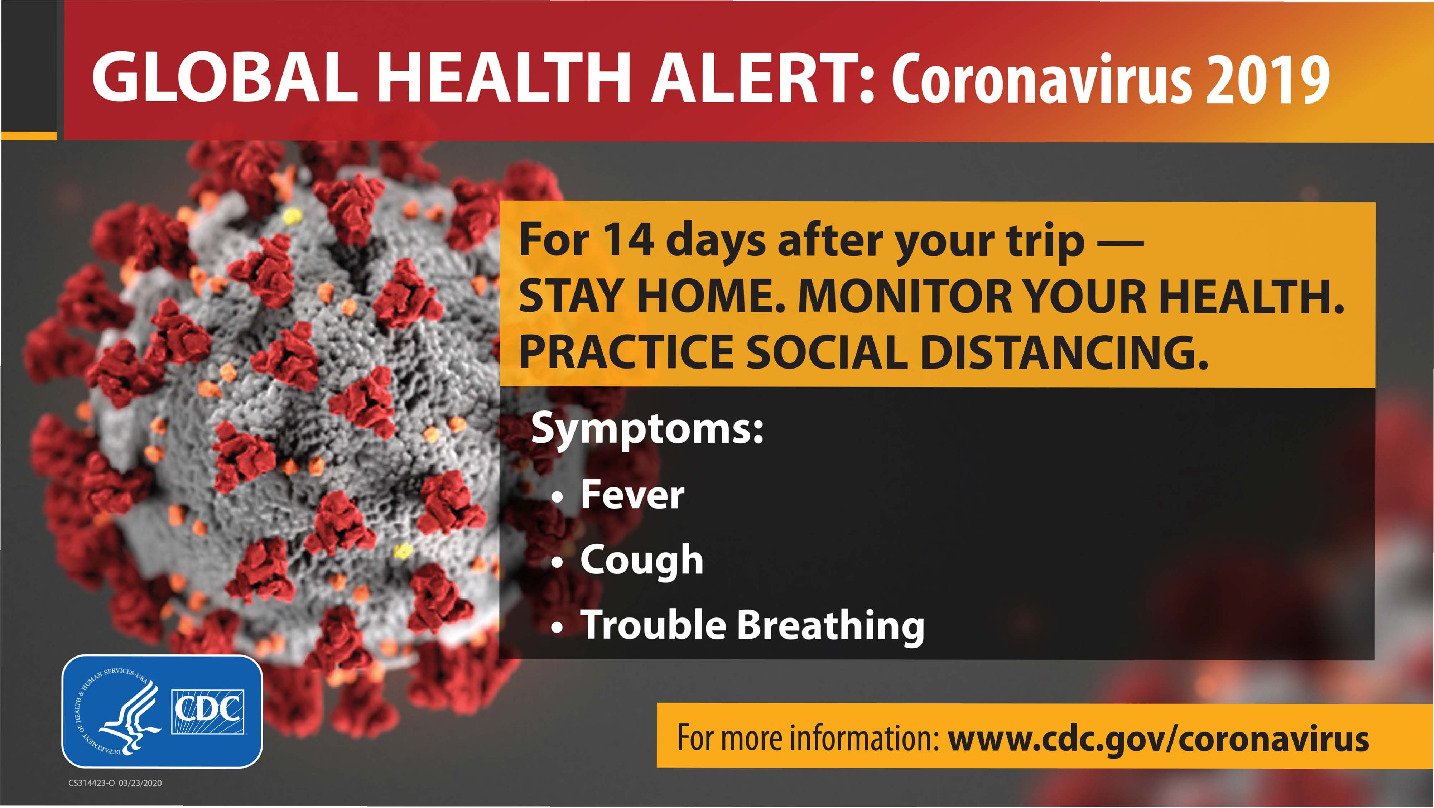

New Covid 19 Variant A Global Health Concern

May 31, 2025

New Covid 19 Variant A Global Health Concern

May 31, 2025 -

Pro Motocross 2025 Riders Races And Predictions

May 31, 2025

Pro Motocross 2025 Riders Races And Predictions

May 31, 2025 -

Spains Power Outage Finger Pointing Intensifies As Iberdrola Highlights Grid Problems

May 31, 2025

Spains Power Outage Finger Pointing Intensifies As Iberdrola Highlights Grid Problems

May 31, 2025 -

Global Health Alert Increased Covid 19 Cases Linked To New Variant

May 31, 2025

Global Health Alert Increased Covid 19 Cases Linked To New Variant

May 31, 2025 -

Thompsons Bad Luck In Monte Carlo

May 31, 2025

Thompsons Bad Luck In Monte Carlo

May 31, 2025