Post-Revision, House Passes Trump Tax Bill

Table of Contents

Key Provisions of the Revised Trump Tax Bill

The revised Trump Tax Bill boasts a range of provisions designed to reshape the US tax landscape. Let's examine the core components impacting both individual taxpayers and corporations.

Individual Income Tax Changes

The bill significantly alters individual income tax rates and deductions. Key changes include:

- Individual Tax Rates: Reductions in individual income tax rates across several brackets, aiming to stimulate the economy through increased disposable income. However, the long-term effects of these "individual tax rates" are still debated.

- Standard Deduction Increase: A substantial increase in the standard deduction, simplifying tax filing for many individuals and potentially reducing the number of taxpayers itemizing deductions.

- Child Tax Credit Expansion: An expansion of the child tax credit, providing greater tax relief for families with children. This "child tax credit expansion" was a key point of contention in the revisions.

These changes will affect different income groups differently. While some lower and middle-income families may see immediate tax savings thanks to the increased standard deduction and expanded child tax credit, the impact on higher-income earners is more complex and depends on individual circumstances. Data from the Tax Policy Center suggests a significant tax cut for the wealthiest 1%, while middle-income families will see more modest benefits.

Corporate Tax Rate Reduction

One of the most significant changes is a dramatic reduction in the corporate tax rate. The bill lowers the federal corporate tax rate from 35% to 21%. This "corporate tax rate" reduction is intended to boost business investment, increase job growth, and enhance US competitiveness globally.

- Impact on Businesses: Lower corporate taxes could incentivize businesses to invest more in expansion, research and development, and hiring.

- Job Creation Potential: Proponents argue that this will lead to increased job creation, a key promise of the "Tax Cuts and Jobs Act."

- Economic Forecast: Experts offer varying forecasts on the actual economic impact. Some predict robust growth, while others caution about potential inflation and increased national debt.

The success of this corporate tax cut hinges on how businesses utilize the additional capital. If the money is primarily used for stock buybacks rather than investment and job creation, the intended economic benefits will be diminished.

Changes Made Post-Revision

The Trump Tax Bill underwent significant revisions before its final House passage. These amendments aimed to address concerns raised by various factions, including:

- State and Local Tax Deduction (SALT): The original bill proposed eliminating the state and local tax deduction (SALT), a move that sparked strong opposition from high-tax states. The revisions offered a modified approach to mitigate this impact, though the details remain a source of contention.

- Individual Mandate: The bill made adjustments to the Affordable Care Act's individual mandate, influencing healthcare costs and coverage.

- Pass-Through Businesses: Changes were made to address the tax treatment of pass-through businesses, aiming to achieve greater fairness and avoid unintended loopholes.

These "bill amendments" reflect a complex political negotiation process, ultimately influencing the bill's final form and its long-term effects. The political implications are far-reaching, with implications for upcoming elections and ongoing debates around tax policy.

Economic Impacts and Predictions

The Trump Tax Bill's economic consequences are a subject of intense debate. Experts offer diverging forecasts on various key indicators.

Projected Economic Growth

Proponents of the bill predict that the tax cuts will stimulate economic growth through increased investment and consumer spending. However, critics argue that these benefits will be limited and overshadowed by increased national debt and potential inflationary pressures.

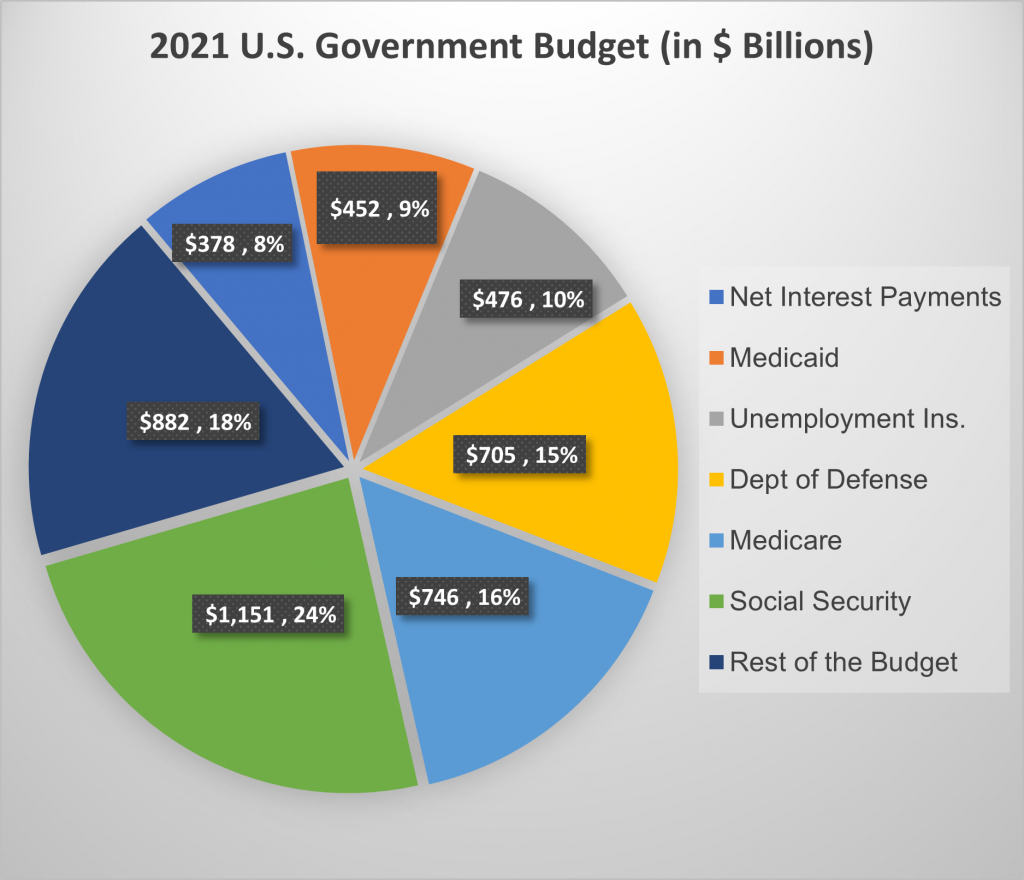

Impact on National Debt

The bill's significant tax cuts are expected to increase the national debt considerably. This "impact on national debt" is a major concern for economists and policymakers who warn about long-term financial instability. The Congressional Budget Office (CBO) provides detailed projections on the budgetary impact.

Distributional Effects

The tax cuts are not evenly distributed across the population. The "distributional effects" are likely to exacerbate existing income inequality, with higher-income earners benefiting disproportionately. This aspect of the bill has drawn criticism from those advocating for greater social equity.

Political Fallout and Public Opinion

The Trump Tax Bill has generated significant political polarization and diverse public reactions.

Reactions from Political Parties

The Republican party largely supports the bill, hailing it as a vital step towards economic prosperity. However, the Democratic party overwhelmingly opposes it, citing concerns about its impact on income inequality, the national debt, and healthcare.

Public Perception and Polls

Public opinion on the "Trump Tax Bill" is divided, reflecting the broader political climate. Polls show mixed support, with varying levels of approval depending on demographic factors and political affiliation.

Potential Future Legislative Challenges

Despite its House passage, the Trump Tax Bill faces potential challenges ahead, including further negotiations in the Senate and potential legal battles. The long-term implementation and enforcement of this "revised legislation" will require ongoing scrutiny.

Conclusion

The revised Trump Tax Bill represents a monumental shift in US tax policy. It introduces significant changes to individual and corporate tax rates, deductions, and credits, with potentially profound economic and political ramifications. The bill's projected impacts on economic growth, the national debt, and income inequality remain central points of discussion and debate. Understanding the intricacies of this "Trump Tax Bill" and its long-term consequences is crucial for informed citizenship. Stay updated on the Trump Tax Bill by following reputable news sources and government websites to learn more about tax reform and understand the impact of the revised Trump Tax Bill on your finances.

Featured Posts

-

Big Rig Rock Report 3 12 Your Guide To 98 5 The Foxs Trucking Updates

May 23, 2025

Big Rig Rock Report 3 12 Your Guide To 98 5 The Foxs Trucking Updates

May 23, 2025 -

Remont Pivdennogo Mostu Rozkrittya Detaley Proektu

May 23, 2025

Remont Pivdennogo Mostu Rozkrittya Detaley Proektu

May 23, 2025 -

Antonys Rejected Offer A Man Utd Rivals Pursuit

May 23, 2025

Antonys Rejected Offer A Man Utd Rivals Pursuit

May 23, 2025 -

Neal Mc Donough Rides The Bulls In The Last Rodeo

May 23, 2025

Neal Mc Donough Rides The Bulls In The Last Rodeo

May 23, 2025 -

Big Rig Rock Report 3 12 X101 5 Your Essential Breakdown

May 23, 2025

Big Rig Rock Report 3 12 X101 5 Your Essential Breakdown

May 23, 2025

Latest Posts

-

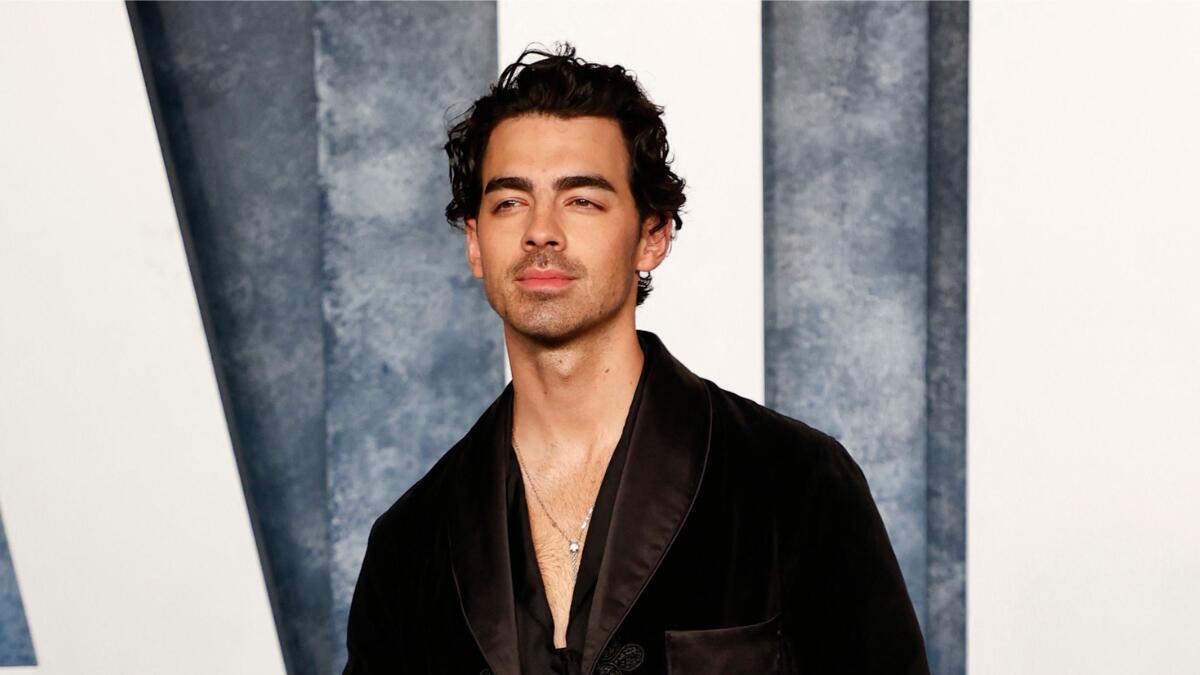

A Couples Fight Joe Jonass Response And The Internets Reaction

May 23, 2025

A Couples Fight Joe Jonass Response And The Internets Reaction

May 23, 2025 -

Couples Hilarious Fight Over Joe Jonas His Reaction

May 23, 2025

Couples Hilarious Fight Over Joe Jonas His Reaction

May 23, 2025 -

Joe Jonass Mature Reaction To A Couples Dispute

May 23, 2025

Joe Jonass Mature Reaction To A Couples Dispute

May 23, 2025 -

Couple Fights Over Joe Jonas His Hilarious Reaction

May 23, 2025

Couple Fights Over Joe Jonas His Hilarious Reaction

May 23, 2025 -

Joe Jonas Responds To Couple Arguing About Him

May 23, 2025

Joe Jonas Responds To Couple Arguing About Him

May 23, 2025